As the biggest global pandemic in over 100 years, the COVID-19 crisis is having major impact on the global economy and organizations in almost every industry across the globe. And while the worst of the outbreak is hopefully behind us, the return to normalcy and timeline for economic recovery is anything but certain.

So how are organizations adapting to the disruption and uncertainty that lies ahead? The answer is that many are relying on corporate performance management (CPM), a.k.a. enterprise performance management (EPM) software solutions to monitor changing business conditions, re-forecast and revenue and cash flow for future periods, and model multiple scenarios to support agile decision-making.

Navigating Disruption with CPM/EPM Software

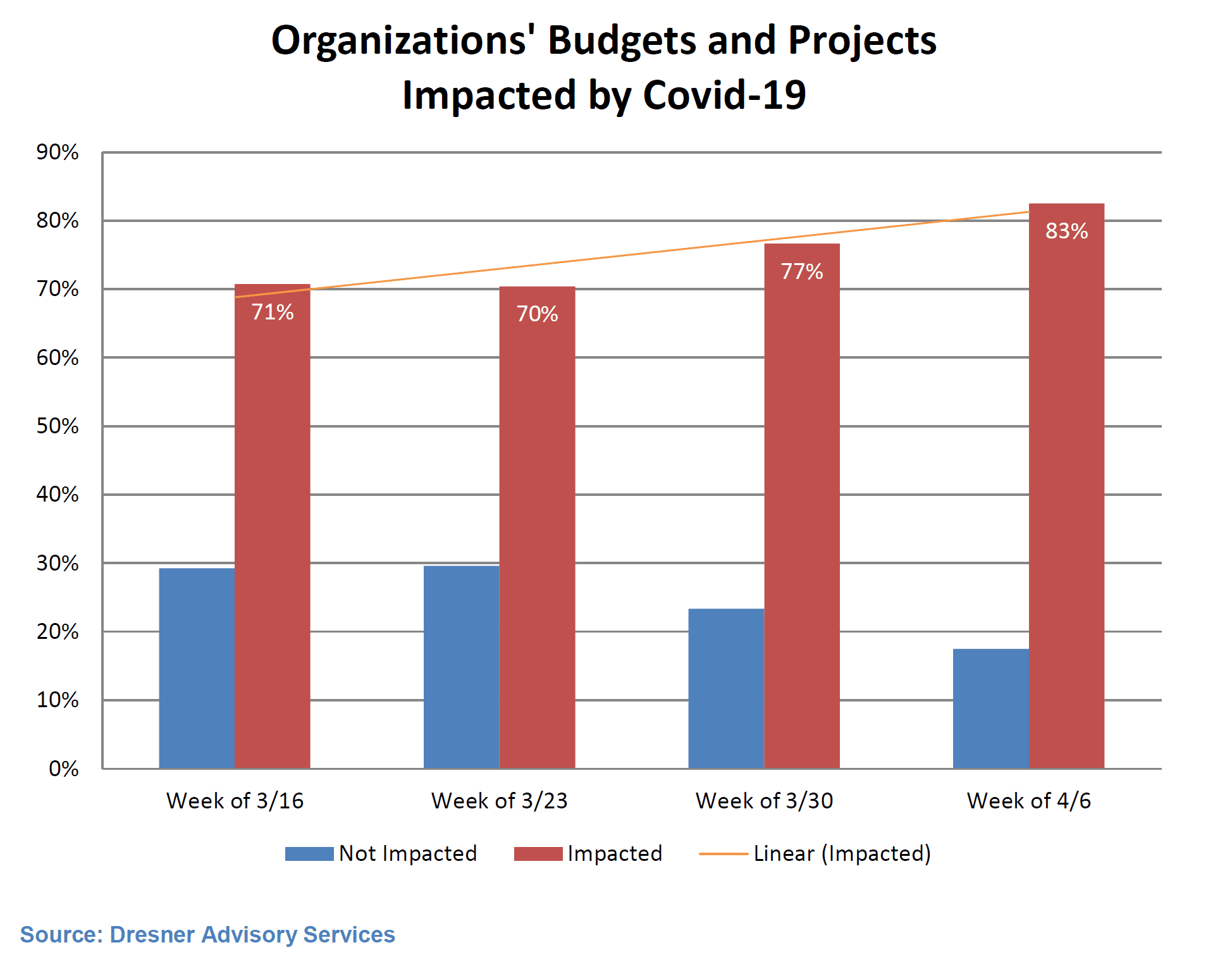

The capabilities of CPM/EPM software were highlighted in a recent research insight published by Dresner Advisory Services titled, “Use EPM to Help Navigate Through the COVID 19 Crisis.” The report is based on survey data that tracks the impact COVID-19 is having on organizations’ budgets and projects, and how that has changed in the weeks leading into April of 2020. During that 4-week period, the % of organizations citing impacts increased from 71% to 83%. (figure 1)

Figure 1 – Impact of COVID-19 on Organizations’ Budgets and Projects

According to the report, the biggest concerns of most organizations during this period are loss of revenue and the availability of working capital to finance ongoing operations. Understanding the impact of the crisis, and managing cash flow as revenues decline, has clearly been a big issue as thousands of organizations were forced to lay off or furlough employees, and/or apply for loans to help get them through the crisis.

Revenue Planning and Cash Flow Forecasting in Focus

The 2019, Dresner Advisory Wisdom of Crowds® EPM Market Study highlighted that revenue planning and cash flow forecasting are key capabilities and priorities for users of CPM/EPM software. CPM/EPM software is also known for supporting strategic planning, rolling forecasts, driver-based planning, and other financial and operational planning requirements.

The Dresner Advisory report also cites scenario analysis as the most-important CPM/EPM capability that can help organizations navigate the COVID-19 crisis. Scenario modeling and analysis helps organizations assess immediate impacts of the crisis on their business, play-out different recovery scenarios for future periods and helps management make more effective decisions about how best to respond.

Many organizations rely on spreadsheets for budgeting, planning and forecasting. But the manual nature of collecting and compiling plans and forecasts via spreadsheets and email slows the process and limits agility during times of rapid change. Spreadsheets are also known to be error-prone and lacking in audit trails and version control.

The Dresner Advisory report goes on to highlight the strategic planning capabilities of CPM/EPM software, including support for long-range financial planning, M&A analysis, and debt vs. equity financing analysis. The report also highlights how the annual budget for most organizations has been rendered obsolete by the COVID-19 crisis and how rolling forecasts extending out 12 – 18 months have become the preferred method of planning through uncertainty and rapidly-changing business conditions.

Customer Use Cases Validate the Research

Throughout the COVID-19 crisis, OneStream’s Customer Success team has been checking in with our customers to see how they are faring through the disruption. While some implementation projects have been delayed, many customers are citing the benefits they’re experiencing by having a unified CPM platform in place. The platform, whether running on-premise or in the cloud, is keeping their finance teams connected and productive while providing them the insights and agility needed to navigate their businesses through the crisis. Here are a few examples:

Scenario Analysis – a company in the aerospace industry that has been hit hard by the disruption is using OneStream to evaluate multiple scenarios for the coming months, at quite a granular level of business detail. In the past this would have taken them weeks of Excel work.

Weekly Cash Flow Forecasting – the CFO of a diversified health, fire safety and fluid metering company told his finance team they needed to do weekly cash forecasting during the crisis. Rather than build a single-user model in Excel, team created a cash flow model in OneStream in about 4 days. They are going to be looking at cash by each of the 60 business units, rolling up 13 week rolling forecast to manage liquidity and cash position.

Daily Sales and Working Capital Analysis – a Fortune 500 food and beverage is using OneStream XF Cloud to move beyond the month-end close and reporting process and is now loading and analyzing sales volume and working capital data, on a daily basis. As a result, through graphical dashboards, the CFO and finance team are now able to view 7, 14, 21 and 28-day trends vs. the prior year so they can spot key trends, update their forecasts and make better, faster decisions that can impact their business results.

Learn More

The COVID-19 pandemic is a true “black swan” event that has disrupted the global economy in ways that were never envisioned. But as the Dresner Advisory research insight highlights, having modern CPM/EPM software in place can help organizations to closely monitor their business, run daily and weekly forecasts of revenue and cash flow, and model multiple recovery scenarios to support agile decision-making.

Hundreds of OneStream customers are already seeing the benefits our unified finance platform is providing then as they navigate this disruption. To learn more, download the Dresner Advisory report, or contact OneStream if you are ready to take the leap from spreadsheets or legacy CPM/EPM applications.

Get Started With a Personal Demo