Congratulations. Like many Finance leaders lately, you’ve made the decision to finally move your corporate performance management (CPM) processes forward with a new software solution. Reaching this critical decision is certainly a milestone. But at the same time, you must also prepare for what comes next – creating and managing an effective evaluation process. For many organizations, especially first-time buyers of CPM software, getting the due diligence process right is critical for selecting the right solution.

With so many Finance teams now rethinking their planning and financial close processes, we wanted to share our 5-step guide to conducting an effective CPM software evaluation.

Step 1: Document Your Needs with Specificity

Documenting your specific needs is the single most important task in the whole evaluation. One common error I’ve seen is that well-meaning folks define their existing processes rather than defining what’s required to achieve their desired state. Here’s a few tips to consider:

- Keep the end-state in mind and be open to different and potentially better ways to accomplish the results you seek.

- Define your requirements, and work directly with vendors to ensure they understand those requirements. When possible, provide a list of the areas/items you want to see each vendor demonstrate in the solution. But don’t force a vendor to follow a specific script. Why? Well, what you think might be a logical flow based on your understanding of current processes may not be sufficient within a new solution. Instead, be sure all your requirements are met, but allow the vendor to demonstrate the solution in a sequence that best reflects the differentiators or uniqueness of the vendor-specific solution.

- Ensure you fully understand what it takes for the demo to actually materialize in the final product. Be specific in your asks. For example, rather than asking how reporting works, let the vendor know what specific report types your organization requires. Then ask the vendor to demonstrate how reports were built and have the vendor build one from scratch.

Step 2: Keep the Size of Your Selection Team Manageable

Be smart about who is part of the selection team. Including everyone in Finance who interacts with the system can make the selection team too large and dilute the process.

Instead, keep the selection team as lean as possible while still involving the key stakeholders. Involve IT early as well to avoid surprises. With IT’s input up front, you can also ensure your evaluation doesn’t come to a grinding halt because the chosen solution doesn’t meet fundamental IT standards and guidelines.

Step 3: Develop and Memorialize Your Selection Criteria

Selection teams at many organizations struggle to remember each vendor’s demonstration. You can avoid those struggles by making sure you’ve defined the selection criteria and a clear process. Then ensure you have a crisp method for each stakeholder to capture personal impressions and notes. Here are a few suggestions:

- Create an electronic version of your detailed business requirements in the form of a scorecard. Then let each member decide how to individually take notes (e.g., recording info online, printing out the requirements with room for handwritten notes, simply providing a score, etc.).

- Create a weighting system to properly evaluate the impact of key requirements to the entire selection process. Not all items have the same significance, so each weighting should reflect the relative importance of each criterion. For example, the need for the solution to handle your complex intercompany eliminations and partial ownership interests probably would outweigh your team’s user interface preferences. Similarly, your need for account reconciliations may overshadow your need for multi-currency capabilities, especially if you only operate in a single currency.

Step 4: Get Under the Hood on the Technology

Kicking the tires of the technical foundations on CPM solutions is critical. Why? Because this is your moment to get under the hood and ensure the future investment is right for your organization. Here are just a few key considerations when evaluating multiple CPM solutions:

- Financial Data Quality – You must have a strategy to ensure accurate data enters your CPM solution. Data quality issues are often the number one challenge in determining the long-term success of a CPM solution. And if you’re relying on IT for both data integration and data quality, you’re asking for problems. Why? Because IT is not going to understand the “business context” of the data, let alone know whether the data is accurate. Any vendor that doesn’t discuss data quality with you likely doesn’t understand the real-world scenario you’re facing. Best practice is to ensure that data quality is not only integral to the overall data integration process within the CPM solution but also understood or ideally run by Finance.

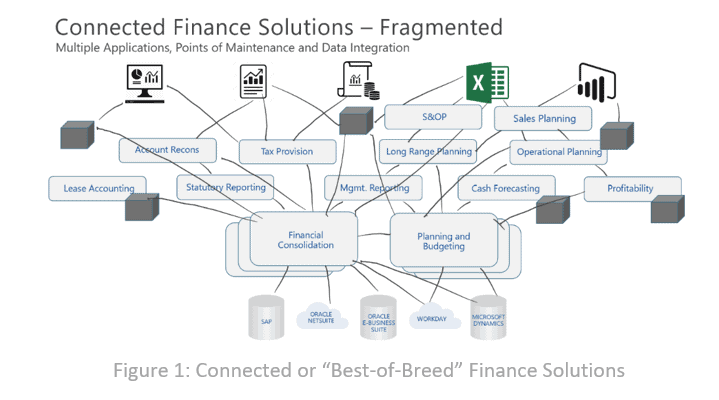

- Scalability – Ensure you understand how the CPM solution scales to address your unique requirements. Listen closely for terms such as “connected plans (See Figure 1),” “additional pods” or the need for “additional applications or modules.” These terms are red flags. The terms are almost always “code” for limitations in architecture. Such limits ultimately force administrative burden and complexity onto Finance teams trying to move data, reconcile data and manage fragmented tools.

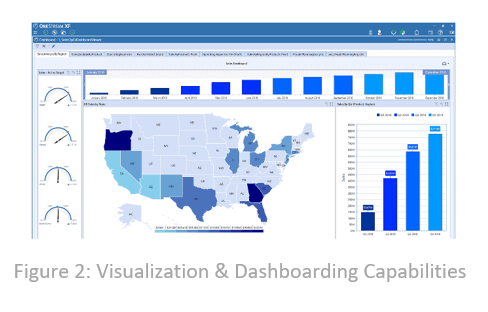

- Reporting & Analysis – Reporting and analysis is another area where CPM systems differ. Many rely on connected and multiple reporting options from third-party vendors for performance reporting (see Figure 1), visualization (see Figure 2) and/or ad-hoc analysis – creating another potential red flag. Why? Because being forced to use multiple tools for different reporting requirements can add unnecessary risk, cost and complexity to your financial processes. And this risk is not just limited to the software, either. It also applies to internal training, maintenance and administration.

A Word on Third-Party and Integrated CPM Software

While some organizations are attracted to a “best-of-breed” strategy for CPM (see Figure 1), relying on third-party or “integrated” products means that you’ll inevitably run into conflicting upgrade schedules. How do you spot when you’re running into trouble?

Pay close attention when the vendor talks about a “compatibility matrix” to make sense of “what” version of “which” software has cross-compatibility. As part of your diligence process, pay close attention to the upgrade process. Understand the timing, potential black-out periods and costs, both in dollars and human capital. And importantly, ensure those “minor details” don’t make it impossible to get the business value your organization requires from a new CPM investment.

Step 5: Check References to Ensure 100% Success

Ultimately, the success of your new CPM solution is determined by your implementation and reliability – not the initial demo. As a Finance leader, you can best predict success by speaking with customer references to get a first-hand account of their experiences.

Ideally, ask each vendor to provide a complete list of customers and let you choose which to call. Don’t let the vendor “cherry pick” the reference list. Best practice is to provide key criteria related to the industry, business requirements or underlying ERP system compatibility that you’d like to learn about. Then have the vendors identify customers on their list that meet those criteria.

Call all of those customers and ask the tough questions. Then call several other customers on the list that weren’t identified by the vendor. Being thorough helps ensure you get a complete picture of what you can expect.

Learn More

CPM solutions are no longer a nice to have for mid-sized to large organizations – these solutions are required to help Finance teams drive performance and lead at speed. Click here to learn about some real-world success stories and contact OneStream if you are ready to take the leap from spreadsheets or legacy CPM solutions.

Get Started With a Personal Demo