Surviving and thriving in today’s volatile economy requires Finance and line of business executives to have a steady pulse on financial results, as well as detailed operational data and metrics. However, many organizations struggle to integrate financial and operational results and end up with a fragmented array of business intelligence (BI) and corporate performance management (CPM) tools. This approach results in multiple versions of the truth, which hinders decision-making.

Given their historic role in the delivery of accurate and trusted financial results, the CFO and Finance organization are in a great position to extend this capability to encompass operational data that can support effective decision-making. But simply accessing operational details is not enough? Why? Because within large and dynamic organizations, just accessing operational data alone does not help leaders make decisions. The data needs to be accurate and put in context.

The bigger challenge for Finance teams is how to govern vast amounts of operational data and integrate it with financial data in a structure that supports informed decision-making. This approach provides decision-makers with a complete and seamless view of financial performance and the underlying business drivers.

By taking the lead and providing timely, governed and accurate financial and operational insights to decision-makers – Finance can solidify its position as the go-to business partner for strategic, financial and operational decision support.

This was the focus of a recent OneStream webinar titled: “Taking Data-Driven Decision-Making to the Next Level with Governed Analytics.” Hosted by yours truly and featuring industry expert Howard Dresner, Chief Research Officer at Dresner Advisory Services – we discussed the latest market trends and requirements in corporate/enterprise performance management (CPM/EPM) and Business Intelligence (BI), and how OneStream is addressing these requirements with our platform. Read on for a summary of the webinar.

State of the Market for Performance Management and BI

Mr. Dresner kicked off the webinar with his view of the “modern management system,” which he said should include modeling, planning, reporting and analysis as integral components. Recalling key concepts from his book “The Performance Management Revolution”, Mr. Dresner highlighted the relative roles of BI vs. CPM solutions. While the main purpose of traditional BI tools has been providing knowledge through the access and analysis of business information, Mr. Dresner views performance management as “BI with a purpose,” and described how performance management software solutions fortify the management cycle with “enterprise-class modeling, planning, BI and analytics in a single system.”

Mr. Dresner then highlighted some of the key findings of Dresner Advisory’s “Wisdom of Crowds” market surveys on EPM and BI trends. The key trends identified for EPM include:

- EPM software usage is higher in larger organizations, almost 60%, although the availability of cloud-based EPM solutions has helped increase adoption in small and mid-sized organizations.

- Only 9% of respondents prefer to source EPM solutions from their ERP vendor, while 91% prefer EPM specialist software providers or are open to any solution.

- 88% of respondents employ data-driven decision-making most or all the time

Contrasting the findings of his research on BI software adoption to EPM, Mr. Dresner highlighted the following:

- BI initiatives are most often driven by operations, followed by executive management, then Finance vs. EPM which is most often driven by Finance.

- The #1 targeted users for BI solutions are executives, followed by middle managers and line managers.

- Penetration and usage of BI tools has increased in his 2019 vs. 2015 surveys.

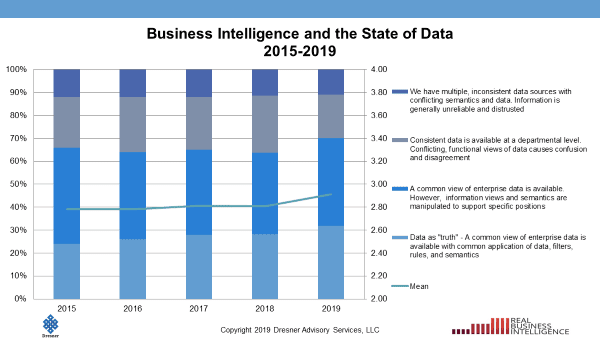

Mr. Dresner also highlighted that his research shows increased reliance on trusted data for decision-making, including a common view of enterprise data with common filters, rules and semantics. His research also found that organizations that embrace EPM, referred to as EPM advocates, have a higher chance of success with BI initiatives and they also see increased benefit from their use of BI tools.

In conclusion, Mr. Dresner’s research indicates that Performance Management is increasingly viewed as critical and is moving beyond the historical base of Finance and large organizations. Business Intelligence usage continues to expand, moving beyond executives to all stake holders and including customers. And as mentioned earlier, organizations embracing EPM and BI are more likely to be successful with their use of information and key business objectives.

Evolving EPM Customer and Market Requirements

Following Mr. Dresner’s presentation, I reviewed some of the new and evolving market requirements we are hearing from the market. One of the obvious ones is that for Finance to become a true business partner they need to shift more time to forward-looking analysis by automating as much of their day-to-day tasks and processes as possible, shortening reporting and planning cycles.

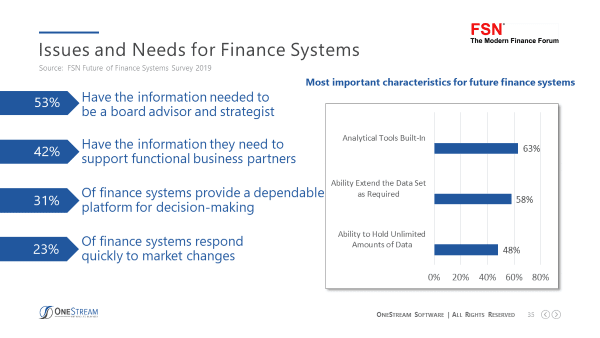

But an emerging requirement is the need to combine financial, operational and larger volumes of detailed transactional data for decision-making, all while insuring the accuracy and auditability of this data. And Finance teams are looking for easier ways to share results with executive and managers. They are also looking for improved data visualization capabilities, and reduced data latency – meaning reduced reliance on 3rd party BI tools, which requires data to be exported from CPM systems like OneStream causing delays and loss of control over the data.

These emerging needs are validated by third party research we’ve seen recently from firms such as FSN, and Gartner. For instance, according to FSN’s 2019 Future of Finance Systems Survey the top characteristics for future Finance systems include built-in analytical tools, ability to extend the data set as required, and the ability to hold unlimited amounts of data.

OneStream Introduces Built-In, Governed Analytics

With this backdrop of changing customer and market requirements, I provided an overview of the new, built-in governed analytics OneStream introduced with our Fall 2019 platform release. Our goal is to provide easy access to all the data finance and line of business teams need for analysis, directly within OneStream so they can “analyze without compromise.”

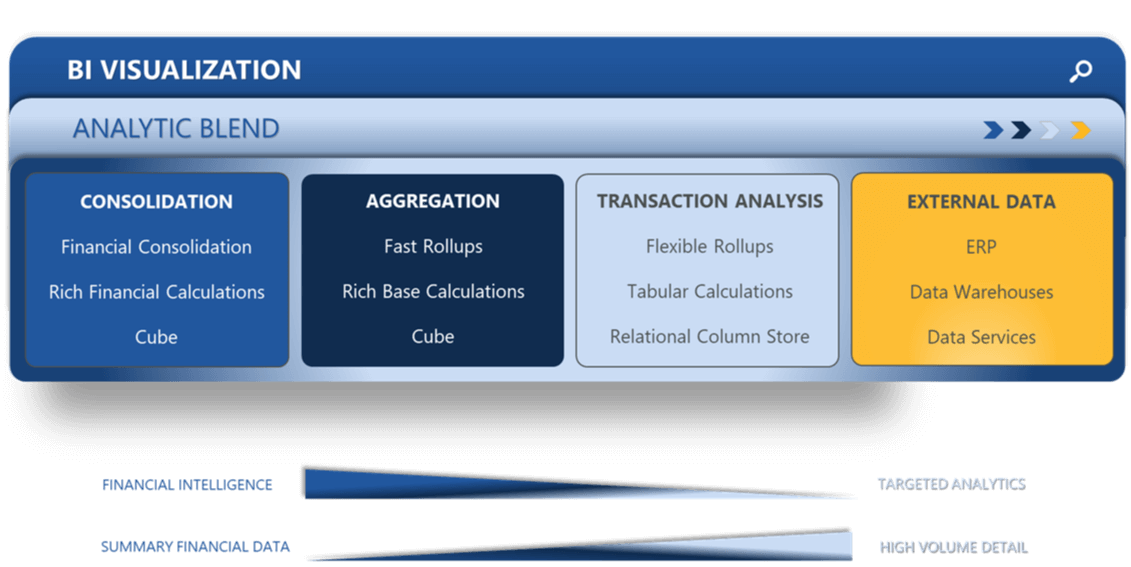

In our Fall 2019 platform relase (a.k.a. OneStream XF 5.2) we extended the OneStream platform with new BI Visualization capabilities and introduced a new capability called “Analytic Blend.” Here’s a graphic and brief description of these new capabilities.

BI Visualization: With new self-service, drag and drop, easy to build dashboards – OneStream is enabling users to quickly configure interactive dashboards that extends real-time access to trusted data in OneStream, and other data sources, to a much larger user community of business users and executive decision-makers.

Analytic Blend: The OneStream XF platform now provides a unique “blend” of governed analytical capabilities ranging from Financial Consolidation – to Data Aggregation – to Transaction Analysis in one platform. The ability to support all three types of data in one platform is ground-breaking.

Potential use cases for the new Analytic Blend capabilities can range from detailed workforce analytics to manufacturing analytics and production planning, detailed sales analysis by product or customer, price/volume/mix and profitability analysis – all leveraging transactional data coming from HCM, CRM, ERP and other data sources.

Learn More

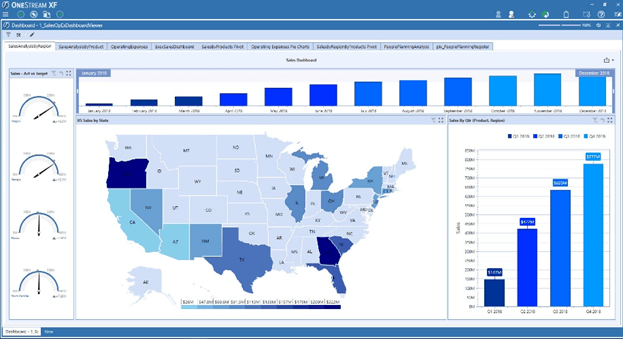

The webinar finished up with a live demonstration of the new BI Dashboards, highlighting how an advanced dashboard such as the one pictured above can be created in about 5 minutes.

Again, our goal here is to enable finance and operating teams to “analyze without compromise” in an environment that’s comprehensive, controlled and consumable by users. The benefits of this approach to customers include:

- Eliminate Fragmented Tools and Reduce TCO – leverage one platform for CPM/EPM, BI, Analytics and Visualization across Finance, sales, HR and line of business operations.

- Integrate Financial and Operational Data – supporting the capture, mapping and loading of millions of rows of data from external sources (ERP, CRM, HCM, DW) for speed of thought reporting and analysis.

- Eliminate Data Latency and Replication – eliminate the need to export data from CPM applications to BI tools (e.g., Tableau, Qlik, Power BI, etc.) causing data latency and loss of control.

- Increase Speed to Value – promote self-service dashboard creation for Finance users, line of business analysts and power users for super-fast, drag-and-drop ad hoc analysis against summarized financial results, or millions of rows of operational data.

- Visualize with Transparency – enable complete transparency and audit trails from summary visualization down to detail transactions and sources of all data.

To learn more about the market trends highlighted in the article and the new capabilities OneStream has introduced into our platform, watch the replay of the webinar or register for one our upcoming live events.

Get Started With a Personal Demo