One question that often comes up as enterprises are considering modernizing their financial systems is what should they upgrade first – their GL/ERP or corporate performance management (CPM) software? This reminds me of the old chicken and the egg question.

The answer is often “it depends.”

It depends on what? The dependencies can include the pain points or challenges an organization is facing, IT budgets and resources, compelling events that may be driving a system upgrade, as well as other factors. For example, according to 2020 research note published by Gartner1 , “In the current environment (as impacted by COVID-19), organizations are more likely to opt for projects with significantly less change management risk offer a quick time-to-value approach without the significant change management requirements associated with migrating to the latest generation cloud core financial management suites.”

Here’s a quick summary of the roles GL/ERP systems play vs. CPM solutions and some considerations to keep in mind as you plan your organization’s upgrade strategy.

GL/ERPs Run the Business

ERP systems focus on helping organizations run operational processes. The term first came into use in the 1990’s to extend the capabilities of manufacturing resource planning (MRP/MRP II) and to reflect the evolution of application integration beyond just manufacturing.

Today, ERP is generally referred to as a category of business software — and typically a suite of integrated applications—that an organization uses to collect, store, manage and interpret data from these many business activities. Examples of the business activities ERP systems help automate and track include:

- Manufacturing

- Supply Chain Management

- Project Management

- Order Processing

- Finance and Accounting – e.g., General Ledger, Fixed Assets, Accounts Payable, Accounts Receivable, Cash Management

The objective of ERP systems is to automate and integrate these processes across the enterprise to drive accuracy and efficiency in day-to-day transaction processing and operations.

CPM Manages the Business

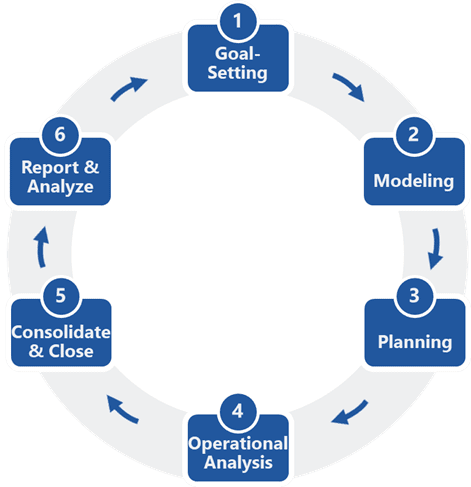

CPM (or EPM systems) focus on helping organizations improve management processes. CPM software systems help organizations achieve their financial objectives by linking corporate strategy to plans and execution. It includes the process of collecting and integrating data from many systems across the enterprise (e.g., ERP, CRM, HCM) to plan, monitor and manage performance. Examples of the key processes EPM/CPM systems help automate include:

- Strategic Planning

- Financial and Operational Budgeting, Planning and Forecasting

- Financial Close and Consolidation

- Financial and Management Reporting

- Analytics and Scenario Modeling

From a software standpoint, a small enterprise may start out using Microsoft Excel for budgeting. Then as the enterprise grows it may implement a basic CPM software solution for budgeting, planning, and management reporting. Then as the organization grows and expands in complexity, with multiple subsidiaries transacting with each other, international operations with multiple currencies, joint ventures and partial ownership interests – they may upgrade to an enterprise-class CPM software solution with more robust financial consolidation, reporting, planning, forecasting and analysis capabilities.

Which to Upgrade First – ERP or CPM?

If an enterprise already has both ERP and CPM software solutions in place, and if their ERP system is no longer meeting their needs and is hindering operations, there may be a good reason to focus on the ERP implementation first, then upgrade the CPM software after the ERP upgrade is complete.

However, in a larger enterprise, an ERP upgrade or re-implementation can be a major project that takes several years, costs millions, and can be very disruptive to the business. One strategy that organizations will often use to minimize the disruption is to upgrade or implement a new CPM solution before the ERP upgrade project, or to unify data from multiple ERPs.

Why CPM first? Here are several reasons upgrading your CPM system first makes sense:

- Faster Time to Value – a well-scoped CPM project can go from start to go-live in 6 months or less. If the focus is on financial close and consolidation, or budgeting/planning/forecasting system design, configuration, testing and go-live can be accomplished quickly and at a much lower cost than an ERP upgrade.

- More Flexibility – in general, CPM applications provide more flexibility in reporting and analysis than ERP systems. CPM applications can support multiple, alternate hierarchies or rollup structures for reporting and analyzing results from different points of view – e.g. management structure, legal entity structure, tax structure, and others. And CPM applications also provide the ability to quickly change reporting hierarchies to quickly see the impact of reorganizations or acquisitions on financial results – something ERP systems are not designed to support.

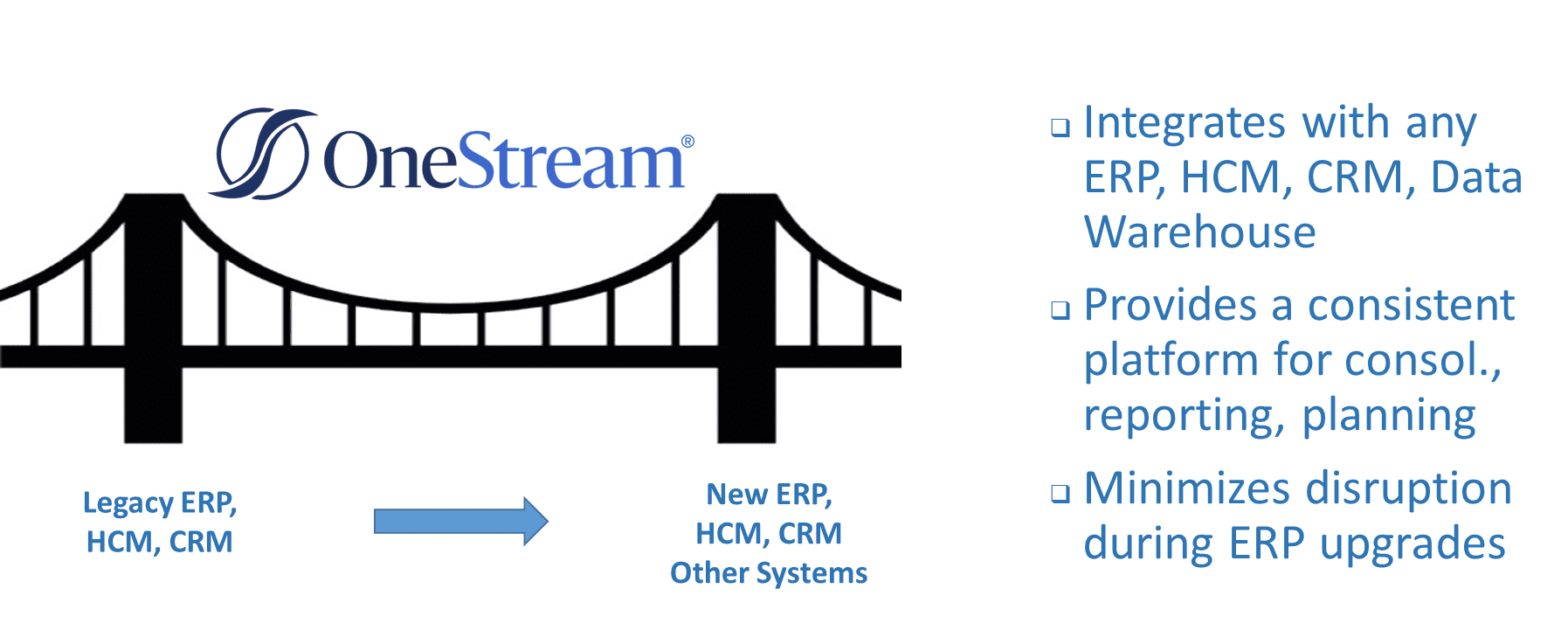

- Bridge to the Future – In this case, the new CPM solution can serve as a “bridge to the future”, initially integrating data from the old ERP system, or multiple ERP, HCM, CRM and other systems. Then as the new ERP system is being implemented and older systems are being phased out – the CPM solution can integrate data from old and new systems – providing a consistent and continuous platform for financial consolidation, external reporting, planning, budgeting and forecasting, management reporting and analysis.

This “bridging” approach not only minimizes disruption during the ERP transition, but it also provides a flexible environment for supporting future changes – such as integrating acquired companies, new systems, organizational changes, or addressing new regulatory and management reporting requirements.

Unifying Multiple ERPs with OneStream

Headquartered in Mexico City, Grupo Traxión started through acquisitions of several logistics and transportation companies. These companies had their own ERPs, including SAP and Oracle systems, each with a different chart of accounts, philosophy of work and APIs. Grupo Traxión was using Excel® spreadsheets for financial consolidation and reporting, but inconsistencies in data collection from each entity created a long and inefficient month-end close process.

In addition, senior management lacked visibility into the individual business segments, which limited their ability to perform detailed analysis and strategic decision-making. Grupo Traxión selected OneStream to strengthen internal controls over financial information with a unified platform for financial consolidation, internal and external reports, comparatives and analysis.

Grupo Traxión initially focused their OneStream project on financial close and consolidation, which was successfully implemented within a swift six-month period. The build included a multi-consolidation process for financial and management data. Data integrations are also in place between the data sources and OneStream’s Cloud platform, which enables Traxión’s 65 users to drillback to the transactions for deeper insights into financial data.

The company later extended their OneStream solution with operational analytics, then budgeting and forecasting. With Excel® the close process was five days but has now been shortened to two to three days with OneStream. This gives Grupo Traxión the opportunity to spend more time reviewing and analyzing results rather than preparing reports.

Learn More

Grupo Traxión is just one example of the speed of implementation and value a unified CPM platform can provide in integrating data from multiple ERP systems to create a flexible platform for consolidation, reporting, planning and analysis. To learn more, visit the customer testimonials on our web site and contact OneStream if you thinking about an ERP upgrade but need a bridge to the future that can help minimize the disruption to you organization.

1 3 Ways to Flatten the Finance Record-to-Report Curve in Times of Crisis and Opportunity, Gartner, 17 July 2020.

Get Started With a Personal Demo