2021 FSN Global Survey: Unleashing Forecasting Agility with Scenario Planning

Scenario planning was a key focus in FSN’s Agility in Planning, Budgeting and Forecasting Global Survey 2021. Drawing responses from 509 international senior Finance professionals from the FSN Modern Finance Forum on LinkedIn, the survey covered finance professionals across 23 different industries. Using scenario planning enables organisations to ‘look out further’ and saves them from the risk and uncertainty of not understanding or planning for what could happen when a major change event occurs.

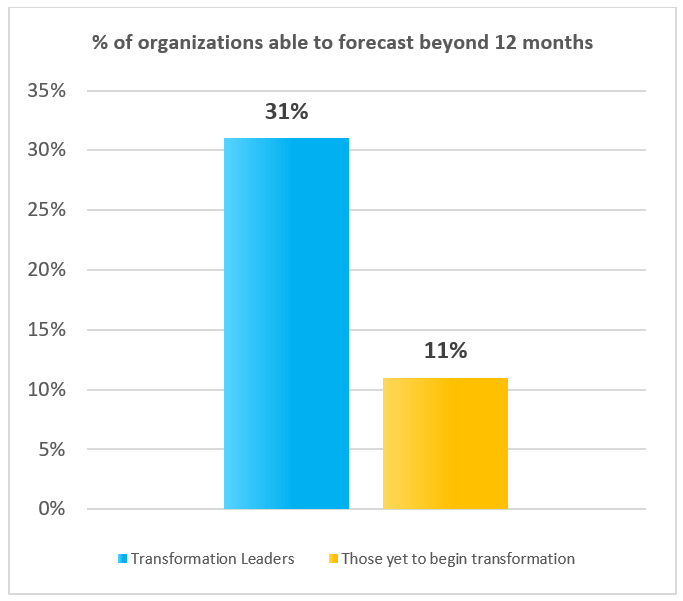

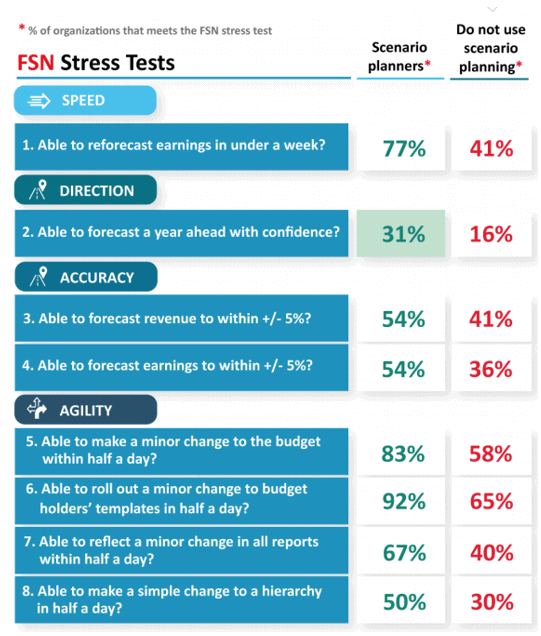

To any organization, agility is invaluable. Yet the survey shows that producing accurate, far-sighted forecasts and responding quickly to both internal and external changes aren’t skills universally demonstrated in all organizations. In fact, the Agility in Planning, Budgeting and Forecasting Survey found that some organizations fall significantly short of having the basic competencies needed to maintain an agile planning, budgeting and forecasting process. Importantly the survey found that scenario planners are twice as likely to be able to forecast a year ahead with confidence – that means 31% of organisations who do scenario plan vs 11% within organisations who do not use scenario planning and have yet to start finance transformation (See figure 1).

What Is Scenario Planning?

When managing through uncertainty, Finance teams should almost always look to scenario planning as their “go-to” choice. Why? Well, here are the key reasons:

- Facilitates Speed & Agility: Scenario planning enables Finance teams to quickly create various “what-if” scenarios without requiring a full bottom-up forecast. Unlike with a full forecast, scenario planning DOESN’T require stakeholder input from across the organization.

- Focuses on Business Drivers: Effective scenario planning focuses on business drivers that span across the organization or key lines of business. The best practice is to focus on “big-ticket” business drivers that influence revenue and costs, such as product volumes or pricing. For example, if your organization is tied to construction activity, then housing starts and/or permit activity are business drivers that likely indicate demand.

- “Flexes” Across Financial Statements: While scenario plans focus on changes to key business drivers, effective scenario analyses “flex” each scenario to dynamically calculate the related impact across the P&L, balance sheet and cash flow statements. This approach gives Finance leaders visibility into the impact on COGS, gross margin %, EBITDA, EPS and cash flow – all of which are critical KPIs when navigating through uncertainty.

- “Surrounds” the Numbers with Realistic Scenarios: Creating too many scenarios does little to enable sound decision-making. By avoiding scenario overload, scenario planning focuses on only realistic scenarios – allowing you to create a limited, but realistic number of scenarios to monitor and align to key decisions. The analysis not only provides a clear and actionable plan, but also results in a plan that you can easily pivot from if and when needed. Not to mention, scenario analysis also gives CFOs the ability to “surround” the numbers. Why’s that important? Because during crisis situations, CFOs are often asked to provide risk-adjusted guidance on new revenue or profit expectations to inform future forecasts for investors and stakeholders.

Low Adoption in Organizations

Based on the benefits above, the case for using scenario planning is clearly compelling – so why do so few organizations embrace it?

The FSN survey found that a mere 4% of organizations make sufficient time for effective scenario planning (see Figure 2). Worse, this low adoption rate has persisted despite the surge of interest in scenario planning since the COVID-19 pandemic swept away assumptions and forecasts with unprecedented speed and ferocity.

So again, why do organizations shy away from scenario planning? A principal reason, as stated in the FSN survey, is a (perceived) lack of automation. Without automation, scenario planning is time-consuming and practically worthless unless an organization can simultaneously model multiple scenarios, assumptions and variables – which is at best a grueling process and at worst entirely impossible within the limitations of a spreadsheet.

The Effects of the COVID-19 Pandemic

The survey found that COVID-19 intensified the focus on scenario planning as organizations had to quickly respond to change and plan for the uncertainties ahead. Unfortunately, some organizations found themselves dramatically unprepared for what was happening. Finance teams were often being asked to model different outcomes several times a day as restrictions increased, business models changed and many sources of traditional revenue dried up. How did all of that impact planning?

Well, many organizations were simply unable to meet analysis demands. And if they did manage to meet the demands, the road there was often littered with inefficient manual processes and potentially multiple errors. These issues could have initially led to some to poor decision-making. But such issues have also driven organizations to establish the right foundation for any future event of a similar nature.

Even today, the pandemic remains an ongoing problem in many countries, but opportunities will also continue to arise within those environments. The survey states that “organizations won’t be able to take advantage of them [opportunities] unless they have a clear vision of their future, and for that they need supreme agility in planning, budgeting and forecasting.”

In other words, they need the right tools.

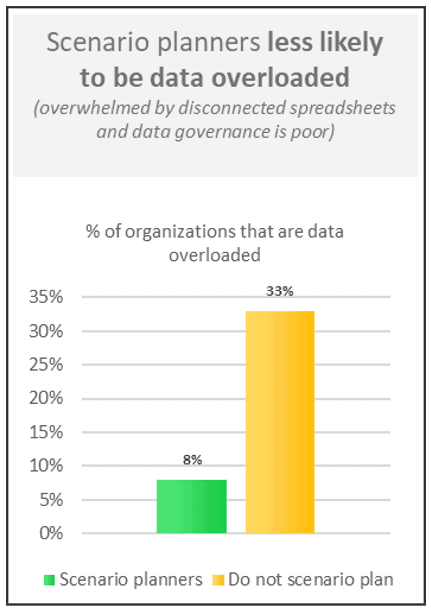

Specialist Tools Are Essential

The complexity of managing and running various scenarios means organizations still wedded to spreadsheets will be severely limited in what they can achieve. Only those organizations that have mastered their data and deployed specialist tools can properly enjoy the benefits of scenario planning. The survey found that 33% of non-scenario planners say they are “data overloaded,” meaning they’re overwhelmed by disconnected spreadsheets (data governance is also poor) vs just 8% with scenario planners (See figure 3).

The Benefits Are Comprehensive & Extensive

According to the FSN survey, 77% of organizations that find the time to consider alternative scenarios can reforecast earnings within a week (see Figure 4). Comparatively, 41% of Finance executives say they lack the time for scenario planning.

Scenario planning also adds to the accuracy of forecasting. Fifty-four percent of scenario planners can forecast to within +/- 5% of earnings and revenue. But only 36% and 41% of non-scenario planners manage to forecast earnings and revenue, respectively, with such accuracy.

Scenario planning ultimately sets up the ability to change in times of extreme flux. The survey found that 83% of scenario planners can adjust for a minor change, such as a new cost line added or taken out of a budget or forecast model, in half a day versus just 58% for their less-prepared competitors.

That agility is supported by two additional key benefits of scenario planning:

- Data Mastery: A scenario planner’s relationship with data and how it’s managed speaks volumes about the benefits for the organization. Data mastery leads to analytic agility.

- Engagement & Process: Scenario planners are more likely to engage more with stakeholders, both inside and outside the organization, and the boosted engagement leads to more efficient and effective processes and resource utilization.

Scenario Planning Delivers Agility Now and in the Future

The recent pandemic proved that, to survive, organizations needed to react fast, understand the different options and preserve cash. Some organizations may have discovered details about themselves and how they operate for the very first time. Such realizations are possible because many short-term models used by organizations today are ill-suited to handling the long-term strategic cash management now required. Why? Well, the models are often simply too short term and too granular – with many only focused on a single customer, region or transaction.

Effective scenario planning (See Figure 5) delivers scenarios that vastly differ to ensure maximum discussion on the potential actions. When scenarios are run, the actions to take should be clear, so models must identify specific outcomes to make that possible. The use of Monte Carlo simulations – which produce thousands of scenarios – delivers a level of probability to the outcomes and helps foster a level of confidence in the forward decisions to be made.

Does not planning for certain scenarios always lead to disaster? Not necessarily. But it can leave the door open to increased risk and missed opportunities – is your organization willing to take those risks?

Learn More

To learn more, download the FSN report here. Ready to get started on a platform that supports agile planning, budgeting and forecasting? Contact OneStream today to make the leap into scenario planning.

Get Started With a Personal Demo