Businesses rely on finance leaders to provide unique insights into the development of an effective annual plan. The annual planning blueprint determines the course of operations in the coming year, advising stakeholders on where to invest, cut costs, and allocate resources. For most organizations, fiscal planning is supported primarily by Excel® spreadsheets, but given the fast pace of business and the frequency of global disruptions to markets, and supply chains, and the pace of business today it’s time for a more dynamic annual planning process.

Annual Planning in a Fast-Paced Business Environment

Whether a company faces economic, geopolitical, labor-pool, or supply-chain disruptions, static financial forecasts no longer cut it—and neither does using Excel as a primary planning tool. A better option is a dynamic process that enables seamless collaboration, simple results-tracking, and a faster, more reliable planning process. Such a solution ensures that the annual planning process drives more value to the business and is far less siloed and time-consuming.

The annual plan must ultimately bring together elements of all planning processes across an organization—financial, operational, and qualitative—to deliver a complete picture for the coming year. This includes, but is not limited to, practical operational plans external to the finance function but impacting fiscal results, strategic plans defining mid-range institutional objectives, and even long-range planning with a focus on out-years (see figure 1).

Figure 1: Operational, Strategic, and Long-Range Planning Goals

Excel Prevents Speed and Agility in the Annual Planning Process

Excel is a powerful tool in the financial toolkit, and it’s understandable that financial analysts may feel as though they have a degree in the “art of Excel.” That said, Excel can present time-wasting hurdles that frustrate users, thereby thwarting the annual-planning process.

The challenges of wrangling a large dataset in Excel and maintaining confidence in the numbers can quickly overwhelm any financial planning process. The consequence of data wrangling often forces finance professionals to spend precious time re-validating and defending numbers during crunch planning periods due to difficult-to-follow or opaque Excel models.

Figure 2: Digging into Excel data to identify hidden formulas can be frustrating and time-consuming

The good news is that it doesn’t have to be that way.

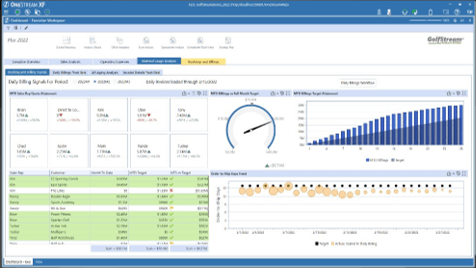

Drive Business Partnerships in the Annual Planning Process with CPM Software

To avoid these limitations, finance professionals can evolve the annual planning process by migrating away from error-prone and time-consuming spreadsheets to a CPM software solution that aggregates and unifies (figure 3) operational and financial data – immediately delivering value to the planning efforts.

Figure 3: Aggregate and unify operational and financial data for better insights in OneStream

Here are a few key benefits of leveraging purpose-built CPM software for annual planning:

- More Effective Collaboration: Eliminate version-control issues and tiresome email threads with multiple attachments by bringing various teams together in a single application. Make sure nothing is missed by using CPM software that assembles internal and external historical data in one place. Data integration of financial and operational information helps finance professionals identify missed insights.

- Improve Forecast Accuracy: Decrease erroneous changes and track and drive performance to generate better insights. These insights then improve forecast cycles, generate better/cleaner data, and ultimately result in more accurate financial projections. Proper utilization of flexible spreadsheets as a front-end to CPM software allows for data analysis using built-in Excel functionality without over-relying on Excel’s limited capabilities—users can finally gain control of the connection between data outputs and source data in CPM software.

- Enable Better Auditability: Enable drill-back capability into transaction-level data to ensure confidence in the numbers with built-in Financial Data Quality. Gone are the days of suffering from mis-keyed or corrupted data cells providing no traceability; instead, give finance professionals complete confidence in the numbers used in the planning process.

- Save Time and Get Back to What Matters: Reclaim time to perform value-added tasks and meaningful analyses that lead to better insights. Free analysts from troubleshooting, pouring over buggy spreadsheets, and digging through rows of data to fix mis-keys or errors. Restore work-life balance by allowing the finance team to focus on important work instead of spending long hours and late nights in the office dealing with software and data issues.

As we know, time is money – and the more time spent on valuable insights instead of wrangling data from disparate systems, the better and more reliable your annual plan will be.

Conclusion

While Excel spreadsheets can be powerful, your team must have confidence in the output of your annual-planning efforts – and there’s no better way to do so than by upgrading from a spreadsheet-heavy process to CPM software. CPM software supports efficient collaboration and reduces time wasted on non-value-added activities, driving more meaningful dialogue on risks and opportunities, and providing a better understanding of cash and capital requirements that drive business value.

Learn More

Get Started With a Personal Demo