As stated in our previous blog post titled “Why Is Integrated Business Planning So Hard?,” we examine why unifying integrated business planning (IBP) or connected planning processes enables organizations to ensure they take a data-first approach to all planning activities. Such a planning approach aims to unify business strategy with planning, budgeting and forecasting activity for all business lines and functions – providing one version of the truth within a single, seamless technology platform and user experience.

A trusted, common view of the numbers provides a robust baseline for agile decision-making and keeps all teams together, collectively trying to achieve the same corporate objectives while staying focused on specific KPIs. In other words, the different teams maintain their independence while working in unison to achieve corporate success by leveraging the same trusted and governed data.

This approach is underpinned on a single technology platform that can manage planning, budgeting & forecasting (PB&F), consolidation and reporting all in one place – without the need to duplicate data or otherwise maintain different solutions. The advantages of this approach are many:

- Trust in the numbers. While every function plans at a different level of granularity, all can be tied back to financial metrics and strategic objectives because all functions are using the same data within the same platform.

- Leadership buy-in. Using one version of the numbers is pivotal to managing business performance. No substitute exists for a single accurate picture of plans and performance, so hardly any CEO and CFO would turn away from this advantage.

- Improved collaboration. One key aim of unifying business planning is to help reach consensus among all planning parties. When teams no longer need to collate and compare plans, collaboration flows and allows consensus planning to happen faster.

- Instant response to events. When the same data is used for forecasting and consolidation, actuals can be served to support shorter forecasting cycles (daily, hourly) and what-if simulations. In current volatile times, this capability offers a true competitive advantage.

- Faster IBP process implementation. If one of the IBP fundamentals is “one set of numbers,” why not set it as the single most important requirement for any IBP process implementation? Having one single technology and data model is a unique way to obtain “one set of numbers.” When this requirement is met first, the IBP process can deliver faster business integration, establish a superior planning structure and begin to model the right culture and behaviors.

Leading the Change

Intelligent Finance teams lead business planning unification and foster collaboration across the organization. While the teams oversee and facilitate the planning activity, doing so should not suppress the detailed planning required between and by the different business lines and functions (e.g. Supply Chain, HR, IT).

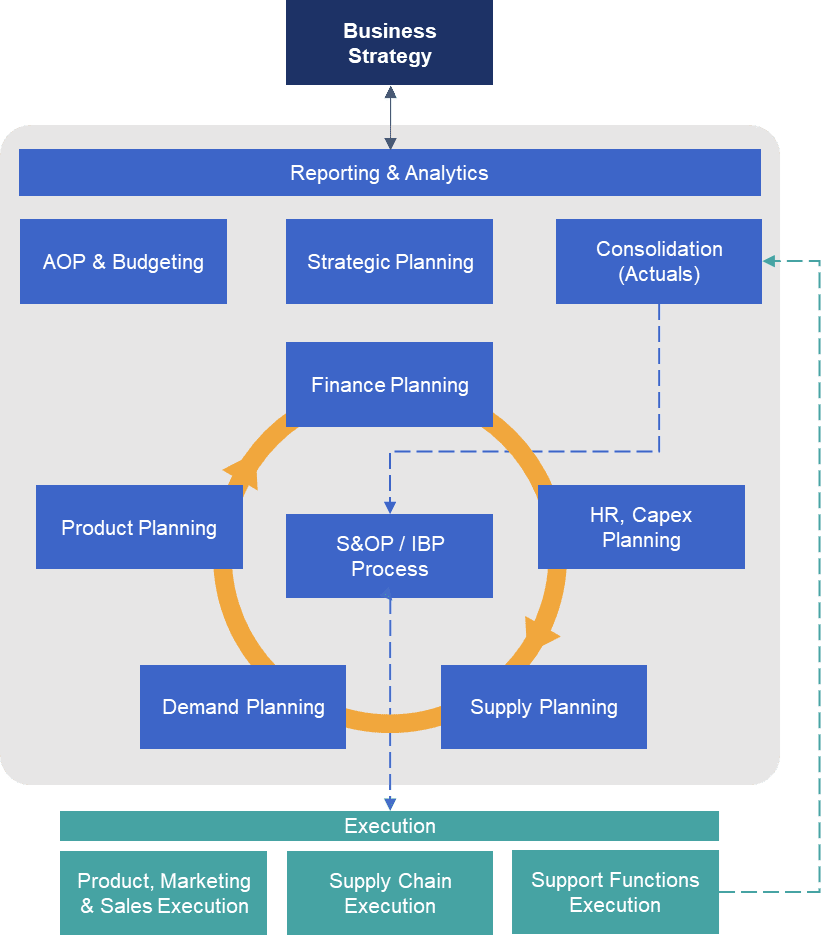

Instead, all planning activities should focus on a central Finance planning capability that orchestrates and aligns data, strategy, processes and people across the different business units and functions (see Figure 1). This central capability is simple to understand when the main mechanisms to show market value and performance against strategy goals are financial artifacts such as P&L, balance sheet, and income and cash statement.

Unfortunately, most options for connected planning, integrated business planning are simply not built for this purpose. Why? Rather than relying on a truly unified data model, Finance and IT teams are forced to connect plans across systems and spreadsheets by moving and reconciling data. Those processes, in turn, add material risk and cost to integrated business planning efforts.

In other words, true unification matters – a lot.

How to Unify Business Planning

Unified business planning is anchored on 3 key principles:

- Principle of collaboration. Team collaboration starts with adopting a clearly communicated vision, setting the expectations around teamwork, and defining KPIs aligned to strategic objectives and financial attainment. Finance should orchestrate and foster collaboration and support all teams. Ideally, a leadership role – one that reports to the CFO – should be established to orchestrate all planning activities.

- Principle of simplification. Simplification occurs as a result of process step elimination, minimization and automation. Planning processes should be challenged by removing complexity, redefining measurements and ultimately automating tasks. When a unique view of the plan is instilled, the need for file version control, data reconciliation and validation is drastically reduced or eliminated.

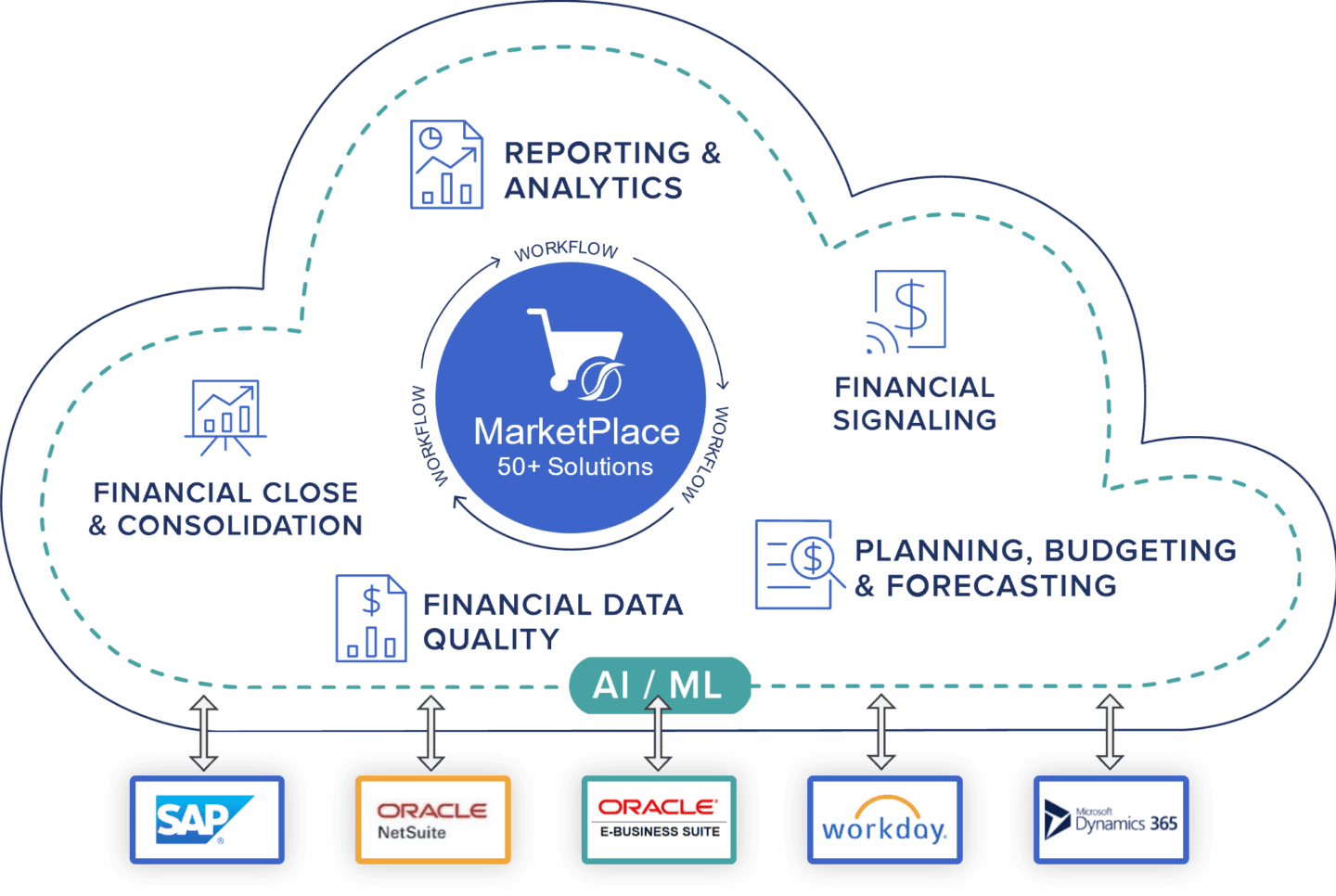

- Principle of technical unification. This principle is the single most important precept to follow in a unified business planning approach. Achieving technical unification calls for breaking away from suboptimal technology solutions and spreadsheet patching. Instead, such unification requires considering a solution capable of managing both financial and operational forecasting, planning and budgeting processes while providing financial consolidation, reporting and analytical tools all in one place – and doing it with speed and scale (see Figure 2). When a single solution is used to manage all these processes, bringing people together and simplifying the process becomes easier.

These principles not only provide a robust foundation throughout the IBP journey, but also facilitate the adoption of technology that truly unifies people and processes.

Unified Integrated Business Planning Model

A data-first approach to integrated business planning unifies the views of strategy, planning and performance, increasing the speed of decision-making.

Figure 3 shows the model for unified business planning platform. In light gray, the figure shows the key processes that must be part of the same platform under one data model to reap the benefits of this approach. The figure also displays a representation of an IBP process with a closed loop between planning and execution – a loop that remains aligned to the business strategy because everything relies on the same data and technology.

Unify Integrated Business Planning, or Face the Hidden Costs

Unifying integrated business planning brings data and people together, helps the organization model the right behaviors, and removes the friction of traditional technology silos and spreadsheets.

Today, Finance leaders have the organizational influence to lead an IBP process based on a unified approach. However, unifying integrated business planning requires one single platform and extensible data model, not an integrated set of connected modules from the same vendor. This approach offers the most effective way to unify business strategy, planning and performance.

By not taking a unified and data-first approach to IBP process implementation, organizations face the hidden costs of dealing with archaic and fragmented technology:

- Technical debt: Cost of maintaining outdated or obsolete technologies.

- Reduced efficiency: Costly mistakes derived from reconciliation and manual touch-points.

- Less effectiveness: Organizational friction and higher elapsed time between planning and execution.

- Higher risk, opportunity loss: Result of slow, biased decision-making.

Learn More

Learn how to maximize the benefits of Integrated Business Planning in our next blog:

Get Started With a Personal Demo