As CFOs maneuver their organizations through the warp-speed environment of the 2020s, Finance Transformation is en vogue again. Why? Let’s face it—Finance chiefs at large, sophisticated organizations cannot afford to manage their organizations with the same technology widely used for the past 20 years. Not if the goal is to actually help teams move with the agility and pace required to drive performance through periods of volatility and disruption.

With the debate on the need and value of Finance Transformation settled, Finance teams can finally focus on taking the steps needed to lead at speed. And that journey starts with a simple objective.

To lead at speed, Finance teams must finally conquer the complexity of their dis-connected corporate performance management (CPM) tools and processes.

As we shared in the kickoff of the “Inspiring Digital Transformation with Intelligent Finance” blog series, now is the time to break the cycle. But where to begin?

A good first step, and the topic for this post in our blog series, is by defining what it takes to be an Intelligent Finance organization.

The Intelligent Finance Organization

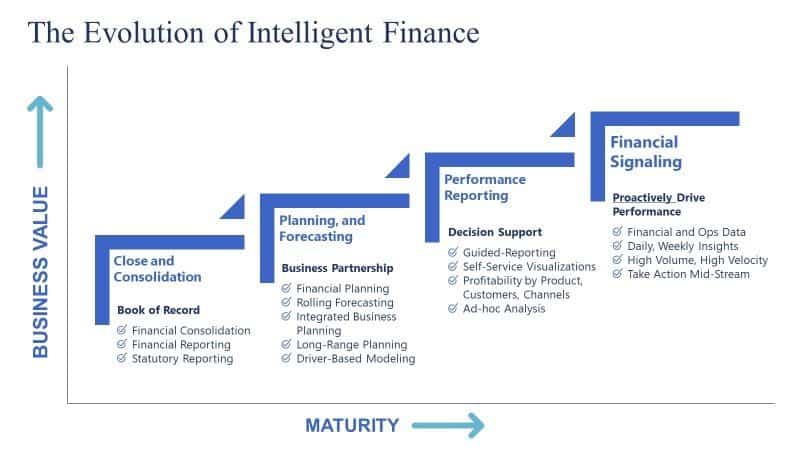

No matter where your organization sits in the transformation journey (see Figure 1), creating a collective vision, as a team, is always helpful.

Intelligent Finance offers organizations the chance to take control of their destinies. To finally leverage the benefits of technology without compromising on their requirements. To drive performance by unifying their Finance teams. By working smarter, not harder to unleash the power of Finance, empower the organization with insights to drive performance, and continuously evolve the scope and value of their Finance teams.

Here are the 3 steps to becoming an Intelligent Finance organization:

- Step 1 – Intelligent Finance teams unleash the organization from manual and disjointed processes. How? By using digital transformation to automate tedious tasks and increase the productivity and effectiveness of the financial close, planning, budgeting, forecasting and reporting processes.

- Step 2 – Intelligent Finance teams empower the organization to focus on value-driving initiatives and provide decision-makers with data-driven financial and operational insights. How? By exploring opportunities to leverage advanced analytics – such as predictive forecasting and machine learning – to elevate the accuracy and value of forecasting.

- Step 3 – Intelligent Finance teams evolve their organization and processes to address the ongoing challenges and requirements in today’s uncertain, volatile and competitive markets. How? By dedicating resources and expertise to Sales, Merchandising, Operations, Marketing and HR to accelerate decision-making and unify planning across the organization.

Step 1: Unleashing the Value of Finance through Digital Transformation

Step 1 of becoming an Intelligent Finance organization starts by unleashing your team from tedious and disjointed, manual processes. Why? Well, to start, spending time on “low-value” processes holds Finance teams back from performing higher-value work – such as evaluating new capital investments or analyzing the impact of new product innovations. Too much manual work also kills culture and adds risk to CPM processes.

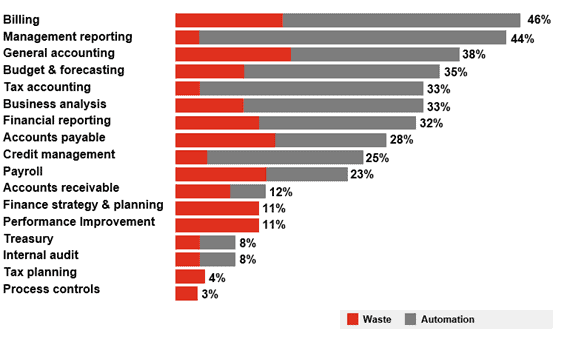

Unfortunately, according to PWC’s “Leading Finance in the Digital Era” research, manual processes are still the status quo. As PWC notes, (see Figure 2), Finance teams have a material opportunity to eliminate waste and drive automation across a number of CPM processes, including for reporting, budgeting & forecasting, and analysis.

Here are a few additional data points from PWC’s research:

- Data Gathering – In most organizations, data gathering takes up over 66% of the Finance teams time and is heavily dependent on spreadsheets.

- Transactional Processing – This type of processing still accounts for ~60% of the effort, while only 26% of time is spent on providing insights.

- Data – Very few organizations have unified enterprise data models, and many organizations often excessive interfaces and reconciliations.

Intelligent Finance teams take a platform approach to CPM, replacing multiple legacy systems, spreadsheets or cloud-based point solutions. The benefit? It simplifies the organization’s IT landscape for administrators and users. This approach reduces the time, effort and costs of maintaining multiple legacy applications while reducing manual data movements and accelerating planning, reporting and analytics.

By eliminating manual work and accelerating these processes, Finance teams can shift their time and attention from administration tasks to performing value-added analysis and decision support – unleashing the true power of Finance.

Step 2: Empowering the Organization with Data-Driven Financial & Operational Insights

With an intelligent platform like OneStream in place, the second step toward becoming an Intelligent Finance team focuses on empowering the organization with financial and operational insights.

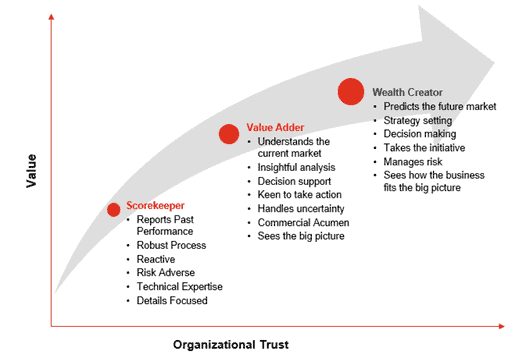

As cost pressures and the pace of change increase, Finance is being asked to do more to help support critical decision-making across the enterprise. But as PWC notes in its “Leading Finance in the 2020’s” research, developing insights and wisdom to inform the business requires Finance teams to elevate from the traditional “scorekeeper” role (see Figure 3) into a wealth creator role for the organization.

Intelligent Finance teams create enterprise value, or wealth – not only by being smart about “the numbers” – but also by first developing organizational trust.

How do they accomplish this? By learning the “big picture” of the business, of course. By working side by side with Sales, Operations, Marketing and HR. By aligning their understanding of the big picture to create data-driven insights around customer or product profitability. And by sharing daily operational analytics and financial signals to drive controllable cost-efficiency.

Intelligent Finance teams leverage data-driven insights to create trust and increase value to the organization. But these teams also rise to the challenge of helping their organizations address altogether new challenges.

Step 3: Evolving the Organization to Address New Challenges & Requirements

Intelligent Finance teams prepare their organizations for the unexpected. Yes, they anticipate what’s next. But how do they do it?

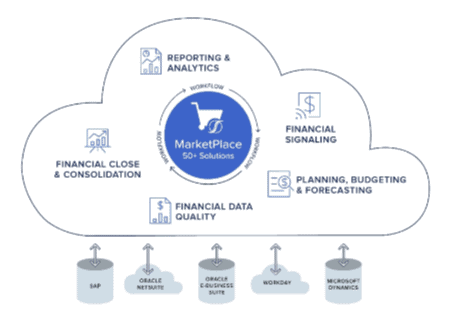

Intelligent Finance teams stretch out beyond the boundaries of the “Finance org chart.” And they put their money where their mouth is by investing in dedicated resources to support Sales, Operations, HR, IT and so on. Why? Well, how else can Finance teams expect to build expertise into the business? How else can Finance teams gain the trust of their business partners? And how else can Finance teams expect to earn their seat at the strategy table to help guide decision-making for extended planning & analysis (see Figure 4).

Intelligent Finance teams also think big when it comes to digital innovation. How? They make technology decisions that move CPM processes forward through automation. They also future-proof the Finance function by making investments with the scale to address a range of capabilities – such as people planning, account reconciliations, machine learning and predictive analytics. And they do it all without adding the technical debt of new, disconnected Finance software.

Conquering Complexity to Lead at Speed

OneStream’s Intelligent Finance platform (see Figure 5) was designed with flexibility and scale in mind to help Finance teams conquer complexity to lead at speed. By unifying CPM processes through a single, extensible solution, OneStream eliminates the burden of data gathering, reconciliation and administration of fragmented, connected finance solutions that continue to hold so many Finance teams back from reaching their true potential.

For those of you wondering, “what’s next,” remember this: True Finance Transformation is really more of an evolution than a revolution. And for many Finance teams, no matter where your organization is in the journey, as in life, always know your “why” by operating with a clear purpose and mission for your future.

At OneStream, we call this Intelligent Finance.

Learn More

To learn more about OneStream’s Intelligent Finance Platform, tune in for additional posts from our Inspiring Intelligent Finance blog series and download our interactive whitepaper.

Get Started With a Personal Demo