Intelligent xP&A: Financial Signaling for Effective Scenario Planning

As most Finance teams have experienced, static financial forecasts no longer work. In a world where disruption and uncertainty have become the norm, Finance must instead work toward a forecasting process that enables scenario planning continuously. How? Traditional Financial Planning and Analysis (FP&A) teams must find opportunities to elevate toward an eXtended Planning and Analysis (xP&A) framework. And FP&A can do so by finding unique ways to enable sales, supply chains, and HR groups with financial signals and operational insights to drive continuous collaboration and performance.

Financial Signaling Enables Intelligent Finance

To drive effective scenario planning, Finance teams must move ahead of the monthly reporting cycle of generating a forecast and only return at the end of the month to look where results didn’t track to the plan. Why? To remain competitive in a cut-throat, volatile market, businesses must continually track and assess results – and take action! Finance teams can, for instance, make strategic decisions based on changes in supply and demand, labor shortages, high spot procurement rates, demand trends, economic factors, and any other factors that impact the business.

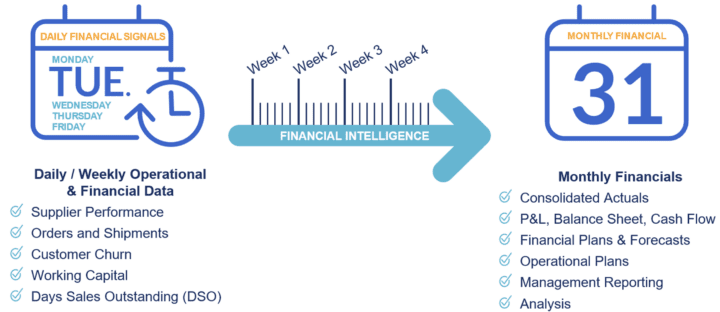

And with financial signaling (Figure 1), Finance teams can finally harness the vast amounts of daily and weekly transactional and operational data from across the organization. By deciphering the hidden signals with large volumes of data, FP&A teams can help guide operational leaders to take action midstream to impact the financials – all before month-end.

Key Considerations for Effective Financial Signaling

So financial signaling is important, sure, but how can an organization guarantee that the insights being gathered are accessible, reliable, and consumable? After all, financial signaling doesn’t work when the process to generate and stitch the data together is too time-consuming and error-prone. Financial signaling works best when the data is…

- Accessible: Finance must have access to data from a variety of sources. If the system doesn’t enable multiple points of integration, then valuable data goes to waste. A unified platform ensures that all critical data – internal or external, financial or operational –makes it into the system. The data can then be used to monitor cash flow, profitability, manufacturing and purchasing trends, and so on. A good example involves external data about seasonality trends or consumer data that change supply chain ordering habits. Such data can help avoid costly inventory holding practices or too much unsold product due to changes in consumer purchasing habits. With a unified platform, that data can be actionable sooner – before it impacts the P&L and balance sheet.

- Reliable: Once the data is brought into the system, having reliable data ensures data analysts aren’t wasting precious time cleaning and making sense of data from various sources. Built-in financial intelligence enables better, faster insights. How? By allowing analysts to better spend their time analyzing data as opposed to cleaning and making sense of it.

- Consumable: What good is a treasure trove of data if it can’t be understood and turned into actionable insights? A unified platform must provide consumable data for analysis by operational and financial analysts, executives, and line-of-business managers. And it does so by providing data through interactive dashboards and configurable reports.

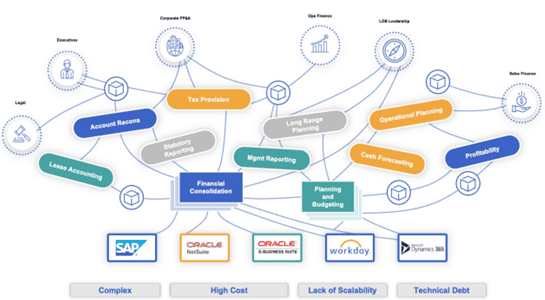

All these enablers allow for faster, more reliable signals to fuel effective scenario planning. But all too often, time is wasted while stitching together data from various disparate sources and tools (see Figure 2) through points of manual integration. And all of that adds risk, cost, and complexity to already-taxed Finance teams.

Conclusion

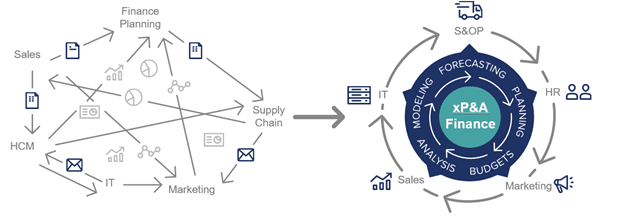

By enabling key business partners in Sales, Supply Chain, HR, and others with financial signaling, Finance teams can create a shared vision for xP&A (see Figure 3) and effective scenario planning.

Finance teams can help their business partners respond to daily and weekly signals amid a continuously changing environment. And finally, Finance has the unique opportunity to earn a seat at the strategy table to help drive performance across the P&L, impact cash and move the business forward.

At OneStream, we call this Intelligent Finance.

Learn More

Want to learn more about how financial signaling enables Intelligent Finance in the financial forecasting process? Check out our solution brief on financial signaling.

Get Started With a Personal Demo