President Trump’s recent Tweet suggesting the SEC rethink the requirement for public companies to report their results quarterly has ignited a debate about this topic. On one side are the investors and regulators who are demanding increasing transparency from publicly-traded companies to track performance, gauge the return on their investments and prevent fraud. On the other side are companies who cite the increasing cost of compliance, and the focus quarterly financial reporting puts on short-term profits rather than on long-term investments.

Others in this group cite the number of companies delaying IPOs or going private due to the costs and scrutiny placed on public companies. The most recent example of this is Tesla’s Elon Musk Tweeting that he’s considering taking his company private due to the costs and scrutiny Tesla faces as a public company. Another point made by this camp is that reporting requirements for publicly-listed companies in Europe is less stringent than for US companies, with the requirement to report results semi-annually instead of quarterly.

Recent surveys of publicly-held companies do reveal that costs of compliance are increasing, partly due to new US GAAP reporting guidelines such as the new Revenue Recognition guidelines under ASC 606 and the new Lease Accounting guidelines under ASC 842. On the flip side, the US SEC has been working to streamline disclosure requirements for publicly-held companies and the AICPA recently reported that XBRL filing costs for small companies has dropped by 45% since 2014.

Regardless of which side of this debate you are on, the reality is that most companies collect, consolidate and review financial and operating results at least monthly, for reporting to management. Modern performance management and analytics software applications make this process easier than ever with key features such as:

- Direct integration to ERP, GLs, data warehouses and other source systems

- Automatic data validations, audit trails, and drill-through to transaction details

- The ability to automate complex global consolidations including currency translation, intercompany eliminations, and partial ownerships.

- The integration and comparison of actual results to budgets, plans and forecasts.

- Predictive modeling and forecasting, and the use of machine learning and artificial intelligence to forecast demand and revenue

- Reporting in many formats for internal/external purposes:

- Automated generation of financial statements

- Excel-based access and analysis

- Interactive dashboards and mobile information delivery

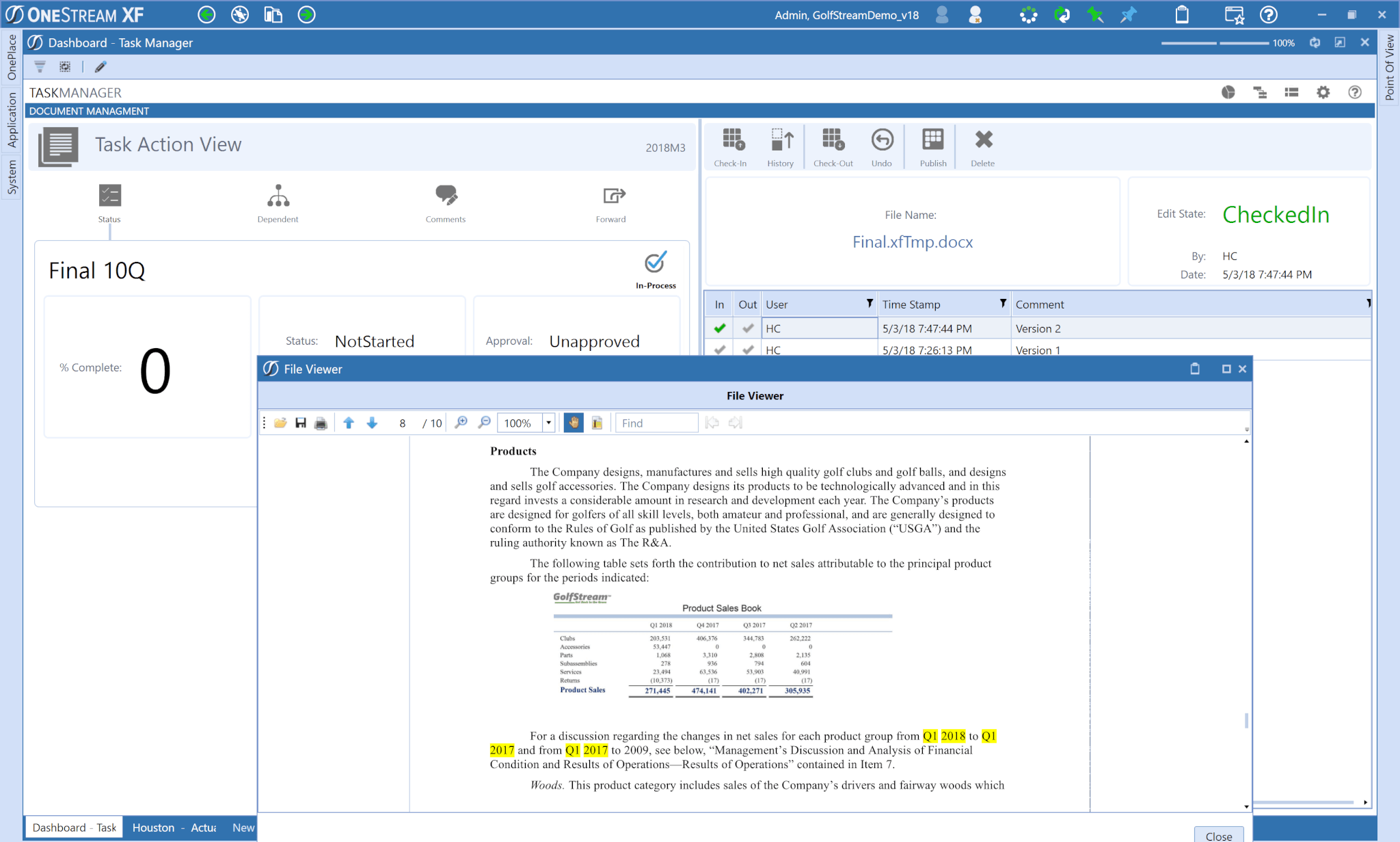

When it comes to integrating financial statements, tables, charts, and textual information, many modern performance management solutions provide seamless integration with Microsoft Word and PowerPoint for creation of board books, board presentations, and regulatory filings – with automatic updates as data changes, which eliminates copying and pasting.

For publicly-held companies who need to file 10Qs and 10Ks with the US SEC, there are many XBRL tagging tools and services that can automate the filing process, at a fairly low cost.

In summary, with the volatility of today’s markets, companies have been moving towards providing more detailed and timely information to management – monthly, weekly, daily, sometimes hourly. The good news is that modern performance management and analytics software solutions allow managers to gain near real-time access to data, and to easily package information for internal and external stakeholders. Regardless of what the SEC decides, companies still need to monitor performance on a regular basis and today’s modern software makes that faster, easier, and more cost-effective than ever.

Read the original version of the blog article as published by Accounting Today: https://www.accountingtoday.com/opinion/quarterly-financial-reporting-is-easier-than-ever

To learn more about OneStream’s financial consolidation and reporting capabilities download our eBook:

John O’Rourke is Vice President of Product Marketing at OneStream Software. With a background in accounting and finance, John has over 30 years of experience in the software industry, including 20 years of experience in product marketing at Hyperion Solutions, Oracle and Host Analytics. He has worked with many customers and partners on financial reporting and planning initiatives and has spoken and written on many topics in corporate performance management. John has also held positions in strategic marketing and product marketing at Dun & Bradstreet Software, Kenan Systems and Decisyon.

Don’t Miss Another Blog Article, Subscribe Today!

Get Started With a Personal Demo