In recent years, Financial Planning and Analysis (FP&A) providers have seen a relative explosion in the number of AI software solutions. AI software for FP&A is gaining importance because it significantly enhances the efficiency and accuracy of financial analysis. In fact, the best AI software solutions for FP&A enable organizations to quickly analyze vast amounts of financial data, identify patterns and generate insights.

AI helps automate routine tasks, freeing up Finance professionals to focus on the more strategic aspects of financial planning. Overall, the integration of AI in FP&A contributes to resource optimization, efficiency, agility and better-informed decision-making.

In this blog post, we examine the Top 5 AI software solutions for FP&A in 2024 using our own interpretation of their relative offerings. We only include software that meets the following non-negotiable qualifications:

- Earned at least 4.5/5 stars on Gartner Peer Reviews – Financial Planning Software

- Listed in the Budgeting Section on Capterra

- Offers a wider EPM offering

What Is AI Software for FP&A?

AI software for FP&A enables Finance teams to move beyond historical reporting and embrace machine learning (ML)-backed predictive analytics. By analyzing historical data patterns, AI algorithms can more accurately forecast future trends. Those trends then help organizations make more informed financial decisions. For example, AI can analyze customer behavior, purchase history and market trends to predict the ideal price point for each product or service. This personalized approach maximizes both revenue and customer satisfaction, paving the way for sustainable growth.

As FP&A teams continue to embrace AI, adopting a sensible approach to ML – one that balances automation with transparency and human insight – has become increasingly important. After all, effective planning is critical for businesses to remain competitive and adapt to changing market conditions.

Common features across AI software solutions for FP&A include the following capabilities:

- Easy-to-access interactive dashboards that FP&A teams can use to discern financial trends.

- Enhanced forecast accuracy by generating more precise analysis using business intuition or external factors within forecasts.

- Easily visualized impact of planning decisions on profitability and margins with “What-if” driver-based planning.

- Reduced forecast bias within scenarios, compare against human forecasting to drive better dialogue and collaboration.

By leveraging these features and others, organizations can transform the FP&A function, plan with confidence, gain insights and forecast more accurately.

This comparative analysis explores the features and functionalities of 5 leading AI software solutions for FP&A: OneStream, Planful, Board, Workday Adaptive and Wolters Kluwer CCH Tagetik.

The Best AI Software for FP&A

1. OneStream

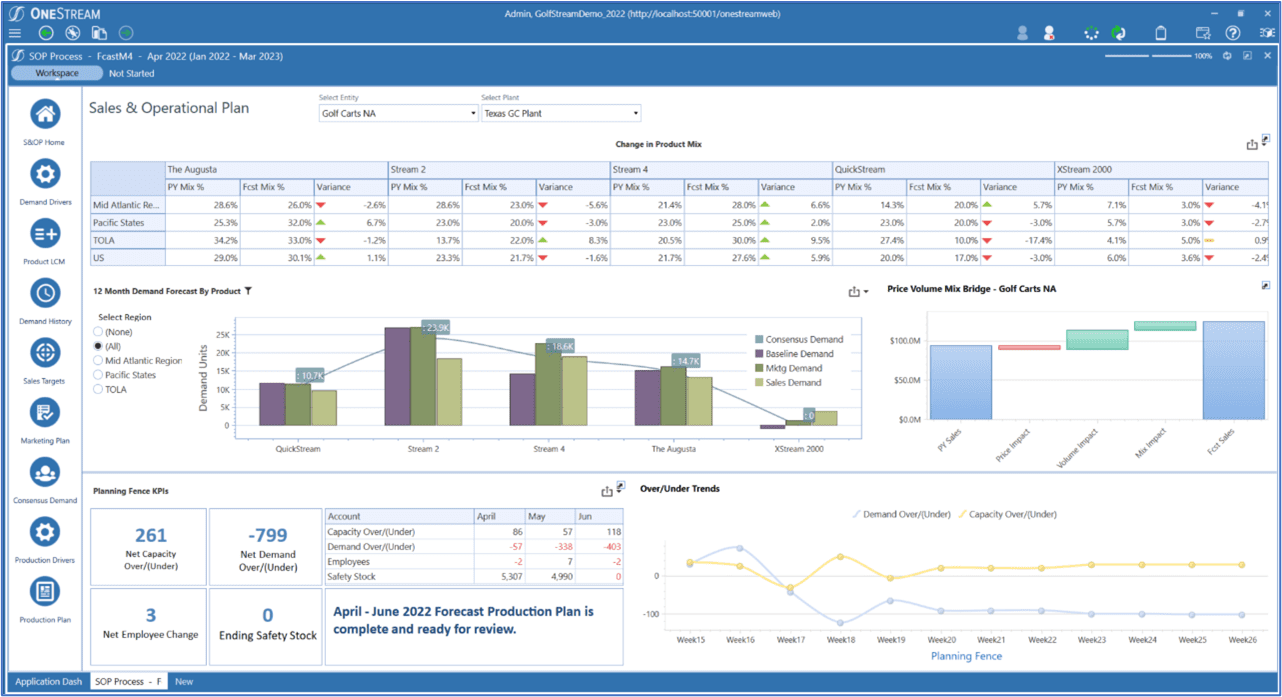

OneStream is how finance teams can stop wrangling data and start making more of an impact on the business. It’s the only enterprise finance platform that unifies all your financial and operational data, embeds AI for better decisions and productivity, and lets you keep adding capabilities without adding technical debt.

Pros

- Enables users to create thousands of highly accurate daily and/or weekly ML forecasts across products and locations via the unique “Model Arena” concept where models compete to win the most accurate forecast for each individual team.

- Allows the capture of business intuition such as promotions, events and other external factors within ML forecasts.

- Fully unifies and aligns demand forecasts with driver-based sales, material costs, inventory and labor plans across financial statements including the P&L, Balance Sheet and Cash Flow.

Cons

- Tailored implementation process potentially requiring additional configuration time to meet customers’ unique business requirements.

- Potentially prohibitive pricing, especially for smaller businesses.

- Smaller but growing market presence compared to other alternatives – despite growing popularity and having 1,300+ customers across the globe.

2. Planful

Founded in 2001, Planful is a private company supported by private equity firm Vector Capital. The Planful platform aims to streamline diverse business processes, such as planning, budgeting, consolidations, reporting and analytics. Used globally, this platform acts as a tool for Finance, Accounting, and Business users to improve their planning, reporting and closing processes. Planful’s ultimate stated aim with its AI software for FP&A tool is to accelerate process cycles, boost productivity and enhance overall accuracy.

Pros

- Offers very user-friendly, adaptable interface (i.e., functions in both web and Excel interfaces) that requires little IT help and has syntax similar to Excel.

- Allows customers to only buy what they need since Planful is sold as modules.

- Receives very highly rated customer service within public reviews.

Cons

- Difficult-to-detect seasonality due to the lowest granularity being monthly.

- Inability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- Limited scale as users are constrained to running only 10 models at one time.

- Data integration delivered using a third-party solution – not developed by Planful.

3. Board

Board was founded in 1994 in Chiasso, Switzerland, and has headquarters in both Boston and London. While the overall product is marketed as integrated business intelligence reporting and analytics with enterprise scalability, Board markets its planning solution as Intelligent Planning for FP&A teams. Board is a private company with customers worldwide, the highest percentage in Europe.

Pros

- Employs a model competition concept where models compete to win the most accurate forecast for each individual line item – enabling users to create thousands of highly accurate daily and/or weekly ML forecasts across products and locations.

- Provides prebuilt integrators with ERPs and over 270 APIs to multiple source systems that import GL and transactional information.

- Offers visually appealing UI with tight connection between the presentation layer and back-end.

Cons

- Ongoing maintenance required as everything must be built, meaning little pre-built functionality exists.

- No ability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- Limited accuracy improvements due to only statistical models vs. machine learning models being available.

- No health monitoring of models and auto-rebuilds to maintain accuracy of models.

4. Workday Adaptive

Workday is a leading provider of enterprise cloud applications for Finance and Human Resources. Founded in 2005, Workday delivers financial management, human capital management and analytics applications. Workday Adaptive Planning originates from the acquisition of Adaptive Insights in 2018. Marketed as enterprise planning software, the Workday solution helps Finance create budgets and forecasts with more speed, flexibility, collaboration and accuracy.

Pros

- Provides Finance-focused planning solution with strong market awareness, especially in the US.

- Uses automation and connectivity to Excel through Office connect, ensuring ease of use.

- Offers outlier reporting and anomaly detection, allowing for quick analysis and plan comparison.

Cons

- Limited accuracy improvements due to a single model applied across all line items or product-location combinations vs. a specific model application for each line item, which can be achieved through a Model Arena.

- No ability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- No health monitoring of models and auto-rebuilds to maintain accuracy of models.

5. Wolters Kluwer CCH Tagetik

Wolters Kluwer is a global entity specializing in professional data, application solutions and services. The company targets sectors such as healthcare; taxation and accounting; corporate and financial compliance; legal and regulation; and corporate performance and ESG. Originally developed in 2005 to deliver trusted, comprehensive and scalable CPM solutions globally, CCH Tagetik was acquired by Wolters Kluwer in 2017.

Pros

- Surfaces drivers impacting the business.

- Shows accuracy uplift with forecast comparison of statistical predictive vs. baseline forecasts.

- Offers unified platform approach that differs from multi-solution approaches (e.g., SAP and Oracle).

Cons

- Separate ML product requiring integration, administration and, therefore, unification and transparency.

- Limited accuracy improvements due to a single model applied across all line items or product-location combinations vs. a specific model application for each line item.

- Limited accuracy improvements due to only statistical models vs. machine learning models being available.

Conclusion

Choosing the right AI software for FP&A is essential for organizations seeking to move away from unreliable, inadequate EPM applications and/or spreadsheets and instead evolve to a modern AI-driven EPM solution.

Each of the Top 5 solutions featured in this blog post offers unique features and benefits, catering to the diverse needs of organizations across industries. Ultimately, however, if you’re looking to streamline your key Finance processes and significantly increase confidence in your reporting, OneStream is the best AI software for FP&A to handle all your needs, no matter how complex.

Learn More

To learn more about how organizations are managing the complexity in their financial planning and analysis by using AI, check out our whitepaper titled “Revolutionize Your Planning with Sensible ML.” And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

Download the White PaperGet Started With a Personal Demo