Account Reconciliations are an important part of the financial close and reporting process; however, they are often treated as an afterthought by Finance departments. Perhaps this is due to the pressure organizations face to speed up the financial close process. But the reality is that in the post Sarbanes-Oxley environment, organizations need to have stronger internal controls and faster identification and reporting of material weaknesses in financial processes.

This was the focus of a recent webinar sponsored by OneStream Software and our partner MindStream Analytics. The session was led by Seth Landau, Executive Vice President and financial close leader at MindStream, along with Christine Kennedy, Solutions Consultant from OneStream. Here’s a summary of the key points made during the webinar.

Challenges in Account Reconciliation

While account reconciliations are an important step to ensuring the accuracy and completeness of financial statements, this is one of the more mundane tasks in the life of a corporate accountant. However, if they are done right, having a solid account reconciliations process can improve the accuracy of financial statements, eliminate the need for restatements, and reduce external audit costs. Some of the challenges organizations face in performing fast account reconciliations include:

- Disparate legacy GL/ERP systems create many reconciliation points, areas of risk

- The process is often highly manual, using volumes of Excel worksheets that are error-prone

- Problems aligning business unit account reconciliations with corporate processes

- Lack of workflow control – preparer, reviewer, final approver, peer review

- Lack of built in checks to ensure validation

- Too easy to “plug” differences

- No automation to quickly approve zero balance accounts

- Limited visibility to material exposures

- Ledgers are kept open well past end of period – can create havoc with reconciliation unless proper controls are in place

In most organizations, account reconciliations are performed as a parallel process to the financial consolidation, close and reporting cycle, either in spreadsheets or an account reconciliation system that’s separate from the consolidation and reporting system. This approach limits visibility into the entire set of closing activities, leads to inefficient communication, time lags, and gaps between people, processes and systems used in the financial close and reporting cycle.

Best Practices in Account Reconciliations

Having a well-defined and efficient account reconciliations process can help organizations in many ways. These include ensuring accuracy and consistency in balance sheets and income statements, providing an early warning signal to potential issues, driving more accountability though the ranks, and making the organization better prepared for audits. Having a well-defined and executed account reconciliations process reduces the risk of errors, non-compliance and potential fraud. Some of the best practices identified during the webinar included:

- Categorize all reconciliations (i.e. – Cash, AR, Inventories, etc.)

- Have good checks and balances with preparers / reviewers

- Sort reconciliations by Balance Comparison vs Account Analysis

- Institute a set schedule to prepare, review and remediate the reconciliations

- Implement a “Peer Review” process for post-audit analysis

- Have electronic documentation as backup detail that can be easily accessed

- Invest in a proper General Ledger package that tracks and links sub-ledger activity to the General Ledger and can easily export data for reconciliation

- Invest in automation (i.e. Account Reconciliation software)

OneStream Account Reconciliation Manager

OneStream allows customers to attack the challenges in account reconciliations in a unique way, with a solution that is completely integrated with its financial consolidation and reporting solution. Available as a free download from the OneStream XF MarketPlace, its Account Reconciliation Manager solution can be integrated into the financial close workflow, and leverages data that already resides within the consolidation application.

There is no bolt-on solution and no movement of data to support account reconciliations. The solution uses the same application, same security and same user interface as OneStream XF. The overview and demonstration of OneStream’s Account Reconciliation Manager covered several key capabilities, including:

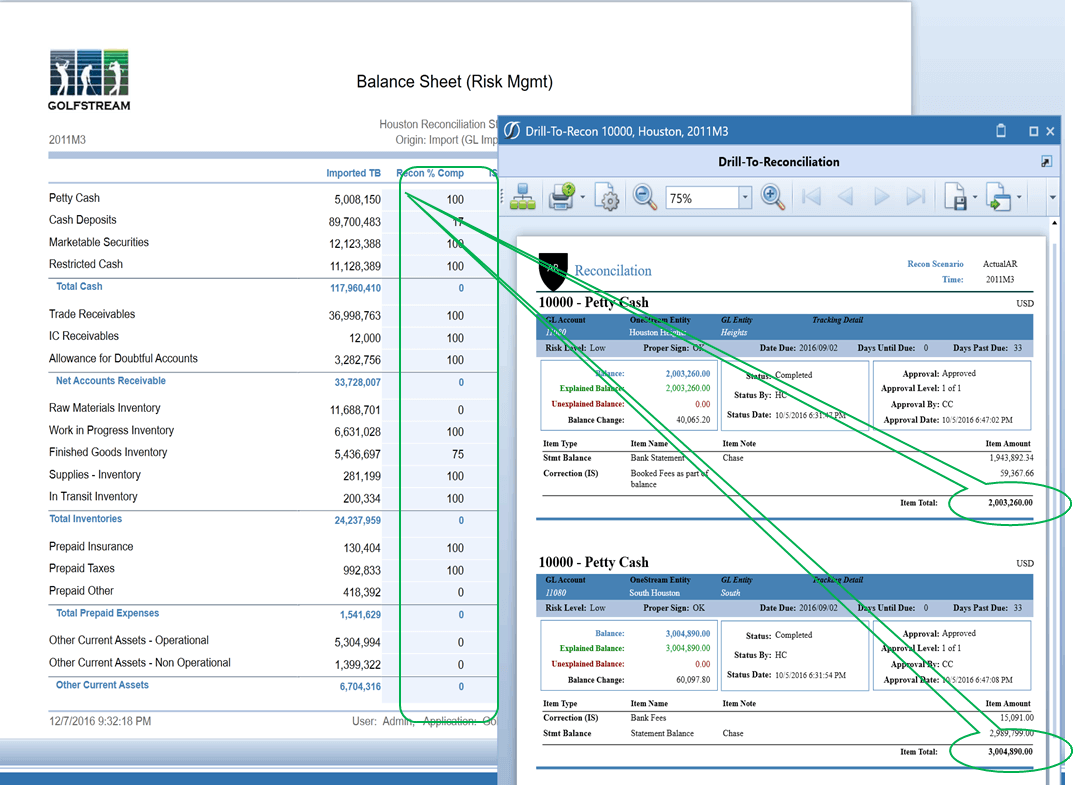

- Risk Management Reporting – Delivers a complete statistical view of financial reports including a risk adjusted balance sheet

- Drill-To-Reconciliation – Link reported balances to reconciled accounts and drill all the way from your financial statements to the reconciliations

- Trial Balance Single Sourcing – Means there is never a disconnect between what you reconcile vs. what you report

- Process Control – Leveraging Guided Workflows and the stage engine for complete process controls and a simplified end-user experience

- Single Point of Maintenance – Reuse metadata & mappings, same user access

Advantages of an Integrated Approach

While other CPM software vendors offer purpose-built account reconciliation solutions, they are separate applications that require data movement and the potential for gaps and risks in the process. OneStream’s unique, integrated solution approach to account reconciliations provides several advantages for customers, including:

- Full insight into the complete process and required activities

- Increased quality of reporting through a risk-based approach

- Reduced effort in monitoring compliance initiatives by leveraging existing setup

- Collaborative and workflow-driven processes for full, end-to-end control

- Available for free for existing customers

- Fast to deploy

Customers that have deployed OneStream Account Reconciliation Manager have streamlined their account reconciliation process, eliminated point solutions, reduced license costs and reduced auditing costs.

Learn More

To learn more about OneStream Account Reconciliation software, and to see a short demonstration of the solution, watch the replay of the webinar.

Get Started With a Personal Demo