Good strategic planning ensures an organization can react quickly and effectively to a changing environment. That’s the goal anyway. And achieving this adaptability has become more challenging and crucial than ever with the post-pandemic changes to the business. In fact, the ability to move beyond a static, antiquated process heavily reliant on manual processes and Excel® spreadsheets is critical to achieving organizational goals. Elevating the processes from disconnected and inefficient spreadsheets to effective corporate performance management (CPM) software enables Finance teams to drive continual performance and evolve traditional processes into an eXtended Planning & Analysis (xP&A) future.

Strategic Planning in a Post-Pandemic World

Finance leaders are uniquely poised to understand the strategy needed to execute long-term organizational goals and aspirations through a strategic and financial lens. Accordingly, Finance can naturally lead the effort for strategic planning.

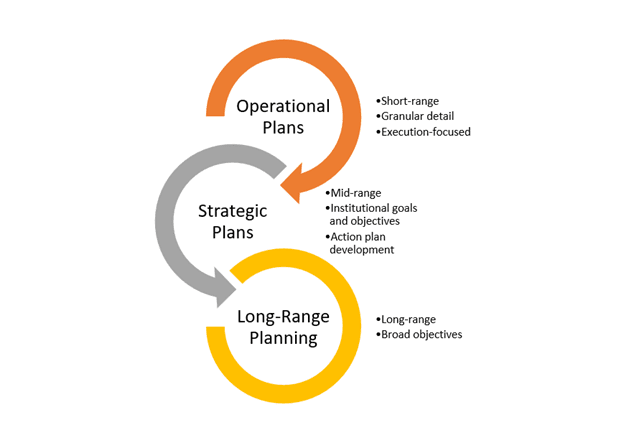

In the planning and budgeting cycles, strategic planning sits between the short-term operational plans and the longer-term long-range plans (LRPs). A successful strategic plan looks to define how an organization intends to realize long-term goals. After all, having goals and a vision of the future, as laid out in the LRP, helps focus the overall vision and direction of the enterprise. But without a strategy, the LRP can resemble a list of wishes without any direction.

Strategic planning, then, helps turn the fantasy into reality. And being able to compile the strategic plan and continually track performance against it are key to an effective process.

Understanding the realistic path to achieve organizational goals and aligning them with the financial plan are important steps to charting a clear course for company growth and managing expectations. A good strategic plan looks to allocate resources, align financial goals and track financial performance.

Excel Introduces Limitations to the Strategic Planning Process

Excel is a powerful tool for Finance professionals, and most can relate to feeling like they have a degree in the art of Excel after working as an analyst. That said, Excel also comes with drawbacks that can frustrate users and waste time – introducing limitations to the strategic planning process.

As a former Finance professional, I can certainly attest to missing weekends, evenings, appointments, family events, and holiday time with my family to troubleshoot a corrupted Excel file that was used for one of the most important financial planning processes in our organization. Excel often falls short, however, when it comes to powerfully tackling important financial processes that require traceability and reliability.

The challenges of wrangling a large dataset in Excel and maintaining confidence in the numbers can quickly overwhelm the planning process. The consequence of that often forces Finance professionals to spend precious time re-validating and explaining numbers during crunch planning periods due to corrupted or difficult-to-follow Excel models.

The good news is that it doesn’t have to be that way.

Deliver Business Value in the Strategic Planning Process with CPM Software

To avoid limitations, Finance can evolve the strategic planning process from an error-prone and time-consuming effort in spreadsheets to instead leverage a CPM software solution – which will deliver big business value.

Here are a few key benefits of leveraging purposed built, CPM software for strategic planning:

- Time Savings: Give analysts time back to perform value-added tasks and meaningful analysis that leads to better insights by eliminating time spent troubleshooting buggy spreadsheets and digging through rows of data to fix mis-keys or errors.

- Better Collaboration: Eliminate long email threads with multiple attachments and version control issues by bringing together different teams in a single application and ensure everyone speaks the same language and gets on the same page by allowing everyone’s voice to be heard in the planning process.

- Improved Forecast Accuracy: Decrease erroneous changes and track plain performance to drive better insights that lead to improved forecast cycles, better/cleaner data and more accurate forecasts.

Improve on Excel with Technical Enablers in CPM Software

When evaluating CPM software to aggregate and unify operational and financial data to compile and track performance against the strategic plan, organizations should decide what technical enablers are critical. Here are a few to consider:

- Data Integration: Ensure alignment in all business areas by tracking progress against the plan by leveraging insights from all available data – CPM software allows for various points of data integration, bringing in data from operational and financial sources to avoid missed insights.

- Workflow Capabilities: Ensure no parts of the review and approval process are missed. Planning takes a village with many different people involved, making it vital to keep everyone in the loop to ensure nothing gets overlooked in the planning cycle.

- Auditability: Allow for drill-back capability into transaction-level data, and ensure confidence in the numbers with built-in Financial Intelligence. No more suffering from mis-keys or corrupted cells of data with no traceability thanks to complete confidence in the numbers used in the planning cycle.

- Built-In Excel Functionality: Leverage spreadsheets as intended – as flexible, on-the-fly tools for ad-hoc analysis – to drive the flexibility spreadsheets allow for data analysis and gain control of the connection back to the source data in CPM software.

Ultimately, these technical enablers deliver business value via time saved in the planning process, improving collaboration. Time is money, after all – and the more time you can spend on valuable insights as opposed to wrangling data from disparate systems and troubleshooting temperamental spreadsheets the better, more reliable your plan becomes.

Not to mention, quality of life also greatly improves for the people involved in the process. Having one single source of truth ensures the efforts of all the groups across an enterprise are aligned and ensures that changes and mistakes don’t go unnoticed saves time and effort.

100% Customer Success

Headquartered in Houston, Texas, with manufacturing facilities and sales offices on six continents, Prince specializes in developing, manufacturing and marketing performance-critical additives for niche applications utilized in the construction, electronics, consumer products, automotive, industrial and similar end markets. Prince has processing centers strategically located globally and has been growing at an exponential rate – with 18 acquisitions over the last 13 years. Today, Prince manages over 25 entities, more than half outside of North America. Across the enterprise, multiple ERP systems – including IFS, Ross, and SAP – are in use. And to make matters worse, Prince was relying on Excel to reconcile, translate, consolidate and report financial information.

After implementing OneStream, Prince can now drill back to the ERPs to understand data at the transactional level, by voucher line item or journal line item. Prince is also now doing annual budgeting in OneStream – all while managing a five-year strategic plan. Comparisons of actuals against budget are all being done in OneStream as well. “We were able to utilize OneStream’s capabilities to produce an EBITDA bridge for our end markets, comparing periodic results to prior year, prior month, budget, etc.,” said the Controller at Prince.

Conclusion

While Excel spreadsheets can be a powerful tool, your team needs to have confidence in the output of your strategic planning efforts – and there’s no better way to do so than upgrading from a spreadsheet-heavy process to CPM software. CPM software will save time in the strategic planning process by freeing up more time for driving strategic initiatives. It also drives collaboration among the different teams needed for a strategic plan with a full view of the organization because you leverage the platform across the Finance department and beyond.

Ultimately, with CPM software, your strategic plan becomes more accurate thanks to increased collaboration in the planning process and less time wasted on non-value-added activities (e.g., troubleshooting spreadsheets). Adopting CPM software also drives more dialogue on risks and opportunities, providing a better understanding of cash and capital requirements. Collectively, those benefits culminate in more business value – and that empowers your team lead at speed.

Learn More

Want to learn more about how your organization can align its strategic plan with financial goals? Click here to watch our video titled “Lead at Speed in Planning & Analysis: Unifying the Strategic Plan with Financial Goals.”

Get Started With a Personal Demo