The buzz around ESG is real. And the fact that it’s being so widely discussed underpins how it has really become a business imperative for organizations to develop a strategy for ESG reporting & planning and then take positive action.

Research shows that positive action on ESG pays off. How? By making companies more resilient in times of change. Pandemic-related supply chain interruptions offer the perfect example. Companies that invested in trusted relations with suppliers and employees got production back on track faster and grew faster than companies without those relations – underpinning the need to incorporate ESG across the organization.

Introduction

While moderating a recent joint webinar with PwC on ESG reporting & planning, I was joined by Julie Bogus (ESG Consulting Partner at PwC), Leonardo De Biasi (Performance Management & ESG Partner), and Liane Boyer (OneStream Senior Solutions Consultant).

I kicked things off by quoting a statement from PwC’s research: “Now is of course time to get serious about climate risk.” But I also emphasized that even more important is recognizing the positive opportunities that arise from taking action.

Then I polled the audience with the following question: “How concerned are you that your organization does not have the right technology in place to support ESG reporting that meets the regulations where you operate?”

The results were interesting – 49% of respondents felt somewhat concerned and 25% felt highly concerned. Only 4% reported not being at all concerned.

The Evolution of ESG

After the poll results, Ms. Bogus explained the three key elements of ESG: Environment, Social & Governance. But the focus for organizations, she emphasized, should be on more than just the environmental aspects (e.g., emissions/pollution/waste) to include a wider focus on the people impacted by an organization and the demonstrated governance and leadership. She then described how not all topics are equally relevant to all organizations. The relevance level depends on the industry.

Next, she shared some key statistics (see Figure 1) to support the statement that organizational stakeholders know they must drive transformation with a positive ESG focus.

Figure 1: PwC ESG Consumer Intelligence Series 2021

Ms. Bogus then spoke about the ESG landscape of regulations, some only in the proposal stage as with the SEC and others fully announced as with the EU. Still, though, EU member states must ratify the regulation, which she emphasized could take another year.

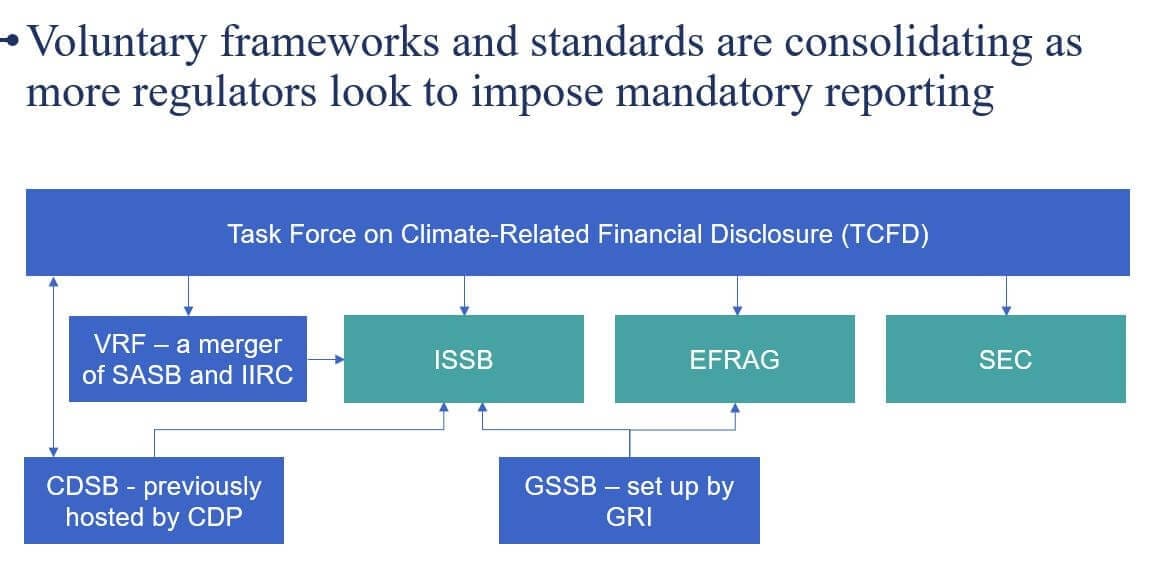

The reporting framework developed by the Task Force on Climate-Related Financial Disclosure (TCFD) (see Figure 2), Ms. Bogus went on to explain, underpins the reporting standards being developed by the International Sustainability Standards Board (ISSB), the European Financial Reporting Advisory Group (EFRAG) and the US SEC.

Figure 2: PwC ESG Frameworks

Below is a quick breakdown of the voluntary frameworks/standards Ms. Bous explained:

- Value Reporting Foundation (VRF) being founded in 2021 as a merger of the SASB and the IIRC

- IRFS Foundation bringing the VRF and CDSB together to provide staff and resources to the ISSB

- Global Reporting Initiative collaborating with ISSB to coordinate work programs and standard-setting activities

- GRI sharing technical expertise on ESRS development with EFRAG

When responding to a question, Ms. Bogus agreed the current frameworks are challenging to navigate.

The Common Challenges

Ms. Bogus then shifted to talking more widely about why many organizations today struggle to incorporate ESG due to having limited policies, procedures and governance, highlighting the following challenges:

- Lack of controls or established governance framework

- Highly manual processes/information flow

- Disparate data sources and offline spreadsheets

- Frequent data issues mostly addressed in an ad-hoc fashion

The OneStream ESG Solution

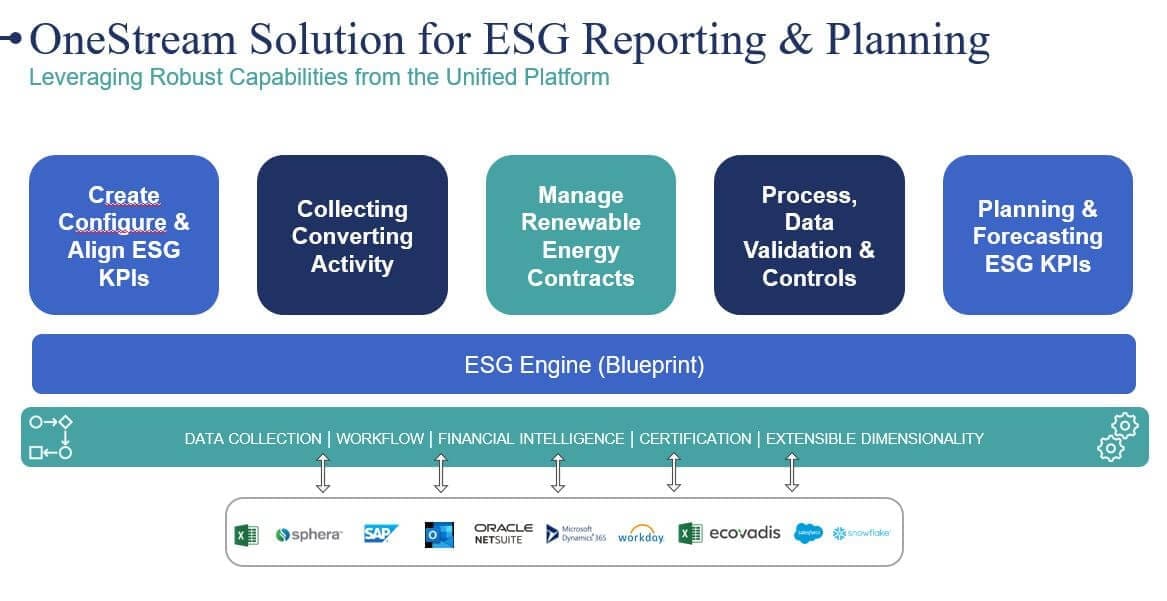

At this point, I introduced OneStream and talked about how it’s a unified, Intelligent Finance platform that simplifies and unifies processes (see Figure 3). I specifically explained how organizations can perform all required reporting activity for ESG KPIs using the robust OneStream capability – a capability that has now successfully supported the financial processes of more than 1,200 customers worldwide.

Figure 3: OneStream Solution for ESG Reporting & Planning

Continuing, I focused on how OneStream delivers the capability that brings ESG processes to life with an accelerated implementation option through the OneStream ESG Blueprint. This blueprint is available as a free download from the OneStream OpenPlace – Part of the Solution Exchange.

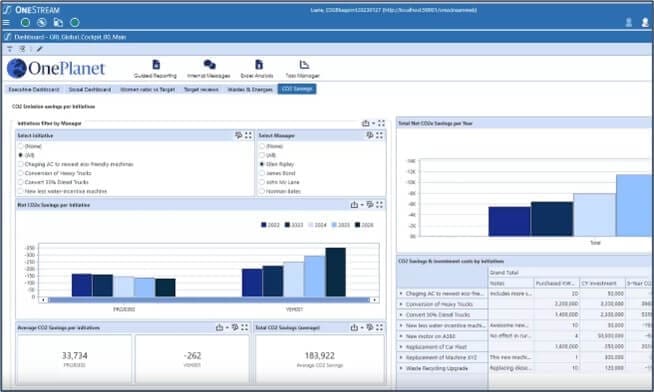

Ms. Boyer followed with a short demonstration of some of the many ESG capabilities in the OneStream platform, including data upload, validation and workflow to ensure the quality of entries. Specifically, she explained how data can be integrated from underlying ERPs, operational systems and HR systems. She also highlighted how ESG metrics and commentary can be viewed down to an individual

Figure 4: OneStream ESG Dashboard

Panel Questions

A panel session followed where I asked questions to Ms. Bogus and Mr. De Biasi. Here’s a breakdown of what our Q&A covered:

- “Why ESG disclosures require more than just ticking boxes and disclosing GHG emissions since results will be closely scrutinized, requiring enterprise-wide transformation rather than just getting the data right once.”

- “The magnitude of current changes in ESG regulations to the invention of double-entry accounting some 500 years ago. Organizations must now consider how every transaction will impact the ESG world”.

- “The guiding principles of financial reporting and planning must be applied to ESG”.

- “Organizations need to fully identify all the disparate data sources and offline spreadsheet sources”.

- “Action is required in organizations to break down silos and bring together those who have been on point for setting emission reduction targets and linking to FP&A. Ensuring that planning activities are occurring using only the ‘right’ assumptions about the organization’s size and future activities”.

To wrap up the Q&A, I asked Mr. De Biasi whether he sees financial leaders doubling down on ESG investments and initiatives again in 2023. He referred to the second poll we ran during the webinar, the results of which showed that 41% of respondents reported investing in new technology. While he saw that as a positive sign, it’s simply not enough. And he explained why: Every organization must have the right technology in place to meet all ESG reporting and planning requirements. Anything less simply leaves some organizations lagging behind competitors and over-exposed to risk.

Learn More

Need to invest in new ESG technology and want to learn more, read our ESG Whitepaper or check out the blog posts in our ESG series. And if your organisation is ready to align ESG reporting & planning with financial reporting and get ahead of the upcoming disclosure mandates, contact OneStream today to get started.

Get Started With a Personal Demo