How is COVID-19 Impacting Short and Long-Term Financial Decision-Making?

The COVID-19 pandemic has clearly had an impact on the personal lives of everyone around the world with restrictions on travel, who we interact with, and how we interact with family, friends and our communities. It has also had an impact on the work lives of most professionals, who have been forced to work from home, and interact with colleagues, customers and partners virtually for the foreseeable future.

But how has the pandemic impacted financial decisions of enterprises for the remainder of 2020 and going into 2021? OneStream Software recently sponsored a Hanover Research survey of financial decision makers in North America designed to answer that and several underlying questions, including the following:

- How are financial decision makers currently tracking financial recovery?

- What external and internal metrics are they tracking? What tools are they using?

- What is their outlook on the future of the financial landscape and what are their investment plans for the future?

- What software tools do they plan to adopt, if any?

Read on to learn the highlights of the research survey and download the full report to see the details.

COVID-19 Sentiment and Reactions Among Financial Decision Makers

This OneStream-sponsored survey was carried out in North America in July of 2020. We gathered responses from 212 finance executives in the US, Canada and Mexico across several industries including Finance and Insurance (36%), IT and Professional Services (25%), Manufacturing and Construction (16%) and other industries (23%). Here are some of the highlights of the survey.

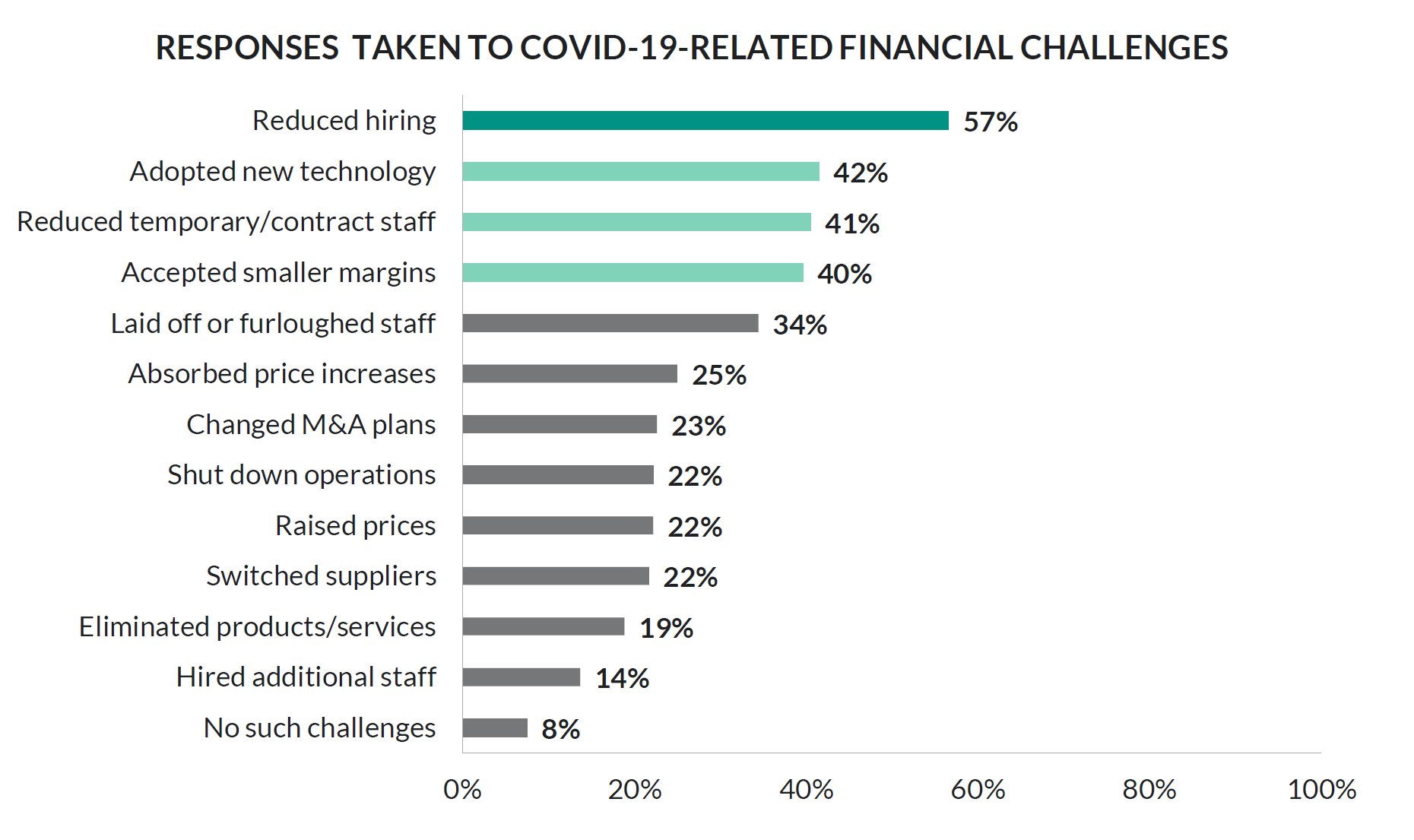

COVID-19 ’s impact is most acutely felt in hiring. Not surprisingly, a majority of companies (57%) have reduced hiring as a result of pandemic-related financial challenges. Many have also reduced temporary/contract staff (41%) or implemented layoffs/furloughs (34%). One of the top four responses was the adoption of technology (42%), mostly likely to support a remote workforce during the crisis (42%).

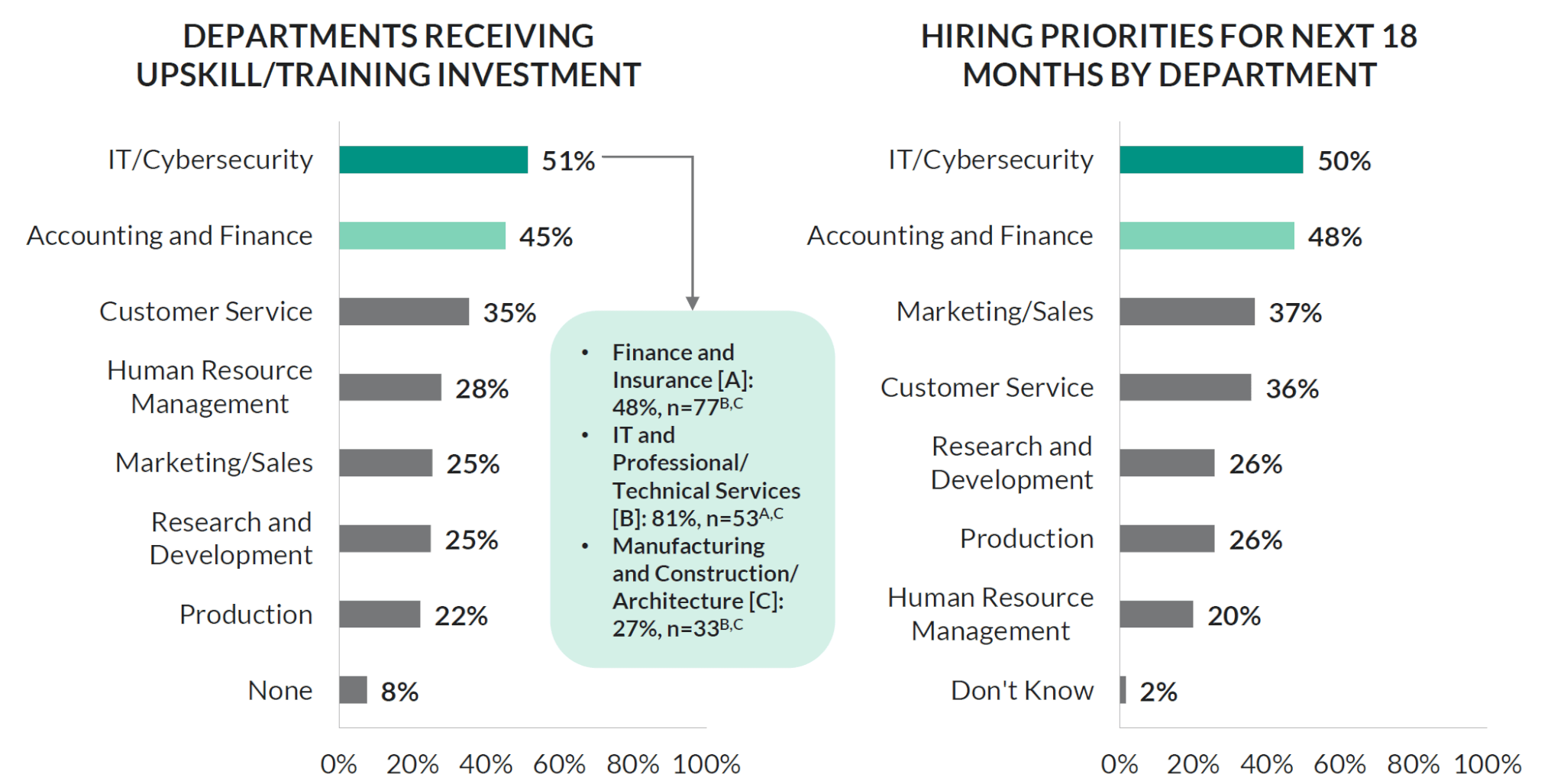

Companies are investing in and prioritizing their IT/Cybersecurity and Accounting/Finance departments. These departments are the most likely to have received remote work-related upskilling/training 51% and 45% respectively) and are the most likely to be prioritized when it comes to hiring in the near future at 50% and 48% respectively.

On a related note, most companies (56%) anticipate budgetary increases in their IT budgets for remote work enablement while about a quarter (24%) are expecting a decrease in their IT budgets.

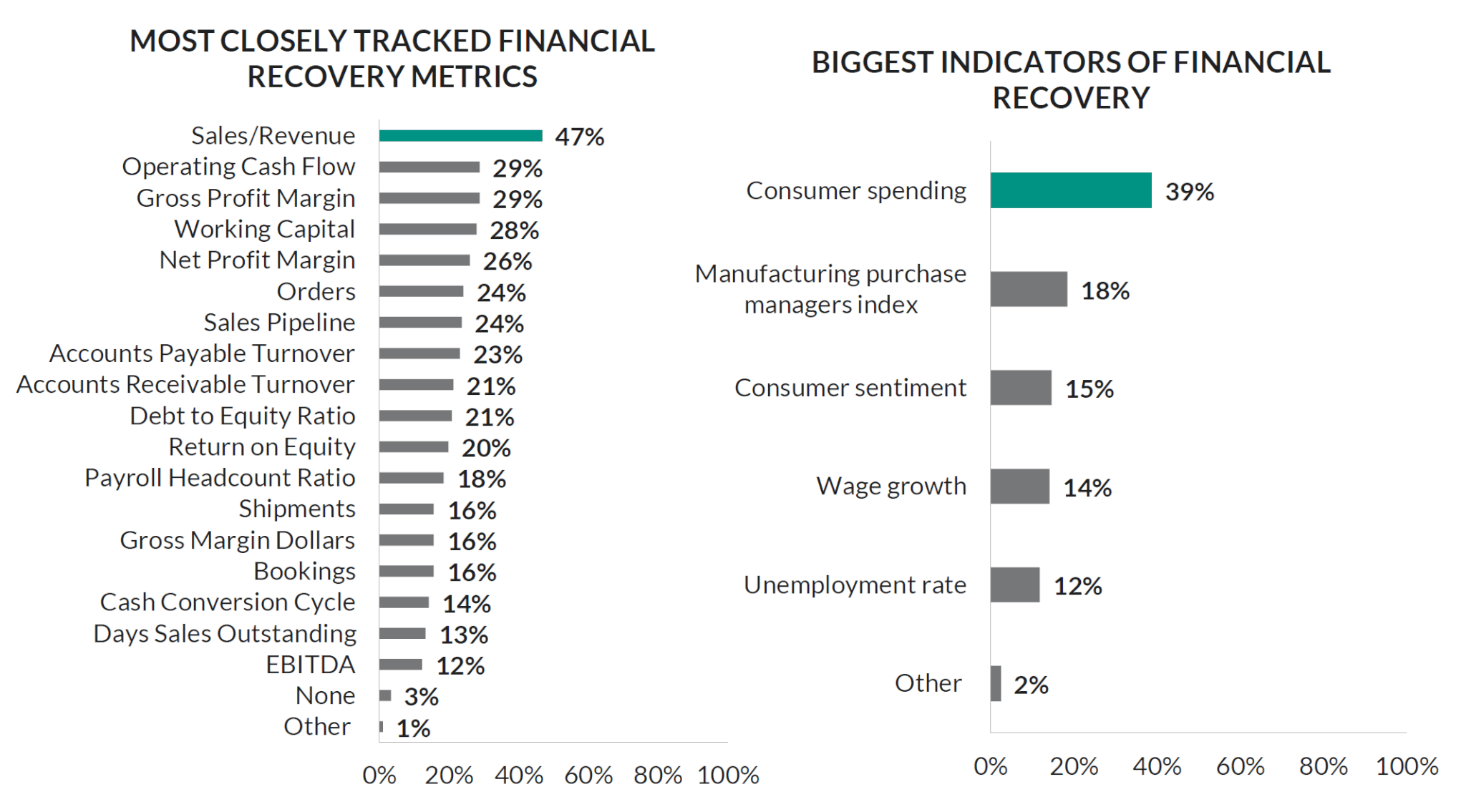

Companies are most closely tracking Sales/Revenue and Consumer Spending as indicators of financial recovery. The former serves as a measure of company level recovery while the latter is an indicator of the state of the macroeconomic environment. The results here were a little surprising as we expected to see finance executives focus more on leading indicators of recovery such as Sales Pipeline and Orders from an internal standpoint. Externally, we expected to see a stronger focus on leading indicators such as Consumer Sentiment and the Purchase Managers Index. These were in the mix but didn’t have as many responses as Revenue and Consumer Spending.

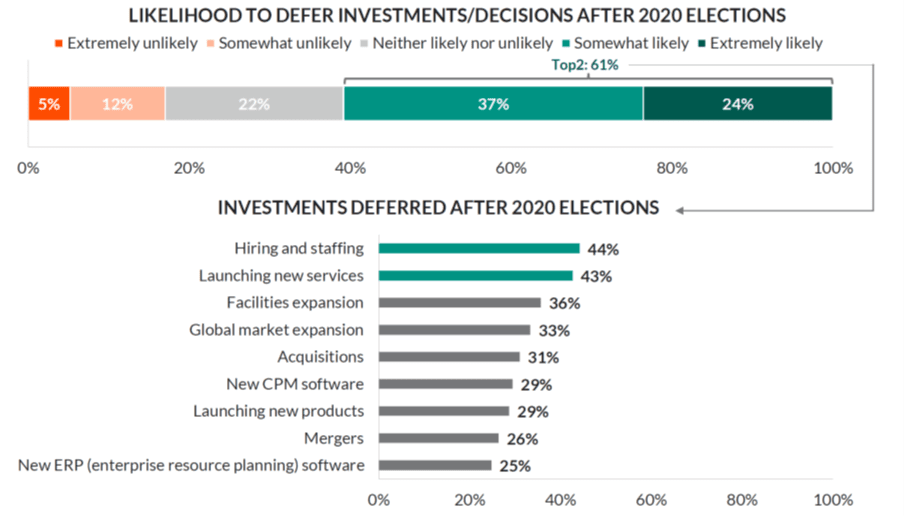

Most companies (61%) are deferring some investment decisions until after the US elections. Investments being deferred include hiring and staffing (44%), launching new services (43%), as well as facilities (36%) and global market expansions (33%). This reflects a cohort largely in tune with the fact that the outcome of the election could have big impacts on tax, economic and trade policies.

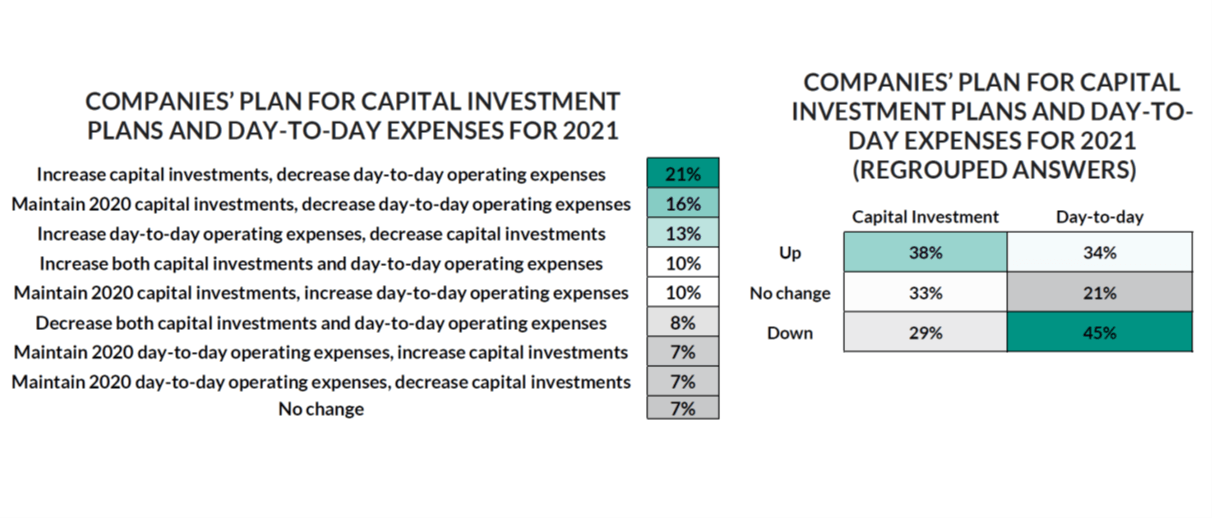

Finance decision makers are divided when it comes to their current read of the near future economic and regulatory atmosphere. The share that are optimistic and anticipate budgetary increases (42%) is roughly equal to the share that are pessimistic and anticipating decreases (38%). Looking to the future, companies expect day-to-day spending to decrease but are split on capital investments. Slightly more (38%) expect capital investments to increase rather than decrease (29%).

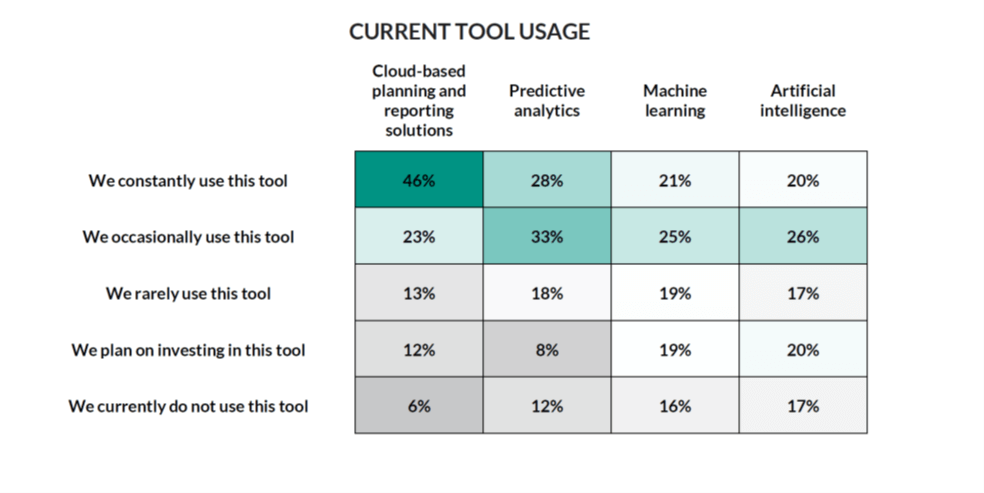

Among data tools, cloud-based planning and reporting tools are used the most. Most companies also regularly use predictive analytics (61%). Just under half regularly use machine learning or artificial intelligence (46% each). Looking forward, more companies plan to invest in these tools (19% and 20% respectively) than any others.

Summary and How to Learn More

Given the impact of the COVID-19 pandemic on the global economy, it’s important to understand how financial decision-makers are responding to and planning for unprecedented challenges. The biggest lever most companies pulled in response to the economic downturn felt in Q2 of 2020 was hiring and staffing. Luckily, only a third of companies that responded to the survey reduced staffing. One of the notable surprises was that 42% of respondents indicated they invested in technology as a result of COVID-19. This trend correlated well to the increased investment and staffing respondents indicated for IT/Cybersecurity and Accounting/Finance staff. It was encouraging to see organizations beefing up their back-office operations during the disruption, so they are better prepared for the recovery.

Another surprise in the results was the focus on lagging metrics to measure the recovery – e.g. Sales/Revenue and Consumer Spending. We expected to see more focus on leading indicators here, but maybe this demonstrates the “show me the money” mentality of finance executives who want to see actual sales/revenue coming in vs. looking at pipeline or consumer sentiment. It was also surprising to see 61% of respondents are deferring some investment decisions until after the US elections in November of 2020. I guess they are expecting some major policy changes as a result of the outcome.

In terms of software tools being used to navigate the COVID-19 disruption, it was encouraging to see more than half of respondents using cloud-based planning and reporting tools, as well as predictive analytics. And also encouraging to see the increasing interest in machine learning and artificial intelligence tools. To learn more, download the complete report on the Hanover survey results and contact OneStream if your organization is looking for a software platform that can help you plan and navigate your way through this volatile economic environment.

Get Started With a Personal Demo