Introduction

There is an evolution taking place in the Office of Finance, and many organizations are seeing the benefits. Many FP&A teams are taking steps to move from static back-office processes into more strategic, business partner-oriented roles using rolling forecasting, integrated planning, and driver-based planning processes.

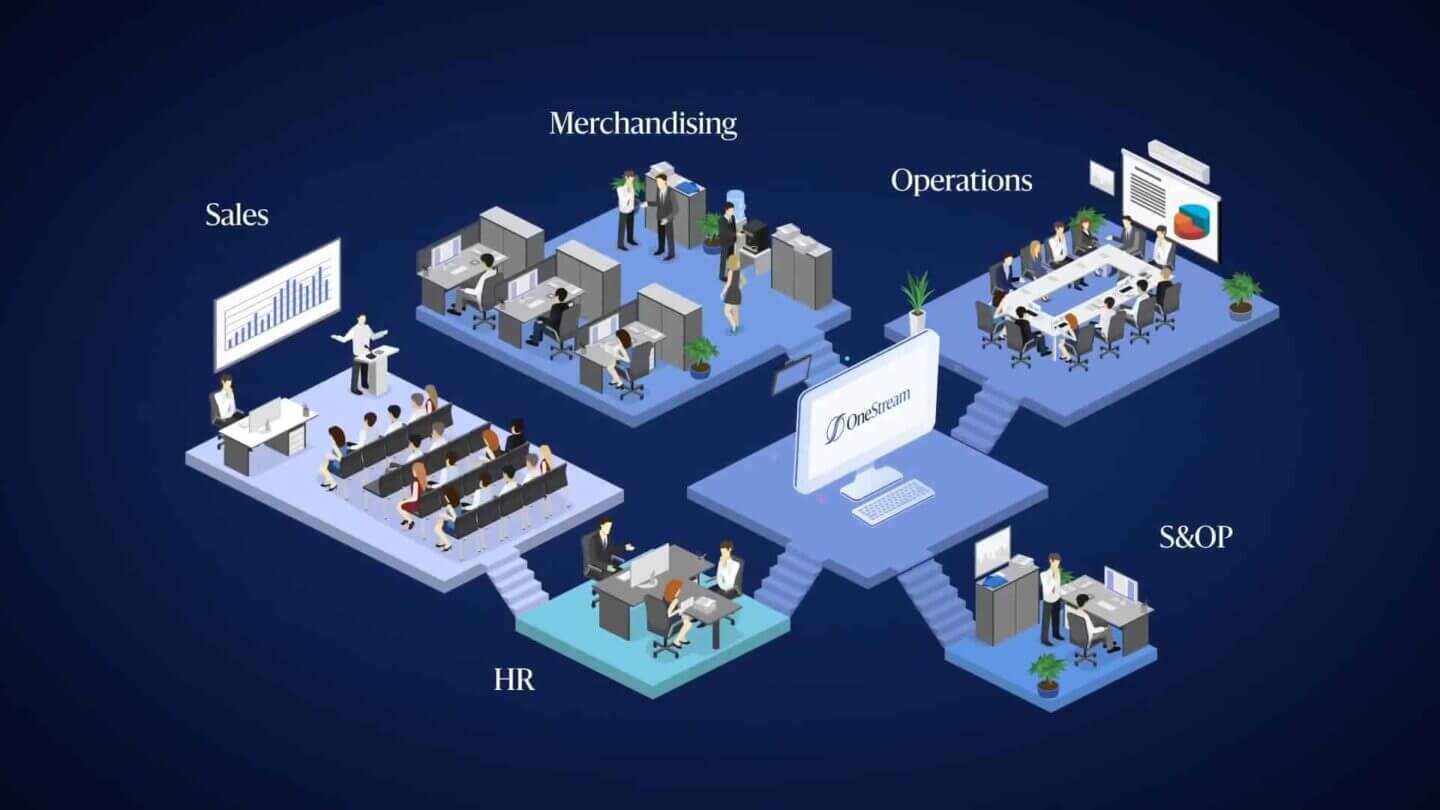

A great real-world example of FP&A’s shift into the business partner role is Gartner’s redefinition of planning from FP&A to xP&A or eXtended Planning & Analysis.

Gartner[1] defines xP&A “the evolution of planning, combining financial and operational planning on a single composable platform”. And they state that xP&A will “require organizations to plan in a more consistent, cross-functionally aligned, collaborative, agile and accurate manner as they seek to pivot quickly and gain competitive advantage.”

It “extends” traditional FP&A solutions focused solely on finance into other enterprise planning domains such as workforce, sales, operations, and marketing. xP&A solutions help organizations exploit the challenges faced when introducing new digital business models and navigating economic uncertainties. Said another way, xP&A enables organisations to “lead at speed.”

5 Key Factors for Effective xP&A

As FP&A leaders prepare to take advantage of xP&A to drive performance across the organisation, here are 5 key factors to consider as part of the evaluation process:

1. A Unified, Extensible Platform

At the core of an effective xP&A strategy is the alignment of granular operational plans with financial forecasting and performance through a unified, extensible platform and data model.

‘Connected’ Finance solutions with data scattered across fragmented files, systems and cubes cannot effectively unify planning. Such data is, by definition, “connected” not unified.

Planning processes must therefore be unified through a single, enterprise-wide platform that is pervasive across operational and financial functions. The platform must have the capability to support corporate standards and controls, with the flexibility for business units to report and plan at additional levels of detail such as divisions, business units, and departments – all through a single application.

2. Built-In Financial Data Quality

High-quality and accurate management reporting is critical to empowering Finance teams and their business partners to develop insights and guide key decisions that drive performance.

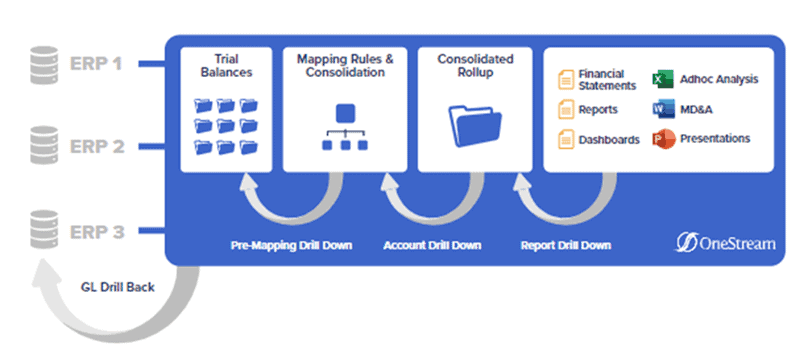

To support xP&A strategies, organizations require a platform with built-in capabilities to check, confirm, certify, and lock data for complete confidence in data quality and processes. Achieving such capabilities begins with effective data integration to ensure the timeliness and accuracy of financial and operational results.

Users must also, at the same time, be provided with the ability to drill back into source data (see figure 1) for transactional analyses that assess invoices, capital projects, product profitability, and workforce analysis.

Figure 1: Financial Data Quality Drill through and Drill Back

3. Built-In Financial Intelligence

Why is built-in financial intelligence important? Because having built-in financial intelligence speeds the implementation process reduces costs and ensures the accuracy of the results produced by the solution.

With some connected planning solutions, financial intelligence must be built during the implementation process. That process typically leads to more complexity and longer and more expensive implementations.

OneStream considers the following capabilities as critical examples of built-in financial intelligence for effective xP&A:

- Account Intelligence – The solution should understand financial account types (e. g., assets, liabilities, equity, revenue, expense, intercompany, and statistical or non-financial accounts).

- Time Intelligence – The solution must automatically accumulate data over time and support various time-based calculations.

- Currency Intelligence – The solution must have built-in currency translation capabilities. Such capabilities should include translation rules for constant currency using either actual or budgeted translation rates.

- Financial Consolidation & Reporting Intelligence – effective xP&A solutions enable organizations to acquire capabilities for both high-volume aggregation and full financial consolidation.

- Security & Audit Trails – Having the ability to control read/write/update access by users and groups is an essential control required in xP&A applications.

4. Financial Signaling

To truly lead at speed, Finance leaders must break organizational reliance on the month-end reporting cycle by accessing and leveraging the vast amount of daily and weekly operational insights across the organisation. Financial Signaling (see Figure 2) enables FP&A teams to leverage the financial intelligence at the core of the organizational monthly financial processes (e. g., hierarchies, dimensionality, and translations), and then blend it with higher velocity financial transactions and operational data from multiple sources.

Figure 2: Financial Signaling for Daily/Weekly Insights

With this capability, Finance teams and key business partners can begin to analyse the signals such as order pacing or controllable costs on a weekly or even daily basis to compare how these key metrics and KPIs are pacing vs. their monthly forecasts and run rates.

5. Auto Artificial Intelligence (AI)

No matter where an organization is in the Finance transformation journey, it’s critical to consider artificial intelligence (AI) as part of an effective xP&A strategy. Why? Well, like it or not, machine learning (ML) and other subsets of AI are here to stay as tools to help increase forecasting accuracy and enable continuous scenario modeling within the current environment of increasing complexity and pace of change.

AutoAI is a gamechanger that breaks down the traditional high barriers to entry of advanced analytics for Finance teams, enabling organizations to leverage internal and external data to create insights for decision-making.

AutoAI delivers these additional characteristics for Finance and Operations teams:

- Faster — The Power of Automation

- Easier — Programmatic Data Science Intuition

- Cheaper — Agile Data Science Teams

Learn More

As your FP&A team begins your xP&A journey, download our whitepaper to learn more about the key factors that are critical for effective xP&A.

Get Started With a Personal Demo