Having an efficient financial close process is essential to producing timely results to internal and external stakeholders. And thanks to increasing use of technology, the financial close process continues to improve. According to the 2019 Office of Finance Benchmark research by Ventana Research, 46 percent of companies close their monthly books within four business days compared to 29 percent in their 2014 study. Despite the improvement, Ventana Research still concludes that most organizations continue to be laggards in adopting technology that measurably improves effectiveness.

Automation is a big factor in improving the efficiency of the financial close process. Why? Because automation of tedious and repetitive tasks speeds the process and frees up Finance staff to focus on more value-added activities.

Account reconciliations is a great example of a tedious and repetitive process that are a prime target for automation, especially in organizations that have hundreds to thousands of accounts to reconcile every month or quarter-end. Going hand-in-hand with account reconciliations is the process of “transaction matching,” another tedious process that can benefit from automation.

Challenges in Transaction Matching

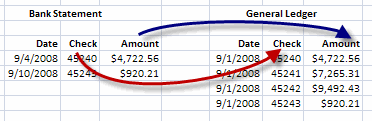

Transaction matching is the process of collecting and matching large volumes of transactions (from two or more sources), identifying and resolving differences in order to accurately finalize period-end balances and close the books. Common examples of transaction matching use cases include tasks like:

- Matching Bank Statements to General Ledger Cash Accounts

- Matching Intercompany Transactions at the Invoice Level

- Matching Purchase Orders to Goods Received and Accounts Payable

- Matching T&E Transactions to Expense Reporting

Due to the volume of transactions that must be matched across these and other use cases, transaction matching can be especially challenging for organizations that rely on Microsoft Excel and manual work to manage the process.

A big challenge is just extracting and converting the data so it can be matched, which can be very tedious and time-consuming. Manually matching transactions via Excel can also be very tedious and is highly prone to errors. As a result, the account reconciliations and overall financial close process can be delayed, and when unresolved items linger it can result in write-offs with negative impacts to the income statement.

Transaction Matching Solutions Improve Speed and Accuracy

Transaction matching software solutions address the weaknesses of manual, Excel-based matching processes through automation and rapid exception-handling. These solutions are designed to load transaction data from multiple sources for matching, automate the matching of large volumes of transactions, then identify and quickly resolving un-matched transactions.

Instead of waiting until month-end to load and match transactions, data can be imported weekly or daily as needed. Automatic matching of transactions is supported through a rules-driven approach that can include 1 to 1, 1 to many, many to 1 or many to many matchings. The entire matching process can be supported by comments and attachments, as well as workflow and management approvals.

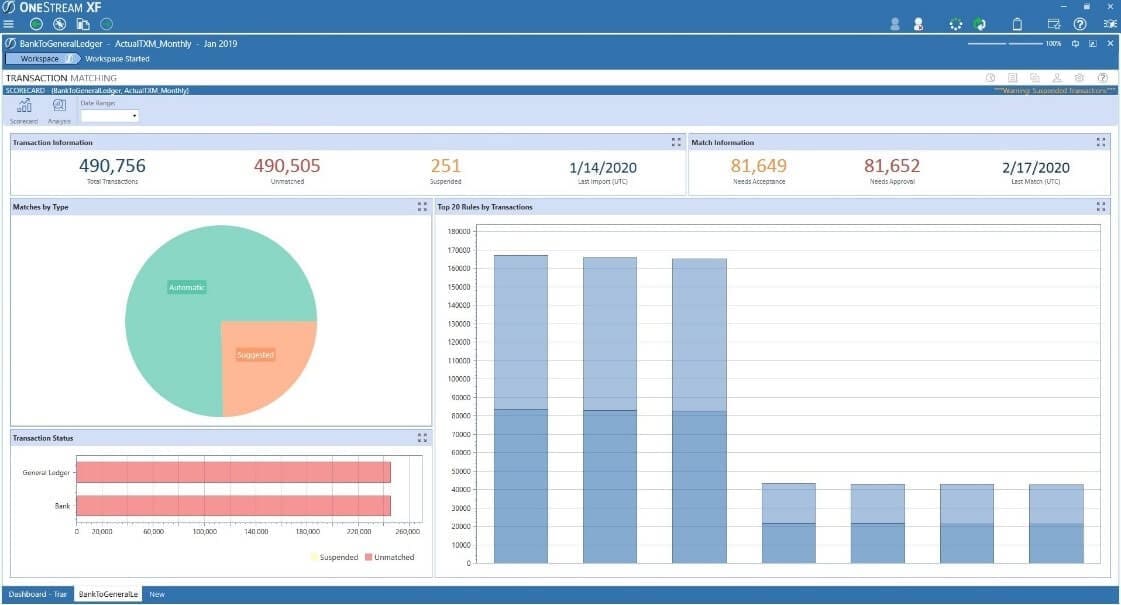

OneStream Transaction Matching – Now Available on the XF MarketPlace

OneStream Software recently introduced a Transaction Matching solution on the OneStream MarketPlace. The OneStream MarketPlace includes over 50 solutions that customers can download, configure and deploy to extend their investment in the OneStream Intelligent Finance platform and quickly address new business requirements. As a complement to our popular Account Reconciliations solution, OneStream’s Transaction Matching solution offers several advantages over Excel spreadsheets and point solutions that customers may already be using. These advantages include the following:

- Leverages OneStream’s Powerful Data Integration/Data Quality Capabilities

- Can Handle Intercompany Matching at the Transactional Level

- Leverages OneStream’s End-User Reporting and Dashboards

- Provides Full Visibility Back into Source System Data

- Is Available at No Cost to Existing Customers

- Part of OneStream’s Unified Platform

Because it automates a large part of the transaction matching process, OneStream’s Transaction Matching solution enables users to focus on the exceptions and speed the transaction matching and account reconciliations process while providing full visibility and audit trails. By automating the process and improving the speed and accuracy of transaction matching, OneStream’s Transaction Matching solution provides several business advantages, which are included below:

- Reduce Period-end Close Cycles

- Reduce Write-offs of Unexplained Differences

- Improve the Accuracy of Financial Statements

- Reduce Costs of Ownership with OneStream’s Unified Platform

West Bend Mutual Insurance is one of the early adopters of the solution who is already experiencing the benefits. “We are currently using OneStream Transaction Matching for a new process we are implementing with claims,” said Jessica Greisch – Financial Analysis and Tax Manager. “This new process involves direct payments from our bank account, requiring us to reconcile the transactions daily, instead of waiting for month-end. Doing this daily matching of bank transactions manually with Excel would have been a nightmare, whereas the Transaction Matching solution allows us to automate much of the process and save a great deal of time and effort.”

Learn More

Existing OneStream customers who want to learn more about OneStream’s Transaction Matching solution can visit the MarketPlace and download it directly. Alternatively, you can download the solution brief from our web site and register for our upcoming Live Demo webinar featuring OneStream Account Reconciliations and Transaction Matching solutions.

Get Started With a Personal Demo