The financial close – a well-established term which even non-finance people can understand is the overall name for a series of processes which are critical to the continuance of any organization. The financial close processes include data assurance, consolidation, reconciling balances, calculating tax provisions and reporting. The output from the close is essential to navigating the path forward and for both internal and external compliance purposes. Why? Well there are very strict rules around financial and tax reporting which all organisations must adhere to. The consequences of filing late, not filing or filing incorrect figures can be very serious and have long term cost and reputational implications.

Change happens all the time throughout all areas of life. But the change we’re seeing in Finance teams is faster and greater in just the past 2-3 years than during many of the preceding decades. Why? Well, a series of significant global events have shaken many organisations to the core. Survival of the fittest is more relevant than ever, and organisations are being forced to take action now to speed up their processes, align their organisations and transform digitally to ensure accuracy, agility and longevity.

Now is the time to Re-Imagine the Financial Close.

Re-Imagining the Close Blog Series

Over the coming weeks, we’ll share a four-part blog series posts discussing the path toward re-imagining the close through digital transformation. Here’s a sneak peak of the key topics:

- Re-Imagining the Financial Close, Part 1: 5 Signs it is Time to Re-Imagine the Close

- Re-Imagining the Financial Close, Part 2: 6 Key Challenges in Financial Close & Reporting

- Re-Imagining the Financial Close, Part 3: Moving Beyond the Connected Financial Close

- Re-Imagining the Financial Close, Part 4: Financial Signaling & Reporting

Regardless of where you are in your finance journey, our Re-Imagining the Close series is designed to share insights from the experience of OneStream’s team of industry experts. We recognize, of course, that every organization is unique – so please assess what is most important to you based on the specific needs of your business.

The Increasing Pace of Change

As the world becomes ever more connected, many organisations heavily depend on travel and lean supply chains amidst an increasing pace of change. As a result, the global pandemic, the Suez Canal blocking, and other unexpected events are having a bigger impact than ever. And advancements in technology and communications are making it increasingly easy for disruptors to enter markets and challenge the established status quo.

Despite such changes, many organisations are still dependant on multiple legacy corporate performance management (CPM) tools or even spreadsheets to manage their critical Finance processes. These older tools can cause a multitude of problems with time delays and expensive integrations. Not to mention, such tools also usually have too many manual workarounds. The net impact is an inability to close the books in a reasonable time frame and potentially something even more problematic – making forward-looking decisions without timely and accurate data.

What’s Holding Organisations Back?

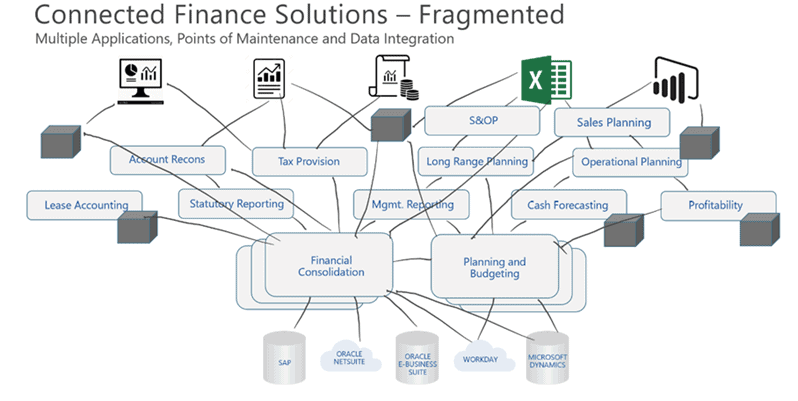

The evolution of legacy CPM solutions has resulted in the ‘connected solutions’ many organisations have in place today. Why connected? Well, the technology available at the time meant solutions for the different CPM process areas were built differently and in separate applications. Integrations were then required to align the dimensional structures used in each application and to move data between applications (see Figure 1). These requirements added risk, cost and complexity to already-taxed Finance teams.

As a result, many organizations with connected solutions are left facing the following issues:

- Suffer from fragmented software & processes – adding unnecessary & costly time delays.

- Require more data management & administration – diluting the ability of strategic finance teams to focus on driving performance and supporting critical decision-making.

- Lack critical financial close capabilities – missing much of the core ‘financial logic’ required to support monthly financial processes, which results in added time, added costs and more manual workarounds.

Figure 1: Connected Finance Solutions – Fragmented

Automating and unifying the financial close and reporting process ensures faster delivery of financial, operational and sustainability/ESG results to management for accelerated decision-making. It also allows results to be delivered faster than before to external stakeholders.

Finance Needs to Lead at Speed

The pace of change is leading to an explosion in the number of Finance Transformation projects. Indeed, most Finance leaders are realising they cannot continue to respond with yesterday’s technology. They urgently need to move forward and drive the performance of their organisations at speed. To truly lead at speed, however, Finance teams must conquer the complexity of disconnected CPM tools and financial close processes.

Even more importantly, Finance teams must also find ways to move beyond the traditional month-end financial close cycle.

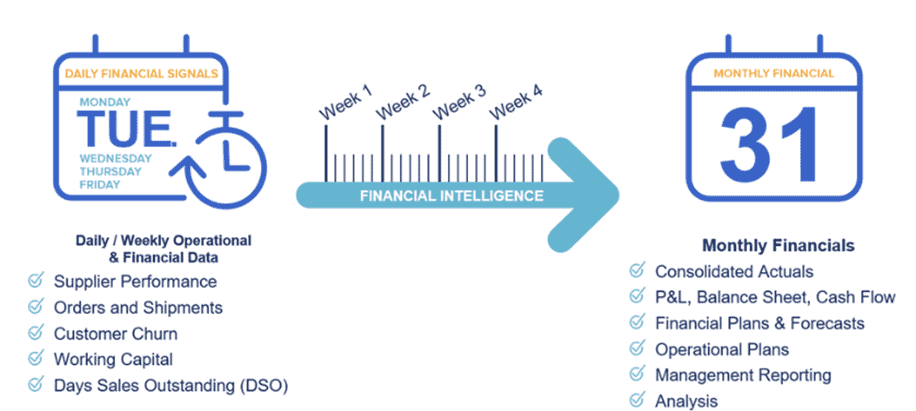

Enter Financial signaling. With this capability analysing revenue, costs, cash flow and operational signals on a weekly or even daily basis is no longer just a vision — it’s essential to navigating rapidly changing business conditions.

Figure 2: Financial Signaling

Financial signaling (see Figure 2) makes the vision of daily close performance reporting a reality by empowering Accounting and Finance teams with daily or weekly insights into key metrics and drivers of the business. These ‘signals’ can highlight critical opportunities or risks that require action.

Re-imagining the Financial Close

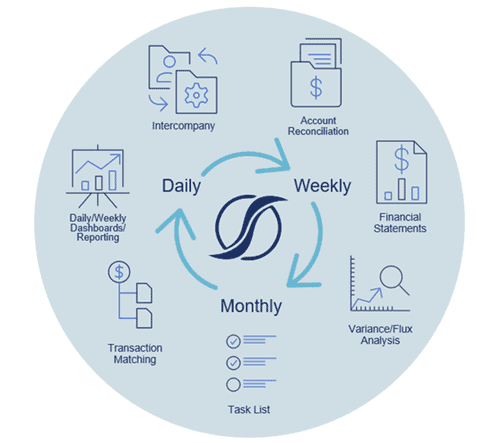

A fully unified financial close process combined with financial signaling (see Figure 3) provides a unique opportunity for Finance and Accounting teams. How? It allows them to re-imagine the financial close and challenge the mindset that key data cannot be available before the books are closed.

Figure 3 – Complete Financial Close and Compliance Processes

The end result is that Finance teams are empowered to proactively manage risk and drive the performance of the organisation. Notably, a single line of sight is created from data loading at the source system(s) to the end CPM processes and reporting right back to transactions through drill back when required. And with the right software, driving performance becomes an every day occurrence.

OneStream’s Intelligent Finance Platform

Why is OneStream different from connected Finance solutions?

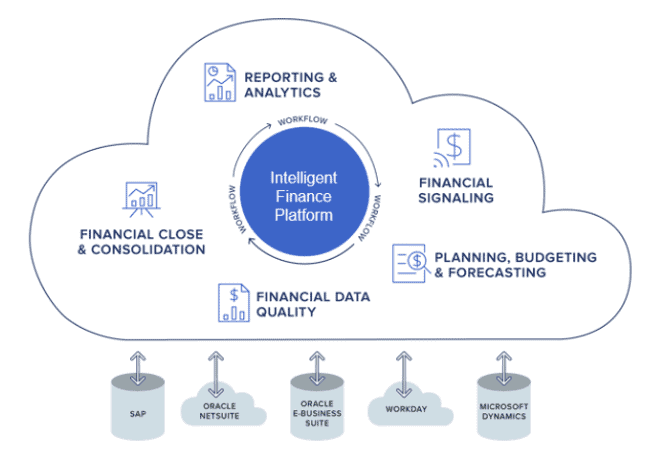

OneStream’s Intelligent Finance Platform (see Figure 4) uniquely unifies all core CPM processes – such as financial close and consolidation, planning, reporting, analytics and financial data quality – for the world’s leading enterprises. Having these processes all in one platform signfiicantly simplifies the user experience and technology environment because there is only one product to learn, own, use and maintain.

Figure 4 – OneStream’s Intelligent Finance Platform

OneStream Creates ‘One Source of the Truth’ for BDO

![]()

OneStream helps Global Professional Services firm BDO to align their external, legal, management and FP&A process all within a single solution while providing a framework to address different levels of detail between actuals reporting and budget/forecast collection across Accounts, Cost Centres and Departments. All of that in turn provides additional granularity for reporting and planning across various lines of business – in a single solution that offers a unified data model.

Learn More

To learn more about how you can re-imagine the financial close with the unrivalled power of OneStream’s Intelligent Finance Platform, download our whitepaper here. And don’t forget to tune in for additional posts from our Re-Imagining the Financial Close blog series.

Get Started With a Personal Demo