Finance Transformation has been the mantra for CFOs and financial executives for many years. The goal is to transform Finance from focusing most of its time on back-office processing and scorekeeping – to value-added analysis, forecasting and being a better business partner to the organization. The benefit? Gaining better alignment between Finance and Operations usually leads to improved overall corporate performance management.

Roadblocks to Finance Transformation

Making this shift requires Finance to gain efficiencies in both transactional and management processes, such as financial consolidation, account reconciliations, management and financial reporting, planning, forecasting and other processes. Upgrades to modern ERP, CRM and HCM systems have helped many organizations improve their transactional processes. However, many are hindered in gaining efficiencies in their management processes due to reliance on legacy corporate performance management (CPM) applications.

Issues with Legacy CPM Applications

Legacy CPM applications, or CPM 1.0 applications – such as Oracle Hyperion, SAP EPM and IBM Cognos –are very fragmented in nature. These product suites include many different standalone applications and tools for processes such as financial consolidation, budgeting, planning, forecasting, financial and management reporting, and account reconciliations. Customers must manually move data from transactional systems into each of the individual CPM applications and must also manually move data between the applications, i.e., to compare budget vs. actual financial results.

CPM 1.0 applications also have multiple points of maintenance when it comes to meta data, security, maintaining business rules and other functions. Due to their fragmented nature, CPM 1.0 applications are typically very costly to upgrade, too. For customers who have deployed multiple CPM applications, upgrading to even a minor point release can take several months, tying up internal staff, and often requires the services of external consultants.

CPM 1.0 applications are typically deployed in the organization’s on-premise data center, requiring some level of dedicated IT support, or may be hosted by a 3rd party with some managed services to maintain the applications. While most CPM 1.0 vendors are now offering cloud-based versions of these applications, the cloud-based solutions are also fragmented.

So while the burden of setting up infrastructure and installing the software is removed, configuring, managing and maintaining cloud-based versions of CPM 1.0 applications are still time-consuming and costly endeavors. And many of the CPM 1.0 solutions that are available in the cloud don’t provide all the functionality offered by their on-premise counterparts.

CPM 1.0 applications often replace spreadsheets and manual processes, only to be insufficient in terms of being a complete solution. Organizations that deploy these products typically must still continue to leverage spreadsheets to fill gaps in the product line or to address the needs of departmental users, who require more detailed planning, reporting and analysis.

The bottom line is that organizations leveraging CPM 1.0 applications are not fully able to achieve Finance Transformation. Why? Because Finance teams are spending too much time moving data into and between applications, and administering multiple software products. That means they cannot focus on value-added analysis of financial and operating results and improving decision-making across the enterprise.

CPM 2.0 Solutions and Finance Transformation

CPM 2.0 applications are designed to address the same business problems as CPM 1.0, but with an architectural approach that addresses many of the pitfalls of CPM 1.0 solutions – enabling true Finance Transformation. This more modern architectural approach should include the following capabilities:

- A unified application supporting multiple CPM processes

- On-premise or cloud deployment

- Integrated analytics that support both corporate and BU requirements

- Easy extensibility to address specific requirements

CPM 2.0 applications also provide many benefits to customers:

- Reduced costs of ownership

- Streamlined reporting and planning processes

- Improved accuracy of financial results, plans and forecasts

Moreover, with CPM 2.0 applications, Finance Transformation is moved forward by enabling teams to shift more time to value-added analysis, partnering with lines of business, and improving alignment and decision-making across the enterprise.

OneStream XF is SmartCPM

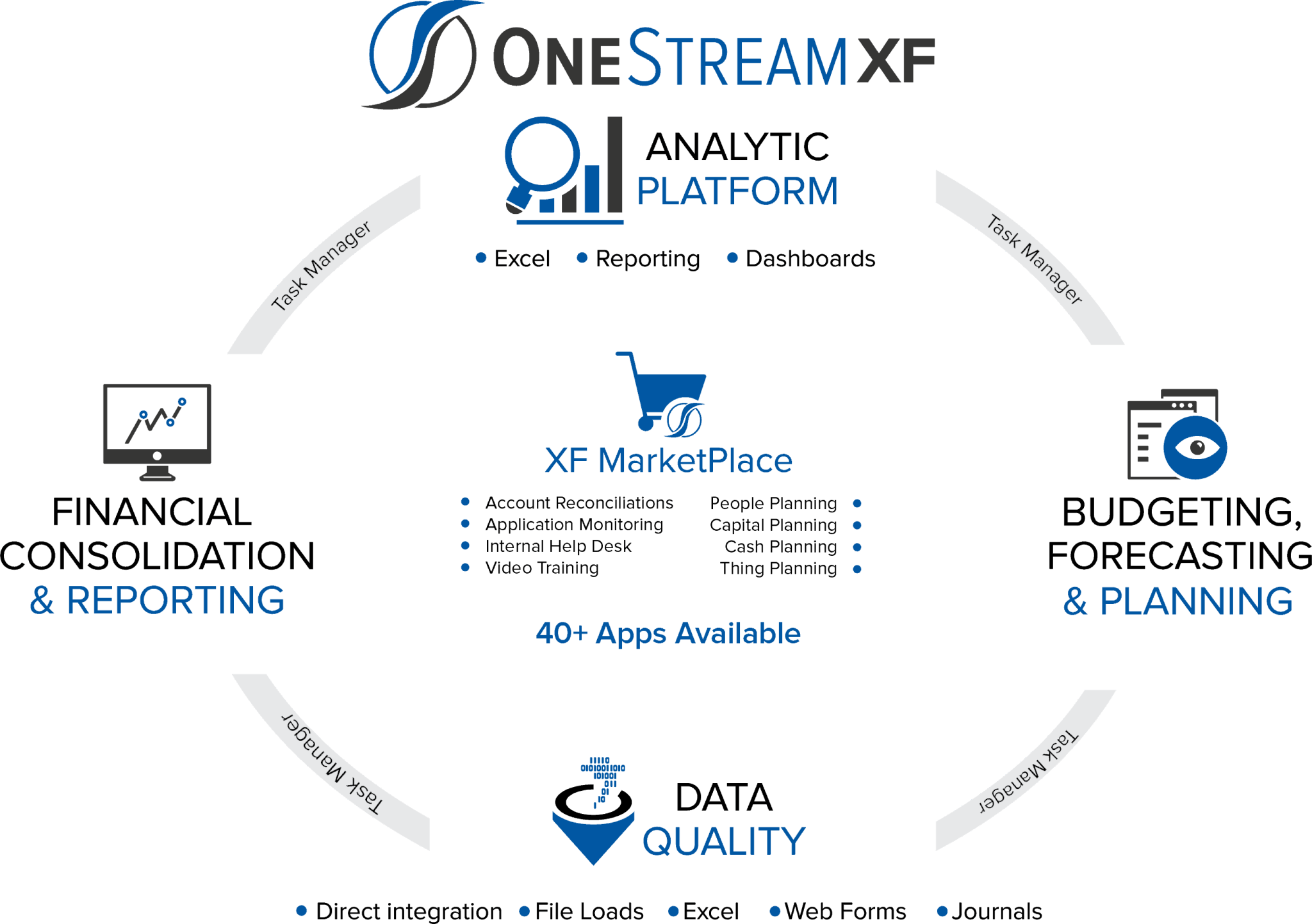

OneStream Software provides a revolutionary CPM 2.0 solution, the OneStream XF SmartCPMTM platform (XF stands for Extensible Finance). OneStream XF unifies and simplifies financial consolidation, planning, reporting, analytics and financial data quality for sophisticated organizations.

Deployed via the cloud or on-premise, OneStream is the first and only solution that delivers corporate standards and controls, with the flexibility for business units to report and plan at additional levels of detail without impacting corporate standards – all through a single application. We call this unique capability Extensible DimensionalityTM.

The hallmark of a SmartCPM platform is the capability of having multiple solutions for actuals, budgets, forecasts, plans, reconciliations, profitability analysis and more – all living together in a single application. Each solution benefits from leveraging all that the platform offers. OneStream XF eliminates risky integrations, validations, and reconciliations between multiple products, applications and modules.

Another unique capability of OneStream is the XF MarketPlace. The OneStream XF MarketPlace features downloadable solutions that allow customers to easily extend the value of their CPM platform to meet the changing needs of Finance and Operations. Examples of OneStream XF MarketPlace solutions that are already available and in use by customers include People Planning, CapEx Planning, Cash Planning, Account Reconciliations, Sales Planning and many others.

SmartCPM = Smart Customers

Organizations that have adopted the OneStream XF SmartCPM platform are already seeing the benefits described above. Here’s what a few of them had to say:

“With AFL’s rapid growth, we recognized the need for a CPM solution that could effectively handle our complex environment while also offering us the ability to adapt to changes,” said Pam Brady, Global Financial Business Analyst at AFL. “The consolidation process that took hours in our previous system now takes only minutes with OneStream XF. In addition, OneStream offers full budgeting and forecasting capabilities, along with superior cash flow reporting and a solution for account reconciliations that replaced our previous account reconciliation solution. The Guided Workflows provide simple end-user steps that allow us to focus on results instead of mechanics.”

“OneStream in the cloud has been incredibly adaptable,” said Don Bleasdell, VP of Finance at TEAM Industrial Services. “We have people around the world accessing the system, and it’s always available and always at peak performance. In addition, OneStream XF Cloud has eliminated the need for IT to maintain infrastructure and databases, which saves time and money.”

“The OneStream XF platform allowed us to deliver global financial consolidation, management reporting, guided workflows and a robust planning solution all in one product and one application,” said Lori Strangberg, Corporate Controller at Johnson Outdoors. “The modern platform gives us the ability to adapt more quickly to business changes and deliver more value to the business. Business unit controllers that never touched Hyperion Enterprise are now seeing the value of the additional details and reporting capabilities of our unified OneStream XF solution.”

To learn more, visit www.onestream.com to check out these and other customer success stories.

Get Started With a Personal Demo