In today’s competitive global market, providing managers with accurate insights into profitability by products, standard service lines, distribution channels, customers and other dimensions of business is essential to agile and effective decision-making. Yet many organizations struggle to create the visibility and transparency for these insights either due to the lack of time, technology, perceptions it is too complex to do, or executive support.

Addressing this challenge was the focus of a recent OneStream-sponsored webinar titled “How to Enhance Business Insights and Agility with Effective Profitability Management.” The featured speakers were Gary Cokins, Founder and CEO, Analytics-Based Performance Management LLC and Linda Hellebuyck, Corporate Controller at Henniges Automotive. Read on to hear the highlights of the webinar or watch the replay to see the details.

Cost Allocations and Profitability Management Best Practices

Gary Cokins is an internationally recognized expert, author and speaker on enterprise and corporate performance management (EPM/CPM) methods including measuring and managing customer profitability (using activity-based costing principles). He has over 30 years of experience in the field and has authored several books on these topics.

Mr. Cokins started his presentation off with a review of the basics of activity-based costing (ABC). His key message here is that when CFOs and Finance teams “allocate” indirect expenses (i.e., overhead) to products and standard service-lines, they spread it like “butter across bread”. And in doing so, CFOs violate cost accounting’s universal “causality principle.” Activity-based costing (ABC) resolves this by “tracing and assigning” expenses based on cause-and-effect relationships for how products and service lines consume work activities, which in turn consume the expenses of resources (e.g., salaries, supplies, utilities, etc.).

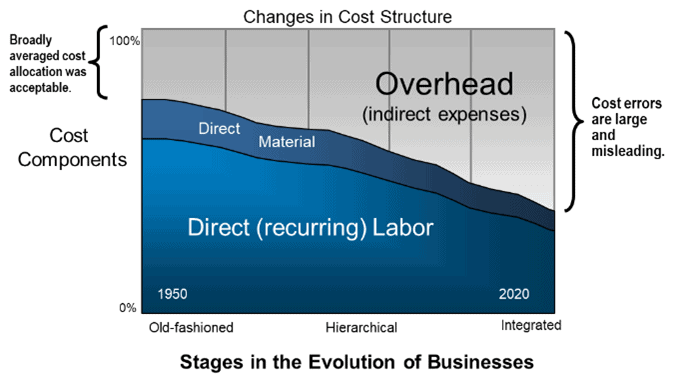

If we roll back the clock to the 1950’s, when direct labor and materials represented the majority of expenses in an enterprise, broadly averaged cost allocations for the indirect expenses was acceptable. But in today’s world, where indirect expenses represent most of the expenses in an enterprise, the averaged cost allocation approach can lead to large flawed and misleading cost errors.

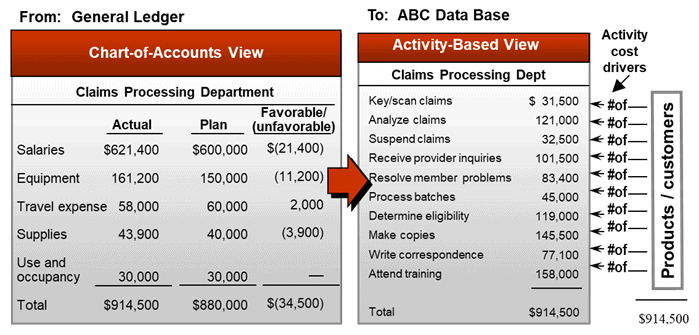

Mr. Cokins went on to highlight the value of ABC in service-based industries, such as insurance and banking. Allocating expenses such as salaries, equipment, travel, supplies and occupancy to the various costs of work activities that occur in a department, such as claims processing, enables a clear view into which groups of customers are consuming relatively more versus less resources and their expenses.

He then reviewed the steps required to effectively implement ABC – allocating expenses from resources (e.g., GL accounts), to the costs of activities, and then to cost objects such as products, service lines, projects, and customers. While applying an ABC-based approach to cost allocations can take more time and effort than performing the traditional but simplistic cost allocations, the benefits are worth it. ABC provides CFOs and Finance teams, and more importantly line managers, with a clear view into which products or services are truly adding to bottom-line profits and which are detracting from profitability – and also a view to what are the drives causing the costs.

The Power of Customer Profitability

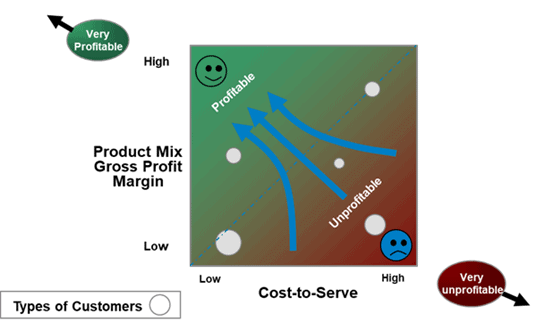

Mr. Cokins went on to highlight the importance of understanding distribution channel and customer profitability. The value of a company is a function of the value it gets from its customers – therefore understanding which customers, or segments of customers, are adding value versus reducing value is critical to driving long-term stakeholder financial value including for shareholders and business owners. Citing several examples from Jeffrey Colvin’s book “Angel Customers vs. Demon Customers,” his message is that by fully understanding customer profitability, CFO’s can help Sales and Marketing to better target customers. This means answering questions like:

- Which type of customer is attractive to newly acquire, retain, grow, or win back? And which types are not?

- How much should we optimally spend attracting, retaining, growing, or recovering each customer micro-segment?

When these questions are answered, organizations can more effectively target the types of customers they want to retain, grow, and acquire; and also make the pricing or customer services changes required to convert less profitable and even unprofitable customers to be profitable customers.

In concluding his presentation, Mr. Cokins provided some guidance on how organizations can overcome the resistance they may encounter when implementing ABC, including technical, misperceptions of excess complexity of ABC, and organizational behavioral barriers. He said, “It is better to be approximately correct than precisely inaccurate”.

Product and Customer Profitability at Henniges Automotive

After a brief introduction to the capabilities OneStream’s Intelligent Finance platform provides to support customer and product profitability, Linda Hellebuyck joined the discussion to highlight the approach Henniges Automotive has taken to understand product and customer profitability.

Henniges Automotive is Leading global supplier of highly-engineered automotive sealing and anti-vibration systems with operations in 8 countries, including 19 manufacturing plants and 4 technical centers. After selecting and implementing OneStream to replace Hyperion Enterprise for financial close, consolidation and reporting – the Henniges team extended their use of the OneStream platform into several additional processes, including Product Line Reporting.

The challenge here is that Henniges produces thousands of automotive products that are very customer and vehicle specific, and as a result, profitability can vary significantly between products. So it’s critical to understand profitability at a customer, platform (vehicle), and product level. Using manual processes and Excel spreadsheets for this type of analysis was very painful, with 80% of the effort going into collecting the data and 20% on analyzing it.

By moving this process into OneStream, Henniges was able to harmonize, store, allocate, and aggregate the data at a detailed (part number) level enabling the Finance team to:

- Produce a summarized P&L (thru EBITDA) for any part, platform(vehicle), product, or customer

- Enable end-user assignment of specific variances (scrap/freight)

- Perform system-generated allocations of other variances

- Identify InterCompany Sales (and Profit) with the ultimate end customer/platform/product

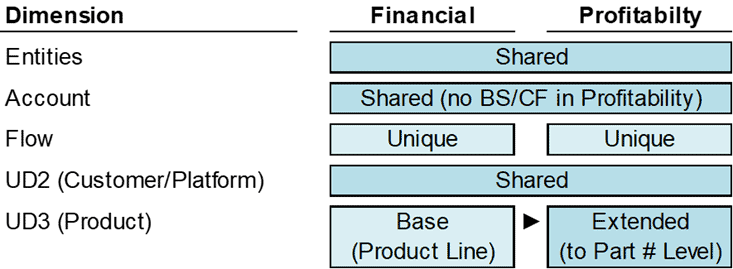

To accomplish this, the Henniges team leveraged many capabilities within the OneStream platform, including its extensibility. This enabled the team to set up two cubes within a single application, one for financial reporting and another for profitability reporting. While the two cubes share several common dimensions, the Profitability Cube has additional dimensions such as Customers, Products, Parts, and Platforms designed to support profitability reporting and analysis.

According to Ms. Hellebuyck, “Because it’s one application, we can share both metadata and data across the two cubes, making cross-cube comparisons easy. In other multi-product solutions, marrying the consolidations data with the part-level analytical data would be significantly more complex.”

Learn More

Leveraging OneStream for financial and profitability reporting has yielded several business benefits to Henniges, and other customers. This includes the ability to collect data faster and on a more frequent basis – moving profitability reporting from an annual to quarterly or even a monthly exercise. The solution provides deeper insight into what pieces of the business are producing (or not producing) bottom-line profits – and to why. This insight helps managers make more informed decisions in areas such as quoting, commercial negotiations, rationalizing which customers to devote more effort on, and implementing cost improvement initiatives.

To learn more, watch the replay of the webinar or contact OneStream if your organization is ready to raise its game when it comes to understanding profitability by products, customers, channels or other dimensions of your business.

Get Started With a Personal Demo