Effective budgeting and planning are crucial for the success of any organization, and higher education institutions are no exception. This reality is particularly true as Finance teams of higher education institutions focus on improving their planning, budgeting and forecasting processes while navigating current trends. Such trends can include staffing issues, changing enrollment demographics and highly demanding board members.

However, the variety of entities within these institutions and the distributed nature of those entities pose a challenge to effectively managing budgets and plans. To manage both, higher education Finance teams must successfully accommodate the varied requirements of each entity within the organization and the requirements of the combined organization.

The Challenges of Institution Complexity and Variety

How do some of the challenges of institution complexity and variety manifest? To illustrate, we’ll look at the following three fictional individuals responsible for distinct aspects of a large higher education institution’s financial and operations management:

- Sandeep is the VP of Finance and CFO of the institution.

- Kyle is the Executive Director of Housing.

- Stephanie is the Executive Director of the Bookstore.

As the CFO, Sandeep provides reporting to the institution’s stakeholders (e.g., board of directors) to give them a comprehensive, holistic view of institutional finances and operations. To deliver this reporting and ensure that the institution’s financial goals and objectives are met, he requires visibility into the financial operations of all departments, including Housing and the Bookstore.

To manage the Housing’s financial operations, including budgeting and forecasting, Kyle requires visibility into occupancy rates, housing expenses and revenue streams. That visibility helps with making informed decisions and ensuring the housing operations remain financially sustainable.

While Stephanie’s budgeting and forecasting responsibilities resemble Kyle’s, her requirements are naturally different since she manages revenue streams and expenses related to the Bookstore. Stephanie requires visibility into inventory levels, pricing strategies and multiple revenue streams. That visibility helps with making informed decisions and ensuring the Bookstore operations remain financially sustainable.

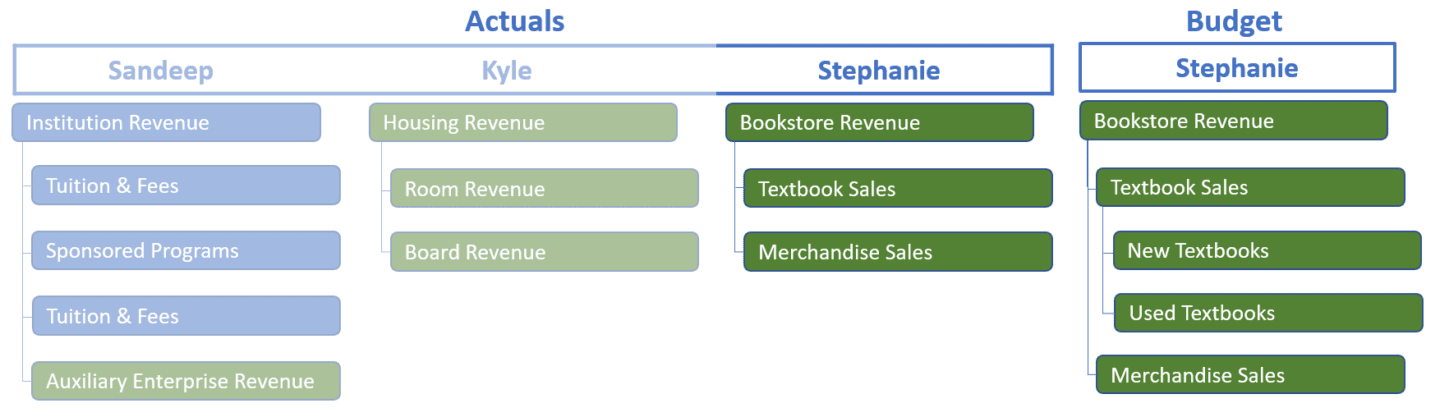

But just how different are the reporting needs for Sandeep, Stephanic and Kyle? Well, we can see a simple example by looking at the chart of accounts dimension (see Figure 1).

At the institution level, Sandeep tracks revenue for both Housing and the Bookstore in a single account, Auxiliary Enterprise Revenue, which falls under Institution Revenue. Kyle tracks Housing revenue in separate accounts, including Room Revenue and Board Revenue. And finally, Stephanie tracks revenue for the Bookstore with accounts for Textbook Sales and Merchandise Sales.

This situation gets even more complicated because Stephanie needs to budget more granularly than Kyle. She reports revenue for textbook sales overall, but to plan properly, she must separately account for new and used textbook sales (see Figure 2).

Visualizing all these dynamics on paper is easy enough, so what makes managing everything so difficult? Well, many higher education institutions are limited by spreadsheets or legacy finance tools in how they can present dimensions such as the chart of accounts to the various users in the organization. These tools only provide a single chart of accounts across all entities and cannot accommodate different granularity needs for budgeting and planning at the entity level.

As a result, when Kyle looks at the chart of accounts, he sees a lengthy list of all revenue accounts for every institution entity. In the simple example above, when working within his legacy tool, he will see his Housing revenue accounts cluttered with the Bookstore accounts.

Stephanie will have the same crowded list of accounts in her system. But adding to her frustration, she will not be able to plan within the legacy system at the level the Bookstore requires. Instead, she will need a separate tool or, most typically, will resort to siloed spreadsheets to plan at the required lower level of granularity.

Of course, these variations become much more complex given all the possible variations in dimensionality across these two entities – not to mention across all the other entities within the institution. Those entities can include medical centers, different colleges, research facilities and more.

How do many Finance teams and entity managers work around these legacy limitations? Typically, a patchwork approach develops with separate systems and stand-alone spreadsheets to accommodate requirements. And just as typically, this patchwork approach leads to abundant headaches for the Finance team as they must now waste time wrangling disconnected data to provide comprehensive financial reporting, planning, budgeting and forecasting. The above situation is untenable. Risks, costs and performance issues abound when using extensive manual processes and patchwork connections between financial systems and spreadsheet silos. Further, the massive effort higher education Finance teams expend managing these processes robs Finance of the opportunity to focus on providing financial insight and institutional decision guidance.

Conquering Complexity for Higher Education Finance Teams

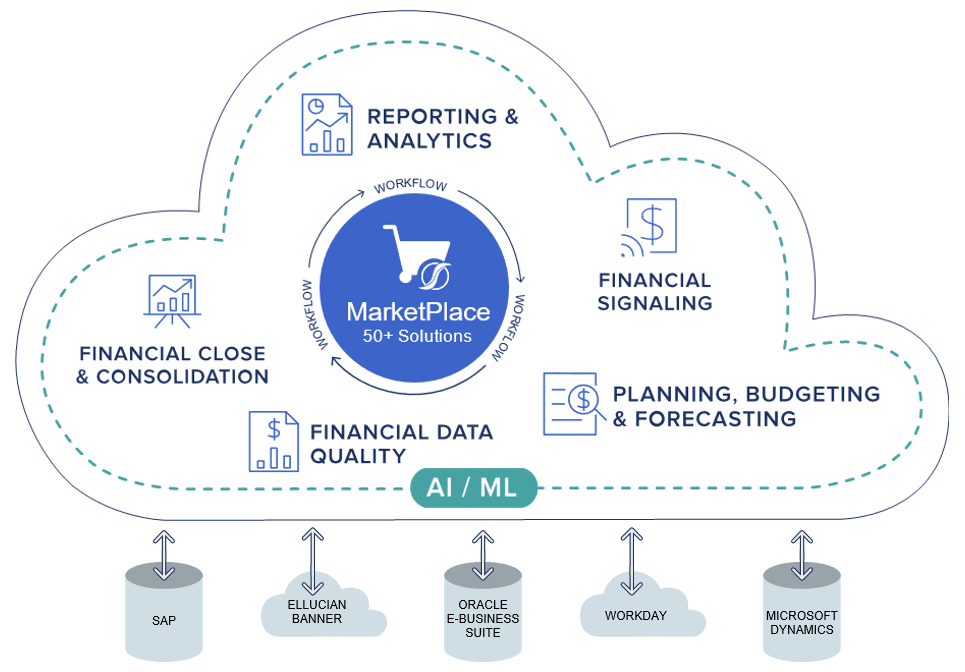

At OneStream, we understand the complexities, frustrations and struggles involved when trying to accurately manage disconnected information. And that understanding is exactly why we built the OneStream Intelligent Finance Platform (see Figure 3). The platform has the capability to gracefully support and enforce institution standards and controls, but also support the more detailed requirements of individual units. How is this possible?

Well, the secret sauce for helping Finance teams meet the demands of diverse units while supporting institutional standards is Extensible Dimensionality®. This unique capability enables a higher education institution to leverage the same dimension for differing requirements – without having to create separate connected Finance applications.

And it’s only possible with OneStream. So, with OneStream, Kyle will only see the Housing accounts and Stephanie only the Bookstore accounts. In addition, Stephanie can plan at the lower granular level of detail the Bookstore requires. To both Kyle and Stephanie, OneStream feels like it was set up just for them. And Sandeep and his team can see the complete picture without having to manage manual processes to combine the data from separate entities. As a unified solution, the OneStream platform empowers higher education Finance and Operations teams to collaborate by creating a single source of truth and user experience for planning, financial close & consolidation, and reporting and analytics.

Learn More

Extensible Dimensionality® is just one reason higher education Finance teams are turning to OneStream to conquer complexity in their financial processes. Click here to learn how one large state university modernized Finance with OneStream to reduce budget completion and reporting times.

Get Started With a Personal Demo