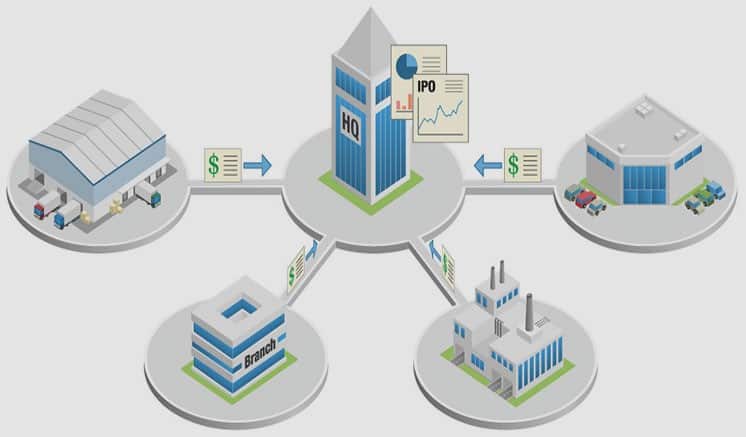

For accounting and finance professionals, financial consolidation is the accounting process of consolidating the financial results for multiple entities of an enterprise, into a parent company. There are several types of software tools available that can support financial consolidation and reporting. Organizations should assess their requirements and select the right tool for the job – one that will minimize manual work, while ensuring speed and accuracy, and minimize disruption to business operations, especially during ERP upgrades.

Accounting-Based Financial Consolidation

In the world of consolidation accounting – the goal is to combine the assets, liabilities, income and expenses of multiple subsidiaries or entities into a comprehensive view of the financial position of both the parent company and its subsidiaries. The consolidated balance sheet of the parent company should reflect the cumulative assets, liabilities and equity of all entities and the consolidated income statement should reflect the cumulative revenue and expenses of all entities, less any intercompany activity.

The creation of the consolidated balance sheet and income statement for stakeholders needs to be performed in accordance with the appropriate accounting and reporting guidelines – such as US GAAP, IFRS, or other global financial reporting guidelines. Under these guidelines, financial consolidation is more than just adding up or aggregating data. There are specific calculations and accounting adjustments that need to be made as the numbers are consolidated from the subsidiary level to the parent company level. This includes steps such as:

- Foreign currency translation – with accounting rules applied correctly for income statement vs. balance sheet accounts

- Elimination of intercompany transactions and balances at the first common parent in all alternate hierarchies

- Adjusting journal entries

- Accounting for partial ownership, joint ventures

There are also different methods of consolidation. These can vary depending on the controlling stake a parent organization has in a subsidiary – ranging from full consolidation to the equity method.

Reporting Consolidated Financial Results

Going hand-in-hand with financial consolidation is reporting. This can take many forms including financial statements, statutory reporting to various regulatory bodies, and management reporting. Financial statements are fairly standardized and include the balance sheet, income statement, statement of cash flows and other supporting schedules.

Statutory reporting can take many forms, depending on the regulator and jurisdiction. Examples include:

- 10-Q and 10-K filings for the US SEC

- Financial Statements under UK GAAP

- Financial Reporting in France Under IFRS and French GAAP

- FDIC Call Reporting for US Banks

- FERC Reporting for US Utilities

Management reporting is the most complex and variable type of reporting. It’s based on the need to cast and re-cast business results in alternative views to speed and enhance decision-making. This can include product line profit & loss (P&L) statements, sales trend reports, cost center manager expense reporting comparing actuals to budget or forecast. More sophisticated reporting includes constant currency rate reporting, and profitability by product line, customer segments and distribution channels. Management reporting can also be delivered in a variety of formats, including:

- Printed books of reports

- Electronic delivery of reports via PDF

- Management dashboards and scorecards

- Drag, drop and pivot Excel-based reporting and ad hoc analysis

- PowerPoint presentations and board books

Tools of the Trade

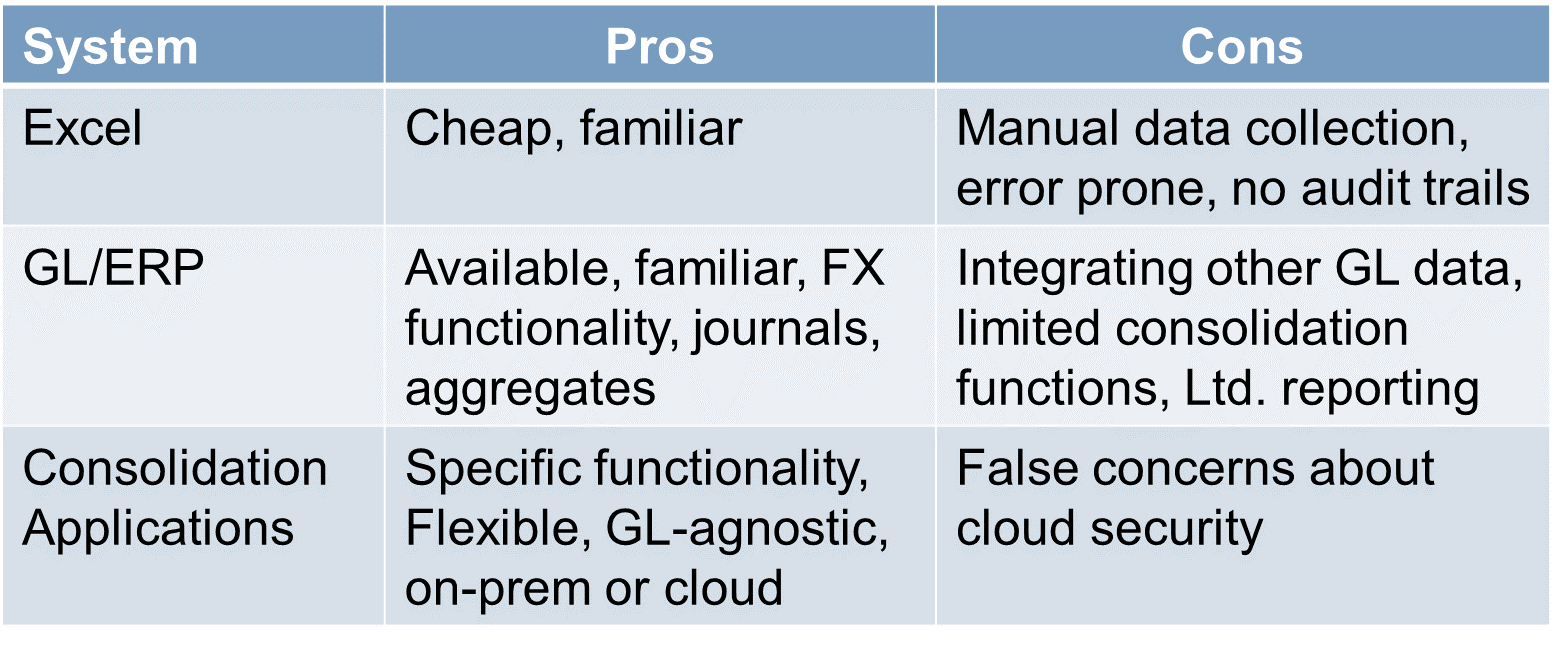

While accounting departments performed financial close, consolidation and reporting on a manual basis for many years, in today’s world there are several types of software tools used to support these processes.

- Spreadsheets – while spreadsheets are widely used by Finance and Accounting professionals, they weren’t designed to support a complex process, such as financial consolidation. Loading data from different systems is a manual process using spreadsheets. And with hundreds of tabs being consolidated in a workbook, the spreadsheet can become difficult to maintain and performance will degrade. Undetected errors can easily occur with the lack of adequate controls. And spreadsheets don’t provide adequate audit trails regarding changes to financial results.

- General Ledger System/ERP – the general ledger (GL) module of today’s enterprise resource planning (ERP) systems typically has many of the required features and works well if an organization has a single ERP system that is used across all subsidiaries or entities. But this approach can become cumbersome if there is a need to collect and consolidate financial results from multiple systems used by different locations or subsidiaries – especially if they have different charts of accounts. And GL’s don’t provide the flexibility to consolidate and report financial results across multiple hierarchies (e.g. legal, management, tax), or to support what-if analysis for potential mergers or acquisitions.

- Purpose-Built CPM Application – purpose-built financial consolidation applications found in today’s corporate performance management (CPM) software solutions are becoming the preferred approach for mid-sized to larger enterprises. They are designed to integrate data from multiple sources, have specific functionality built in to handle the complexities of financial consolidation, and typically have all the required security and audit trails. And they provide easy to use reporting tools that can automatically generate consolidated financial statements, as well as management reports, dashboards, board books, presentations and spreadsheet-based analysis in a fashion that is not conceivable in a transactional system.

While these systems have historically been deployed in on-premises data centers, they are now available as cloud or software as a service (SaaS) offerings, making them easier than ever to deploy and manage.

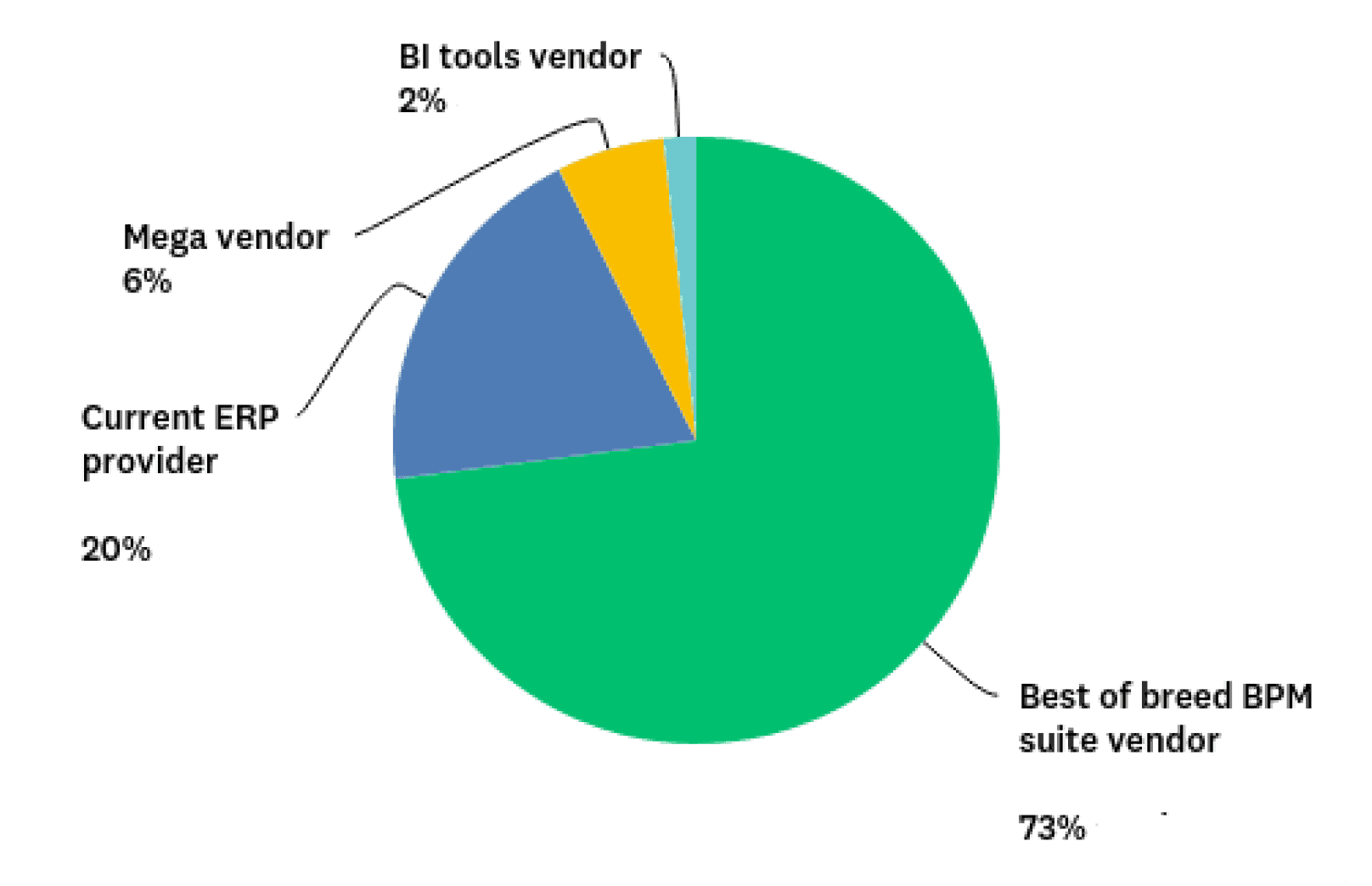

Purpose-built CPM software solutions are provided by a wide variety of vendors in the market. Most GL/ERP software vendors offer CPM applications, that were either built internally or acquired from another vendor. And these solutions are often designed to integrate directly with the vendor’s accounting/ERP system.

There are also many best-of-breed CPM software vendors in the market, who specialize specifically in budgeting, planning, financial consolidation, reporting, and analysis – and whose solutions can typically integrate financial and non-financial data from a wide variety of sources.

According to a 2018 survey by BPM Partners, 73% of respondents indicated they prefer to license CPM/BPM software from a best of breed vendor, while 20% indicated they prefer to license CPM software from their current ERP provider.

Source: BPM Partners 2018 Pulse Survey

Source: BPM Partners 2018 Pulse Survey

Which to Implement First – GL/ERP or CPM?

As enterprises grow and evolve in complexity they tend to outgrow their financial systems over time. This is often the case with accounting software, where an enterprise might start out using QuickBooks when they are quite small and simple. Then when they expand their operations upgrade to a more robust software package such as IntAcct or NetSuite designed to meet the needs of mid-sized enterprises. Then later they may upgrade to a full ERP system designed for larger, complex enterprises – such as those offered by Microsoft, SAP or Oracle.

This progression typically occurs in CPM as well, where a small enterprise may start out using Microsoft Excel for budgeting. Then as the enterprise grows it may implement a basic CPM software solution for budgeting, planning, and management reporting. Then as the organization grows and expands in complexity, with multiple subsidiaries transacting with each other, international operations with multiple currencies, joint ventures and partial ownership interests – they may upgrade to an enterprise-class CPM software solution with more robust financial consolidation, reporting, planning, forecasting and analysis capabilities.

One question that often comes up as enterprises are considering an upgrade of both their GL/ERP and CPM software solutions is – which should they upgrade first? This reminds me of the old chicken and the egg question. The answer is “it depends.”

If an enterprise already has both ERP and CPM software solutions in place, and if their ERP system is no longer meeting their needs and is hindering operations, there may be a good reason to focus on the ERP implementation first, then upgrade the CPM software after the ERP upgrade is complete.

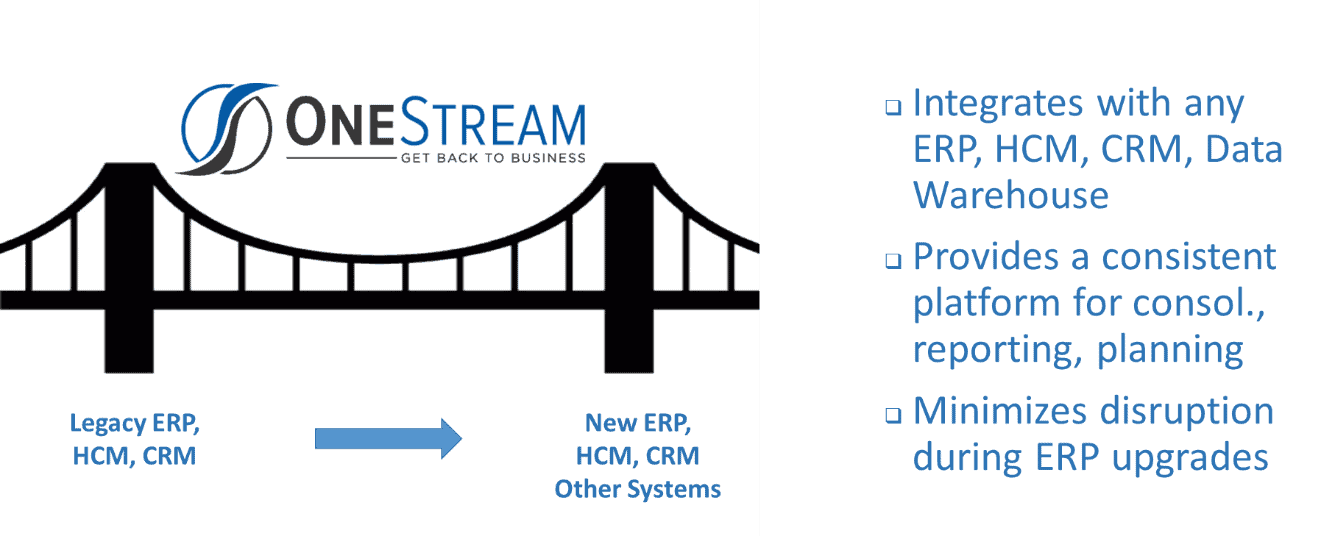

However, in a larger enterprise, an ERP upgrade or re-implementation can be a major project that takes 12 months or longer, cost millions, and can be very disruptive to the business. One strategy that organizations will often use to minimize the disruption is to upgrade or implement a new CPM solution before the ERP project.

In this case, the new CPM solution can serve as a “bridge to the future”, initially integrating data from the old ERP system, or multiple ERP, HCM, CRM and other systems. Then as the new ERP system is being implemented and older systems are being phased out – the CPM solution can integrate data from old and new systems – providing a consistent and continuous platform for financial consolidation, external reporting, planning, forecasting, management reporting and analysis.

This “bridging” approach not only minimizes disruption during the ERP transition, but it also provides a flexible environment for supporting future changes – such as integrating acquired companies, new systems, organizational changes, or addressing new regulatory and management reporting requirements.

Customer Example – Team Industrial Services

Team Industrial Services had grown to over $1B in revenue and over 7000 employees through numerous  acquisitions. However, a new acquisition the company was undertaking in 2016 was too big to integrate using the newly implemented MS Dynamics AX ERP and Excel spreadsheets. The company needed a more powerful and scalable financial consolidation and reporting solution.

acquisitions. However, a new acquisition the company was undertaking in 2016 was too big to integrate using the newly implemented MS Dynamics AX ERP and Excel spreadsheets. The company needed a more powerful and scalable financial consolidation and reporting solution.

After evaluating several alternatives, Team selected OneStream XF in March 2016, with the goal of going live with the new system by year-end and choosing to deploy the solution via the XF Cloud.

OneStream XF was configured with a direct connection to 4 major GL systems, with flat file integration being used to collect data from 20 other GLs. Over 20 workflows were defined in OneStream XF, including cash flow and administrator workflows. Input forms were built for all required lead schedules and roll-forward data.

After initially implementing OneStream for financial consolidation and reporting, Team Industrial extended the implementation to support budgeting, forecasting and cash flow reporting. In phase 3, Team downloaded and deployed the Account Reconciliations, People Planning, and Capital Planning solutions from the OneStream XF MarketPlace. These new solutions did not add any technical complexity to the architecture and live and work in the same application with financial reporting and planning.

Overall, the new OneStream XF solutions have saved Team Industrial Services time and money via automation of data collection, consolidation of actuals, budgets and forecasts, improved reporting, and drill-down capabilities. This has allowed the Finance organization to shift more of their time from data gathering to value-added analysis.

“OneStream in the cloud has been incredibly adaptable,” said Don Bleasdell, VP of Finance. “We have people around the world accessing the system and its always available and always at peak performance.”

Learn More

Purpose-built financial consolidation and reporting applications delivered as part of modern CPM platforms have become the preferred approach for sophisticated organizations with more complex requirements. In evaluating CPM platforms, organizations should consider their current requirements, as well as future requirements and ensure the platform they are selecting has the ability to evolve and grow as requirements expand. Organizations considering both an ERP and CPM upgrade, should consider the advantages of implementing a new CPM platform prior to an ERP upgrade, to provide a consistent reporting, planning and analysis environment, that minimizes disruption during the ERP upgrade.

To learn more, download OneStream’s Financial Consolidation and Reporting eBook.

Get Started With a Personal Demo