Financial reporting is an essential function of any Finance organization. It provides stakeholders with a snapshot of the financial results and financial position of the enterprise. You may think that financial reporting is mainly a function of the Accounting group within the Office of Finance, however financial reporting and the related analysis of financial results is an important function of most Financial Planning & Analysis (FP&A) departments. Financial reporting capabilities are also an important feature to evaluate when selecting a software package to support FP&A as well as the Accounting team. Read on to learn more.

What is Financial Reporting?

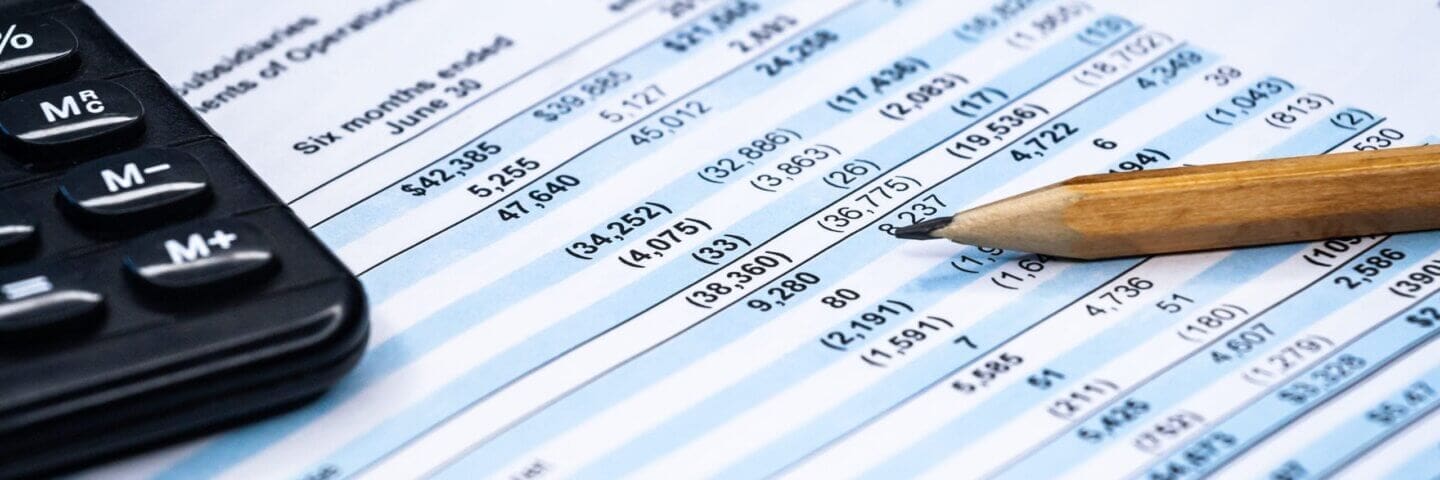

Financial reporting refers to processes and practices that provide stakeholders an accurate depiction of the finances of an enterprise, including its revenues, expenses, profits, capital, and cash flow. The enterprise could be a private or public company, non-profit, government agency, higher education institution, or other organization.

The primary financial statements that are produced through the financial reporting process include the following:

- Balance Sheet – Provides a consolidated view of the assets, liabilities, and capital of the enterprise at a specific point in time. The balance sheet is typically produced at month-end, quarter-end, and year-end.

- Income Statement – Also known as profit and loss, an income statement is a financial report that summarizes the enterprise’s income, expenses, and profits or losses over a specific period of time. Income statements are typically produced for a specific month, quarter, full year, or on a year-to-date basis.

- Cash Flow Statement – The cash flow statement summarizes the amount of cash that the enterprise has generated (sources) and how the cash is being spent (uses). It contains elements of both the income statement and the balance sheet, and it is critical to the successful financial management of an enterprise.

Key Stakeholders and Their Requirements

Financial reporting needs to inform and serve the needs of a variety of stakeholders. This can include external stakeholders such as investors, owners, bankers, public markets, regulators, and boards of directors – who all need to understand the financial performance of the enterprise to guide investment decisions, levy taxes, ensure compliance, and provide advice to executive management.

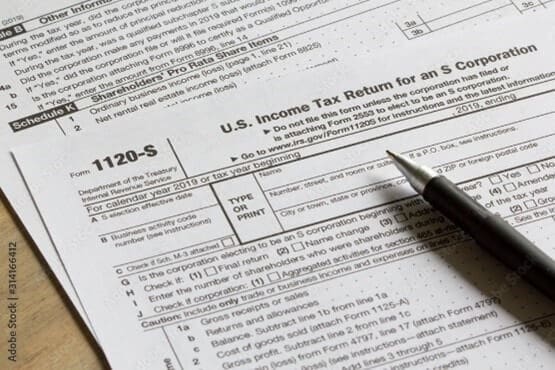

External stakeholders are typically most interested in the key financial statements mentioned in the prior section, as well as supporting details, schedules, and commentary (e.g., management discussion and analysis) about the financial performance of the enterprise.

Financial reports are also essential tools for informing internal stakeholders about the financial performance of the enterprise. This can include the CEO, CFO, and senior management team, as well as managers across the enterprise who need to understand how their particular subsidiary, department, business unit, or function is performing in relation to the overall enterprise. Internal stakeholders are typically most interested in the consolidated income statement of the enterprise, as well as profit and loss reports for their specific area of responsibility. This is where financial reporting expands to include financial analysis. This financial analysis delivered as part of internal management reporting may include the following:

- Comparisons of the financial results to the original budget for the period showing positive and negative variances that should be analyzed.

- Comparisons against prior period performance (e.g., prior quarter or same quarter in the prior year)

- Comparisons of revenue, expenses, and profit or loss across subsidiaries, business units, departments, or product lines.

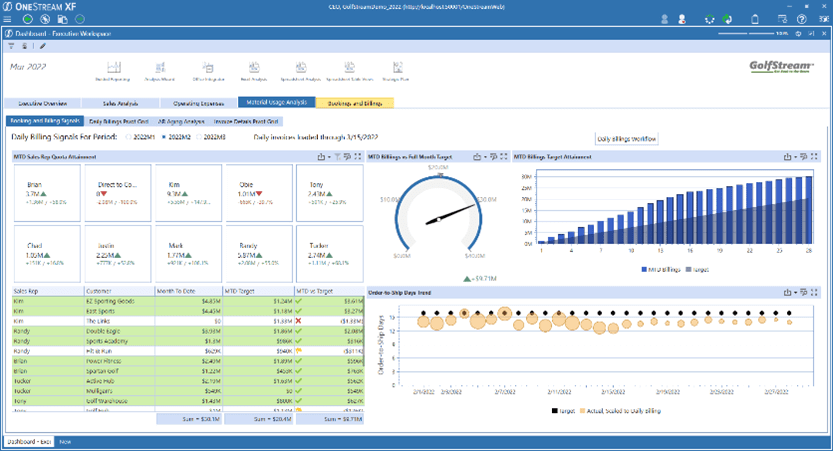

The form these internal financial management reports may take can vary based on the preferences of the internal stakeholders. Some may prefer printed financial reports or books of reports. Some may prefer electronic access to financial reports via email delivery, while others may prefer to review financial results through an interactive dashboard (see figure 1), with the ability to drill into key performance indicators (KPIs) or values on financial reports. Financial and operational analysts may prefer to have access to financial and operational results via an Excel spreadsheet so they can slice and dice the data and perform scenario analysis as needed.

The Financial Reporting Gap

Given the demanding requirements of internal stakeholders when it comes to financial reporting and analysis, you might be wondering how well enterprises are doing in meeting the needs of this audience. Unfortunately, despite the explosion of data across organizations, many organizations still struggle to meet the information requirements of executives and managers because they just don’t have the right tools for the job.

In fact, according to the FSN Future of Analytics in the Finance Function survey from 2020, only 14% of Finance leaders consider their reporting and analytics insightful. That means 86% of reporting and analytic effort is missing the mark. Why is this? Because most enterprises are relying on fragmented silos of spreadsheets, legacy ERP and corporate performance management (CPM) software, data lakes, and BI tool for their reporting needs, which force Finance teams to build disjointed processes around their technology and are not organized in a way they understand.

Reporting and Analytics in CPM Software

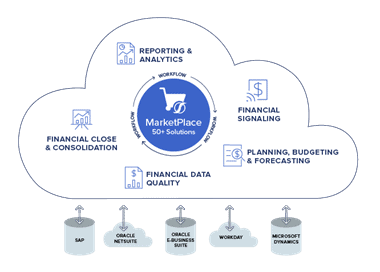

Today’s modern CPM software solutions offer a number of advantages over legacy CPM solutions. They are most often deployed in the cloud enabling faster time to benefit. They offer specific functionality designed to address the financial close, consolidation, planning, reporting, and analysis needs of enterprises. And most include robust, built-in reporting and analysis capabilities. If this isn’t part of the CPM solution you are selecting, then you’ll need to augment the solution with 3rd party BI and reporting tools.

For example, with a broad range of reporting and analytics capabilities, OneStream helps reduce reliance on spreadsheets and fragmented reporting tools to increase the speed, scope, and accuracy of reporting across the organization. OneStream’s Intelligent Finance Platform (see figure 2) unifies finance processes across the office of the CFO while enabling the organization with self-service, easy-to-use financial reporting software for a variety of stakeholder groups. OneStream’s reporting and analysis capabilities include the following:

- Guided Reporting for rapid creation of financial statements

- Production Reporting for pixel-perfect operational reporting

- Interactive Dashboards with sophisticated data visualizations

- Analytic Blend engine which combines detailed operational data with summarized financial data so managers can identify daily and weekly trends and financial signals

- Microsoft Excel® integration for data entry, reporting, and analysis

- Microsoft Office® integration including Word and PowerPoint

Learn More

Financial reporting is an essential function for both Accounting and FP&A functions, and these capabilities are an important factor to consider when enterprises are evaluating CPM solutions for financial close, consolidation, planning, and forecasting.

Over 1,000 enterprises have chosen OneStream’s unified Intelligent Finance platform to support their financial close, consolidation, planning, reporting, and analysis requirements and to deliver timely, accurate financial and operational results to internal and external stakeholders. To learn more, check out our interactive eBook and contact OneStream if we can be of assistance.

Get Started With a Personal Demo