Let’s face it, complexity is the inevitable byproduct of growth and change. And though the 2020’s kicked off with major disruption from COVID-19, Finance Leaders are facing ongoing and diverse challenges of rapidly changing markets, operational complexity and accountability to deliver on stakeholder expectations.

That’s why Finance teams no longer have a choice – we have to lead at speed.

Sounds logical, right? But how do successful Finance teams lead at speed? And what steps are required to make the leap to lead at speed and unleash the true value of Finance?

Over the coming weeks we’ll share a series of blog posts designed to help Finance teams answer the following questions and more:

- Why is conquering complexity critical to lead at speed?

- What are the 6 steps to Leading at Speed?

- How can you drive performance with Financial Signaling?

We’ll kick off this blog series by examining why conquering complexity is critical to leading at speed.

Conquering Complexity to Lead at Speed

Leading at speed requires organizations to first get their core Finance processes under control and then to attack more value-added processes. Typically, Finance transformation projects starting in one of two areas – (1) financial close and consolidation or (2) planning, budgeting and forecasting – but some Finance projects involve simultaneously attacking both of these areas.

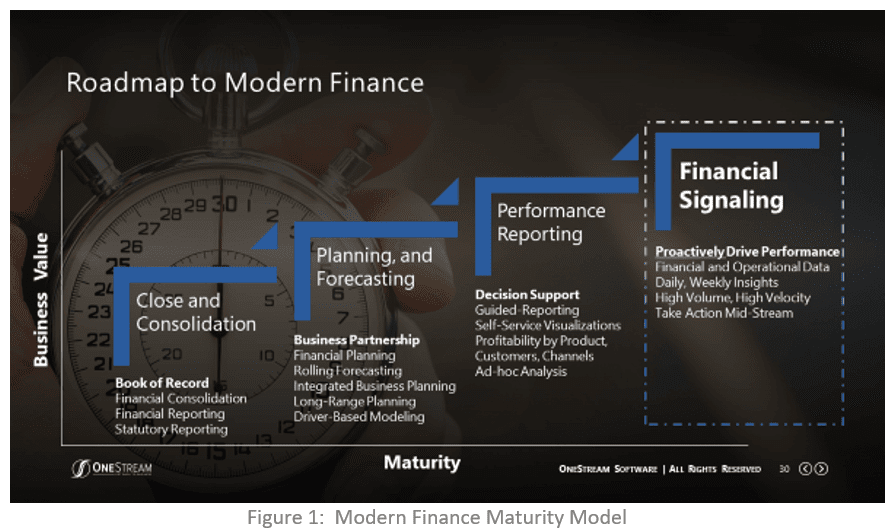

Whatever the case, with these two core processes running well it’s easy and logical for Finance teams to layer on performance reporting and then move into the more advanced process of financial signaling. Below is a sample maturity model (see figure 1) depicting these processes and a brief overview of each process.

– Financial Close and Consolidation – This process drives the “book of record” reporting for the organization, making it an important process to conquer. Whether the organization is private or publicly held, reporting for external stakeholders needs to be accurate, timely and compliant with US GAAP, IFRS or other local regulations. These requirements apply to financial statement reporting, as well as statutory reporting and filings for regulatory bodies.

– Planning, Budgeting and Forecasting – This process helps establish goals, objectives and resource allocations for the enterprise. Accordingly, conquering the process is critical to ensuring a strong partnership and alignment between Finance and Operations regarding plans for hiring, for making capital investments and for meeting revenue, expense and profit objectives. Moreover, in today’s volatile and often disruptive economic environment, leveraging agile planning techniques – such as driver-based rolling forecasts on a quarterly, monthly or more frequent basis – is quickly becoming the norm.

– Performance Reporting – Performance reporting is about delivering periodic (typically month- or quarter-end) financial and operating results to the executive team, board of directors and managers across the enterprise. These results help support stakeholders’ decision-making. Performance reporting ultimately comes in many forms, depending on the needs of the stakeholders, including the forms below:

- Graphical dashboards and scorecards for executives and senior management

- Standard financial statements, board books and presentations for board members

- Product line or divisional P&Ls for line-of-business management

- Profitability analysis by product, customer or channel for product managers, customer service and channel managers

- Ad-hoc analysis and scenario modeling capabilities for Finance and Operations analysts

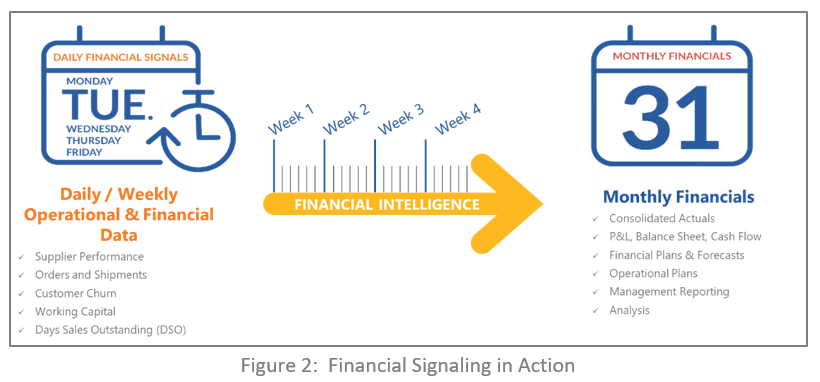

Financial Signaling – This process takes performance reporting to the next level. The monthly and quarterly financial and operating results are essential for stakeholders and can support strategic decision making. But in many cases, those reporting frequencies are insufficient. Given the speed and volatility of today’s economic and business environment, waiting until month- or quarter-end to analyze results and act remains highly insufficient in many industries.

Decision-makers in fast-moving industries need more frequent insight into financial and operating metrics – such as on a weekly or sometimes daily basis – to support more agile decision-making that can impact the outcomes at month- or quarter-end. Unfortunately, the panacea of the “virtual close” or the “continuous close” where the books are closed every day and consolidated financial results can be instantly shared with stakeholders is just not feasible. And it’s especially infeasible when the transactional data is sitting in multiple GL/ERP, CRM, HCM and other systems.

Leading at Speed in Action

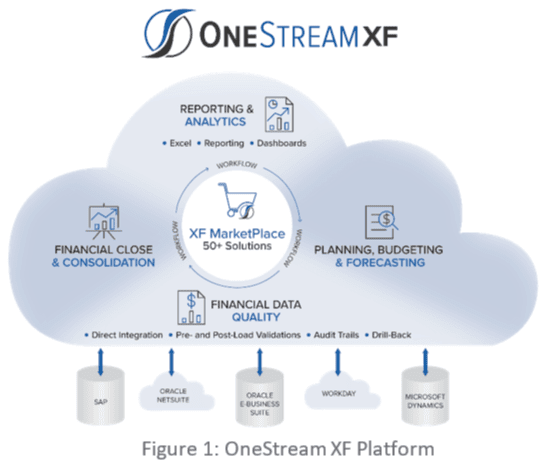

– OneStream Software (see Figure 3) has worked with over 550 organizations across the globe, and across industries, to help them conquer the complexities of the financial close, consolidation, reporting, planning, forecasting, analytics and financial signaling. As a result, their Finance teams have been empowered to lead at speed and support more effective decision-making. Here are examples of the value these organizations have achieved with OneStream’s unified platform:

- Finance enabled more timely and informed decisions by empowering executives and managers with faster and more accurate information.

- Increased Finance team productivity and focused more time on value-added tasks by automating routine tasks and processes and reducing the time spent on system administration.

- Increased business agility – enabling managers across the enterprise to leverage new opportunities and reduce risks.

- Increased revenue, reduced costs and optimized overall business performance

- Reduced the time, effort and total cost of ownership (TCO) of CPM applications by simplifying their IT footprint and moving to the cloud.

Learn More

To learn more about how OneStream’s Intelligent Finance Platform helps organizations conquer complexity and lead at speed, download our white paper titled: Finance in the 2020s – Leading at Speed and stay tuned for additional posts from this blog series.

Get Started With a Personal Demo