“Setting profitability objectives is not the same as managing profitability”, said Robert Kugel from Ventana Research in his 2020 analyst perspective1. And he’s right. In practical terms, there’s a very distinct difference between the two. Why? Because companies that can navigate the increasing complexity in their businesses by understanding revenues and costs across their products, customers, markets or channels will – and do – gain significant competitive advantages.

This level of analysis involved with several layers of complex allocations can be difficult for some organizations – especially those with disparate corporate performance management (CPM) legacy systems or those working in Excel, given the widely known limitations of spreadsheets. For many, the indirect costs (e.g. Rents, Utilities and Marketing) as a share of overall costs are growing, particularly for organizations with shared services models. The focus on customer service and experience has also become imperative, especially because maximizing customer satisfaction can result in some businesses losing control over direct costs.

In essence, to preserve margins and ensure profitability and longevity, organizations must have the right tools in place to fully understand and continuously monitor their business processes.

According to FSN’s 2020 report on The Future of Analytics in the Finance Function, as many as 40% of organizations are technology constrained and lack the analytical tools to fully exploit their existing data. OneStream has the power to release those constraints. How? By unleashing Finance teams from fragmented CPM and manual processes. More specifically, OneStream offers profitability management as part of a unified, Intelligent Finance platform that supports financial consolidation, financial, statutory, and management reporting, planning, forecasting and analysis.

Align Customer & Product Analytics with Financial Results

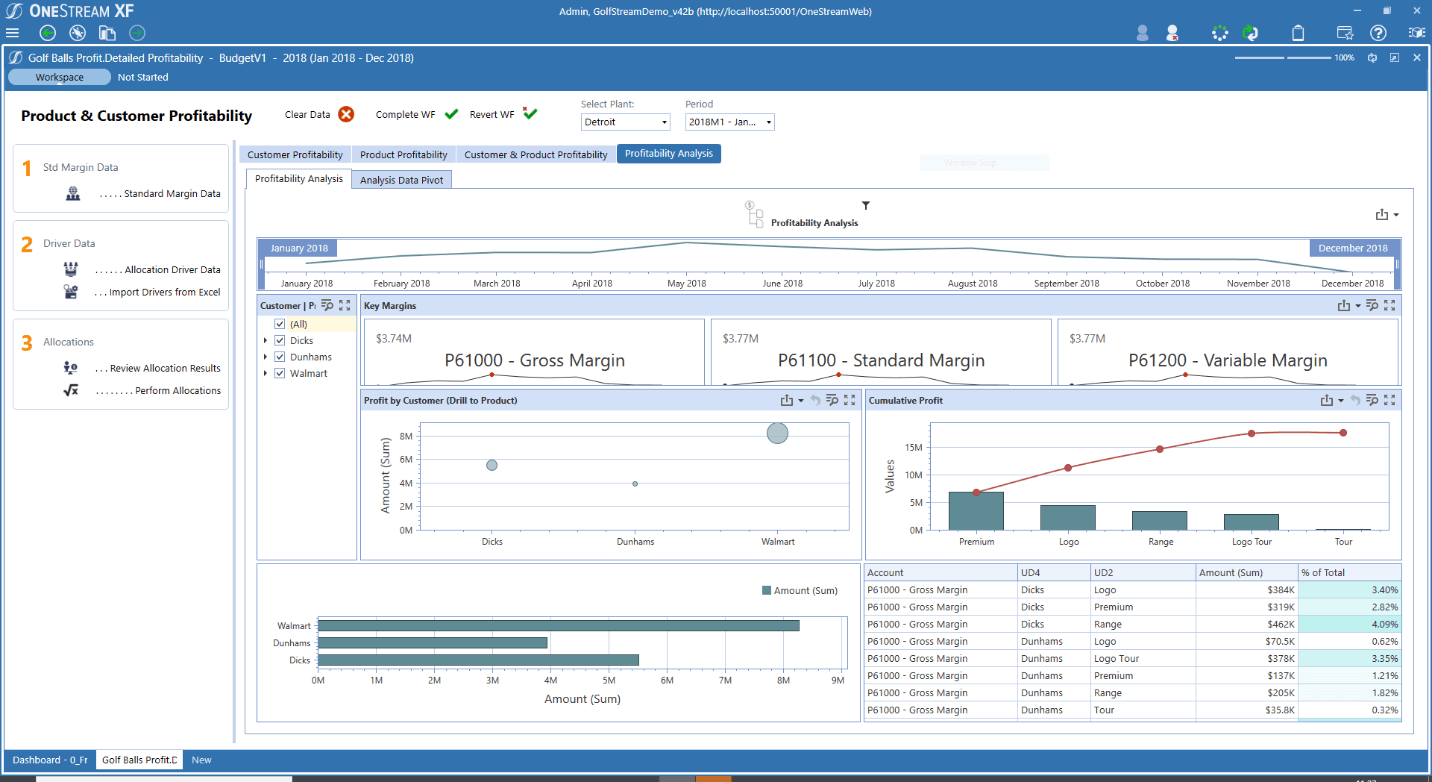

OneStream’s Intelligent Finance platform blends financial and operational data to enable users to create and share insights into key drivers, such as customer and product profitability (see Figure 1). The platform also allows users to see how profitability varies by region or channel.

Using built-in, self-service reporting and analytics, users can leverage OneStream’s integrated allocation model to identify which areas of the organization are adding value vs. which are detracting value. This model, through those capabilities, immediately empowers Finance teams and their business partners with the insights and awareness required to effectively take action and ensure the optimal financial outcome.

Here are a few of OneStream’s key capabilities for profitability management:

- Powerful, Multi-Step Allocations with Audit Trails

- Complete transparency and auditability into profitability drivers, which builds confidence in the data and allows for collaborating with key business partners.

- A single source of truth across key stakeholder groups.

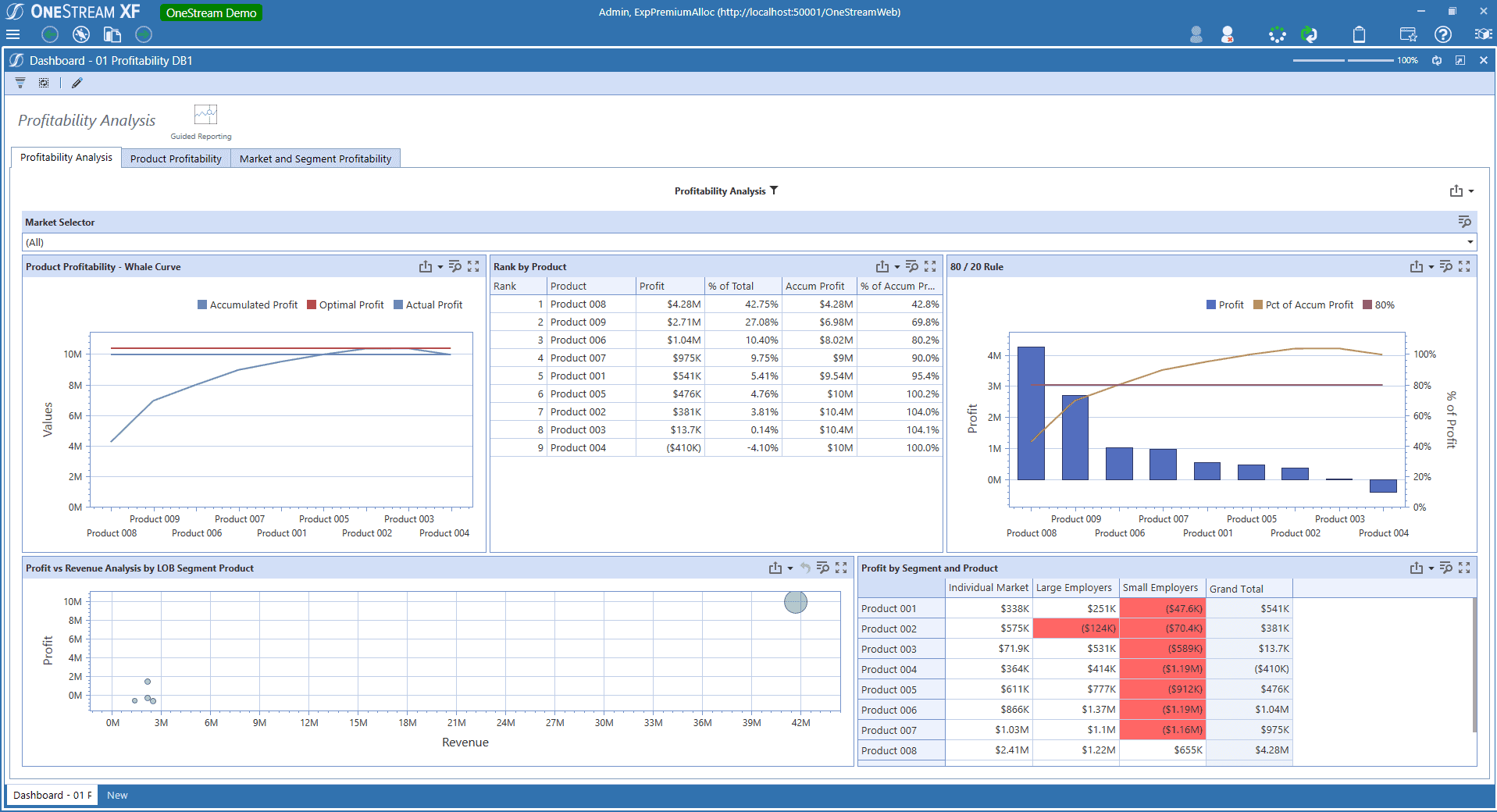

- Built in Reporting & Analytics (See Figure 2)

- Ability to identify key business trends and gain insights into product performance and customer performance.

- What-If Scenario Modeling

- Ability to dynamically manage and track multiple scenarios to identify and build customer or product-specific action plans to drive profitability.

Profitability Management in Action

Global automotive parts manufacturer Henniges implemented OneStream to meet all its financial reporting & analysis requirements – including those for profitability management – in one application. Leveraging the OneStream platform, Henniges can now collect data more quickly (day 4 vs. day 16) and more frequently allowing them to shift from quarterly profitability reporting to a monthly process. The OneStream solution also provides Henniges management with deeper insight into what pieces of the business are producing (or not producing) bottom-line profits.

Key Takeaway

Profitability management is a crucial component of effectively managing and driving the performance of your organization. In times of increasing complexity, it’s more important than ever for your organization to have an in-depth and full understanding of all revenue and cost drivers.

OneStream will empower your Finance team with the detailed insights required to lead at speed, drive decision-making and deliver sustained profitability across the enterprise.

Learn More

To learn more, click here to download our Conquering Complexity in Profitability Management Solution Brief. And feel free to contact us if you are ready to gain improved analytical insights into your business.

1 – Robert Kugel’s Analyst Perspectives – Profitability Management is a CFO Imperative

Get Started With a Personal Demo