At its core, strategic planning involves creating a mid-range financial plan for an enterprise to help the business achieve strategic goals and understand the financial impact of those strategies. But before even starting the strategic planning process, an organization must set the goals and targets that will shape the strategic initiatives. Those targets and goals not only shape the strategies that will lead the organization to hit all those targets, but also serve as benchmarks – offering something to measure against as the strategic plan becomes operational. In short, strategic planning ultimately drives capital resource allocation, but the process starts with target setting.

Driving Capital Resource Allocation through Strategic Planning

Some of the most important decisions CFOs and Finance teams make focus on how to allocate limited capital resources. But what’s the best way to do that? To start, Finance can generate a 3- to 5-year strategic plan to help make those decisions. Such planning should not only be integrated with the P&Ls, balance sheets, and cash flow statements, but also clearly model the business as it exists today with possible strategies layered over top. These strategic plans then determine how capital planning can support strategic initiatives across an enterprise in a manner that best supports the mid-range goals the organization intends to prioritize.

Potential strategies that can be modeled in a strategic plan include acquisitions and divestitures; debt issuance, share buybacks; projects for IT, capex and marketing; and more (figure 1). Strategic planning must allow for agile scenario analysis as well. Such analysis allows Finance to quickly model, evaluate and, if necessary, pivot to alternate scenarios while strategic planning.

Before the strategic planning process can take place, then, Finance must set and understand the mid-term organizational goals and targets. Strategic planning fits into the existing budgeting, planning and forecasting process by driving the budget. After all, the financial impact of the important strategic initiatives – which impacts both the budget and forecasts – has been modeled and determined during the strategic planning process.

But how can Finance pick which strategies will ultimately steer the direction of the organization? The answer is simply: by determining the targets and goals an organization wishes to focus on, Finance can model and implement strategic initiatives that support those goals, based on which initiatives will (likely) yield the best results.

Determining Organizational Goals and Targets Shapes Strategic Plans

Before determining a mid-range strategic direction, an organization must first identify the it’s goals and targets the strategies will address. Below are some example organizational goals and targets that might shape an enterprise’s strategic direction, broken down into three types of objectives.

- Financial objectives allow the organization to focus capital in the areas that will drive financial growth by analyzing revenue trends, evaluating spending and decreasing costs for example.

- Increase revenue: An organization can increase revenue by modeling price changes, adding new products or services, increasing sales efforts, or reducing manufacturing costs. These potential strategies can be modeled for their impact on revenue ahead of decision-making.

- Maintain profitability:An organization can analyze profitability to maintain an edge, whether by eliminating nonessential processes, decreasing waste, or improving vendor negotiations for better pricing on raw materials and resources to ensure profitability.

- Internal objectives help an organization determine which processes will help drive innovation, customer relations and operational excellence.

- Grow sales for new products: An organization can model potential strategies for growing market share for new products by analyzing and evaluating a new strategic marketing direction and campaigns.

- Streamline core business processes: An organization can evaluate scenarios for streamlining core business processes by assessing how to increase cost-efficiency by streamlining software, improve productivity and communication with better management systems, and ultimately improve time management and minimize risk.

- Customer objectives ensure an organization can develop and retain customer relationships by offering competitive pricing, maintaining product value to cost, and evaluating potential new product offerings and strategies.

- Increase market share: Strategic models can generate scenarios for increasing market share by looking at opportunities for innovation, price-lowering strategies, advertising initiatives and even acquisitions.

- Expand product offerings: The impact of adding a new product line or diversifying an existing product line can be modeled from a financial perspective to understand how change can impact product offerings.

Ultimately, understanding what goals and targets an organization wants to prioritize in the mid-term can help determine which strategic initiatives should be focused on. And that drives the strategic scenario modeling that feeds the eventual budget.

But doing all that also depends on deploying the right tech.

Enabling Effective Strategic Planning with Good Technology

If an organization is determining goals and targets but cannot create a useful strategic plan, the whole effort falls flat. The process can also get too bogged down with painful, manual processes that rely heavily on manual calculations and disparate spreadsheets. As a result, the value in the process diminishes.

But it doesn’t have to be that way. Technical enablers can help drive a better strategic planning process in the following ways:

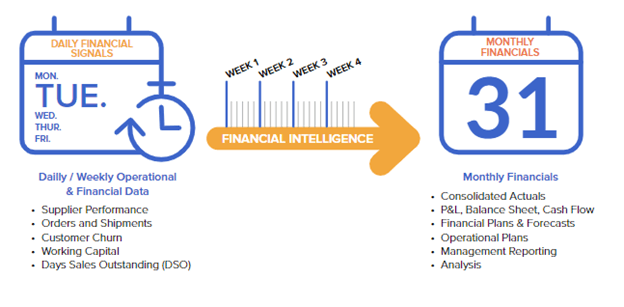

- Utilizing a solution with financial signaling: By leveraging a solution that has built-in financial signaling, Finance can create agility in the strategic planning process by surfacing daily and weekly trends ahead of month-end to drive strategic initiatives (see figure 2). This includes but is not limited to signals on sales volumes, supplier analytics, working capital, etc.

- Leverage a solution with built-in self-service reporting and analytics: By leveraging a solution that allows for visualizing and sharing the results of strategic scenario analysis, Finance can quickly and easily disseminate the analysis and results with key business partners and stakeholders to help spur collaboration and drive performance.

Good strategic planning may start with target setting. But the planning is kept alive with good technology and processes that support an agile, repeatable process that ultimately drives business value and alignment with business partners and key stakeholders within the organization.

Conclusion

Finance can drive strategic growth and initiatives across an organization by first determining the goals and targets the organization hopes to achieve. Strategic planning is there critical to help prioritize the key initiatives required to achieve those targets. While Strategic Planning processes must start with good target-setting, best-in-class Finance teams rely on technology that unifies planning targets across enterprise scenario planning and reporting processes.

To learn more about how to best implement a strategic planning process, check out our solution brief on Conquering Complexity in Strategic Planning.

Get Started With a Personal Demo