While annual operating plans are the norm for most organisations to level-set expectations or anchor compensation targets, such plans do very little to help with resource allocations in a dynamic business. After all, working in a fast-paced, sophisticated organisation isn’t easy – especially if the goal is to respond quickly to new opportunities and risks.

Rolling forecasts are therefore an opportunity for Finance leaders to help push their organisations to think differently. To think long term. And when done consistently, a rolling forecast process can eventually not only eliminate the need for an annual budget but also positively affect the DNA of an organisation. Why is such agility so critical?

That’s an easy one: with the rapid pace of change happening internally and externally, so many factors can change – and change quickly. What factors? Customer wins or losses. External factors like changing oil prices, commodity prices, or interest rates. Changing staffing needs or inventory levels. The list feels endless.

Whatever changes arise, rolling forecasts help organisations adapt.

Challenges to adoption

Many organisations have been reluctant to change or have lacked the right leadership approach. And to make this change happen, executive sponsorship is absolutely fundamental. There are also significant time investments required – something that many stretched Finance departments simply don’t have to spare.

Rolling forecasting has sometimes been seen as a ‘bit of a dark art’ or something unnecessarily complicated. This perception is perhaps derived from the fact that it is virtually impossible to create effective rolling forecast models in Excel. Heck, it’s even impossible in some early financial forecasting software. Many people have tried these technologies and failed, many often burning too much time in the process.

It doesn’t have to be that way, though. Let’s look at the five essential steps to building a successful rolling forecast strategy.

Step 1. Foster buy-in and focus on culture change

The first and most important step requires securing buy-in from all stakeholders before the rolling forecast journey starts. Afterward, change management is critical to the success of any project—in this case, the advantages rolling forecasting can offer.

Now, taking such steps might seem obvious; but Finance projects often fail due to lack of communication with and between stakeholders. That communication then only diminishes the deeper it goes down into the organisation. Keeping the lines of communication open can be challenging, but it’s necessary. If stakeholders do not clearly understand the value for the organisation, the success of implementing rolling forecasts may be at risk.

To ensure success, rolling forecasts must be fully accepted, from stakeholder to analyst and everyone in between. Keeping communications consistent throughout the process of introducing rolling forecasts is a top priority.

Step 2. Keep it simple to solve a complex problem

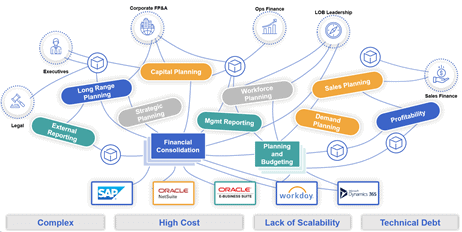

Simplifying the approach to forecasting is key to driving efficiency, which drives value. For many Finance teams, identifying the problem is easy. Deploying a simple agile solution, however, is challenging. Many organisations will be familiar with the situation where the initial purchase of a simple point solution matures into a spiderweb of confusing siloed applications and fragmented data as new applications are purchased to meet changing requirements (see Figure 1).

Why does this happen? Well, because of the pressure Finance is under to solve for the immediate needs of the organization. One of the easiest paths is leveraging tools that are readily available, such as Excel, Essbase or quick, low-cost financial forecasting software options which always, in the moment, feel like the correct choice. Unfortunately, the cost of perpetual usage increases complexity over time, causing delays in access to the data and a general mistrust in the information provided.

Leveraging a unified platform for planning, budgeting and forecasting ensure that rolling forecast processes remain simple and that data is accurate and readily available.

Step 3. Determine the forecast roll (monthly? weekly? 12 or 24 months?)

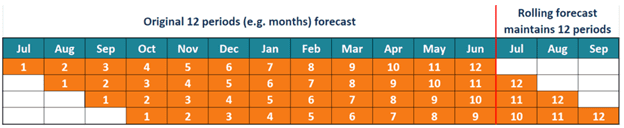

Finance leaders understand that forecasting four to eight quarters past the current quarter actuals is considered a best practice. But they will also agree that there’s no fixed guideline for the time interval in a rolling forecast. The best timing depends on the organisational needs, external pressures, and the time needed to make decisions.

Absent a fixed guideline, one best practice is to ensure rolling forecasts can extend (e.g., roll) beyond the current calendar or fiscal year (see Figure 2). Forecasts can extend anywhere from 12 months at a time to 18 months – sometimes even up to 24 months in highly specialised industries.

Step 4. Roll with drivers, not with revenue

Rather than focusing on all aspects of revenue, organisations should identify the value drivers most likely to contribute to achieving success. The key here is focusing on what the organisation plans for and not having too many goals, which could obstruct Finance from achieving the objectives that are most important to business performance

Ultimately, the act of planning, budgeting, and forecasting is NOT only about Finance. It’s not only about revenues or expenses, either. It is about unleashing value across the organisation.

It’s also about driving measurable business performance. And to do that, the organisation must focus on whatever impacts the business. Finance leaders must then create processes to help translate how changes in the business impact organisational performance.

A driver-based rolling forecast focusing on workforce and/or sales plans ensures agility, collaboration, alignment, and a focus on what drives the organization.

Step 5. Always analyse variances to actuals (best practice for FP&A)

Using the rear-view mirror of budgets and variances as the primary tool to manage performance is less than optimal. As a best practice, Finance leaders should analyse variances to actuals to compensate for rapidly changing market pressures.

This best practice enables Finance to measure the effectiveness and accuracy of a rolling forecast. How? By re-calibrating the forecast based on changes in both internal variables (e.g., changing demand volume and pricing) and external factors (e.g., fluctuations in the industry, economy, weather or geopolitical ecosystems) which cannot be fully accounted for in the prior budget season.

Rolling forecasts focused on variances to actuals will give Finance the foresight to make adjustments throughout the year and increase organisational performance.

OneStream unifies rolling forecasting with actuals

When creating a rolling forecast, having financial forecasting software that can consolidate and pre-populate data to save time is not only vital but also exactly what OneStream was designed to do. The solution will automatically populate rolling forecasts with actuals the moment that the actuals have been certified.

As a unified, Intelligent Finance platform, OneStream is designed to help increase the agility and effectiveness of planning, budgeting, and forecasting as well as financial close, consolidation, and reporting processes. OneStream even dynamically updates reports and report books using the most current forecast. This functionality drastically cuts down the time and energy that FP&A teams spend generating reports, making it much easier to forecast monthly.

There’s no doubt that switching over to a rolling forecast will take some additional time and effort for your organisation and its employees. However, your employees will thank you (and you’ll thank yourself!). The rewards are well worth the work – you’ll quickly see for yourself that transitioning to a rolling forecast has a huge ROI.

Learn More

As your FP&A team begins its rolling forecast journey towards organisational agility, download our 5 Key Factors for Effective XP&A Whitepaper to learn more. And if your organization is ready to make the leap from static planning to agile forecasting, contact OneStream today!

Get Started With a Personal Demo