In a recent blog article titled “How Connected Is Your Planning?” John O’Rourke suggests finance leaders should “look under the hood” when evaluating technology options to support integrated business planning (IBP) or what’s often referred to as “connected planning.” Cloud-based planning applications can certainly improve collaboration and help organizations move beyond spreadsheets or legacy corporate performance management applications (CPM). But true enterprise-class IBP requires more. To understand why, let’s explore the business case for IBP.

Business leaders face unprecedented challenges – uncertainty from Brexit, US–China trade and fear of the next recession are impacting demand in ways not yet understood, just to name a few. In response, organizations are innovating beyond the traditional sales and operations planning (S&OP) process to align financial and operational goals with executing business strategy across the entire organization – including for finance, sales, operations, HR, marketing and other support groups.

Integrated Business Planning Defined

As modern finance leaders expand their roles, many leverage IBP as a management framework to set organizational strategy and optimize operational plans. IBP allows for aligning external factors like competition and economic changes with financial goals and detailed operational plans between sales, operations, marketing and HR. In doing so, IBP creates a continuous cycle to review and analyze financial results and compare actual results with detailed operating plans across the organization. That, in turn, enables the organization to understand risks/opportunities and develop action plans.

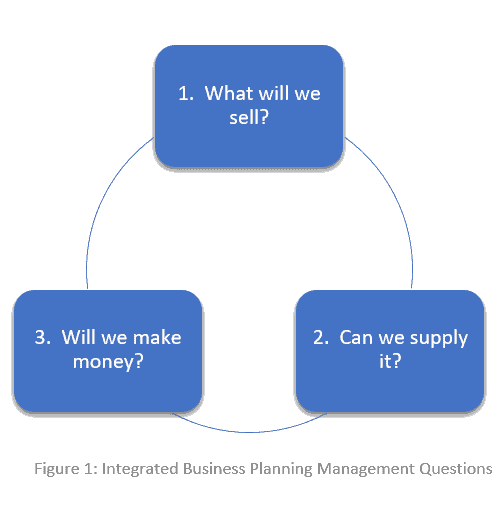

IBP addresses 3 critical management questions [1] (designed to align 1) how the company goes to market,  2) what plans are required to support the business and 3) how those plans translate to earnings and cash generation. More specifically, these questions are designed to address the following as illustrated in figure 1:

2) what plans are required to support the business and 3) how those plans translate to earnings and cash generation. More specifically, these questions are designed to address the following as illustrated in figure 1:

- What will we sell? What products or services, and to what customers? In what region? When, and how many? Is marketing required to assist?

- Can we supply it? What are the current capacity, staffing and logistical concerns, if any, and what changes are required to meet demand and sales plans?

- Will we make money? What is the impact on the price and profit margin vs. the budget and prior year? What is the impact on cash flow?

Today’s Business Planning Challenges

To thrive in today’s economy, sophisticated enterprises must execute across diverse lines of business – each of which requires unique go-to-market and operational plans across the globe. Without IBP, organizations face numerous challenges when create alignment between consolidated company or business unit financial goals and detailed operational plans. Some of these challenges include the following:

- Difficulty aligning key executives and stakeholders

- Lack of business agility

- Siloed decision-making

- Negative impact to business performance

Reality Check: Not-So-Connected Planning

As finance departments innovate their CPM processes to include IBP, sophisticated organizations are immediately confronted with their reliance on legacy applications and spreadsheets – which will not scale for enterprise-level business planning. To address these challenges, many organizations are turning to cloud-based planning applications to improve adoption and collaboration across organizations to support IBP.

Many cloud-based software vendors offer their version of “connected planning” for IBP. However, as Mr. O’Rourke points out, “Buyers need to look under the hood and understand what they are truly getting into.” For example, if a planning solution relies on a series of cubes or modules where data must be linked and moved to one another, that solution is NOT connected. Real IBP is unified and requires unique, advanced features to align financial goals with business plans across the enterprise.

All Planning Software Is NOT Equal

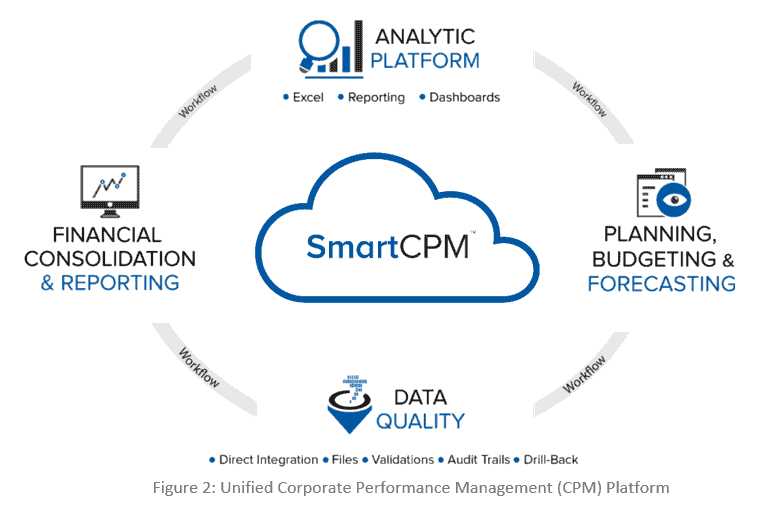

Real IBP requires a unified corporate performance management (CPM) platform (see figure 2) to simplify processes and align financial plans and results with detailed operational plans. By leveraging a unified platform approach like OneStream, users are not required to move data between cubes or modules. That means users can “get back to business” and shift more time to reviewing planning assumptions, modeling scenarios and creating proactive, real-time plans that dynamically unify financial goals and plans with detailed operational drivers across sales, operations and HR.

Further, an effective IBP platform requires a unique set of features to technically enable real-time collaboration between finance and operational leaders in order to optimize performance. Here are some of the key features:

Further, an effective IBP platform requires a unique set of features to technically enable real-time collaboration between finance and operational leaders in order to optimize performance. Here are some of the key features:

- Extensibility: An extensible platform for IBP enables sales, product management, marketing and operations to plan at a granular level, such as a business driver, while still adhering to a corporate standard for consolidated reporting

- Data Blending: Data blending aligns both cube and relational database technology to IBP processes by enabling users to develop operational plans that dynamically impact financial statements in real-time

- Financial Data Quality: Financial data quality adds depth to variance analysis and business insights by providing transparency and drill-through back to source systems and guided workflows to ensure accuracy when moving data between source systems

- Purpose-Built Applications for Sales, Operations and HR: Generate value for all IBP business partners with specialty applications to capture plans at the opportunity level (sales planning), by capital project (operations) and with detailed human capital data (HR)

- Flexible Reporting and Analysis: Once detailed plans are complete, finance and business leaders can build scenarios, conduct sensitivity analysis and leverage dashboards to align financial and business plans for IBP executive reviews

For those who are evaluating a move to IBP, the journey to build organizational support and evaluate potential software to unleash the potential of the business is worth the investment. In fact, according to Ventana research, [2] companies that leverage IBP typically forecast more accurately and have more effective planning processes.

Integrated Business Planning at Work

Dril-Quip

Dril-Quip is one of the world’s leading manufacturers of offshore drilling and production equipment primarily used in deepwater applications. With operations in the United States, Brazil and Singapore, Dril-Quip’s manufacturing is vertically integrated, meaning that certain products can be initially manufactured in one location and then transported to another location to be finished and/or sold.

After leveraging its unified CPM platform for financial consolidation, Dril-Quip extended its investment to meet all its financial reporting and planning requirements in one application – including an 18-month global rolling forecast, sales planning, people planning and capital reporting. Every quarter, departmental managers create driver-based detailed plans with full visibility into financial impact – ensuring business leaders can hold their teams accountable and build alignment to overall financial plans and company strategy.

The Takeaway

As Dril- Quip’s experience shows, IBP can be a powerful asset for sophisticated enterprises – providing opportunities to increase shareholder value and align financial goals with detailed operational plans across the organization. For modern CFOs and finance leaders, IBP also represents a natural opportunity to create a new foundation for collaboration with strategic business partners. But to be effective, IBP requires more than “connected planning” point solutions that require users to move data between disparate cubes and modules.

True IBP is real-time and – as a management framework – requires a unified platform to align finance with operations, leverage new technologies and increase business agility.

Learn More

To learn more about the benefits of IBP, download our whitepaper “Integrated Business Planning – Driving Business Action with Agility.” Want to learn even more? Don’t miss the companion whitepaper titled “Integrated Business Planning Gets Unified with OneStream.”

[2] Ventana Research “Business Planning Benchmark Research”

Get Started With a Personal Demo