For decades, organisations worldwide have relied on a small number of legacy EPM applications for complex financial consolidation needs. Such solutions have provided valuable support by simplifying financial close processes and enabling sophisticated statutory consolidations and reporting. However, vendors are signalling that support for these legacy applications will end in a few years.

Organisations are now proactively exploring advanced solutions that not only match and supersede the capabilities of these legacy systems, but also fully unify consolidations with planning, budgeting, and forecasting. In this blog post, we’ll show why OneStream has emerged as the optimal solution for complex global organisations, focusing especially on consolidations.

Why OneStream Simplifies Financial Consolidation

OneStream is the leading solution for complex financial consolidations, providing organisations with a powerful unified platform that addresses the challenges inherent in managing intricate financial structures. Globally and across industries, over 1,300 mid-sized to large enterprises are using OneStream for planning, financial close & consolidation, reporting and analytics. In fact, 70% of OneStream customers replaced multiple legacy applications (e.g., Oracle Hyperion, SAP BPC and IBM Cognos).

Below are 10 key features and advantages that make OneStream the best choice for complex financial consolidations.

1. Unified Platform:

Despite propelling Finance Transformation for over 20 years, connected Finance solutions (see Figure 1) aren’t really designed to help the largest, most complex modern organisations drive performance.

Figure 1: Connected Finance Solutions – Fragmented

Connected Finance solutions are ultimately difficult to scale. Why? Because every traditional departmental and corporate application or model must be connected or integrated – adding risk, cost and complexity to already-taxed Finance teams due to multiple systems and data silos.

Instead, OneStream’s unified platform seamlessly combines financial consolidation, planning, budgeting and reporting processes. This holistic approach eliminates the need for disparate tools, streamlines financial operations and enhances overall efficiency.

2. Advanced Consolidation Features:

Whether private or publicly held, organisations must confidently conquer the consolidation process – which drives the organisational “book of record” reporting. Therefore, the reporting for external stakeholders must be accurate, timely and compliant with regulations. These requirements apply to financial statement reporting, statutory reporting and regulatory filings, including ESG reporting.

Going beyond simply aggregation, a consolidation tool must support the financial consolidation requirements of the largest, most complex organisations globally via inbuilt intelligent capabilities including:

- Statutory consolidation and reporting (US GAAP, IFRS, Multi-GAAP, local requirements)

- Advanced foreign currency translation

- Powerful, automated intercompany eliminations

- Flexible organisational structures with varying ownership percentages

- Base and topside journal entries

- Powerful allocations

- Complete audit trails and drill-through capabilities

- In-system reporting, analysis, dashboards and Excel® integration

OneStream delivers these advanced features for complex financial consolidations – accommodating diverse financial structures, intricate ownership relationships and multiple currencies. This flexibility is crucial for global organisations operating multiple subsidiaries, each having unique financial intricacies.

3. Real-Time Insights:

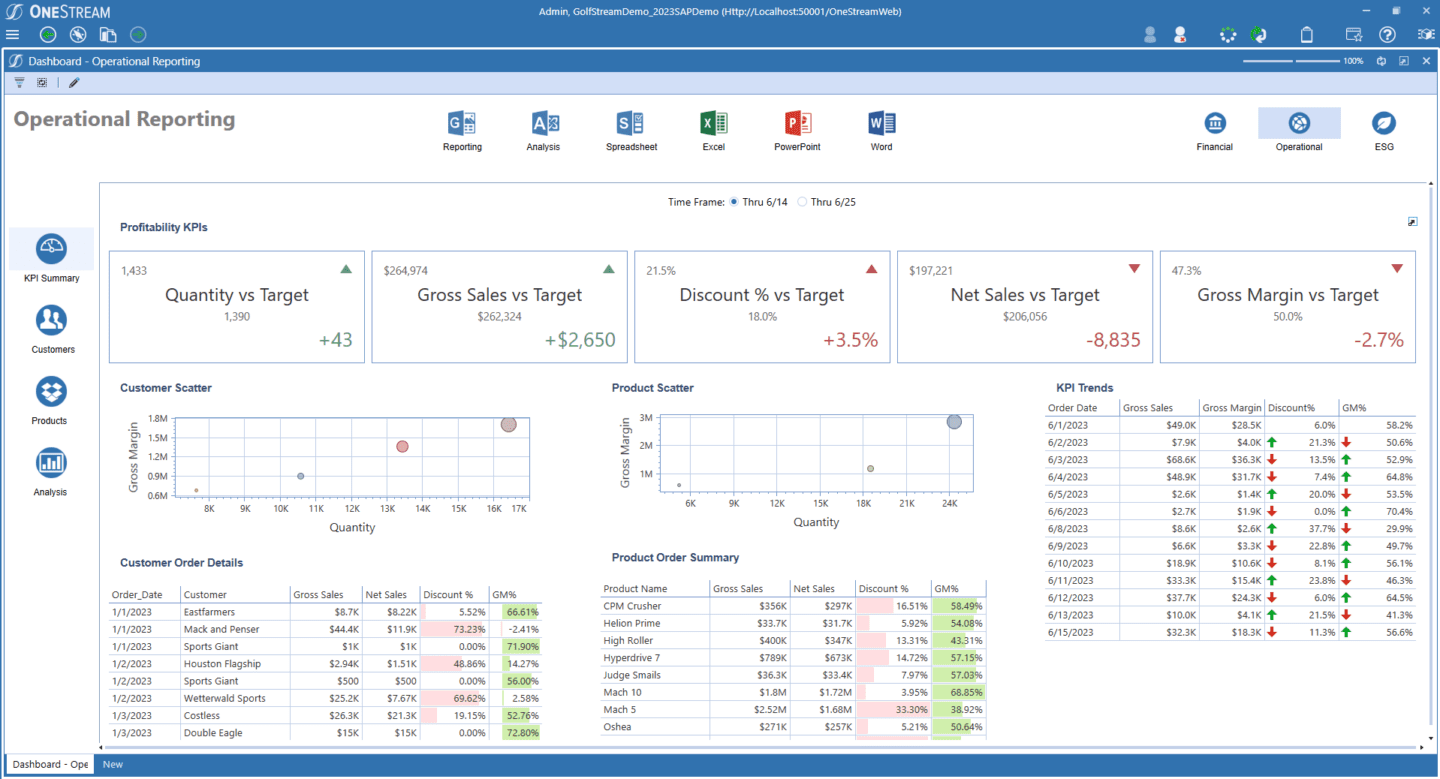

Real-time alerts help realize the vision of daily close performance reporting by empowering Accounting and Finance teams with daily or weekly insights into key business metrics and drivers. These ‘alerts’ highlight critical opportunities or risks that require action.

Such alerts include viewing potential misstatements in the GL before month end, identifying areas of the close process causing delays or applying flux analysis to highlight problematic areas in the financials. With weekly or daily insights into trends and signals in the data points, managers can immediately act to proactively impact the period-end results.

Figure 2 – OneStream Real-time alerts/Financial Signals KPI dashboard

OneStream provides real-time insights into financial data, enabling organisations to make informed decisions promptly based on the most current information (See Figure 2). This capability is invaluable for complex consolidations, where timely information can make the difference in strategic planning and risk management.

4. Streamlined Data Integration:

At its core, a modern unified EPM platform must have financial data quality management (FDQM) to drive effective transformation across Finance and lines of business. One requirement is 100% visibility from reports to sources – all financial and operational data must be clearly visible and easily accessible. Key financial processes should be automated, and using a single interface allows the enterprise to utilise core financial and operational data with full integration to all ERPs and other systems.

OneStream simplifies the often-challenging task of data integration via the seamless flow of financial data from various sources, reducing the risk of errors from manual data entry. The platform’s robust data integration capabilities enhance accuracy and reliability, crucial factors in complex financial consolidations where precision matters.

5. Regulatory Compliance:

A modern unified platform should support all reporting requirements with standard, defined and repeatable processes for financial data collection and consolidation. After all, producing financial statements that meet GAAP, IFRS and local statutory accounting regulations is a non-negotiable aspect of financial management, especially for organisations dealing with complex consolidations.

Failing to comply with industry standards, laws, rules and regulations set by regulatory and government bodies can result in hefty penalties, reputational losses and expensive legal actions. Even worse, non-compliance can cause organisations to fail or be shuttered.

OneStream is designed to support regulatory compliance, ensuring that financial reporting adheres to all industry standards and legal requirements. This support not only mitigates the risk of penalties but also instils confidence among stakeholders.

6. Flexibility to Support Corporate and Local Requirements:

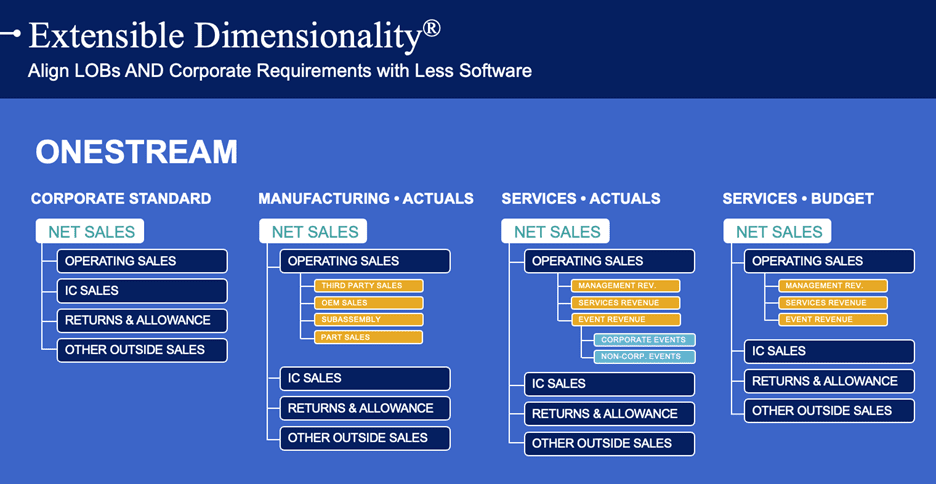

EPM software solutions are typically purchased, set up and rolled out from the corporate Finance organisation for planning, budgeting, forecasting, reporting and other analytical use cases. In such solutions, the defined meta data structures (e.g., chart of accounts, organisational hierarchies) are usually based on corporate financial and management reporting requirements.

However, due to the need to roll out to the line-of-business level, many divisions, business units and departments find they must plan and report at a lower level of detail vs. corporate. Traditional approaches to handle the different levels usually involve spreadsheets, multiple point solutions and often separate instances of the same EPM application.

Figure 3 – Extensible Dimensionality in OneStream

OneStream offers the first and only solution that delivers corporate standards and controls, with the flexibility for business units to report and plan at additional levels of detail without impacting corporate standards — all through a single application. This unique capability is called Extensible Dimensionality® (See Figure 3).

7. Scalability:

The rigidity and inefficiency of disjointed legacy Finance systems has long been a reality for Finance organisations. But the unprecedented volatility of recent years has shown how an agile, extensible EPM solution can support an organisation through future changes.

Alongside growth, organisations’ financial consolidation needs evolve, so scalability is a significant requirement. An EPM solution should therefore be able to scale up to meet increasing demands – which provides a future-proof solution for organisations with expansion plans.

OneStream’s Intelligent Finance Platform uniquely offers extensibility (i.e., the customer’s ability to extend a system) in 3 ways: application design, platform and implementation. Unlike other systems, OneStream doesn’t utilise ‘smart lists’ or ‘alternate roll-ups’. Rather, something configured for one purpose can be used for other purposes, which makes using OneStream for multiple needs (e.g., actual and budget reporting) both possible and easier to maintain and support vs. alternative systems.

8. Collaboration and Workflow Management:

An effective EPM solution should include guided workflows to protect business users from complexity. How? By uniquely guiding them through all data management, verification, analysis, certification and locking processes.

Complex consolidations often involve multiple stakeholders across different departments. Accordingly, strict process controls are vital, and the system should include the following:

- Data and process certification and sign off.

- Audit trails from 10K/10Q to GL source account and GL trial balance

- Support for SOX 302 and 404 certification questionnaires to identify weaknesses in the financial process.

OneStream facilitates collaboration by providing a centralised platform for financial processes. Its robust workflow management capabilities allow for seamless coordination among team members, enhancing communication and ensuring that consolidation processes run smoothly.

9. Reduced Total Cost of Ownership (TCO):

Finance departments often choose a series of point solutions, believing they will lower overall costs. Initially, a solution might have a lower price tag than a unified EPM platform, but Finance often then ultimately spends more on cross-application integrations to cobble together a fully functioning system.

With a unified EPM platform, however, all processes are handled within a single instance. Plus, data is loaded into one central database and immediately available to all business processes. With no manual data movements or reconciliations to perform, the platform saves valuable time and reduces costs.

OneStream’s unified platform, coupled with its scalability and ease of use, contributes to a lower TCO. Specifically, organisations can achieve cost savings by consolidating various financial functions into a single platform, eliminating the need for multiple tools and reducing maintenance and training costs.

10. Success Stories:

Vendor reference checks are a fundamental aspect of informed decision-making. They offer valuable insights into a potential vendor’s past performance, which helps organisations confidently navigate the complex vendor selection process. By tapping into the real-world experiences of existing customers, Finance teams can gain a complete understanding of what to expect from a vendor. This understanding facilitates better-informed choices, effective risk management and long-term partnerships that benefit the organisation.

Numerous organisations have successfully leveraged OneStream for complex financial consolidations. In fact, many case studies and success stories highlight the platform’s effectiveness in addressing the unique challenges faced by businesses with complex financial structures. These real-world examples serve as a testament to OneStream’s capabilities and its positive impact on organisational performance.

For any organisation considering OneStream, we’ll always happily share multiple suitably matched references when asked to assist with selections.

Conclusion

OneStream is the leading solution for complex financial consolidations due to its unified platform, advanced features, real-time insights, streamlined data integration, regulatory compliance support, scalability, user-friendly interface, collaboration tools and cost-effectiveness. As organisations continue to navigate the complexities of the global business landscape, OneStream stands as a reliable partner in achieving efficient and accurate financial consolidations.

Learn More

To learn more about how organisations are conquering the complexity in the financial close, click here to read our whitepaper. And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

Download the White PaperGet Started With a Personal Demo