It has long been the norm that executives face delays in getting insights into key data and KPIs due to the volume and complexity of the monthly financial close. Why is this? Well, most financial close processes have been established over time following a strict period-end process to first gather data from multiple sources and then validate and consolidate that data to provide the required combined view in financial reports. In most cases, data cannot even be viewed until the month-end close and consolidation process is complete. That also means any forward-looking decisions must wait. And those delays often lead to decisions being taken too late and to missed opportunities.

In this fast-paced, modern world, operating this way simply isn’t efficient or effective. And that’s especially true when putting the right solution in place can help the organisation surface key data on revenue, costs, customer orders, or working capital on a weekly or even daily basis in the form of “financial signals”. This level of analysis is no longer just a vision. Today, key data surfaced as financial signals can give executives much earlier visibility into actionable insights to drive performance and remove the unnecessary – and costly – delays while waiting for the financial close to complete.

Enter Financial Signaling

Unfortunately, while attractive, the concept of closing the books every day and instantly sharing consolidated financial results with stakeholders is not feasible for most organisations. Doing so is especially infeasible when the transactional data is sitting in multiple GL/ERP, CRM, HCM, and other systems.

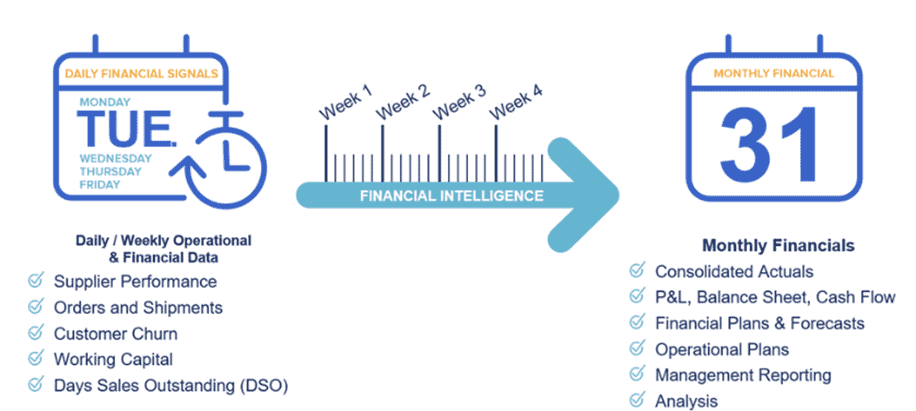

So how can Finance and Accounting teams break down the barriers of the month-end close cycle? Financial Signaling (see Figure 1) provides a unique opportunity for Finance and Accounting teams to effectively re-imagine the financial close and challenge the mindset that key data cannot be available before the books are closed. Financial Signaling brings the vision of daily close performance reporting to reality by empowering users with daily or weekly insights into key metrics and drivers of the business. And it allows users to do so in a unified and seamless process that’s controlled, auditable and complete.

Such financial signals can include data on the sales pipeline, customer orders or shipments, customer renewals, supplier deliveries, working capital, and key metrics such as days sales outstanding. With more regular insights into the trends and signals inherent in these data points, managers can immediately act to proactively project and/or take action to impact the period-end results.

Financial Signaling: How to Get There

Effectively performing financial signaling requires three key capabilities:

- Integrating large volumes of transactional data from a variety of sources.

- Aligning that data with book-of-record financial data and the dimensional structures understood by business users.

- Making the data available for analysis by controllers, executives, line-of-business managers, and analysts through interactive dashboards and other data visualisation and analysis tools.

Having a fully integrated corporate performance management (CPM) software platform with built-in financial signaling capability is vitally important, for several reasons. A fully integrated CPM platform allows for connecting to multiple data sources and rigorous validation and control to ensure the highest quality of data. Having the most advanced functionality for the financial close and consolidation and planning will ensure the organisation can leverage the intelligence that’s core to those processes – without building from scratch.

The solution should include the following three key abilities:

- Applying financial intelligence on accounts, currency, ownership, and intercompany eliminations to non-financial data.

- Organising operational data using the organisation’s financial hierarchies to create a consistent data model and presentation layer.

- Creating financial signals and insights on daily and weekly working capital, controllable costs, sales pace, and other KPIs.

OneStream: A Unique Enabler

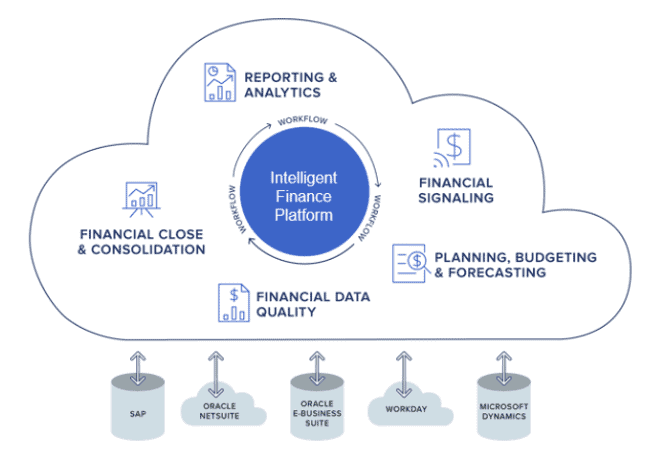

OneStream’s Intelligent Finance platform (see Figure 2) uniquely unifies financial signaling with core CPM processes – such as financial close and consolidation, planning, reporting, analytics and financial data quality – for the world’s leading enterprises.

OneStream’s unique Analytic Blend capability enables financial signaling by combining the financial intelligence that’s core for an organisation’s monthly financial processes with highly granular and high-velocity financial, operational and detailed transactional data – all in a single platform. This ability continually drives monthly, weekly, or even daily performance.

Delivering 100% Customer Success

A growing number of organizations are using OneStream’s unified platform to enable financial signaling for their management teams.

Teledyne Technologies

Teledyne Technologies a leading provider of sophisticated instrumentation, digital imaging products and software, aerospace, and defense electronics implemented OneStream for their CPM requirements. The organization selected OneStream for several reasons – functionality, extensibility, customer references, and pricing.

Teledyne is using OneStream as an accountability tool to help their businesses reach targets. They’re generating dashboard reports in OneStream to inform business leaders of the data and what’s going on with sales. And they use Analytic Blend for weekly transactional sales “signals” to see sales trends across different channels. The organisation’s simplification efforts are expected to drive 100 basis points of margin improvement each year. And OneStream is a key enabler of such improvements – providing accountability for teams to better respond and make changes to see margin improvements. Due to their deployment of OneStream Teledyne were recently recognized by Ventana Research as the winner of their Digital Leadership Award for the Office of Finance category

BDO

BDO is a U.S. professional services firm that provides assurance, tax, and advisory services to multi-national clients through a global network of over 80,000 people working in 1,591 offices across 162 countries.

The BDO team, led by CFO Lynn Calhoun, selected OneStream because it met three primary requirements: scalability, information delivery, and data integrity. In sum, OneStream fit the bill as a platform that could not only handle larger data volumes as BDO grows but also empower key decision-makers with accurate information and rich dashboarding and reporting capabilities. By combining multiple disparate data sets, OneStream creates ‘one source of the truth’ for BDO.

BDO leverages OneStream’s financial signaling capabilities to report on and analyse large volumes of daily transactional data, loading 10 million records nightly. Those records are transformed into 30 to 40 million rows of data through OneStream and then made available for BDO’s users via an interactive dashboard.

The dream of ‘one version of the truth’ is entirely possible with OneStream.

Learn More

To learn more about how you can re-imagine the financial close with the unrivaled power of OneStream’s Intelligent Finance Platform, download our whitepaper and contact OneStream if your organization is looking to empower decision-makers with daily and weekly financial signals that can improve decision-making

Get Started With a Personal Demo