5 Steps to Unleashing the True Value of Finance – Step 1: Know the Business

Congratulations! Your time in the trenches and long nights have paid off. You just started as the head of Financial Planning & Analysis (FP&A) or as the Controller at a major company. It’s the opportunity you’ve been waiting for. And on day one, you know what to do – right?

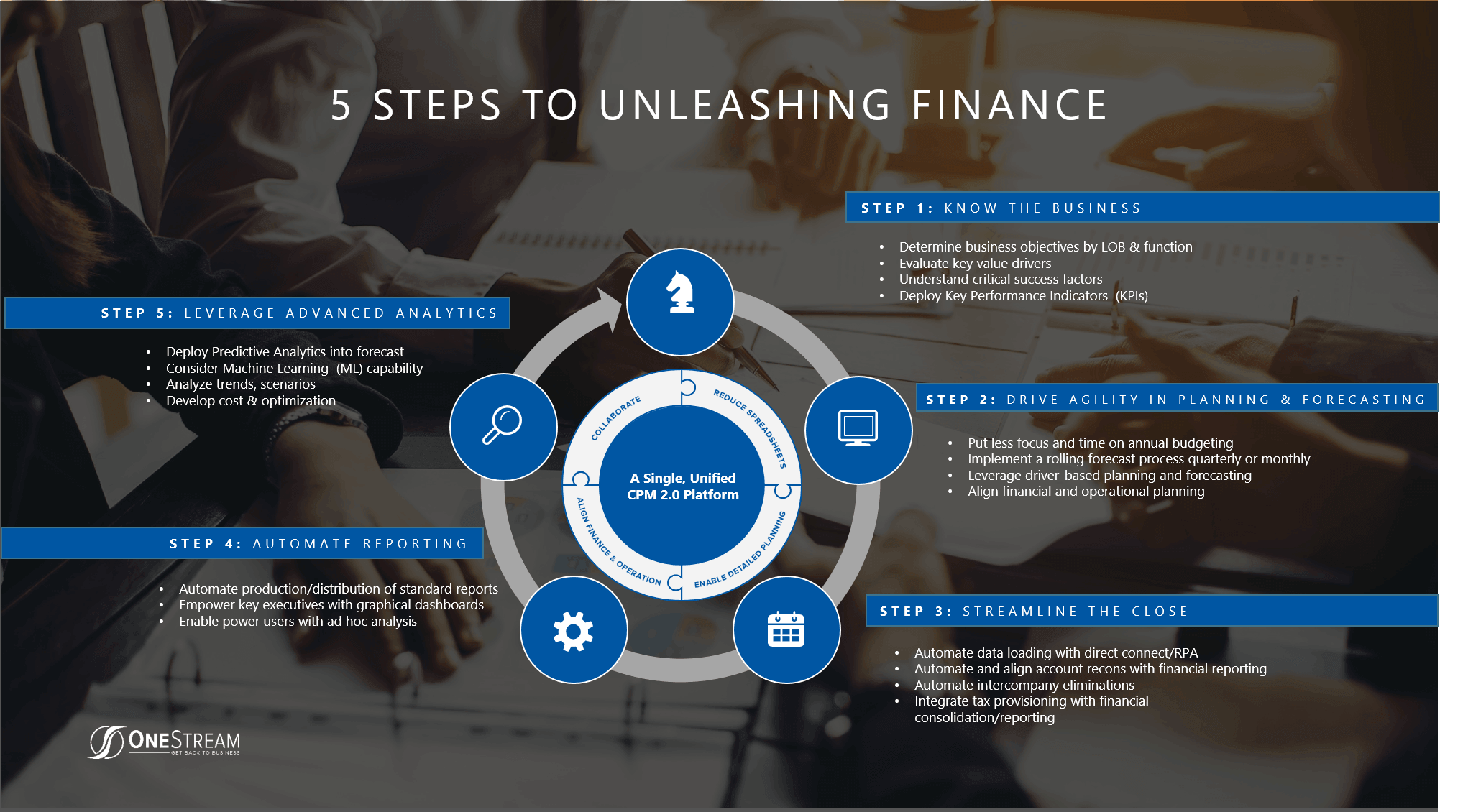

Maybe not. If you’re working within a medium to large organization, the answer is not always clear. But there is good news. We recently launched a white paper and a new blog series titled 5 Steps to Unleashing the True Value of Finance to enable leaders with a path forward. The series is designed for leaders who think big, but who need to understand the stepping stones to achieving their vision for finance.

Creating a Solid Foundation

Before we jump into the 5 steps, to truly unleash the power of finance it’s important to have a solid technical foundation in place. If the organization you joined is using spreadsheets and email, or fragmented legacy corporate performance management (CPM) 1.0 applications for financial and management reporting, planning and forecasting – then you’ll need to think about moving to a modern CPM platform. One that integrates data from multiple sources, creates a single version of the truth for actuals, budgets, forecasts and all your CPM processes. Then with a solid foundation in place you can streamline routine processes and shift more of your team’s time to value-added analysis and partnering with the lines of business.

So what’s next? How do you plan to leverage this new platform to unleash the true value of finance?

Of course, every sophisticated organization is different, so leaders should evaluate which steps are most important to prioritize. The 5 steps to unleashing finance are summarized in figure 1 below:

Being a Business Partner Requires Knowing the Business

In this blog post, we’ll take a deep dive into the first key step when beginning a new role – Knowing the Business. No, I’m not referring to “what” the job function is that you perform.[1] And no, I’m not referring to your “how,” which are your values or guiding principles, like having integrity. I’m asking if you know what drives your business? Because if you only speak in the language of the P&L or the balance sheet, you are not yet a true business partner. And if you’re not a business partner, you cannot yet unleash the value of finance to the broader organization.

Why is it critical to know the business? For one, it’s your responsibility to enable business partners to direct the organization’s resources. To do this effectively, you have to have a point of view. Consider a few of the examples below:

- Have you or your team spent any time on the shop floor or attending sales calls?

- Do you have a “pulse” on the operation or the what customers are saying?

- What products or services do you believe require attention?

Knowing the Business is also first step to help assess and prioritize where to focus finance transformation? How else do you know whether streamlining financial consolidation is more or less important than accelerating management reporting or creating more agility in budgeting, planning and forecasting?

So let’s dive in and get started. Here are a few initial questions and comments to consider as you meet your new business partners and get under the hood. Buckle up and enjoy the ride. Time to unleash!

Are External Factors the Leading Indicators for Your Organization?

Sophisticated organizations are impacted by factors outside their four walls. Want proof? Check out item 1A of the 10K (e.g., risk factors) for any public company. Also, changes in external factors can sometimes  take months to impact product demand (e.g., leading indicators). For example, housing starts and building permits are leading indicators for construction and manufacturing activity. Understanding external factors is essential to Knowing the Business. And topics like the impact of external factors drive great dialogue with business partners to review the budgeting, planning & forecasting processes and allocate resources.

take months to impact product demand (e.g., leading indicators). For example, housing starts and building permits are leading indicators for construction and manufacturing activity. Understanding external factors is essential to Knowing the Business. And topics like the impact of external factors drive great dialogue with business partners to review the budgeting, planning & forecasting processes and allocate resources.

Do You Know What Business Initiatives Define Success?

Despite what the P&L says, revenue and expenses do not drive the organization. Underlying business drivers do. Customers and market demand does. Changes in commodity prices do [impact the business]. Sophisticated organizations develop initiatives whose outcomes often define success. Key initiatives could include the addition of a new product line, or entry into a new market (and new customers), a price increase or capital projects to increase productivity and reduce expenses.

Do you know the business initiatives that define success for your organization? What about those that define success for your business partners? Have you discussed and analyzed their opportunities and risks?

To unleash finance, it’s critical to know what is vital for your business partners, understand their pain points and prioritize investments around their needs. That’s what finance transformation is all about.

It’s Not About Finance, It’s About Business

Guess what? Unleashing finance is not only about the finance team. Instead, unleashing finance is about leveraging modern financial planning and reporting tools (i.e. CPM 2.0 platforms) to enable the organization, right? To get started, learn about the needs of your business partners.

- Are they getting timely access to the financial and operational results they need to make decisions? If not, it may be time to evaluate the financial close (e.g., financial consolidation)

- Can they access month-end KPIs with an appropriate amount of time to change course if needed?

- Are they getting the right KPIs, and are they adding value? Maybe it’s time for a fresh start?

- Is the annual budget and mid-year forecast providing enough agility for business teams to adapt quickly to market changes? Maybe its time to initiate quarterly or monthly rolling forecasts?

Remember, a big part of finance transformation is about enabling your business partners. It’s about developing processes that enable finance to “speak” the language of the business.

Knowing the Business Helps You Know Your Audience – Finance Unleashed

These examples are just a few to demonstrate the power of Knowing the Business. They illustrate why it’s so critical to unleashing the value of finance. Speaking in the language of the business changes everything. Why? Because in doing so, you become credible finance leaders to our business partners. How do you learn the language of the business? .

Spend time with your line of business leaders. Assign members of your FP&A or Accounting team to specific functions or departments. Better yet, consider embedding them or providing rotational assignments. By taking the time to listen and learn from your business partners – to Know the Business – you show empathy. You show your “why” as a leader and as an individual. Most importantly, you build trust and create a path to take your seat at the strategy table. Not because of your title. Not because the CFO demanded it. But because you earned it.

And with credibility and trust from your business partners, you’ve set a foundation for true finance transformation. Transformation that goes beyond the walls of finance.

Now that’s finance unleashed!

Learn More

Stay tuned for additional posts from our blog series titled “5 Steps to Unleashing the True Value of Finance.” To learn more about how to unleash your finance team or OneStream Software, download our white paper titled Finance Unleashed: Enabling Modern Finance with CPM 2.0 Platforms

[1] Simon Sinek, Find Your Why: A Practical Guide for Discovering Purpose for You and Your Team

Get Started With a Personal Demo