As a former accountant, I’m all too familiar with the financial close, consolidation, and reporting process. For over seven years I executed the monthly ritual of collecting and consolidating financial results from multiple entities and systems, managing all the supporting steps in the close process including account reconciliations, and reporting results to internal and external stakeholders. This process was highly manual back in the early 1980s when I did this using archaic technology and took 20+ business days or more to complete.

We’ve come a long way in the past 30+ years and this process is more easily managed with today’s modern technology. So what is the state of the art in financial consolidation, close management, and reporting? What are the key customer requirements and how do the various vendors in the market address them? Read on to hear the highlights of the recently published Dresner Advisory Wisdom of Crowds® Financial Consolidation, Close Management and Reporting Market Study and why OneStream received the overall highest rating among vendors covered in the report.

The Wisdom of Crowds Speaks

Dresner Advisory Services has published a market study for the past several years on Enterprise Performance Management (EPM), but this has focused mostly on the budgeting, planning, and forecasting aspects of EPM. In 2021, they expanded their EPM survey to include market requirements and vendor capabilities around Financial Consolidation, Close Management, and Reporting.

According to the report – as a subsegment of the EPM market targeted specifically at the office of finance, FCCR includes the following capabilities:

Financial consolidation systems which allow organizations to combine and aggregate financial data from multiple operating entities to produce an overall consolidated financial view of the group’s operations.

Close management systems which allow the finance function to control and manage the process of closing the books on a monthly, quarterly, semi-annual, and annual basis. These systems often include tools to facilitate a faster period-end close (for example, reconciliation management).

Financial reporting solutions which are analytics and reporting tools targeted at finance and line of business users. These tools allow users to analyze financial actual and budget data on an ad hoc basis using financial report layouts such as profit and loss statements and balance sheets.

Here’s a summary of some of the key market trends highlighted in the report:

- FCCR is an established market, as the majority of respondents (62%) already use the software and only a small percentage (7%) are considering implementing it. Over a third of respondents have no plans to deploy FCCR solutions and are likely using Excel, in-house solutions, or modules of ERP systems to address their FCCR needs.

- FCCR use is currently lowest among small organizations (1-100 employees), with only 37 percent currently using it. FCCR software is most widely used among large organizations (1,000-10,000 employees) and very large organizations (> 10,000 employees), with 73 percent and 74 percent respectively currently using FCCR.

- 22 percent of respondents from large and very large organizations state they do not use FCCR software. These organizations have complex FCCR needs, so these data indicate they likely use in-house solutions or modules of their ERP systems. These solutions are candidates for replacement by FCCR software.

- Although the finance function is clearly the primary user of FCCR software, it is also widely used by executive management (59 percent, with a further 11 percent either evaluating or considering its use). This is because FCCR software produces consolidated financial information and analyzes financial performance against budgets, both of which are key elements of management information.

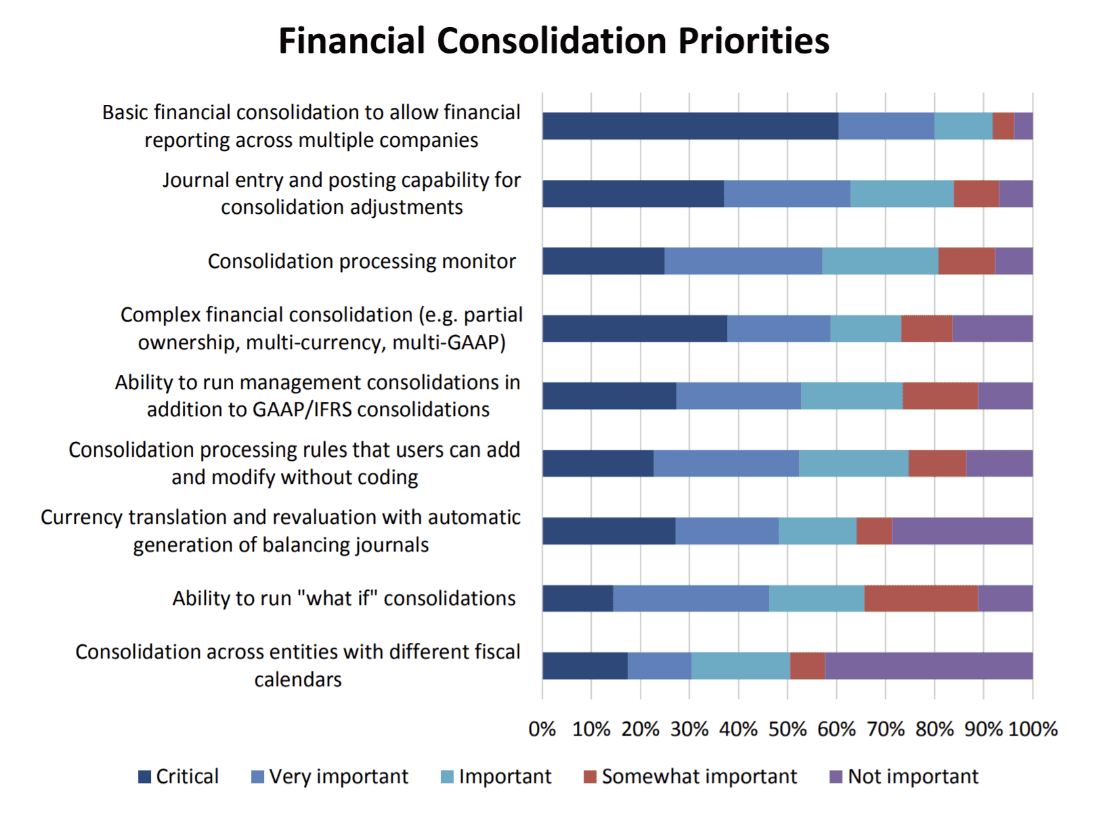

- Respondents rate basic financial consolidation as the most important financial consolidation capability, with 80 percent rating it “critical” or “very important.” However, 59 percent of respondents also rate more complex financial consolidation capabilities as “critical” or “very important.” (see figure 1)

- Close management capabilities are the newest addition to FCCR solutions. Consequently, respondents rate close management capabilities somewhat less important overall compared to financial consolidation and financial reporting capabilities.

- Respondents rate the ability to define additional report layouts for management reporting as the top priority for financial reporting, with 84 percent rating it as “critical” or “very important.”

- Cloud is the most widely supported FCCR delivery model, with 87 percent of vendors currently supporting SaaS / public cloud and 80 percent supporting private cloud / hosted deployment.

Rating FCCR Software Vendors

Vendors whose FCCR offerings were evaluated in this market study were rated based on the following capabilities:

- Financial Consolidation – Model Definition and Structure

- Financial Consolidation – Data Entry and Upload

- Financial Consolidation – Processing

- Close Management (including reconciliation management and disclosure management)

- Financial Reporting (financial statements and management reporting such as board books)

- Architectural Features

So how did OneStream stack up against these requirements? Well, I am pleased to report that OneStream received the overall highest rankings across the 5 scoring categories: Financial Consolidation, Close Management, Financial Reporting, Architecture, and Total Score.

Learn More

According to the Dresner Advisory report, Financial Consolidation, Close Management and Reporting (FCCR) is a fairly mature market with 62% of all organizations, and almost 75% of large enterprises have adopted a software solution. However, we know that most of these organizations are likely relying on legacy, on-premise FCCR solutions that are outdated and may be going off support. So many organizations are evaluating their options and considering upgrades to more modern, cloud-based FCCR solutions.

Download the Dresner Advisory 2021 Wisdom of Crowds® FCCR Market Study to learn why OneStream received the overall highest ranking among the vendors evaluated and contact OneStream if your organization is ready to make the leap from legacy applications or spreadsheets that may be holding your Finance team back from leading at speed!

Get Started With a Personal Demo