Which is Better: Unified EPM or Separate Planning and Consolidation Apps?

There’s been a debate brewing for years in the enterprise performance management (EPM) software market about what’s the best way to deliver the functionality required to support the various EPM processes. The debate centers around whether customers are better served by a unified EPM platform or by best of breed applications designed to support specific processes such as financial consolidation, reporting, planning and forecasting. At the heart of this debate is also the question about what’s more important in EPM software – control or flexibility? What if you could have both in a single product? Read on to learn more.

Taste Great vs. Less Filling

Remember the Miller Light beer commercials from the 1970’s when the product was first introduced? The premise behind them was that most beer-drinkers believed that a low-calorie beer sacrificed taste, then Miller came along and dispelled the myth with their product which “tasted great” and was also “less filling.” There’s a similar debate “brewing” in the EPM/CPM software industry regarding best of breed applications vs. unified platforms.

The main focus of the EPM debate has been financial consolidation and reporting vs. planning, budgeting and forecasting. The financial consolidation and reporting process requires control and accuracy, while planning, budgeting and forecasting requires the flexibility to budget, plan and forecast at different levels of detail than the actual financial results. And furthermore, this level of detail can vary based on the planning process (strategic vs. financial vs. operational) and line of business. The camp that favors the best of breed approach believes that the control required to deliver fast and accurate consolidated financial results hinders the planning and forecasting process, and vice versa. But is this really true? The answer is that it depends on the architecture of the software.

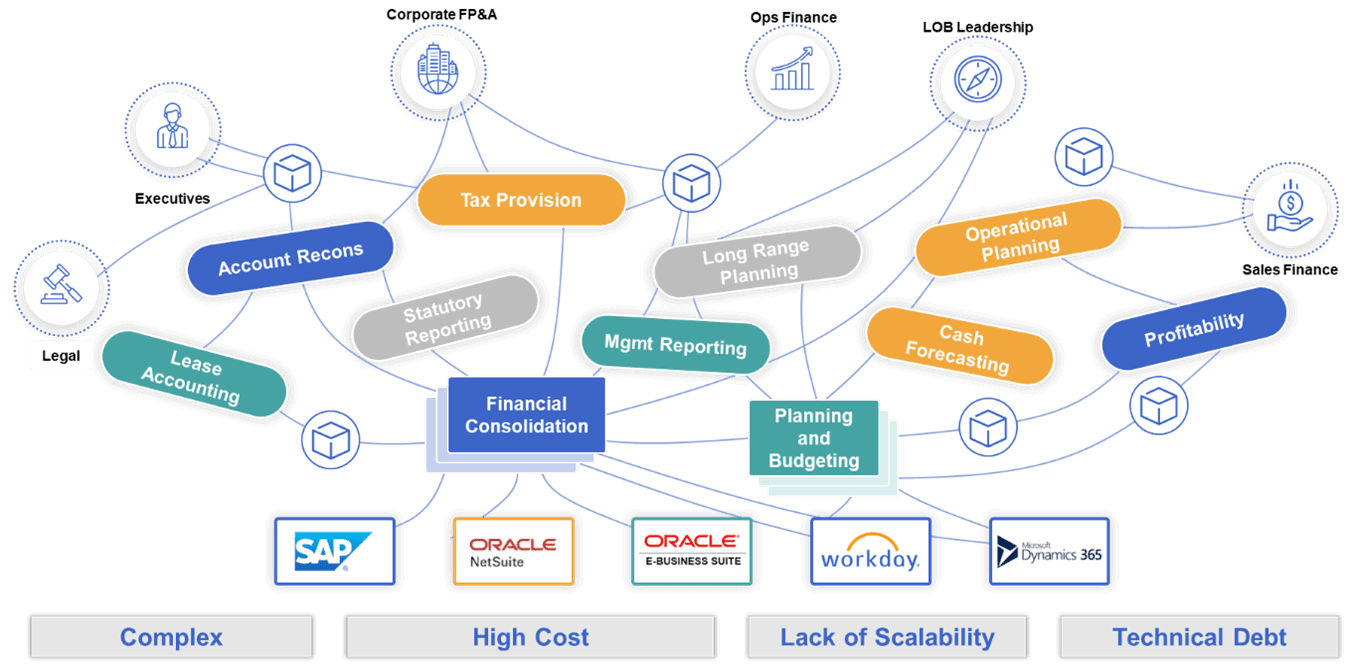

Best of Breed Applications and Fragmentation

Several EPM vendors have chosen to deliver a fragmented set of best of breed applications (see figure 1) to support processes such as financial close and consolidation, reporting and various types of planning. These vendors claim that each of these processes requires a dedicated application that’s optimized to provide either the control or flexibility required by the application. The problem with this approach is that every organization has the need to compare their actual, book of record financial or operating results against their budgets or forecasts in order to identify and analyze variances.

With a fragmented suite of applications, this requires users to move data from the financial consolidation application to the planning application, or vice versa, or to yet another application where the data can be aligned for reporting and analysis. And in addition to spending a lot of time moving data around, the users must maintain and update metadata in multiple applications as new accounts, departments, locations, or products are added to the business.

For example, what happens when your business changes via re-orgs, acquisitions, or divestures? The answer is you need an army of consultants or admins to realign systems, metadata, data and reports to ensure all users are seeing the same definition of net income for example. Having multiple systems means that there is a data reconciliation effort just to try to ensure common definitions. This tax on your systems and resources means they can’t attack other business problems.

Some of the cloud-based vendors in the market offer point solutions that support only specific EPM processes, such as enterprise planning or account reconciliations. The cloud-based planning software vendors claim their software is optimized for this process and that consolidation and reporting should be handled in a separate application. Again, the problem here is that customers need to be able to compare actual book of record financial and operational results against the budgets or forecasts to identify and analyze variances. So the users end up having to extract the actuals, budgets and forecasts out of their respective applications and into Excel spreadsheets or some other system for comparative reporting.

Another problem is that some cloud-based planning software vendors provide planning platforms that include no pre-built financial intelligence – it must all be built from scratch. While this approach might work for supporting only operational planning processes, it doesn’t work for linking operational plans to financial plans and forecasts. This linkage of financial and operational plans is a key market requirement and the essence of what’s now being referred to as eXtended Planning & Analysis (XP&A).

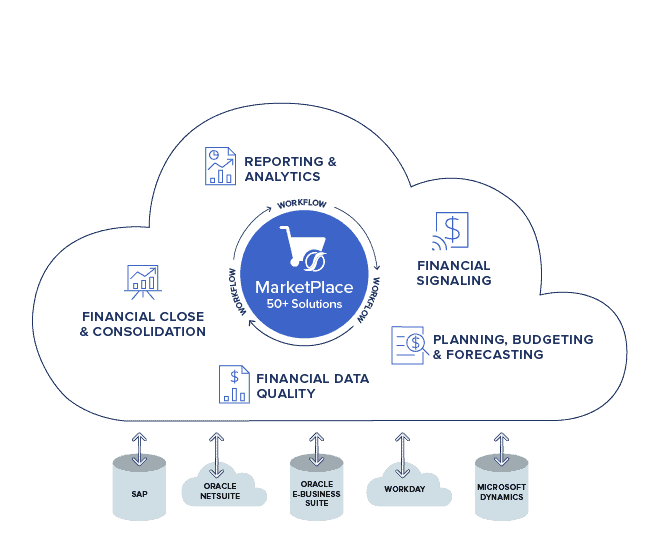

OneStream Provides Control and Flexibility in a Single Application

Now that we have identified the complexities that are created for users by fragmented EPM suites or best of breed planning solutions the question is – can a single unified EPM/CPM application provide both control and flexibility? Is it possible to have a single application that provides the control and accuracy needed to support the complex financial consolidation needs of global enterprises, as well as the flexibility to support financial and operational planning, budgeting and forecasting. The answer is yes – and that’s the essence of OneStream.

OneStream provides a unified, Intelligent Finance Platform (see figure 2) with a modern architecture designed to provide accuracy and control as well as flexibility in a single application. One of the secret sauces behind this is something called Extensible Dimensionality®. This is essentially the ability of the system to support corporate standards, such as the corporate chart of accounts (COA), while providing relevance for operating units. This means the corporate COA can be extended to support the more detailed reporting and planning requirements of various business units without impacting the corporate standard.

The other secret sauce is the multiple calculation engines within OneStream’s Intelligent Finance platform. This includes a world-class financial consolidation engine, as well as an aggregation engine designed to rapidly roll up budgets, plans and forecasts that don’t require the same precision and audit trails as book of record financial results. The beauty of this approach is that the data for all these processes resides in a single data store, providing a single version of the truth for actuals, plans, forecasts and other corporate data.

In addition, a unified application means all processes are aligned with a single point of change, so solutions are always in alignment without manual reconciliation efforts. This single point of changes gives OneStream customers the agility needed to conquer the complexity of business changes. This unique capability is what allows OneStream to replace multiple legacy applications with a single, unified platform. That platform provides the control to support fast and accurate financial close, consolidation and reporting – while also providing the flexibility to support agile budgeting, planning and forecasting across the enterprise. And this unified approach makes it very easy for users to compare actual financial and operating results with budgets and forecasts – at whatever level of detail is required, without moving data between applications. It provides a single version of the truth for actuals as well as strategic, financial and operational plans, budgets and forecasts.

Proof is in the Pudding

Does this approach really work? You bet it does. How do we know that? Because over 80% of OneStream customers use the platform to support their financial consolidation, reporting and planning processes, as well as other tasks such as account reconciliations, transaction matching, tax provisioning, profitability analysis, ESG reporting and other tasks. Here’s one example below.

SPX Corporation had been using their prior EPM application suite for 18 years. SPX was using separate solutions for data loads, consolidations, planning and forecasting and account reconciliations. They had also built their federal tax provision process into their consolidation solution and had built flash forecasts, bridge reporting and state tax provisioning in their planning applications.

This multi-product approach to their critical financial applications created challenges for the Finance and IT teams. According to Keith Chapman, Director of IT for Corporate Applications, “Just keeping all the data and metadata in sync was challenging — given all of the changes in our organization structure with acquisitions and divestitures. The end-users were constantly moving and reconciling data. There was no single version of the truth, and reporting was siloed and fragmented. From an IT standpoint, it was a lot of work maintaining and upgrading the applications, and we also used managed services to keep the products running.”

Since moving to OneStream, the SPX team has experienced many benefits from having one unified platform for actuals, plans, forecasts, tax and account recons. This makes life much easier for users in terms of loading data, reviewing and drilling into the data staging area for the details.

According to Chapman, “OneStream has provided a huge benefit in keeping everything aligned with automated control procedures in place, so when business changes happen, we can keep up. Tax and FP&A are no longer separated; actuals can be seeded into budgets; and we are no longer waiting for overnight processes. The tax team can leverage the roll-forward data from consolidation right into the tax solution. Users enter the data once, and it is leveraged across multiple processes.”

Said Chapman, “We also leverage OneStream’s Extensible Dimensionality®. This allows us to do corporate cost forecasting in the same application, at lower level of detail than our normal forecast — very easily. It’s all about offering solutions to the business and delivering rapid value. Instead of being viewed as a corporate application, OneStream is a platform; it adds value and continues to add value by providing timely insights.”

Learn More

Having the control required to produce an accurate and auditable book of record financial results as well as the flexibility to plan and forecast at the right level of detail is essential for success in EPM or CPM software. And although some vendors are promoting the myth that both control and flexibility can only be provided through separate applications – OneStream has proven this myth is false, just like Miller beer, with a platform that “tastes great and is also less filling.” We have successfully delivered a unified platform that supports financial consolidation, reporting, planning and forecasting for more than 1100 organizations globally. To learn more, check out our Intelligent Finance white paper and contact OneStream if your organization is ready to take the leap to a modern, unified platform that can support all your EPM/CPM processes.

Get Started With a Personal Demo