Higher education Finance teams today are tasked with managing a complex and challenging business landscape – one that requires balancing evolving student needs, increasing people and infrastructure costs, resource constraints and more. The ability to quickly problem-solve and steer the university through these challenges while maintaining financial sustainability is daunting. But what if universities could not only navigate this complexity but also thrive? Corporate Performance Management (CPM) makes both possible. Designed to help maximize business impact, CPM empowers higher ed Finance teams to ensure their institutions keep up with the pace of change, uncertainty and organizational complexity.

The value of modern Finance lies not in eliminating complexity but in effectively navigating it.

Now more than ever, higher ed Finance teams face a diverse set of pressures and challenges, including the following financial constraints, external forces, internal complexities and operational obstacles:

The ability to adapt to the above pressures and changing landscape while ensuring financial sustainability is complex with the tools and processes colleges and universities are using today. To be more agile, Finance leaders are looking for ways to simplify and scale processes to keep pace with rapid change and plan effectively.

Traditional Higher Education Planning Practices

Traditionally, higher education institutions have used disconnected Finance processes and systems for planning and reporting. Those efforts have primarily focused on the cumbersome, time-intensive annual budget process. While the annual budget is important for funding allocations, control and accountability of spend, and communication with stakeholders, it relies on the assumption of operating in a stable and predictable business environment. Today’s rapidly changing and uncertain business landscape shatters that assumption because the budget can quickly become outdated and difficult to revise.

To address these limitations, colleges and universities must evolve to more agile processes that emphasize trust, collaboration, innovation and risk management.

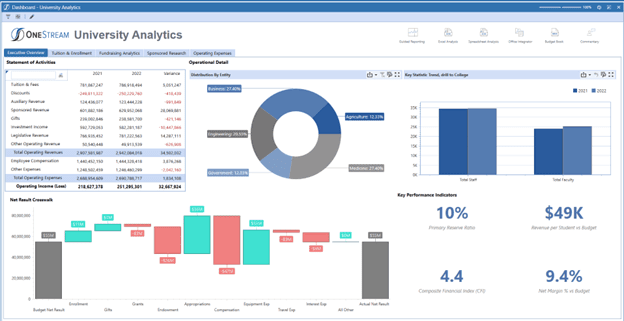

By design, CPM helps higher education Finance teams bring together an institution’s data, analytics, plans and reporting – all in one place – to conquer complexity and enable confident decision-making.

What Is CPM?

CPM is an overarching term used to describe the methodologies, metrics, and systems used to monitor and manage the business performance of an organization.

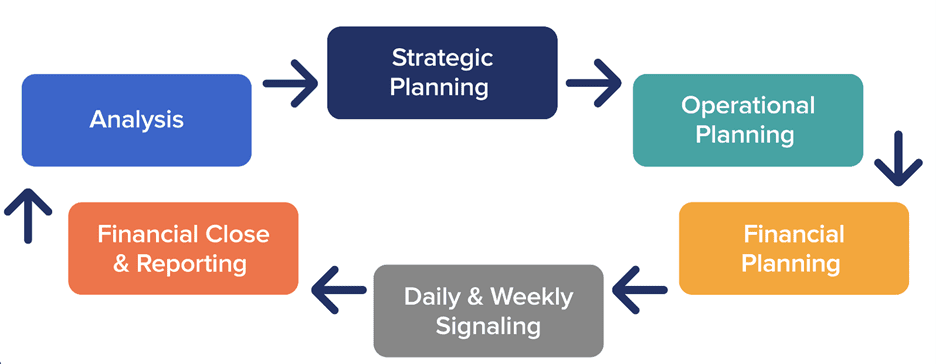

CPM encompasses the core Finance processes of planning, reporting and analytics, with the goal of optimizing performance by aligning strategic initiatives with resources, activities and results. Accordingly, CPM provides business leaders with a framework focused on key performance indicators (KPIs) and the metrics to measure “success.”

That success may look different for each institution because of varying educational missions, communities served, programs offered, and so on. Fundamentally, Finance leaders can define ‘success’ as the ability of an institution to achieve financial sustainability while effectively fulfilling the university mission and strategic initiatives (see Figure 1).

Shifting the institution’s financial processes to include CPM to track strategic priorities, goals and initiatives is imperative for long-term financial sustainability.

CPM gives Finance leaders peace of mind by giving them the tools to navigate the complexity and best serve their institution’s mission and students. How? By enabling more trust in data, better collaboration with stakeholders and more agility in decision-making.

Trust in Numbers

CPM tools combine financial and operational data from various sources to provide a clear view of institutional performance. This view allows Finance to use one source of truth to monitor performance in real-time across various activities, including auxiliaries, academics, research and more.

Such transparency empowers Finance to have a comprehensive view of data and be more confident decision-makers.

For example, as resource constraints continue to expand and change, Finance must understand the current state of funding resources. Are they tied up in commitments? Are they being used for future capital initiatives? The answers to these questions and others provide transparency on how funding is being used to help identify where resources are being underutilized or what areas need additional funding. Recognizing programs with excess funds creates an opportunity to instead invest them effectively in infrastructure, facilities, teaching and other areas in need of additional funding. Finance can look at how to best support each area by asking questions to maximize the impact.

By having a sole source of truth for financial and operational data, higher education Finance leaders can trust the numbers and maximize the impact on the institution.

Improved Collaboration

Getting stakeholder alignment across the institution is tough, but having clear strategic goals and priorities aligned with resources, activities and results helps focus collaboration efforts. When everyone is working toward achieving the same metrics and KPIs, Finance can better partner with departments and programs.

For example, an institution may have an initiative to increase academic program returns by expanding a current program. Having core KPIs, such as administrative costs per student or net tuition revenue per student, helps create direction on how to set up a new initiative for financial success. For such efforts, focused communication and collaboration are essential.

And with CPM, discussions between Finance and stakeholders can be better focused on specific items. Here are a few examples:

- What costs are affiliated with marketing efforts?

- What kind of financial discounts or incentives can be offered?

- How can rising administrative costs be managed?

In other words, the different departments and programs can maintain their independence and innovative thinking while working in unison with Finance to achieve strategic priorities with financial sustainability.

Increased Agility

CPM tools also enable Finance teams to leverage real-time data and scenario modeling capabilities to support agile decision-making. By having one source of truth for financial and operational data, institutions can see the current state of the business and model alternative futures based on different assumptions (e.g., enrollment shifts, interest rate changes, government funding modifications, etc.).

These capabilities allow stakeholders to understand the potential impact of different scenarios and more quickly respond to changes in the budget, forecast or strategic plan (see Figure 2). In turn, the university or college can take advantage of new opportunities and/or minimize risk. And in the current volatile times, the resulting increased agility offers a true competitive advantage.

Confident Decision-Making

Overall, incorporating CPM in your institution will bring more confidence in the financial success of your college or university. Why? Because CPM supports long-term sustainability in the following ways:

- Unifies complex and fragmented business processes to provide a single, holistic view of institutional performance.

- Focuses financial planning processes across the institution to ensure relevancy and purpose in support of the institution’s mission and goals.

- Equips the institution to identify and mitigate potential risks and take advantage of innovative opportunities.

Conclusion

In sum, CPM helps Finance overcome the diverse set of pressures and challenges in the current higher educational landscape. How? By enabling more trust in numbers, better collaboration, increased agility and more confident decision-making. Through those benefits, CPM facilitates actionable insights that will empower and improve strategic decision-making and long-term financial sustainability.

Learn More

Want to learn more about how OneStream can empower your higher education Finance team? Download our Higher Education solution brief, or contact us for a demonstration.

Get Started With a Personal Demo