The collection of quality data is the most important aspect of Environmental, Social, and Governance (ESG) reporting. Why is that? Well, the number of data sources is typically far greater for such reporting than in even the financial reporting process. The difference stems from ESG reporting involving many different aspects, such as reporting on health & safety, fuel usage, property management, waste management, and more. How do organisations collect all this data? Despite technology improvements in large organisations over the years, most organisations have a multitude of operational systems from which to extract this data, which makes data collection for ESG quite challenging.

Why Data Collection and Quality Controls Matter

For ESG reporting to be fully effective, the data collection and quality controls must be built-in and use the same rigor as with financial data. The external image of an organisation is at stake here, leaving no room for second-rate capabilities.

If your role is to sign off on the ESG reporting of your organisation, then ensure you’ve fully aligned your financial and ESG reporting into a single, governed process. You’ll also want to ensure that the capability for collecting quality data is the best available. Ultimately, whatever process and system work for accurate financial reporting can and should also be applied to ESG reporting.

How ESG Reporting Became Mainstream

Several reporting compliance changes moved ESG significantly up the priority list for many leadership teams globally. Specifically, Europe enacted the 2021 Sustainable Finance Disclosure Regulation (SFDR), and the U.S. Securities and Exchange Commission (SEC) released its long-awaited proposals for climate disclosures for U.S. public companies. Why do these changes matter?

Simply put, organisations can no longer rely on volunteering the more positive aspects of their sustainable compliance or on publicising specific actions or donations. Today, an increasing level of socially and environmentally responsible investment activity involves assessing performance metrics beyond just the financial returns. Such assessments answer the demand for evidence of sustainable processes, practices, and management.

Fuelling that demand is climate change, which is forcing organisations and people to think and act differently, to be more interested in and concerned about how communities are impacted. Meanwhile, communities are focusing ever more heavily on what their neighbors and favourite brands are doing. These factors are collectively – and increasingly – pushing organisations towards ethical reporting standards.

Selecting the right system and capability is imperative to meeting those standards.

Why Built-in Data Quality Is Essential

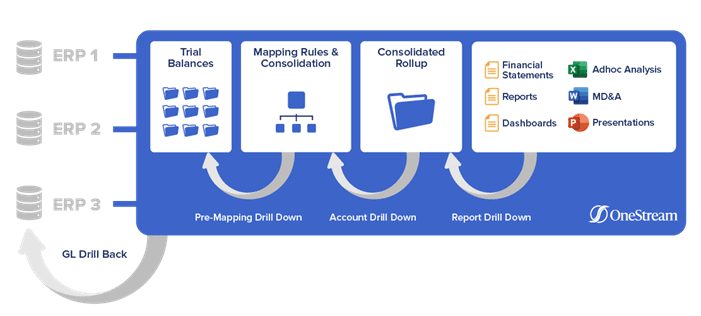

At its core, a fully integrated CPM software platform with built-in financial data quality (see Figure 1) is critical to organisations being able to drive effective transformation across Finance and Lines of Business. A key requirement is providing 100% visibility from reports to data sources – meaning all financial and operational data must be clearly visible and easily accessible.

Why is this visibility so important? When organisations collect data from multiple underlying systems and then complete multiple calculations and consolidation steps, full transparency provides uses and auditors the connections between the source data and the final reported data, including for all transformations, adjustments, and eliminations.

The solution should also include guided workflows to protect business users from complexity by guiding them uniquely through all data management, verification, analysis, certification, and locking processes. Are these workflows critical? Absolutely! The major challenge with ESG reporting is simply the number of data sources to collect from and the sheer volume of requests within an organisation for this kind of data. Using disparate systems, that collection can take many hours or days. Having a unified system with the capability to guide users easily through the tasks, however, will save time and money.

Most important is the system’s ability to validate and transform data to ensure complete and accurate ESG information. When so many different source systems are involved, along with multiple spreadsheets, the system must be able to fill in missing data fields, align analysis and ensure commonality in data before the information appears on reports. For example, if a typo occurs during a manual data entry, the system should flag any value that seems out of place given the parameters of the company.

Data quality matters for several key reasons, as shown by research. According to Gartner,[1] poor data quality costs organisations an average of $12.9 million annually. Those costs accumulate not only from the wasted resource time in financial and operational processes but also – and even more importantly – from missed revenue opportunities. Interested stakeholders closely review every fine detail an organisation publishes. Any errors or omissions will therefore be quickly spotted, and the consequences could be severe.

For instance, poor ESG metrics can make it difficult to attract valuable investment as liabilities are considered too high. One major concern for organisations today is attracting talent – which can also be affected by ESG metrics because people are becoming more selective about who they work for and with.

ESG reporting now, perhaps more than ever, has a significant impact on the profitability and bottom line of an organisation. And as the global standards converge into a clearer position, organisations must bring ESG reporting together in a unified way.

Why a Unified Approach Makes a Difference

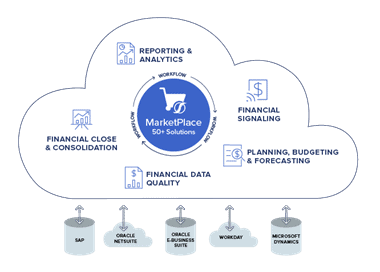

There is now a compelling argument to transition from a connected to a fully unified CPM platform for ESG reporting, financial close, consolidation, reporting, planning, and more. What’s the difference? With a unified CPM platform, all processes are handled within a single application and instance. Plus, data is loaded into one central database and immediately made available to all business processes, which means there are no manual data movements or reconciliations to perform.

Here are just some of the benefits that come from a unified platform:

- One software solution, one application for consolidation, planning, and ESG/financial reporting needs across an entire organisation with extensibility to handle future growth and change – one single controlling team, one single audit.

- Performance improvements thanks to control, consistency, and overall process visibility.

- Lower cost of ownership from replacing multiple software packages and integration points with one unified platform.

Many of the ESG reporting solutions in the market are focused on only a specific aspect of ESG, such as environmental, health, and safety (EH&S) compliance, but aren’t suited to the broader requirements of setting ESG goals and targets, tracking progress against targets and modeling the impact of ESG initiatives on future financial results.

How OneStream Delivers

OneStream’s unified, Intelligent Finance Platform (see Figure 2) with built-in reporting and analytics eliminates the complexity of fragmented ESG reporting tools. With a strong foundation in financial data quality, OneStream allows organisations to integrate and validate large volumes of non-financial data (e.g., ESG metrics and conversion factors) with validation from any number of sources. Confident decisions can then be based on accurate and trusted financial and operating results.

OneStream’s financial data quality management is not a module or separate product. Instead, the management is built into the core of the OneStream platform — providing strict controls to deliver the confidence and reliability needed to ensure quality data.

OneStream can quickly aggregate and consolidate ESG data submissions to provide company-wide results. With OneStream, ESG data is consolidated according to the same principles as financial data. Calculations and eliminations based on specific data values and fuel and energy consumption conversions can also be automated. Essentially, OneStream “future-proofs” CPM and ESG reporting to ensure compliance when new standards come along. How? OneStream allows for unlimited configurable dimensions and hierarchies – ensuring support for GRI, SASB, and other frameworks which may emerge as required.

By intelligently aligning detailed operational and financial data, OneStream’s flexible reporting and analysis capabilities (see Figure 3) eliminate the need for Finance teams to waste time manually copying and reconciling data and creating reports. In other words, OneStream unleashes Finance teams to focus on providing insights and analysis that better support key decisions.

Figure 3: OneStream ESG Analysis Dashboard

As a unified platform, OneStream can enable organisations to plan and forecast ESG initiatives with confidence and without compromise. ESG goals and objectives can be set, and users can track actuals vs. targets and provide variance analysis & commentary. What-if scenario modeling is also available to understand the ultimate impact of ESG policies on financial results and business value.

Effective ESG reporting ultimately allows investors to gauge an organisation’s intentions and actions – from how the organisation treats people to how board decisions are made or whether environmental factors are being prioritised. To achieve meaningful targets, companies must therefore have the right ESG solution to drive performance.

Learn More

To learn more, visit our ESG Webpage, download our solution brief or check out the other blog articles in our ESG series. Contact OneStream if your organisation is ready to align ESG reporting with financial reporting, and get ahead of upcoming disclosure mandates.

Get Started With a Personal Demo