There has been an increasing buzz in the market in the past 12 months around the topic of environmental, social, and governance (ESG) reporting. What’s driving this and why should CFOs and Finance executives care about it? Read on to learn what ESG reporting is, what’s new with ESG reporting standards, why Finance teams should care, and the five benefits of aligning ESG reporting with financial reporting.

ESG Reporting is Rising in Prominence

ESG reporting (a.k.a. Sustainability Reporting) refers to the disclosure of data covering a company’s operations in three areas: environmental, social, and corporate governance. It provides a snapshot of the business’s impact in these three areas for investors, customers, and wider stakeholders. The value of ESG reporting is that it ensures organizations consider their impacts on sustainability issues and enables them to be transparent about the risks and opportunities they face.

For many years, ESG reporting was an annual, voluntary disclosure by public and private companies to their stakeholders about the impacts of their enterprise on the environment and society and how they are managing these programs. With an increasing amount of capital (now roughly $35 Trillion) flowing into “sustainable” mutual funds and ETFs, there is increasing stakeholder interest in ESG reporting and increasing demand for more detailed and frequent disclosures from public and private enterprises.

As a result, corporate sustainability and climate change efforts are fast transitioning from voluntary to mandatory in many countries, and even the US SEC is moving towards defining clear disclosure guidelines for public companies. Based on this inertia, there is a clear driver for companies to develop robust sustainability and ESG strategies with transparent reporting to stakeholders.

Converging ESG and Sustainability Reporting Standards

There are several competing standards for ESG/Sustainability reporting including the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Carbon Disclosure Project (CDP), and others. However, there is now a movement towards a global standard coming out of the recent COP27 conference in 2022.

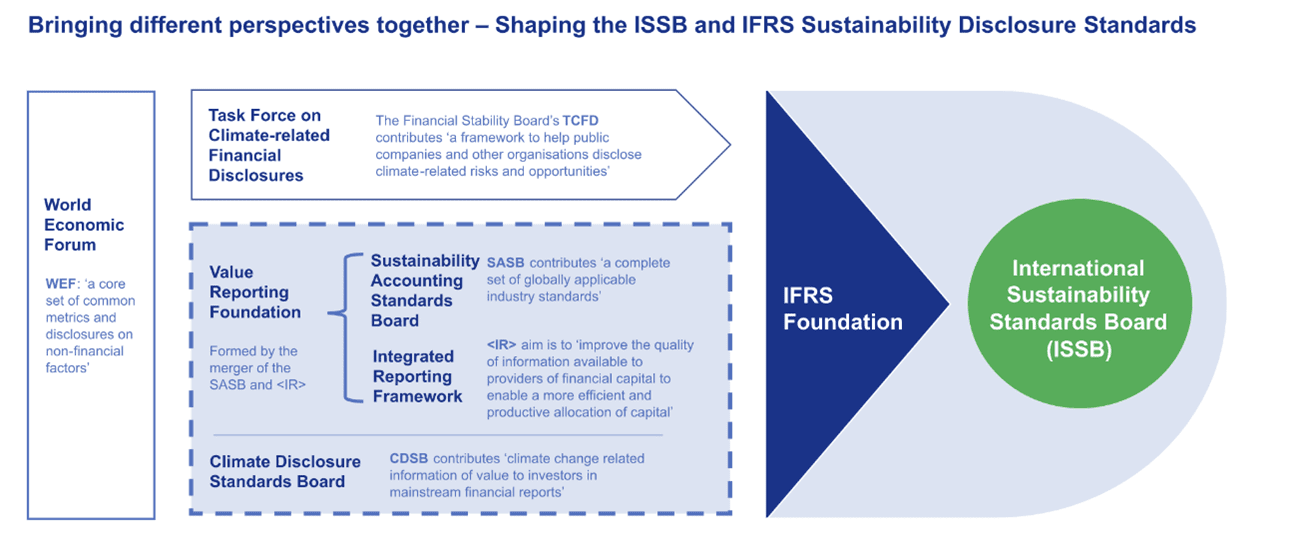

The IFRS Foundation, which oversees accounting standards in more than 140 nations, mostly in Europe and Asia, announced the creation of the International Sustainability Standards Board (ISSB) at COP26. The foundation will oversee the ISSB as it does the International Accounting Standards Board, formed two decades ago. It expects to release two reporting protocols on disclosures in the second half of 2022.

The main driver for the ISSB creation at COP26 (see figure 1) was the fact that current ESG data is lacking clear standards. The data provided is hard to audit and there is no alignment to the financial statements. This makes it extremely hard for investors and other stakeholders to determine the true risk exposure from the data provided.

CFOs and Finance Teams Paying Attention

While thousands of organizations around the world have already been reporting on ESG and sustainability, the data collection and reporting is often handled by Sustainability teams, Facilities, Human Resources, or other groups. But CFOs and Finance teams are now paying more attention. Why is this? Because as this type of reporting transitions from voluntary to mandatory it will require the same level of governance, control, accuracy, and auditability as financial reporting.

But there are other factors driving increasing CFO engagement in ESG reporting. According to a recent Accenture survey, “the ability of companies to raise capital will increasingly be tied to sustainability objectives.” Yet “deficiencies in the ability of companies to target, manage, measure and report sustainability performance still hamper the ability of businesses to effectively deliver on their sustainability commitments.”

According to the survey, fewer than half (47%) of large companies have identified how to gauge the sustainability of their operations despite rising pressure from investors, regulators, and lawmakers for disclosure on environmental, social, and governance (ESG) performance.

Here are some other key points from the survey:

- Meeting demands for sustainability data will be integral to company performance – ESG matters to the market, and therefore to business value.

- Companies with high ESG performance from 2013 until 2020 generated 2.6 times higher total shareholder return than medium performers.

- Making a CFO responsible for sustainability is essential for ensuring a company meets its ESG goals. Companies are much more likely to extensively embed ESG in core management processes when the CFO has accountability for ESG metrics.

- Yet only 26% of finance leaders said they had clear, reliable data to back up their ESG metrics.

ESG and Sustainability Reporting Technology

As with any new data collection or management process, spreadsheets and email are often the initial tool of choice due to their accessibility, ease of use, and low cost. But if control and accuracy are required, the spreadsheets and email approach to ESG reporting quickly suffer from the same shortcomings faced when these tools are used for financial reporting – they don’t deliver.

There are a growing number of purpose-built ESG/Sustainability reporting tools available in the market that can replace spreadsheets. And while these tools can provide value to the process, they create a data collection, consolidation, and reporting process that’s separate from the financial reporting process. And if ESG metrics need to be reported alongside financial metrics, wouldn’t it be better if this data was collected in the same system and processed as financial data?

The answer is yes, and that’s why a growing number of organizations are looking to extend the financial close, consolidation, and reporting capabilities of their corporate performance management (CPM) platforms to handle their ESG Reporting. This can be a viable approach for aligning ESG reporting with financial consolidation and reporting – provided the application has the required features to support the efficient collection, consolidation, and reporting of ESG metrics. These features should include the following:

- Collecting financial and non-financial data from a variety of internal systems.

- Support for forms-based data entry of ESG metrics

- Support for complex conversion calculations for ESG metrics

- Ability to support multiple ESG reporting frameworks and metrics across industries

- Consolidation of ESG metrics and textual commentary across multiple hierarchies

- Extensive data validations, controls, and audit trails

- Ability to capture ESG targets and goals for comparison against actual results

- Produce a variety of output types including standard reports, interactive dashboards, and Excel-based analysis of ESG metrics

Five Benefits of Aligning ESG Reporting with Financial Reporting

ESG and Sustainability reporting is rapidly moving from a voluntary to mandatory process. CFOs and Finance teams need to get engaged to ensure the accuracy and integrity of ESG and sustainability reporting to a variety of stakeholders. Aligning ESG reporting with the financial reporting process and system can yield several benefits to organizations. These benefits include the following:

- Eliminates duplicate data collection, consolidation, and reporting processes.

- Improve the accuracy and integrity of ESG and Sustainability Reporting.

- Align ESG and Sustainability metrics with financial results.

- Establish high-quality controls and audit trails over ESG and Sustainability metrics.

- Compare actual ESG and Sustainability metrics with goals and targets.

To learn more about the value of aligning ESG reporting with financial reporting, download our white paper titled, “The New CFO Imperative: Unifying ESG & Financial Reporting.”

Get Started With a Personal Demo