It’s time for CFOs to live in the moment. Trust me. We know the past. Like a fine swiss-watch keeping time, finance teams have religiously closed the books, reported to stakeholders and complied with regulatory requirements. This was the focus of the previous finance generation after all.

Modern finance is here. But what does that even mean? For sophisticated organizations, it means the finance transformation we’ve talked about for 20 years is largely complete. Want proof? Look no further than the language we use. We use terms like “strategic business partner” to describe the role of finance leaders. We talk about the use of rolling, driver-based forecasts vs. traditional annual budgets. And of course, we talk about enabling the organization with insights to help improve decision-making.

But while we have much to celebrate, as finance leaders, we also must look in the mirror and continue to evolve. Why? Because in the next 5 years, digital innovation and transformative technologies such as predictive analytics, robotic process automation (RPA) and machine learning are bearing down like a tsunami on the horizon. And if finance leaders want to stay ahead of the curve and our competitors, it’s time to think bigger.

Of course, we need to look into the future. But to do that effectively, we must start our assessment in the moment. We need to ask a vital question – how well are we performing the basic financial processes for financial consolidation, budgeting planning & forecasting and financial reporting?

You see, despite how far we’ve come, using the same tools to navigate the path forward simply won’t work. In fact, it’s nearly impossible. Especially if we want to attract or keep the best talent or have the capacity required to analyze the business and help set strategic direction.

The Numbers Don’t Lie: It’s Time for a Change

Don’t just take my word for it. Consider the research from EY, Accenture and the Modern Finance Forum based on their surveys with finance leaders. Check out some of the results below:

- 77% of finance leaders want to be more proactive and aligned in operations alongside business partners across the wider organization

- 73% [of finance leaders] would change organizations to be more involved in innovation

- 47% of survey respondents suggest their current function lacks the mix of capabilities needed to meet the demands of strategic priorities

What do the numbers tell you?

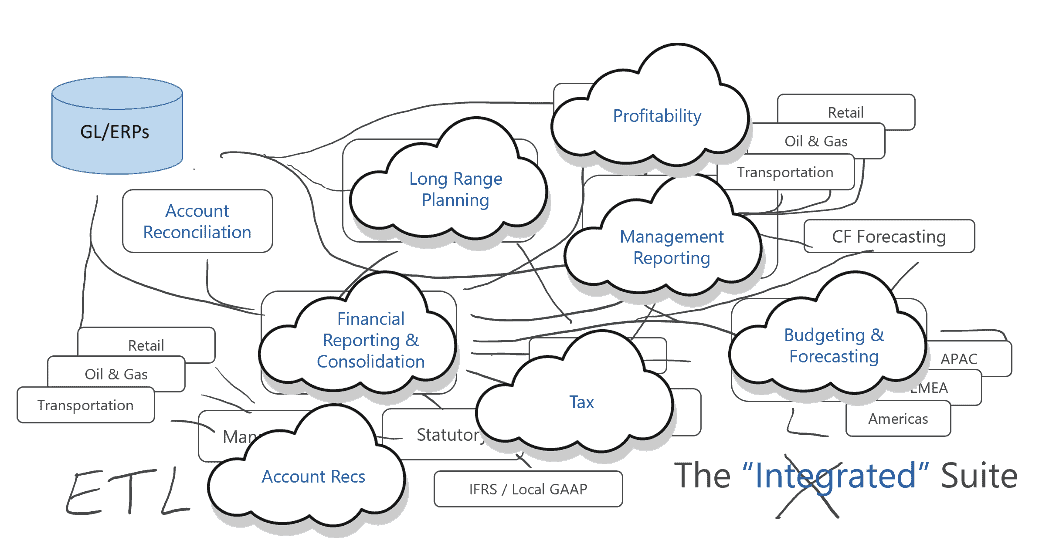

My read is that we’ve reached an inflection point (e.g., see EY Better Finance Podcast). Finance leaders have a desire to do more. Finance leaders want to work even closer with the business. However, those same people are crippled by the fragmented mess of legacy corporate performance management (CPM) 1.0 tools (see figure 1) used for budgeting, planning & forecasting, financial consolidation, financial and management reporting (e.g., the basics). You see, while these tools were the best of their day, they were not designed for modern finance.

Ask anybody who regularly gets “under the hood” about the brute-force efforts required to reconcile data or wait for data to work its way through these systems. Most likely, they spend an incomprehensible amount of time on low-value tasks that have nothing to do with managing a sophisticated business.

And finally, despite billions of dollars invested in CPM 1.0 tools (figure 1), according to an EY survey, about 50% of finance leaders don’t feel ready to meet the demands of strategic priorities. So, in short, finance leaders who want to do more – simply can’t do it and aren’t sure they’re ready for the future. Why? Because we’re often crippled by existing technology? Isn’t the goal of technology to help us after all?

Figure 1: CPM 1.0 Applications

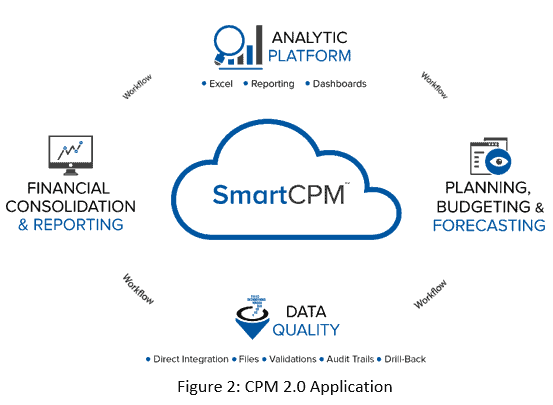

CPM 2.0: The Platform for Modern Finance Organizations

Modern finance leaders are adopting modern CPM technology as a platform for their organizations to  tackle today’s advanced business challenges. Designed to address the same budgeting planning, & forecasting, financial consolidation and financial reporting needs as legacy tools, CPM 2.0 platforms (see figure 2) address these requirements and more with a unified architecture and modern technical approach that addresses many of the challenges with CPM 1.0 solutions. This means that finance teams will have access to a broader range of capabilities that improve finance productivity and allow them to spend more time working with the line of business partners and to help guide decision-making across the enterprise.

tackle today’s advanced business challenges. Designed to address the same budgeting planning, & forecasting, financial consolidation and financial reporting needs as legacy tools, CPM 2.0 platforms (see figure 2) address these requirements and more with a unified architecture and modern technical approach that addresses many of the challenges with CPM 1.0 solutions. This means that finance teams will have access to a broader range of capabilities that improve finance productivity and allow them to spend more time working with the line of business partners and to help guide decision-making across the enterprise.

5 Steps to Unleashing Finance

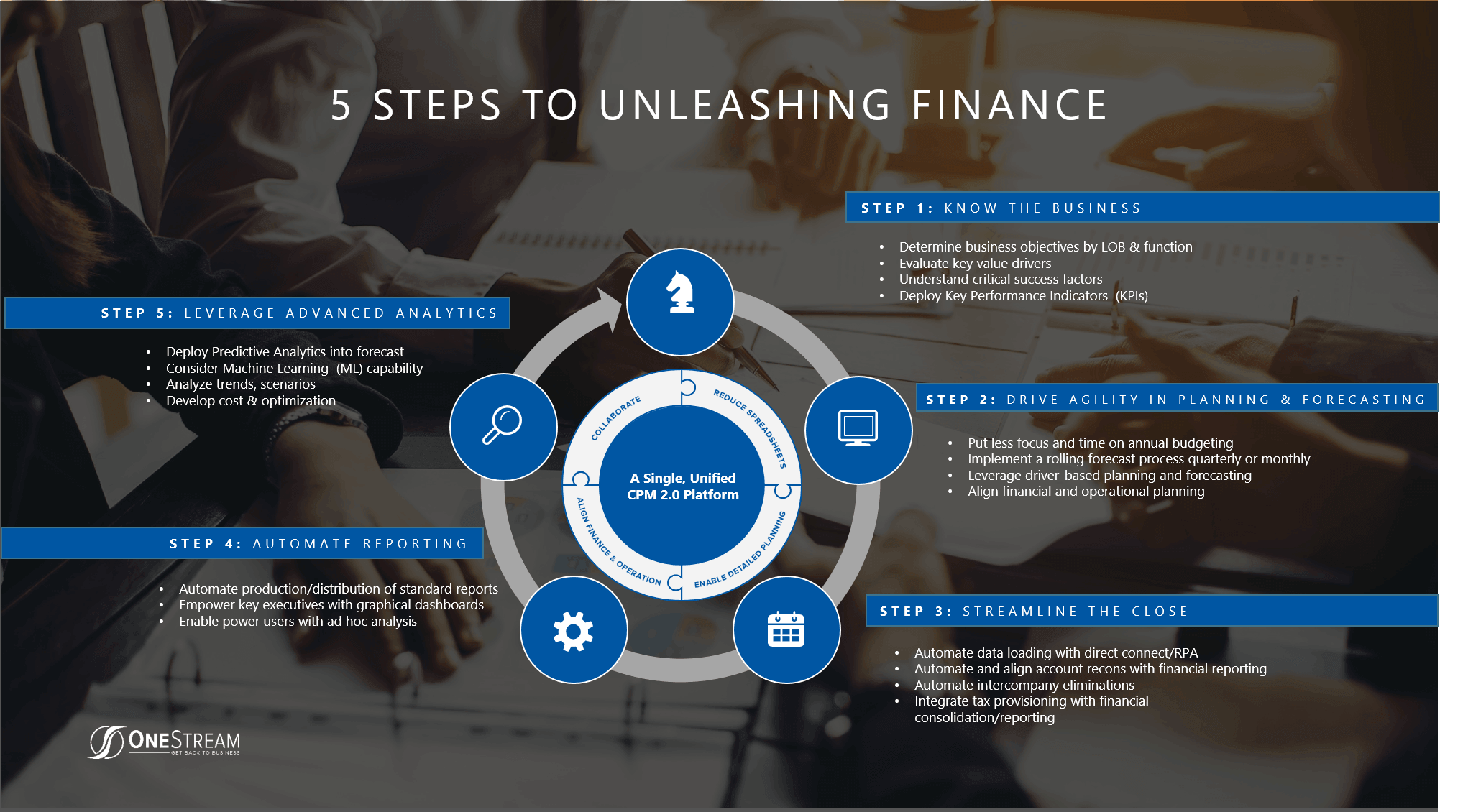

With a modernized CPM Software Solution, finance leaders are taking control of their own destinies and charting a new course for their digital finance futures. And by rationalizing the basics with enabling technology like OneStream, leaders can focus on how to unleash the true value of modern finance throughout their organizations.

To help support finance leaders throughout their journeys, we’ve identified 5 Steps organizations can take to Unleash the True Value of Finance (see figure 3). The 5 steps to unleashing finance include:

- Know the business – Gather feedback from business partners and understand their key success metrics and KPIs.

- Drive agility in planning & forecasting – Adopt dynamic forecasting processes that are less focused on a 1X event, such as the annual budget.

- Streamline the financial close – Simplify tasks with automation; eliminate manual data movement, errors and risk, provide complete audit trails and visibility.

- Automate reporting – Create self-service reporting for business partners, drive standardization and reduce risk.

- Leverage Advanced Analytics – Consider predictive analytics or scenario analysis to enhance the dialogue with business partners.

Figure 3: 5 Steps to Unleashing Finance

Figure 3: 5 Steps to Unleashing Finance

Over the coming weeks, we’ll be covering each of these steps in more detail in a series of blog posts. Regardless of where you are in your journey, our blog series is designed to share insights from the experience of OneStream’s team of industry experts. Of course, we recognize that every organization is unique – so please assess what’s most important to implement and when based on the specific needs of your business.

Over the coming weeks, we’ll take a deep dive into how sophisticated organizations are unleashing their finance teams. And with a dedicated blog post for each step, we look forward to sharing best practices, thought leadership and examples from OneStream’s 300+ successful customers around the globe.

Learn More

To learn more about how to unleash your finance team, download our whitepaper titled Finance Unleashed: Enabling Modern Finance with CPM 2.0 Platforms.

Get Started With a Personal Demo