The COVID-19 pandemic that broke out in the early part of 2020 was clearly one of the most disruptive forces to the global economy since the economic collapse of 2008. When the pandemic hit, nearly every organization around the world was forced to scrap their 2020 plans and budgets and start from scratch. This crisis was a true test of the agility of organizations around the world, and their ability to quickly adjust their forecasts and operating plans. So how agile is your organization compared to the rest of the market? How do you measure agility in planning?

FSN’s Agility in Planning, Budgeting and Forecasting Global Survey

Answering this question was the focus of FSN’s Agility in Planning, Budgeting and Forecasting Global Survey 2021, of which OneStream was a sponsor. The survey drew responses from 509 international senior finance professionals from the FSN Modern Finance Forum on LinkedIn, and covered finance professionals across 23 different industries.

Producing accurate, far-sighted forecasts and being able to rapidly respond to internal and external factors are invaluable capabilities, but not ones universally demonstrated according to the survey. The Agility in Planning, Budgeting and Forecasting (PBF) survey found some organizations fall well short of the basic competencies necessary to maintain an agile planning, budgeting and forecasting (PBF) process. The three main drivers of agility that were studied in the report include the following:

- Velocity – The time to reforecast earnings and revenue should be under a week (speed), and organizations should be able to forecast a year ahead with confidence (direction).

- Accuracy – Agile companies should be able to forecast earnings and revenues to within +/- 5%.

- Ability to change the PBF process under strain – Companies should be able to make a minor change to their budget and should be able to roll out that change to budget holders’ templates, within half a day. Agile companies should also be able to make a simple change to their organizational hierarchy in the same time-frame.

Quickly and Accurately Forecasting Results

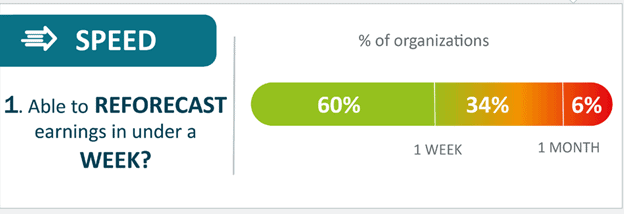

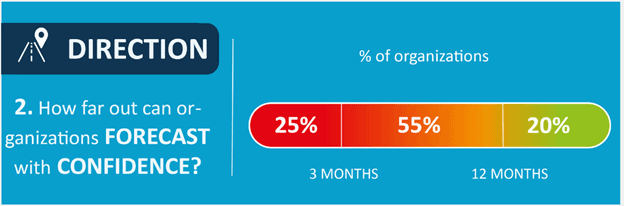

Looking at the speed and accuracy of forecasting, the survey found that around two thirds of organizations manage to reforecast their earnings in under a week. However, only 39% are able to do so within +/-5% accuracy, reflecting a decline from the 42% according to an FSN survey completed four years ago.

The picture deteriorates substantially when determining whether companies have agility in forecasting further into the future. In fact, 80% of respondents reported they are unable to forecast beyond a year, and over 50% cannot see out further than 6 months.

While agility is lacking in many areas, the survey found that organizations that had made headway in transforming their PBF process are better equipped to handle change. Around a third of participants had made some efforts to transform PBF, although only 5% claim to have completely transformed the process. That said, those 5% are able to forecast quicker, more accurately and with greater foresight into the future than the transformation laggards. They are also able to manage their data better and used more advanced BPF tools.

The Impact of Rolling Forecasts and ZBB

Even as many organizations fall short of a truly agile planning, budgeting and forecasting process, there are others that improved substantially by introducing process improvements. Here are a few of the key findings from the survey:

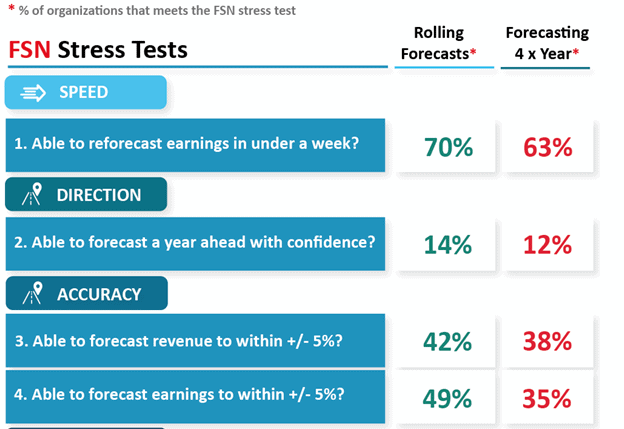

- Rolling forecasts lend more agility than quarterly ones

- Zero-based budgeting improves outcomes ahead of more traditional budgeting methods,

- Companies that implement scenario planning are much more agile than their competitors over the longer term.

Twelve-month rolling forecasts are used by between 19% and 25% of companies depending on size (larger organizations are more inclined towards this), and it helps with many aspects of agility. Reforecasting time improves, accuracy is positively affected and the ability to respond to organizational change is markedly better than companies that only reforecast quarterly (see the graphic below). Rolling forecasts are difficult to implement using cumbersome spreadsheets, which is why the survey finds that those that choose to use this method are likely to have already invested in specialist PBF software in the cloud.

Meanwhile, companies committed to improving their budgeting outcomes are turning to other helpful methodologies including zero based budgeting (ZBB), and this is having a positive impact on agility. ZBB requires budget holders to ‘start from zero’ and justify their resource requirements at each budget setting. It is particularly pertinent in the context of profound business changes such as COVID-19, where there is more scrutiny on resources. The survey shows that ZBB improves all-around performance of the PBF process, particularly in the area of forecast accuracy.

Few Organizations Embracing Scenario Planning

The survey finds that this foresight can be significantly improved when companies use scenario planning. However, a mere 4% of organizations make sufficient time for effective scenario planning, although there has been a surge of interest in scenario planning since the pandemic swept away assumptions and forecasts with unprecedented speed and ferocity. The complexity of managing and running various scenarios means companies that are still wedded to spreadsheets will be severely limited in what they can achieve. Only those organizations that have mastered their data and deployed specialist tools are able to properly enjoy the benefits of scenario planning.

Lessons Learned

Current economic conditions are a stark reminder that organizations must be ready to respond to new market opportunities and threats more quickly than ever before. And while the increasing pace of change is putting more pressure on finance teams, many are taking steps to increase agility and improve decision making by innovating beyond static budgeting cycles. They are focusing on more agile forecasting methods such as rolling forecasting, zero-based budgeting and the detailed business drivers and operational plans that are leading indicators of financial performance.

Unfortunately, many finance teams still rely on disconnected, legacy corporate performance (CPM) applications and cloud-based point solutions to manage their budgeting, planning, forecasting and analysis processes which provide little ability to create leverage and scale for Finance teams. As the pace of market changes increases, and does so at an accelerated pace, Finance teams need to shift their focus from data gathering, reconciling data and managing key integration points to collaborating with line of business partners and providing better, faster insights to support decision-making.

To learn more, download the FSN report here, and contact OneStream if your organization is looking for a platform that can support more agile planning, budgeting and forecasting.

Get Started With a Personal Demo