Capital budgeting is a planning process corporate finance teams use to optimize investment opportunities across the organization. Also, capital budgeting determines the valuation for individual investments, such as buying new equipment, adding a new plant and building new products. When managed effectively, capital budgeting, also referred to as capital planning, gives finance leaders a direct opportunity to increase shareholder value. Yes, while the fund or don’t fund question can be simple – the process to evaluate where to invest, account for each investment and report results over time is anything but simple. And as a finance leader, your role is to do all three while keeping your stakeholders happy!

Just like in our own personal lives, sophisticated organizations have a choice to make – what is the best place to invest discretionary cash. A few general options are noted below:

- Pay off debt to reduce interest expenses and increase cash available for day to day operational needs

- Acquire a company to add depth to a product offering or eliminate competition

- Make Capital Investments to help grow the business or make productivity improvements. Over time, prudent capital investments generate value for the business through incremental revenue and profits

Given the importance of capital investments to support the business – large organizations allocate tens of millions of dollars every year to capital spending. For large, sophisticated enterprises, where capital investments are closely aligned to growth strategies – FP&A plays a major role in the capital budgeting process. They establish guidelines for how much the organization can spend on capital projects. FP&A also develops models, such as a discounted cash flow (DCF) and hurdle rates, that are used to evaluate capital investments. DCF’s help leaders quantify and value the future cash flows for a given project and hurdle rates set the minimum criteria for return on investment (ROI)

Additionally, FP&A works closely with business partners to translate project-level assumptions into a financial model. For example, how and when will the investment generate incremental revenue? Or how the investment will save time (and cost) on labor on the shop floor? Evaluating these risks and opportunities enable finance leaders to assess how likely a project is to generate a particular return or not.

Capital Budgeting Is More Than Project Approval

Once capital projects are approved and funded, it is essential to create visibility across the business. To illustrate, consider a capital project for a manufacturing line required to support a new product launch. In addition to the cost of new equipment, the business case can also include assumptions about new sales people, incremental revenue, labor and marketing expenses.

For business leaders, it is critical to track project status against the business-case assumptions and make  changes to spend or sales and labor plans where applicable. For CFOs and finance leaders, it is vital to understand the impact capital plans have on cash, financial performance and commitments to the board or investors.

changes to spend or sales and labor plans where applicable. For CFOs and finance leaders, it is vital to understand the impact capital plans have on cash, financial performance and commitments to the board or investors.

Unfortunately, the managing and reporting of capital is often challenging. Rather than leveraging a single application to gather financial and operational data, the traditional use of separate applications requires brute-force processes and spreadsheets to gather the basics. Such information can include the following:

- Project Spend: To gather data on the project spend, users typically work with a project planning system or their enterprise resource planning (ERP) application.

- Revenue and/or Expenses: Users must log into a financial module to gather revenue or expenses data. Often, users cannot directly associate P&L data to a specific capital project.

- Workforce Plans: Users will need to log into a separate HR system, gather information about detailed hiring plans, open positions and compensation

What Types of Tools Are Available for Capital Budgeting?

While many companies leverage purpose-built capital budgeting and planning applications found in corporate performance management (CPM) software to collaborate and simplify their financial close, budgeting, planning and reporting – many underinvest in their capital budgeting processes. Instead, companies often rely on a series of disparate Excel spreadsheets, or custom solutions to collect and review project assumptions, gather approvals, plan and report capital. And in doing so, much like when using spreadsheets or legacy systems for the financial close or planning, companies face several risk factors. Here are just a few of the risks:

- Too much time spent collecting and manipulating data across siloed applications

- Data entry and calculation errors can have a material impact on capital plans and reports

- Difficulty aligning capital projects to workforce plans and financial plans

One of the critical responsibilities of a business partner is to “step back” from day-to-day tasks and take a big-picture view of the business. With only a limited pool of dollars available for capital projects, finance leaders must understand which projects are on track or require attention. To accomplish this, leaders need the ability to gather project-level details, compare them vs. plans and quickly analyze against financial and operational goals.

Extending OneStream to Support Capital Budgeting

With a unified, extensible CPM platform, OneStream is ideal for detailed capital budgeting and planning. OneStream’s unified approach aligns detailed operational data with financial plans all within a single application – eliminating the need to access and move data between multiple systems. Users can also extend their investment through OneStream’s XF MarketPlace of purpose-built business and productivity solutions, such as Sales Planning, People Planning and Capital Planning. With powerful features such as Extensible Dimensionality™ and Relational Blending, finance and business leaders can create detailed operational plans and dynamically update financial plans in real-time.

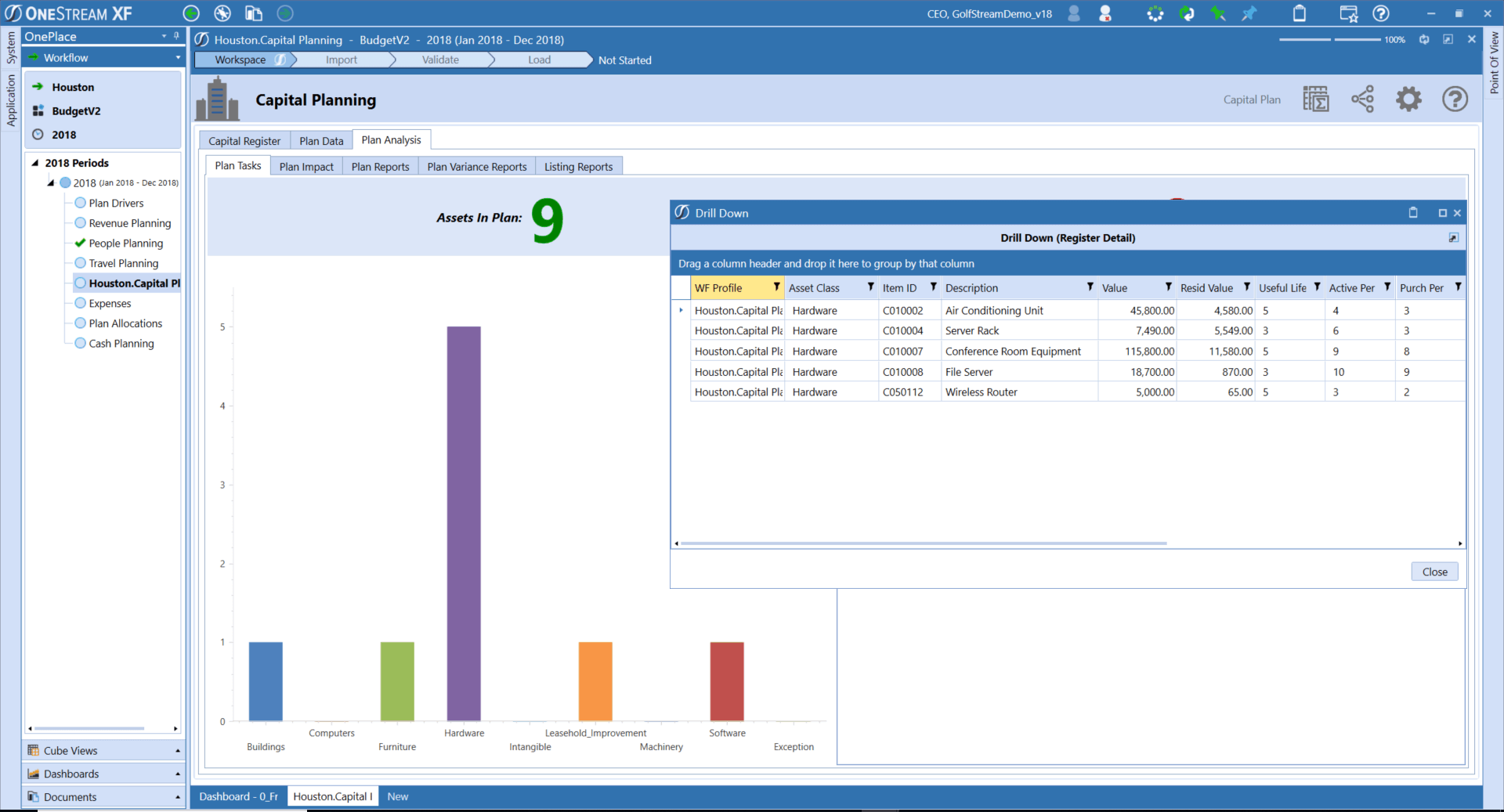

OneStream’s Capital Planning solution (see Figure 1) streamlines the planning of capital assets and their related expenses, including depreciation, maintenance and insurance. With alignment to detailed revenue, workforce and financial plans, users will experience several benefits:

- Gain insight into how capital decisions impact financial results

- Efficiently manage all capital planning with simple end-user workflows

- Leverage operational insight for more consistency and accuracy in plans

- Eliminate off-line manual spreadsheets, reduce errors and improve internal controls

Figure 1: OneStream Capital Planning Solution

Figure 1: OneStream Capital Planning Solution

For sophisticated global enterprises, OneStream enables finance and business leaders with the agility and scale to manage capital planning across multiple product lines, across lines of business and by geography.

Capital Budgeting in Action

Here are some examples of how OneStream customers have extended their investment in the platform to address their detailed capital budgeting and planning requirements.

Wesco Aircraft is one of the world’s largest distributors and providers of comprehensive supply chain management services to the global aerospace industry. The company offers one of the world’s broadest portfolios of aerospace products – including chemical, electrical and C-class hardware – with more than 570,000 active SKUs.

Wesco Aircraft is one of the world’s largest distributors and providers of comprehensive supply chain management services to the global aerospace industry. The company offers one of the world’s broadest portfolios of aerospace products – including chemical, electrical and C-class hardware – with more than 570,000 active SKUs.

Wesco leverages OneStream’s Capital Planning solution for annual planning for about 2,000 assets across APAC, America and EMEA to provide better controls, standardization, transparency and automation versus its previous spreadsheet-based process.

Based on different asset categories that are submitted into the Capital Planning application, Wesco leverages global drivers to calculate a standard (and controlled) useful life for depreciation, impacting the P&L and the balance sheet. Wesco also leverages various control lists to ensure the imported data contains all the required values, which helps streamline and add accuracy into the capital planning process. Centrally, the main benefit is that Wesco can ensure a standard depreciation schedule based on asset class and understand based on the type of inventory – such as construction in process (CIP) and finished goods – as assets move through the internal supply chain.

Dril-Quip, Inc. is one of the world’s leading manufacturers of offshore drilling and production equipment  that is well suited for use in deep-water applications. The company designs and manufactures subsea, surface and offshore rig equipment for use by oil and gas companies and drilling contractors in areas throughout the world. With operations around the globe, finance leaders at Dril-Quip drive accountability at a regional level while adhering to US GAAP standards for useful life.

that is well suited for use in deep-water applications. The company designs and manufactures subsea, surface and offshore rig equipment for use by oil and gas companies and drilling contractors in areas throughout the world. With operations around the globe, finance leaders at Dril-Quip drive accountability at a regional level while adhering to US GAAP standards for useful life.

Leveraging OneStream’s Capital Planning solution, Dril-Quip centralized all previous capital plans from disparate Excel spreadsheets into a centralized fixed asset register. To build controls for US GAAP useful life, Dril-Quip implemented a global driver to apply business logic as different assets are loaded into the register during planning. This application also performs the following processes:

- The business driver will consider the type of asset class that is input into the register and then apply standardized US GAAP useful life assumptions based on that input

- The useful life driver will then apply to depreciation calculations – impacting P&L and the balance sheet

Today, each department manages fixed asset capital planning on its own, with full visibility into all fully depreciated assets and all new assets. Centrally, Dril-Quip created a better control environment by standardizing how useful life is applied within the business, increasing transparency into capital planning by removing spreadsheets and driving accountability into the departments.

Learn More

Effective capital budgeting represents a critical opportunity for modern finance teams to get beyond producing the numbers and increase shareholder value. Managing the capital budgeting process via spreadsheets and email or custom solutions might work in a small enterprise, but in larger enterprises with multiple locations and divisions this approach requires excessive time and effort and introduces the risk of errors. Purpose-built capital planning applications are the preferred alternative for larger enterprises. OneStream provides a unified CPM platform and a marketplace of solutions, including Capital Planning that is purpose-built to address the complexities of capital planning in a larger enterprise. By leveraging OneStream, over 300 customers around the globe are aligning operational plans with financial goals and taking their strategic business partnerships to new levels within finance and beyond.

To learn more about how Dril-Quip is leveraging OneStream’s Capital Planning Solution and more – check out the recent webinar replay here.

Get Started With a Personal Demo