Finance leaders are transforming the Finance function and extending the value they offer their organizations by leveraging the converging capabilities of digital technology to take advantage of predictive analytics. These technological capabilities provide new access to multiple sources of the vast data within organizations, foster the ability to interpret that data and provide tools that advance Finance transformation.

By leveraging these technologies, Finance leaders are expanding their sphere of influence with Sales, HR and Supply Chain. They’re also strengthening business partnerships and trust while providing deep operational insights and guidance for their organizations. How? By speaking in the language of the business and analyzing key business drivers such as pricing and sourcing that drive profit margin and cash flow.

Many Finance leaders successfully navigate part of this Finance Transformation journey with three steps that enable them to employ predictive analytics to provide both strategic and operational guidance:

- Integrate financial and operational data

- Align predictive analytics directly into key planning processes

- Unleash predictive analytic access across the organization

Let’s examine these steps in a bit more detail to see what’s necessary to ensure success.

Step 1: Integrate Financial and Operational Data

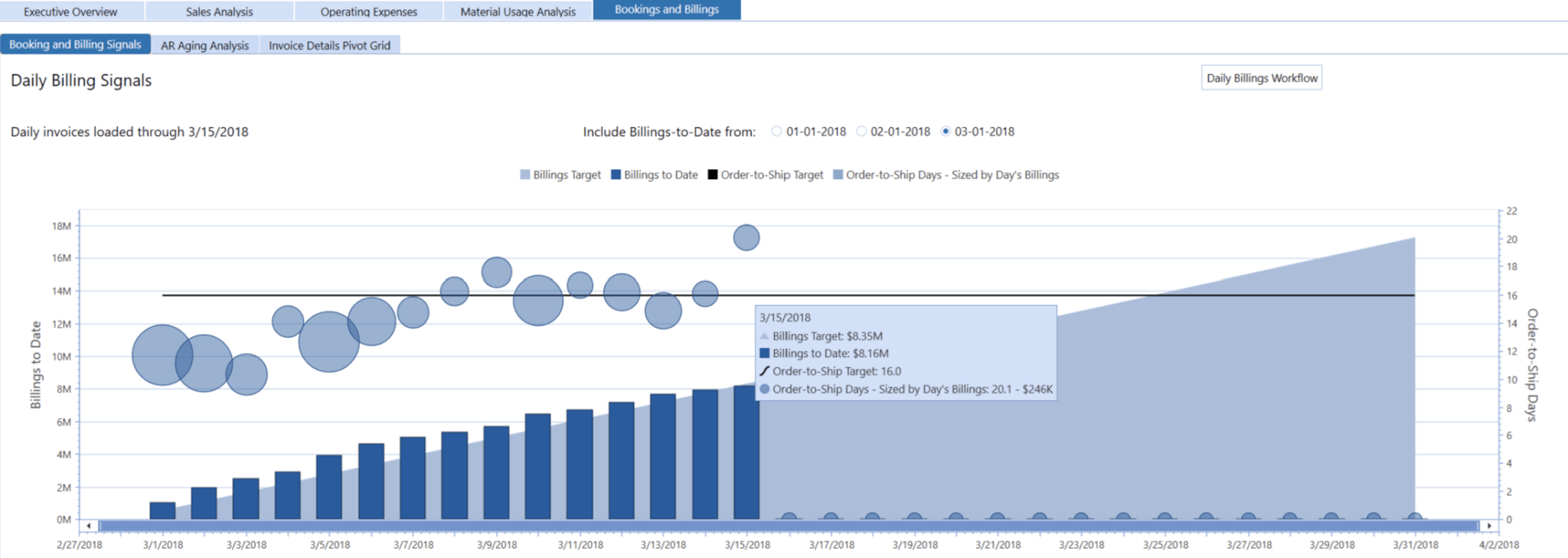

To provide actionable insights, Finance leaders must have access to operational data. Additionally, they must have the capability to examine operational data alongside, and within the context of, financial data (see Figure 1). Sophisticated organizations generate vast quantities of data, so both Finance and business-unit leaders require digital technologies that provide access to these various data sources. For effective decision-making, this access must be efficient.

Access must therefore not require team members to waste valuable time moving and managing data. Additionally, the access must be timely so that up-to-date information is readily available for operational business decisions that have an impact before month-end.

Organizations that fail to align financial plans with granular operational plans will ultimately struggle with forecast accuracy – because they operate in silos. Financially, the impact of that can take many forms and impact both profit and cash generation. Here are just a few examples of impacts:

- Excess inventory from over-forecasting, which impacts the cost to manage inventory (e.g., inventory holding costs) and working capital.

- Lost sales and revenue from under-forecasting. To meet customer demand, products must be in the right place at the right time.

- Lost profit from under-forecasting and rush shipments. To meet customer demand, companies may rush product shipments at a higher cost than planned.

Step 2: Align Predictive Analytics Directly into Planning Processes

No matter where the Office of Finance sits in its Finance Transformation journey, predictive analytics can help focus on collaborating with business partners, find new ways to ask “why” and drive performance. Here are just a few of the top use-cases for organizations thinking about adding predictive analytics and machine learning (ML) into their financial and operational planning processes:

- Assist with target-setting for strategic planning, annual operating plans and rolling forecasting

- Create baseline predictive forecast scenarios for comparison with bottom-up forecasting from divisional Finance or Operational partners

- Automatically seed all or portions of new forecasts with predictive models

- Adjust baseline predictive forecasts with known business changes, such as new customers or products, plant shutdowns, acquisitions, etc.

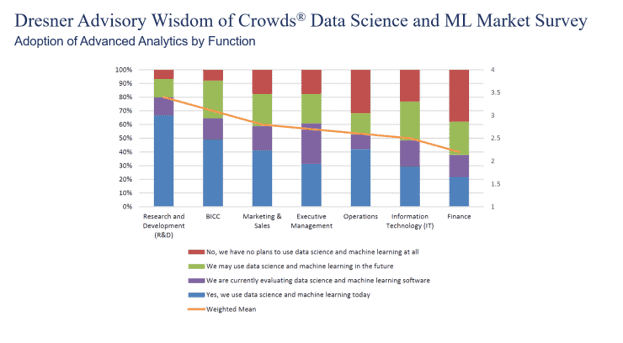

Access to raw data is ultimately meaningless without the capability to interpret that data. Finance notably lags other functions in the adoption of advanced analytics, according to Dresner Advisory’s 2020 Wisdom of Crowds® Data Science and ML Market Survey (see Figure 2). But modern corporate performance management (CPM) solutions offer capabilities that can empower Finance and business-unit leaders with self-service tools for predictive analytic forecasting. With the ability to apply predictive forecast models to data, Finance teams can leverage their organizations’ vast data to guide critical decision-making – and do so at the speed of the business.

Step 3: Deploy Predictive Analytics Across the Organization

With powerful predictive models at their fingertips, Finance teams can take advantage of visualization capabilities to collaborate with business partners. How? By creating and distributing dashboards with easy-to-use charts, graphs and reports that bring forecast data to life.

Sophisticated and modern visualizations also provide interactive access, enabling users to change variables to see real-time results of those updates to models, plans and forecasts. These visualizations and dashboards provide leaders across the organization with not only the ability to access data but also the capability to interpret that data – which helps guide critical decisions and informs organizational plans.

Unleashing Finance with Built-In Predictive Analytics

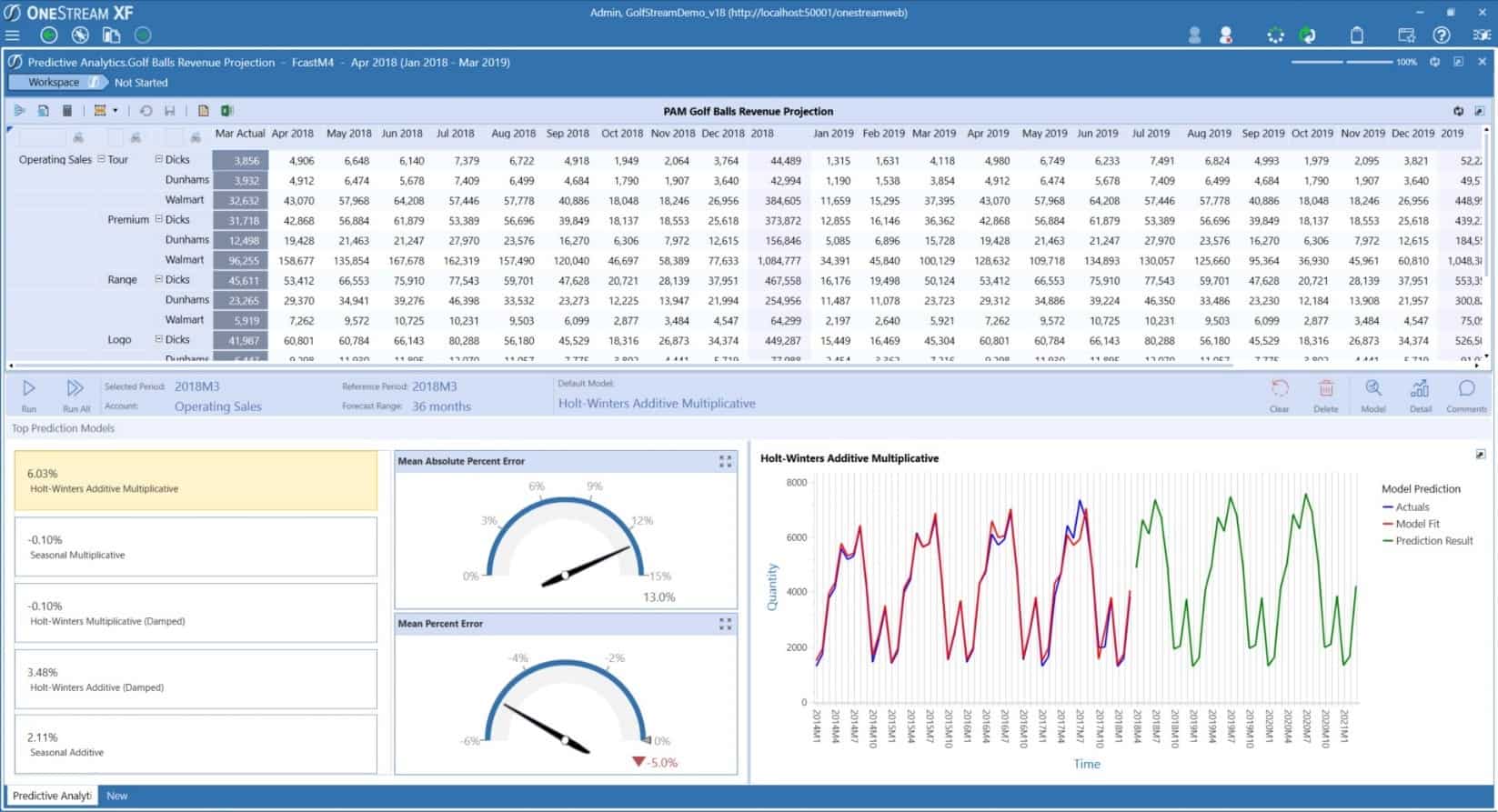

OneStream’s Intelligent Finance Platform empowers Finance teams to lead at speed by unifying predictive analytics with core CPM processes, such as planning, budgeting and forecasting; financial consolidation; reporting; and financial data quality. And with built-in predictive analytics (see Figure 3), OneStream™ is unleashing Finance transformation to take budgeting, planning and forecasting processes even further – allowing teams to plan, analyze and predict with confidence.

Plan, Analyze and Predict with Confidence

OneStream’s Predictive Analytics 123 solution, which can be downloaded from the OneStream MarketPlace™, automatically cycles through multiple predictive algorithms to determine the most accurate forecast type. Results are then graphically displayed and deployed across all aspects of the budgeting, planning and forecasting processes.

Finally, with OneStream’s reporting and visualizations, Finance and business users can bring key financial and operational metrics together by combining tables, charts, graphs and other visualizations. Users can then not only turn insights into action with the ability to see the real-time results of changes to models, plans and forecasts, but also share insights and collaborate on critical analysis and decision-making. With direct integration to data sources, users can drill down into the underlying causes, all the way back to transactional details, to quickly understand business trends.

Learn More

To learn more about leveraging predictive analytics for budgeting, planning and forecasting, view our interactive solution brief, “Leading at Speed with Predictive Analytics 123”.

Get Started With a Personal Demo