As the “go-to” strategic advisor to the lines of business and key functions, Financial Planning & Analysis (FP&A) teams are a natural choice to lead the long-range planning process. Why? Simply put, no other team, with the exception of the CFO and CEO, has the vantage point and capability to understand how detailed operational plans and metrics impact financial plans and forecasts.

As a strategic blueprint for organizational growth, long-range planning helps prioritize strategic initiatives such as M&A activities, new product investments, manufacturing optimization and capital sourcing – all of which are vital to achieving financial goals.

How can FP&A teams maximize the value of the long-range planning process? Like most initiatives in corporate finance, effective planning processes cannot be finance-only exercises. They must align finance and operations and bring value to line-of-business leaders. Here are a few critical activities to consider for long-range planning:

- Target setting – FP&A teams should work with CFOs and business leaders to set revenue and EBITDA targets for each business unit and the consolidated organization. These targets can range anywhere from 3 to 5 years out or even longer for certain industries, such as mining and energy.

- SWOT analysis – Line-of-business leaders should conduct a self-assessment about the products or services they offer. This assessment includes a review of both internal strengths and weaknesses and external opportunities and threats. Internal factors are focused “within” the walls of the organization, such as assessing talent or current product lines. Meanwhile, external factors are “outside” the walls of the organization, such as market demand, competition, and M&A opportunities.

- Strategic initiatives and business-case analysis – Divisional FP&A teams and executives should then identify and model strategic initiatives, such as launching new product lines or technology investments required to achieve financial goals. These “big bets” should also help the organization capitalize on market opportunities and mitigate external risks.

- Capital planning & prioritization – Once submissions from the field are completed, FP&A teams can then work with CFOs to prioritize long-range capital plans. Typically, capital projects are broken down into specific buckets, such as growth, productivity and maintenance projects. This approach helps CFOs balance their capital investment portfolios and align them to overall strategy.

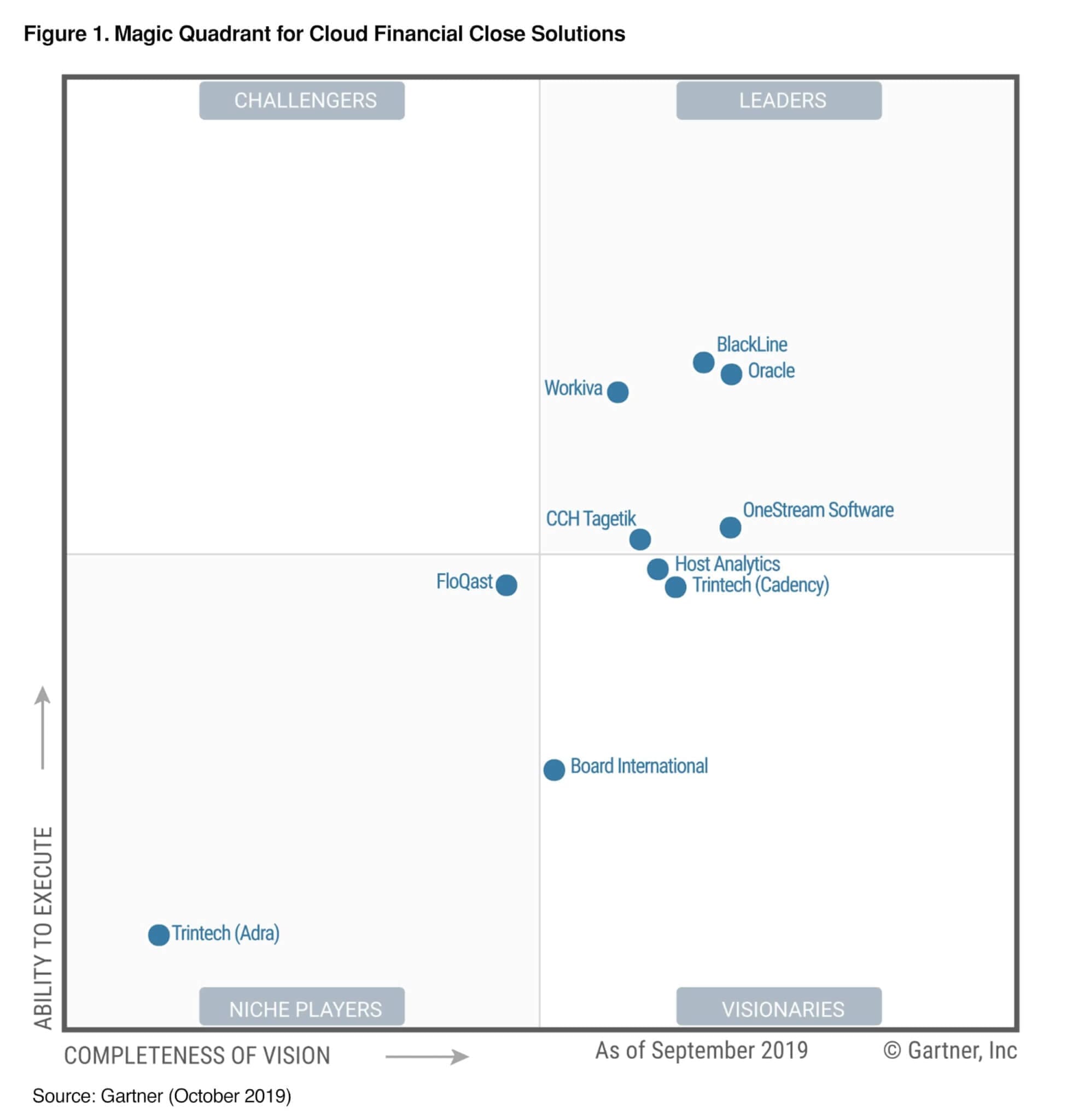

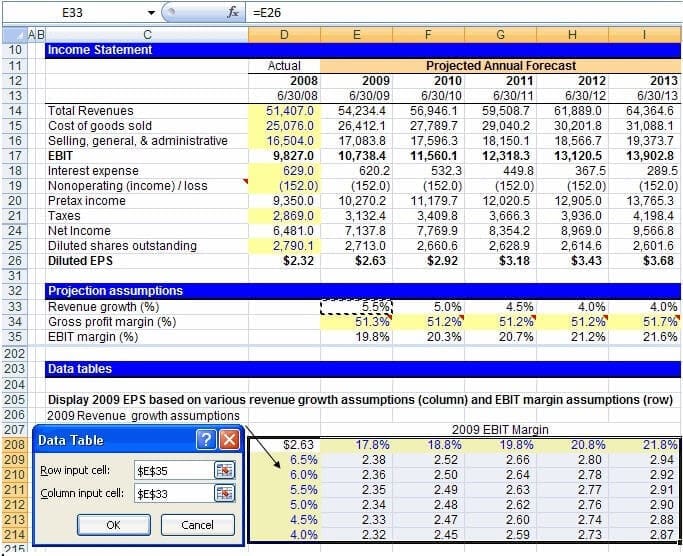

- P&L, balance sheet and cash-flow modeling – Corporate finance teams can then aggregate all final strategic initiatives into a P&L (see figure 1) and then create driver-based balance sheet and cash-flow models. Balance sheet and cash flow models are critical to ensure the organization is well capitalized to fund long-range plans or, if applicable, use excess cash to pay-down debt or buy back stock. Conversely, this exercise also creates signals to CFOs and finance leaders as to if their organization requires additional funding to achieve growth targets.

Typically, the long-range planning process spans anywhere from 4 to 6 weeks for large, sophisticated organizations. This time frame gives the line-of-business and corporate teams time to create multiple scenarios, analyze key assumptions and collaborate. CFOs and corporate FP&A teams should then bring the entire team together to review final financial and business plans prior to the review with the board of directors and/or investors.

Unfortunately, many organizations still rely on Excel to manage the long-range planning process. Corporate Financial Planning & Analysis teams spend hours creating templates, distributing them and then rolling them up. Why? Because they have no other choice – at least not if they want their fragmented models to work right.

Figure 1: Excel Long-Range P&L Plan

Excel and point solutions are also widely used to capture, review and analyze detailed operational assumptions and integrated business plans. This reliance often results in a fragmented mess of additional data and offline files – each containing complex calculations and inter-linked schedules that offer little traceability to financial plans.

With each scenario and iteration, it’s easy to get lost in the minutia of non-value tasks “just to get the job done,” which runs completely counter to the process. After all, isn’t the long-range planning process THE time to think bigger?

A Modern Platform for Long-Range Planning

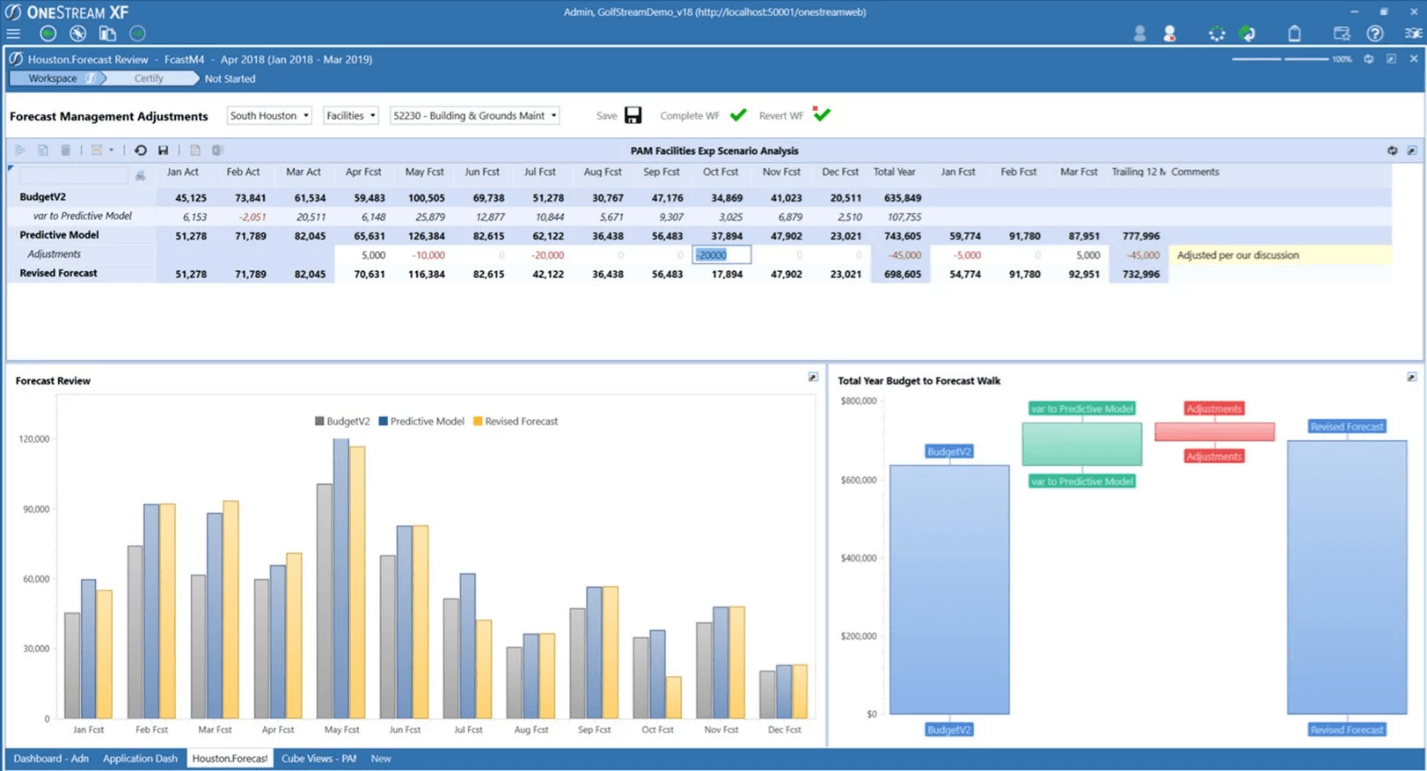

OneStream supports line-of-business and corporate finance teams in managing the long-range planning process with the agility and scalability required to align the organization. And with built-in capabilities for predictive forecasting, reporting, and analytics OneStream’s unified platform streamlines planning and reporting and increases alignment between finance and operations – all while providing the flexibility to support various scenario planning and sensitivity analyses. OneStream’s Long-Range Planning solution includes the following and more:

- Predictive analytics – Based on historical financial and operational detail, OneStream will surface highly correlated predictive models (such as ARIMA, Holt-Winters, exponential smoothing) directly within planning processes to set targets, seed forecasts and create dashboards (see figure 2).

Figure 2: OneStream’s Predictive Analytics Solution

Figure 2: OneStream’s Predictive Analytics Solution

- Extensible Dimensionality® – Extensible Dimensionality empowers line-of-business teams with the flexibility to plan for their unique needs, without compromise and without impacting the corporate standard for consolidated P&L, balance sheet and cash-flow modeling.

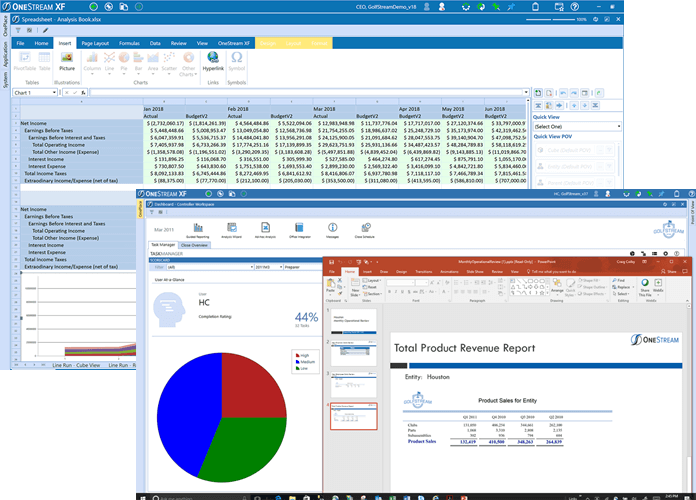

- Built-in Reporting and Analytics – Produce balance sheets, income statements and management reports that easily compare actual results to long-range plans for various lines of business and for the consolidated organization, in a single solution. Leverage Excel & PowerPoint integrations (see figure 3) for ad-hoc analysis and stakeholder reporting.

Agility and Scale = 100% Customer Success

With the scale and agility to manage the entire long-range planning process, FP&A teams are eliminating the low-value tasks and complexities of managing spreadsheets and fragmented tools. This shift gives finance leaders the time they need to focus on the strategic initiatives and value creation activities involved in long-range planning. That freedom is exactly why leaders at the world’s most sophisticated organizations, such as Guardian Industries and The Carlyle Group, are turning to OneStream as the digital finance foundation for their Financial Planning & Analysis teams.

And as a unified solution for financial close, reporting and budgeting, planning & forecasting, OneStream provides a unique opportunity to unify long-range plans with all other core finance processes. Here are just a few additional benefits of aligning long-range plans with actual results and budgets:

- Streamline planning and analysis – Create various scenario models and what-if analyses using business drivers for strategic initiatives and P&L, balance sheet and cash-flow modeling,

- Focus on strategic cash needs – Align various debt schedules for principal payments, amortization and interest expense. Dynamically calculate additional debt pay-down, stock buy-back and working capital with business drivers.

- Scale across the organization – Enable line-of-business and functional business partners to develop and maintain long-range plans. Familiar workflows, controls, reporting and analysis tools increase adoption and accountability.

Learn More

To learn more about how OneStream unifies long-range planning across the Office of Finance and beyond, download our solution brief here.

Get Started With a Personal Demo