Scenario planning is a powerful tool that helps Finance professionals create agility in the financial planning and forecasting process. Through modeling different scenarios and assessing the associated risks and opportunities, Financial Planning and Analysis (FP&A) can future-proof the financial planning process. How? By ensuring that many of the what-ifs associated with the current market volatility are addressed and putting in place action plans to address whatever might arise.

Scenario Planning Enables Agility in Financial Forecasting

Most people regularly engage in some form of scenario planning. Whether it involves bringing a jacket to dinner because it might get chilly outside or carrying jumper cables in the car in the event of a dead battery, scenario planning is the process of thinking through and preparing for various possible scenarios.

From a financial planning perspective, scenario planning helps Finance professionals think through different variables that may affect the business. Why is this important? Well, it helps with identifying warning signs that indicate potential disaster and allows the business to be more agile in reacting and adjusting to change. As most Finance professionals know, by the time the financial plan is finalized, it has already become outdated given the pace at which things change in the marketplace today.

As the pace of change increases – and disruption and uncertainty become more commonplace – it becomes increasingly critical that organizations not only recognize the signs that indicate change but also put in place a plan to react to the possible scenarios that result from any changes. Scenario planning provides a consistent process, framework and collaborative environment that enables organizations to react with agility and certainty in the face of uncertainty and constant change and disruption.

Here are ways to monitor for three signs that financial disruption may be on the horizon:

- Supply Chain Disruption: Monitor for supply chain disruptions – such as the lack of availability of raw materials, labor shortages, shipping delays and more – that can wreak havoc to avoid expensive shipping fees, spot procurement rates or other costly issues by reacting sooner to the disruption and having a mitigation plan in place.

- Demand Sensing: Detect changes in customer habits and demand (e.g., from seasonality trends to competitor trends) that impact manufacturing and avoid costly mistakes like having too much product that won’t sell or not enough stock of an item in high demand.

- Economic Factors: Identify and track economic metrics relevant to the business – such as COVID-19 cases, interest rates, unemployment claims, and tourism and travel cancelations – to adapt accordingly as is relevant to the line of business.

Scenario Planning Identifies Best- and Worst-Case Scenarios

Scenario analysis looks to identify the baseline scenario, which is the base financial plan, and then identify the best- and worst-case scenarios. By assigning risk and opportunity factors to the baseline plan, the best- and worst-case scenarios take shape. Decision-makers are also empowered with the information necessary to take advantage of available opportunities while mitigating risks to financial performance.

By driving a continuous process of assessment to the financial plan, scenario planning elevates FP&A. Specifically, FP&A shifts from being a backward-looking process – one that involves developing a plan and then assessing where it fell short or performed better than expected – to one that can be predictive.

Benefits to Scenario Planning

Having a scenario planning process in place drives collaboration between key stakeholders in the investments and outcomes that move the needle for organizations. How? By ensuring these items are continually being talked about and getting the attention they deserve. Being proactive about these risks and opportunities therefore ensures that the financial planning process isn’t static. Instead, the process is set up for success no matter the outcome.

Here are some key benefits of scenario planning:

- Future-Proof the Financial Plan: Set up the organization to react swiftly and decisively to change. After all, change is an inevitable byproduct of growth, and by accounting for various scenarios, the organization is set up to react with agility and certainty when facing volatile market conditions. Scenario planning helps not only identify possible points of risk or failure in the future, but also calculates for unknowns like labor shortages and supply and demand changes. By having a plan in place to react to these aspects, the organization can respond swiftly and with certainty to avoid potential disaster

- Assess Risks and Failures: Account for possible risks and failures before they materialize and impact the P&L and balance sheet. In essence, the organization avoids potential disaster by preemptively assessing the risks and developing action plans and mitigation activities. Risks and opportunities analyses happen as a continuous collaboration process to assess the baseline plan and adjust forecasts. This process can account for opportunities such as early shipments from suppliers or risks like late deliveries due to supplier shortages or shipment issues.

- Maximize Financial Outcomes: Calculate gains and losses on investments in real estate, machinery or manufacturing facilities, and provide a framework to track risks and opportunities. To do so, the organization must drive a process of continuous monitoring and collaboration and provide KPIs to regularly track and measure the success of the scenario planning process. Organizations can then sense and react to impending risks and offset them with available opportunities (e.g., investments in process improvements or capital investments) that will result in measurable financial savings.

FP&A Is the Ideal Leader for Scenario Planning

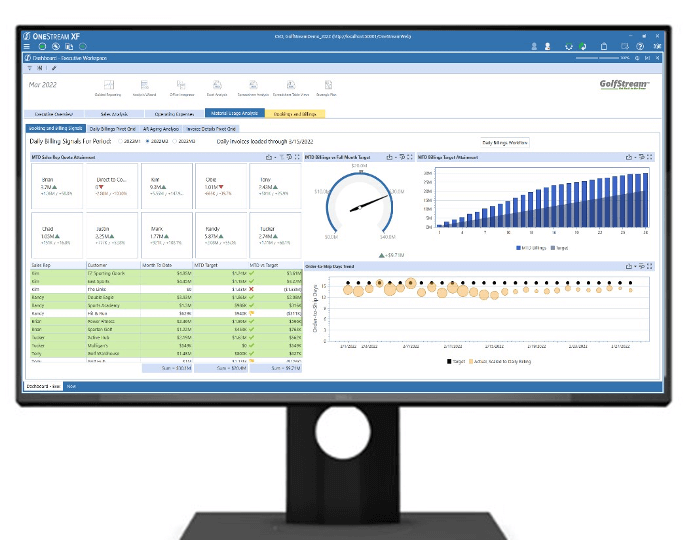

As a strategic business partner to Sales, Supply Chain, HR and IT groups, FP&A has the unique opportunity to elevate the value of scenario planning. How? By incorporating scenario planning not as a one-time ask, but rather by making scenario planning part of day-to-day collaboration and continuous eXtended Planning & Analysis (xP&A) cycles.

In doing so, FP&A can leverage scenario plans as a key input to measure and maintain organizational financial health and profitability – and partner with line-of-business leaders to drive performance.

Learn More

Want to learn more about how scenario planning creates agility in the financial forecasting process? Check out our solution brief on Rapid-Response Finance.

Get Started With a Personal Demo