To chart an organization’s fiscal future, Financial Planning and Analysis (FP&A) managers examine, analyze and evaluate the organization’s financial undertakings. FP&A managers also simplify complex financial information for executives (often with little time), narrate financial performance and advise on adhering to the strategic plan. How? With FP&A reports.

Yet despite the explosion of data across sophisticated organizations, many organizations still struggle to meet the information requirements of executives and managers because the organizations just don’t have the right tools for the job. In fact, only 14% of Finance leaders classify their reporting and analytics as insightful, as illustrated in Figure 1.

Figure 1. Source: Reporting and Analytics for Intelligent FP&A

With the right FP&A software, reporting should be easy – if you know which reports will drive the organization furthest. And we’ve got you covered in that regard. Below, we’ve aggregated the most important FP&A reports for enterprise Finance teams.

The Best FP&A Reports

Regardless of the platform you’re using (even if OneStream is the most straightforward), FP&A reports offer important insights and information. The following reports will help keep the financial division at your organization well-coordinated month to month, quarter to quarter and year to year.

1. Income Statement (Profit and Loss Statement)

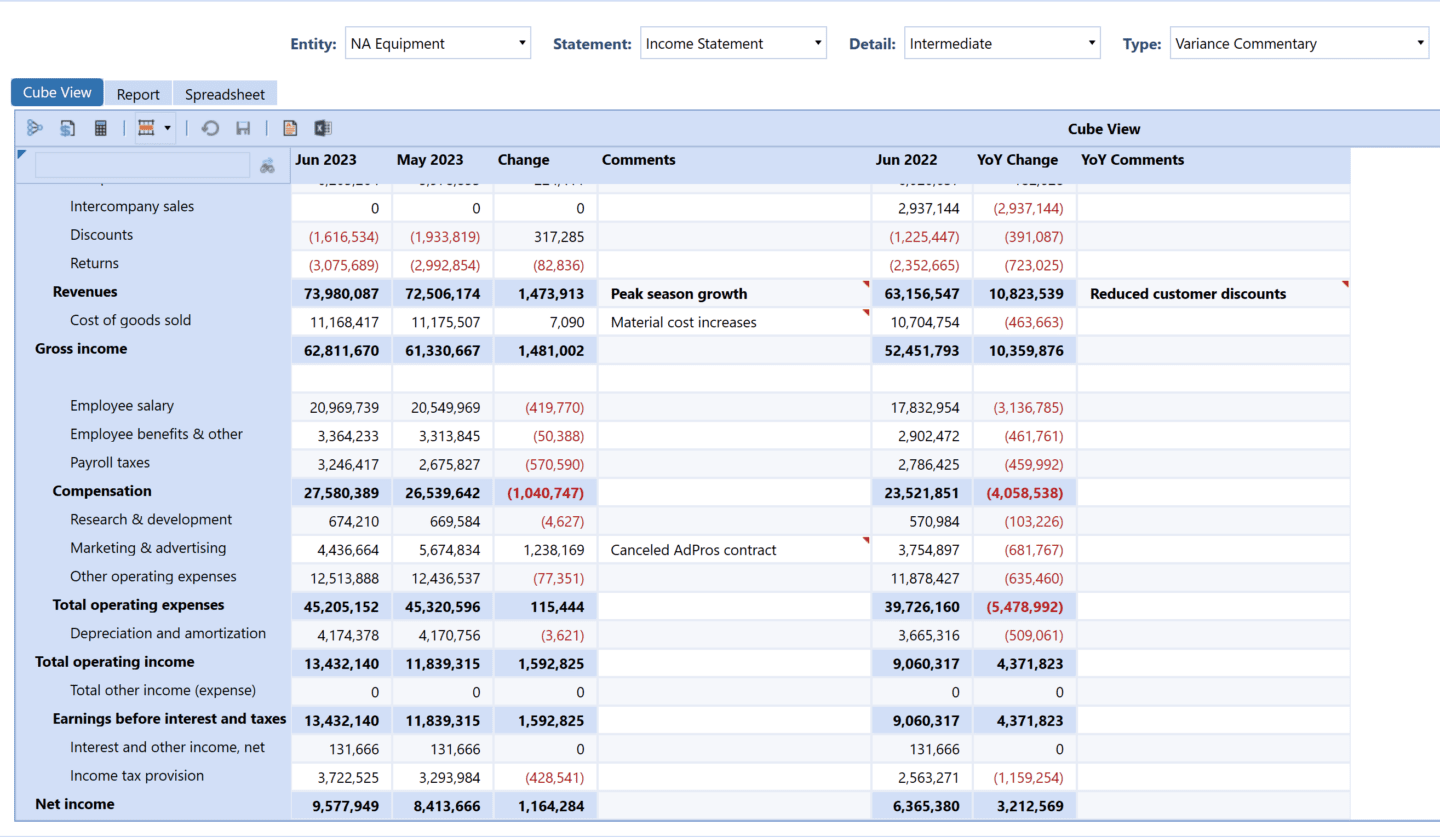

Figure 2. Screenshot of an income statement from OneStream

Sometimes called a “profit and loss” or “P&L” statement, an income statement is a critical financial report. It summarizes the revenues, costs and expenses incurred during a specific period, usually a fiscal quarter or year. Through such details, this FP&A report provides a clear view of the company’s operational efficiency and profitability over time.

Here’s how FP&A views and uses an income statement:

Operational Insight

- Revenue Analysis: FP&A teams dissect revenue streams to understand the business’s income sources and identify trends, seasonal variations and growth opportunities. In turn, this analysis helps with forecasting future revenues and setting realistic sales targets.

- Cost and Expense Management: By examining the costs of goods sold (COGS) and operating expenses, FP&A can pinpoint areas of inefficiency or overspending. This insight is used to recommend cost-saving measures and operational improvements.

Financial Health and Profitability

- Gross Profit Margin: Analyzing the gross profit margin helps FP&A assess the direct profitability of the company’s core activities, excluding overhead costs. When FP&A is evaluating the effectiveness of production and pricing strategies, this analysis is crucial.

- Net Profit Margin: The net profit margin reveals the overall profitability after all expenses, providing a comprehensive view of financial health. With this information, FP&A can advise on budget adjustments, investment decisions and strategies to improve profitability.

Forecasting and Strategic Planning

- Trend Analysis: By comparing income statements over multiple periods, FP&A teams can identify trends in revenue, costs and profit margins. This historical analysis is foundational for accurate financial forecasting.

- Scenario Planning: FP&A often uses the income statement for scenario planning. Using this report, FP&A can assess how different strategic decisions (e.g., market expansion, product launches) might impact the company’s financial performance.

Performance Measurement

- Budget vs. Actual: By comparing actual results with budgeted figures on the income statement, FP&A can measure organizational performance, identify variances and understand why they occur. This evaluation is crucial for refining future budgets and improving forecasting accuracy.

Communication and Reporting

- Executive and Stakeholder Communication: By translating the complex details of the income statement into actionable insights, FP&A can give strategic advice to executives and stakeholders. This communication involves highlighting key financial metrics, risks and opportunities in a comprehensible manner.

In essence, from an FP&A standpoint, the income statement is not just a retrospective financial report. The statement is also used for ongoing analysis, strategic planning and decision support – providing a foundation for guiding the organization toward financial stability and growth.

2. Balance Sheet

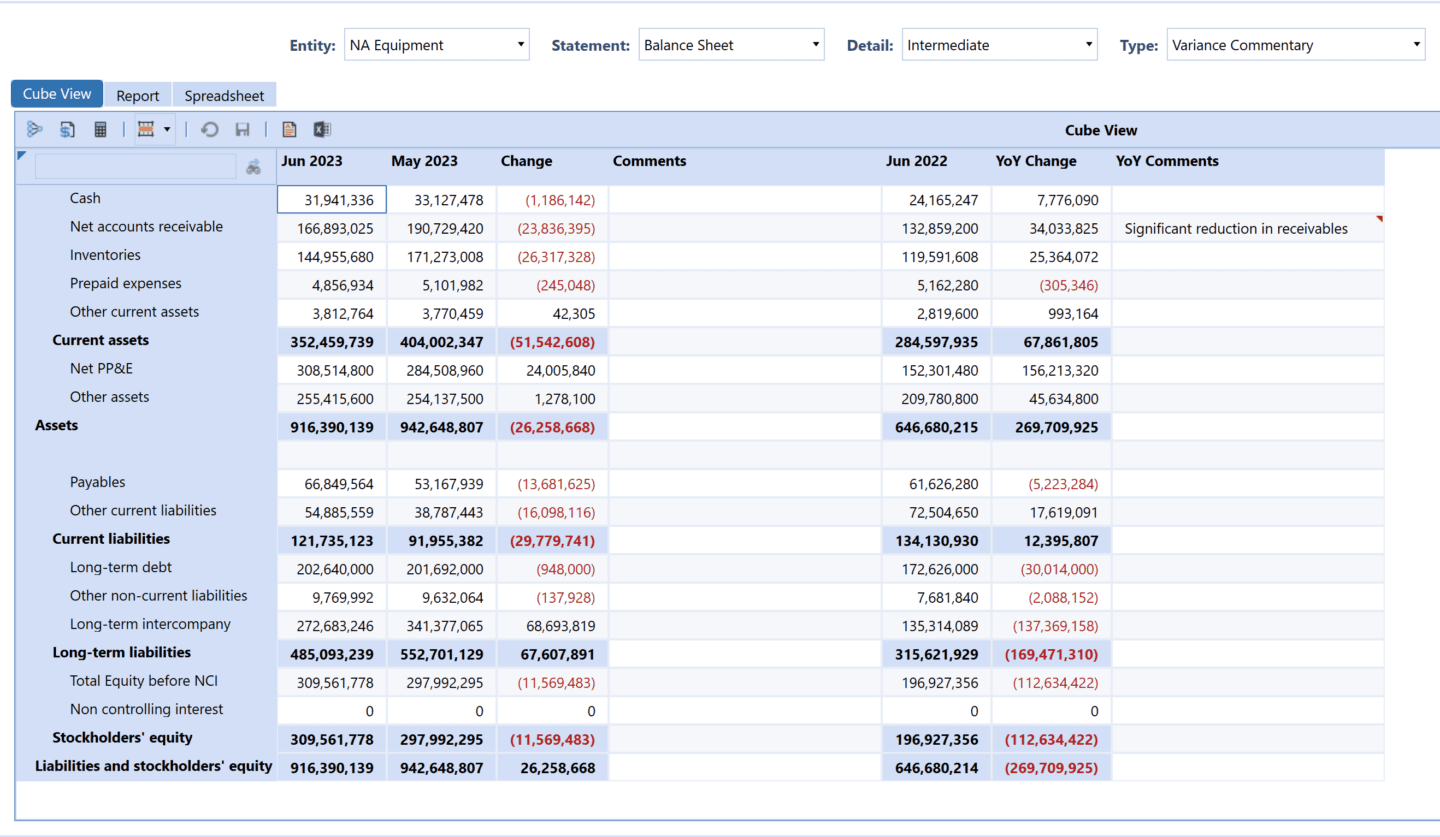

Figure 3. Screenshot of an balance sheet from OneStream

As a fundamental financial statement, a balance sheet gives a snapshot of a company’s financial condition at a specific point in time. The statement details the organization’s assets, liabilities and shareholders’ equity to provide a comprehensive overview of financial health and stability.

Here’s how FP&A views and uses a balance sheet:

Asset Management

- Current Assets Analysis: With this analysis, FP&A teams evaluate current assets (e.g., cash, marketable securities and receivables) to assess the company’s liquidity and ability to meet short-term obligations. The analysis then helps organizations effectively manage working capital.

- Fixed Assets Management: In fixed assets management, long-term assets – such as property, plant and equipment (PP&E) – are assessed. FP&A specifically looks at the role fixed assets play in the company’s operational capabilities and long-term strategy (e.g., investment, depreciation and disposal decisions).

Liability Oversight

- Short-Term Liabilities: Analyzing short-term liabilities (e.g., accounts payable and short-term debt) helps FP&A understand the company’s immediate financial commitments and liquidity pressures.

- Long-Term Liabilities: Evaluating long-term obligations (e.g., bonds payable and long-term leases) provides FP&A with insight into the company’s long-term financial planning and sustainability.

Equity Evaluation

- Shareholders’ Equity: This evaluation includes analyzing retained earnings, paid-in capital and other equity items. Through this analysis, FP&A can understand the company’s funding structure and the impact of operational performance on equity. The information and insights gained are especially crucial for decisions related to dividends, stock repurchases and equity financing.

Financial Ratios and Health

- Liquidity Ratios: When assessing financial health, FP&A uses ratios such as the current ratio and quick ratio to evaluate the company’s ability to pay off short-term liabilities with short-term assets. Such analysis is crucial for liquidity management.

- Leverage Ratios: Debt-to-equity and debt-to-asset ratios are analyzed to understand the level of indebtedness and the financial leverage of the company. In turn, the organization can use the information and insights gained when making impact risk assessments and capital structure decisions.

Strategic Planning

- Capital Structure Analysis: Through capital structure analysis, FP&A assesses the balance between debt and equity financing. The information and insights gained are then used to recommend strategies for optimizing the company’s capital structure. For any strategy, key considerations include cost of capital, risk and financial flexibility.

- Investment and Growth Opportunities: By analyzing the balance sheet, FP&A can identify surplus cash or underutilized assets. Any surpluses or assets can then be redirected toward growth opportunities, mergers, acquisitions, or other strategic investments.

Risk Management

- Contingent Liabilities: Potential future liabilities (e.g., lawsuits or warranties) are considered given their potential impacts on financial planning and risk management strategies.

Stakeholder Communication

- Communicating Financial Stability: FP&A translates balance sheet data into insights about the company’s financial stability, growth potential, and risk profile for investors, lenders and internal stakeholders. In turn, the information and insights gained help support informed decision-making.

The balance sheet is not just a static reflection of assets, liabilities and equity. Instead, this financial statement is a dynamic tool. It’s used for managing liquidity, assessing financial stability, guiding strategic investments and ensuring the company is positioned for sustainable growth.

3. Cash Flow Statement

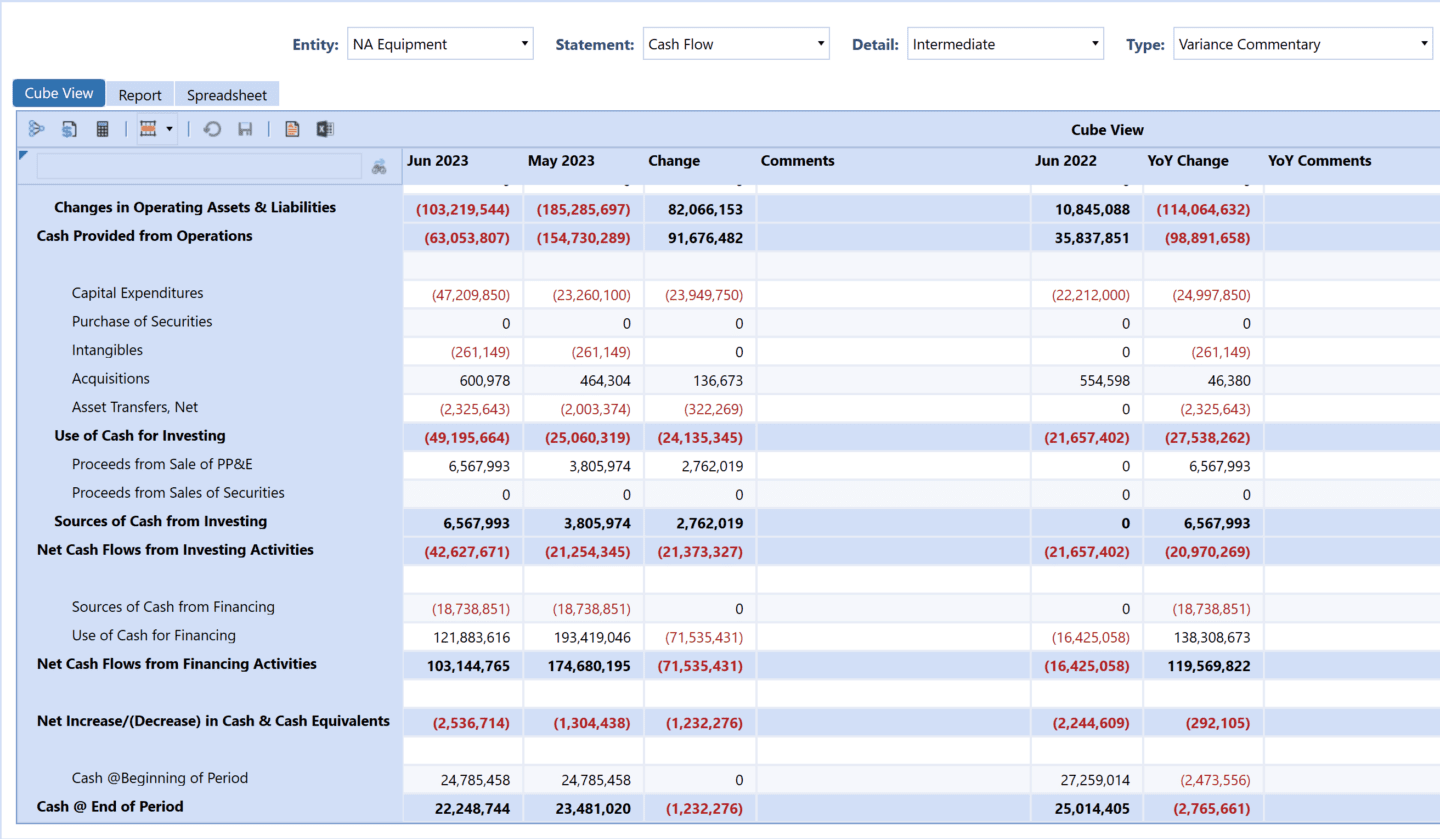

Figure 4. Screenshot of a cash flow statement from OneStream

A cash flow statement is an indispensable financial document. Why? It tracks a company’s incoming and outgoing flow of cash over a specific period. Through that information, a cash flow statement provides a detailed breakdown of cash movements related to operating, investing and financing activities. This statement thus offers a clear view of a company’s liquidity, solvency and overall financial health – beyond what income statements and balance sheets can reveal.

Here’s how FP&A views and uses a cash flow statement:

Cash Management

- Operating Activities: By analyzing cash flows from operating activities, FP&A can better understand the cash generated from the company’s core business operations. This analysis is vital for assessing the quality of earnings and the company’s ability to sustain operations without relying on external financing.

- Investing Activities: Cash flows, particularly a 13-week rolling cash flow, related to investing activities are scrutinized to evaluate the company’s investment strategy and the impact on long-term growth. Through this analysis, FP&A looks at activities such as the purchase or sale of assets, investments and capital expenditures.

- Financing Activities: Examination of financing activities provides insights into the company’s financing strategy and approach to managing capital structure and shareholder returns. Through this analysis, FP&A looks at activities such as issuing debt, repaying loans or distributing dividends.

Liquidity Analysis

- Short-Term Liquidity: To assess the company’s ability to meet short-term obligations and efficiently manage working capital, FP&A uses the cash flow statement. This process includes planning for potential cash shortfalls or allocating excess cash.

- Long-Term Solvency: Analysis of long-term cash flow trends is essential for evaluating the company’s solvency. Specifically, the analysis looks at the capacity to fund operations, repay debt and pursue expansion opportunities over the long term.

Forecasting and Planning

- Cash Flow Forecasting: By analyzing historical cash flow patterns, FP&A teams forecast future cash flows, which helps with budgeting and financial planning. This forecasting is crucial for ensuring the company maintains sufficient liquidity to meet any operational and strategic needs.

- Scenario Analysis: Using the cash flow statement, FP&A performs scenario analysis to understand how various strategic decisions and external factors could impact the company’s cash position. This analysis helps in risk management and strategic decision-making.

Performance Measurement

- Free Cash Flow Analysis: Free cash flow (FCF) is a key metric derived from the cash flow statement. Through this metric, FP&A can better understand the cash a company generates after accounting for cash outflows to support operations and maintain capital assets. FP&A uses FCF to evaluate the company’s financial performance, dividend-paying ability and potential for growth investments.

Communication

- Stakeholder Reporting: FP&A communicates the insights gained from the cash flow statement to internal and external stakeholders. With those insights, FP&A can present a clear picture of the company’s financial health, operational efficiency and future outlook.

- Strategic Recommendations: Based on the analysis of the cash flow statement, FP&A advises senior management on cash management strategies, investment opportunities and financial risk mitigation.

In essence, a cash flow statement is a strategic tool for managing financial health, supporting operational needs, guiding investment decisions and planning for sustainable growth.

4. Budget vs. Actuals Analysis

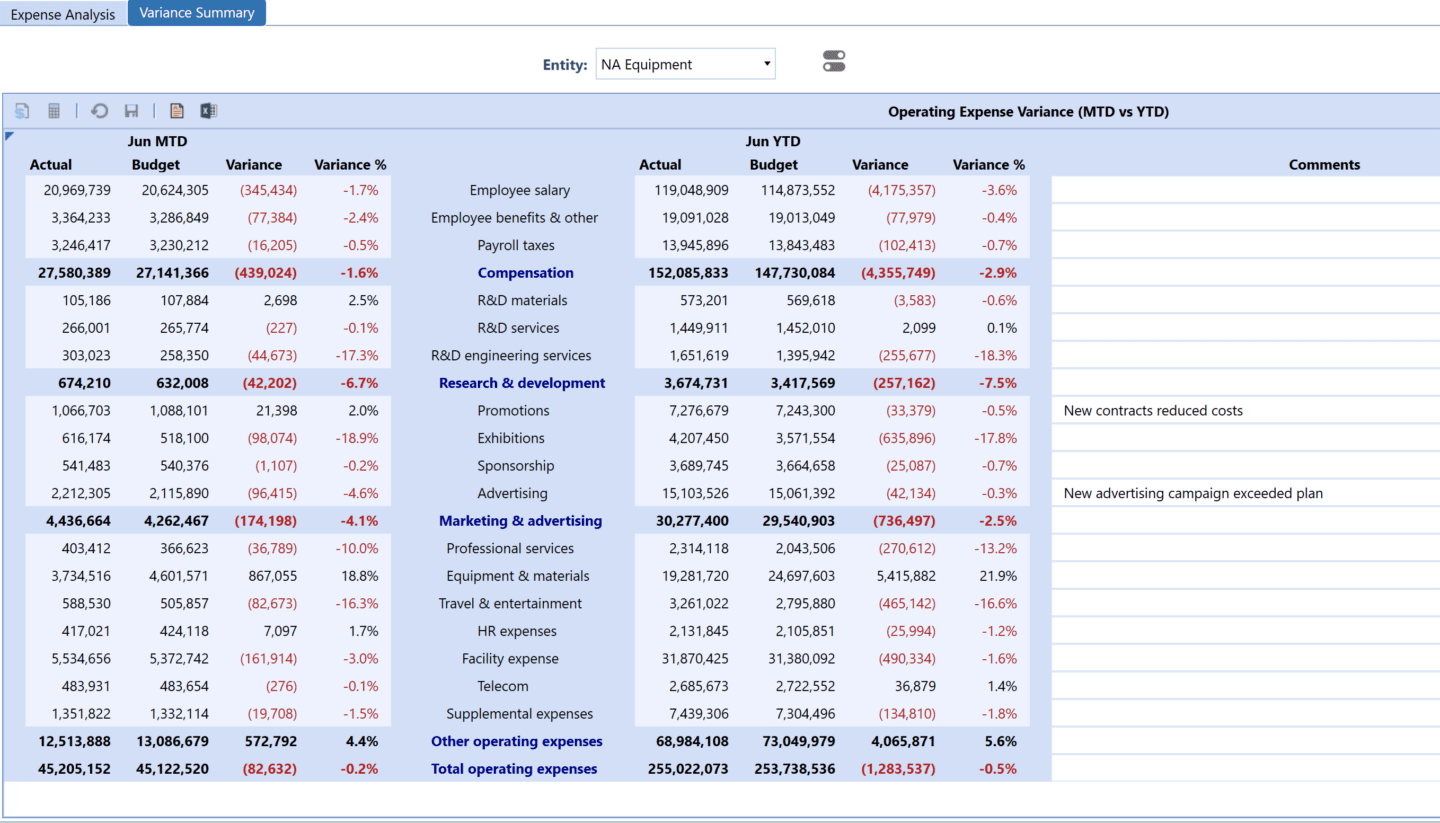

Figure 5. Screenshot of a budget vs actuals analysis from OneStream

The analysis of budget vs. actuals compares planned financial outcomes (budget) with actual results. Using this report, FP&A teams can identify variances, understand the reasons behind these differences and take corrective actions if necessary. The report also helps with refining future budgets and improving forecasting accuracy.

Here’s how FP&A views and uses a budget vs. actuals analysis:

Performance Measurement

- Identifying Variances: One of the primary functions of the budget vs. actuals report is to identify variances between what was expected and what has been achieved. By analyzing these variances, FP&A seeks to understand their causes, whether they stem from changes in the market environment, operational challenges or deviations in strategic execution.

- Operational Insights: By analyzing the differences between budgeted and actual figures, FP&A can pinpoint underperforming or overachieving operational areas. This insight is crucial for making informed decisions about operational adjustments and resource allocation.

Financial Control and Management

- Cost Control: By monitoring actual expenses against budgeted expenses, FP&A can identify areas of overspending. Such information then prompts immediate corrective action to control costs and improve efficiency.

- Revenue Management: Analyzing actual revenues against forecasts enables FP&A to gauge the effectiveness of sales strategies and market conditions, potentially leading to strategy adjustments.

Forecasting and Strategic Planning

- Refining Forecasts: The insights gained from budget vs. actuals analysis are instrumental in refining future forecasts. By understanding the reasons behind variances, FP&A can make more accurate predictions, improving the reliability of financial planning.

- Strategic Adjustments: Regular analysis of budgetary variances informs strategic decision-making, helping to more closely align future budgets with strategic goals and market realities.

Accountability and Performance Incentives

- Driving Accountability: The budget vs. actuals report serves as a basis for evaluating the performance of departments and managers. Through that evaluation, FP&A can be held accountable for their financial management and operational execution.

- Performance Incentives: The analysis of budget vs. actuals informs the development of performance incentives, linking financial rewards to the achievement of budgeted targets and strategic objectives.

Communication and Stakeholder Engagement

- Internal Communication: The budget vs. actuals analysis report is a vital tool for internal communication. With the insights from this analysis, FP&A can provide management and stakeholders with a clear view of the company’s financial performance and operational efficiency.

- External Stakeholders: While primarily used internally, insights from the budget vs. actuals analysis can be shared with external stakeholders to demonstrate fiscal responsibility and operational transparency.

Risk Management

- Identifying Financial Risks: Regular comparison of budgeted and actual figures helps in identifying financial risks early. Using that information, FP&A teams can recommend risk mitigation strategies and contingency plans.

In other words, the budget vs. actuals analysis report is a comprehensive tool for operational and strategic management. The report ultimately enables informed decision-making, enhances financial discipline and drives organizational growth.

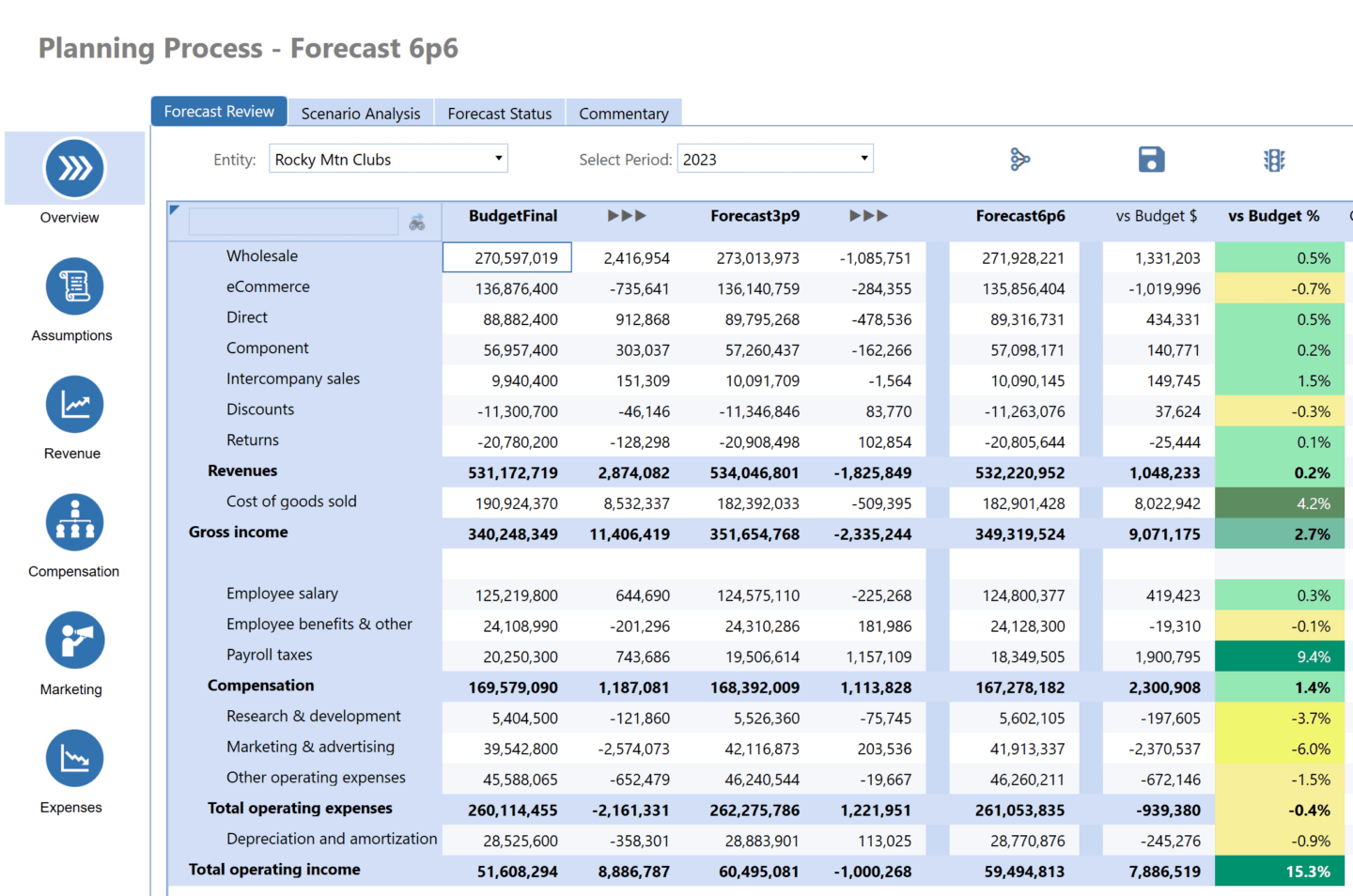

5. Forecast Reports (Financial Forecasts and Projections)

Figure 5. Screenshot of a forecast analysis from OneStream

Encompassing both financial forecasts and projections, forecast reports are forward-looking documents that estimate a company’s future financial outcomes. Those estimates are based on historical data, current market trends and assumptions about future conditions. For FP&A teams, these reports are pivotal for strategic planning, resource allocation, risk management and decision-making processes.

Here’s how FP&A views and uses forecast reports:

Strategic Planning and Decision-Making

- Guiding Strategic Decisions: Financial forecasts provide a foundation for strategic decisions. With the information and insights gained, companies can plan expansions, investments, new products, or market entries by projecting future revenue, expenses and cash flows.

- Resource Allocation: Forecasts enable the efficient allocation of resources by identifying future financial needs, potential funding gaps and areas where investments can yield the highest returns.

Budgeting Process

- Budget Preparation: Forecasts often serve as a starting point for the budgeting process to offer an initial estimate of financial performance. Then, that estimate gets refined into a detailed budget.

- Dynamic Budgeting: In a dynamic and uncertain environment, financial forecasts allow FP&A to adjust budgets in real time. Those adjustments help FP&A respond effectively to changes in market conditions or operational performance.

Performance Measurement

- Setting Performance Targets: Financial projections are used to set performance targets for departments and teams. With such targets, FP&A can align operational efforts with the company’s financial goals.

- Benchmarking: Forecasts serve as benchmarks for evaluating actual financial performance, enabling companies to measure progress towards their strategic objectives.

Risk Management

- Identifying Risks and Opportunities: By examining various scenarios, forecasts help identify potential financial risks and opportunities. Companies can use the information and insights gained to devise strategies to mitigate risks and capitalize on opportunities.

- Contingency Planning: Financial forecasts are essential for contingency planning. Through such planning, companies can prepare for various future scenarios by understanding the financial impact of different risks and uncertainties.

Cash Management

- Cash Flow Planning: Forecast reports provide insights into future cash flows. Using those insights, companies can better manage their liquidity, plan for debt repayments and make informed decisions about dividends or reinvestments.

Investor Relations and Financing

- Communicating with Investors: Forecasting reports are crucial for communicating with investors and lenders. Through the forecasts, FP&A gains a clear picture of the company’s future prospects and strategy for growth and profitability.

- Supporting Financing Decisions: Financial projections support decisions related to raising capital, whether through debt or equity. Using forecasts, a company can show potential lenders and investors its growth prospects and ability to generate returns.

Market Analysis and Competitive Strategy

- Market Trends Analysis: FP&A teams use financial forecasts to analyze market trends, customer behavior and competitive landscapes. As a result, FP&A can adjust strategies to maintain or enhance the company’s market position.

- Competitive Strategy Formulation: Projections inform strategic decisions that affect the company’s competitive stance. With the acquired insights and information, FP&A can improve pricing strategies, market differentiation and customer acquisition efforts.

Forecasting reports are strategic tools that guide the entire spectrum of corporate planning and operational decision-making. The reports help companies navigate uncertainty, plan for the future and position themselves for sustainable growth.

More FP&A reports?

These 5 FP&A reports are a good starting point, but many other reports are available to FP&A teams. For a more in-depth look at FP&A in action, check out our Budgeting, Planning and Forecasting e-book – it’s all online, no forms required.

Are you at an enterprise organization looking to upgrade your FP&A processes? Get started with a OneStream demo today!

Get Started With a Personal Demo