Cash Flow Reporting – The Power of a Flow Dimension in Financial Reporting

There was a time when all cash flow reports were done apart from the trial balance in a tool like Excel. The reasons were, among others, that most consolidation systems could not calculate currency translation and intercompany eliminations correctly and easily. This made writing a cash flow report very difficult. But times and technologies have changed.

Automating Cash Flow Reporting

Back in 2002, the best financial consolidation systems in the market allowed for financial reporting each account by another dimension. One could look at all fixed asset accounts by the detail needed to populate the cash flow statement. Within 5 years it was uncommon for people implementing a corporate financial system to not consider cash flow as part of the project.

While there’s no application that can completely automate production of the cash flow statement, the pros of building cash flow into your consolidation and reporting application far outweigh the cons. The pros include; keeping your cash flow secure with the rest of your financials and reports, having the cash flow as part of any disaster recovery plan, and having the system perform validations on the cash flow data during sign off.

With OneStream XF, because of the Flow dimension that’s provided, there are four other very important reasons to include cash flow in your consolidation and reporting application. They are;

- Automate the change in balances, and pull values from the income statement, and roll forwards.

- Ensure consistency in translation rates and methodology.

- Accurately calculate the effect of exchange rates on the change in cash, and provide a proof of the calculation.

- Validate for the cash flow statement, like other financial statements and ensure the change in cash on the statement reconciles to the trial balance.

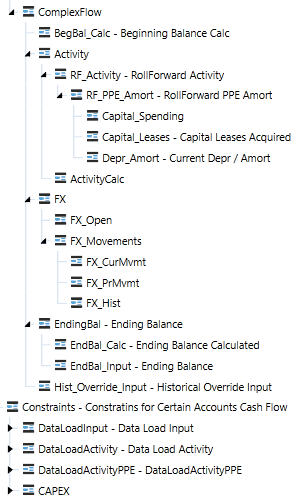

How this works in OneStream is that there is a dedicated Flow dimension for capturing all changes in the balance sheet. So, for every balance sheet account, I can see the beginning balance, the change in activity, foreign exchange (FX) and ending balance.

For the foreign exchange, I can break it down further to see the FX impact on the beginning balance (differed foreign exchange) and the FX impact on the change in the balance. The latter will help me reconcile the FX effect on the change in cash on the cash flow statement. And if you are concerned about how you might set this dimension up, don’t be! OneStream provides this with prebuilt calculations already set up as an easy download from the XF MarketPlace.

Sounds Simple, Right?

It sounds logical but most corporate performance management (CPM) software products don’t have this capability. And the ones that do have it have very rigid settings that limit its use. Which is fine if you only ever intend to use it exactly as they wrote the software.

For example, OneStream XF will allow you to enter the balance or the activity for each account. The system will calculate the beginning balances based on the prior balance sheet. The activity can then be mapped to the cash flow by rules, or using the account dimension hierarchy.

The Flow dimension’s flexibility allows the break-out of activity by type. For example, instead of one number for the total change you could break out this change into lines such as additions, disposals and transfers. While it is best to map that detail from a sub-ledger, if you need to, you could have people enter it directly if necessary. You have the options to fit the system to the limitations of the current process.

Once the account detail is broken out in the Flow dimension, the next step is to set up confirmation rules. OneStream’s workflow allows for all the checks one could want – to ensure the detail in the flow reconciles to the changes on the balance sheet, and is flowing to the statement of cash flows.

Learn More

OneStream really is the most advanced solution in the market for enterprise-class financial consolidations and cash flow reporting. If you are considering a similar solution to help your company, it would be smart to include OneStream in the discussion.

To learn more about automating cash flow reporting, check out this case study.

Peter Fugere is the Chief Solutions Architect Officer at OneStream Software where he develops and leads programs to help the team achieve highest possible customer satisfaction including; application design reviews, growing the services group, quality assurance check points, supporting partners and documenting best practices. He spends a majority of time working on strategic clients and developing solutions maximizing the value of our largest client’s investments in OneStream. Peter has spent 20 years delivering solutions for clients, including many Fortune 100 companies. He is well known for his successful book on delivering Corporate Performance Solutions. He holds a Bachelor of Arts in Economics from the University of Massachusetts, Amherst and a Master in Business Administration from Northeastern University, Boston Massachusetts.

Get Started With a Personal Demo