All CFOs and Finance leaders know an important truth: all data ultimately leads back to the income statement, balance sheet, and cash flow. With that in mind, eXtended Planning and Analysis (xP&A) takes traditional financial planning and analysis (FP&A) and changes the game. How? By unifying plans and forecast data from across the enterprise. That allows Finance to synchronize operational plans and forecasts into a single, unified plan that can inform business decisions for all departments.

And for FP&A teams, storytelling – the ability to combine financial and operational data and tell a story that reflects business performance and/or risks – is a vital skill. That’s been especially true during the COVID-19 pandemic and the disruptions it has caused. Amid the related uncertainty, organizations have been stretched thin, asked to do more with less, and expected to react quickly to unpredictable disruptions in global supply chains.

Finance professionals understand these pressures all too well. Why? Well, with so much reliance on spreadsheets and legacy corporate performance management (CPM) applications, it’s often Finance that feels the pain of combining large, disjointed datasets from disparate systems and manually consolidating data.

But what if organizations could replace spreadsheets and disparate silos of data with a unified data store and visualization environment that can be quickly and reliably refreshed? One that not only ensures data quality but also brings the data into an easily consumable reporting and analytics platform. One that enables the storyteller to drive key decisions quickly and easily across xP&A processes. All of that and more is possible through storytelling that drives effective xP&A.

Use Storytelling to Drive Effective xP&A

Today, storytelling capability isn’t just nice to have. It’s an absolute necessity if you want to operate effectively amid seemingly endless economic uncertainty.

Here are some of the key benefits of leveraging visualizations for storytelling to drive effective xP&A:

- Keeps data accessible to an audience that includes functions outside of Finance. Visualizations help the storyteller translate complex financial data into a digestible and quickly understood format that can be delivered to managers in various functions – even those less accustomed to reading financial reports.

- Makes data consumable to leadership that needs rapid insights. The pace of business is increasing, and busy professionals must be able to easily and reliably understand and react to rapidly changing data. Sifting through mountains of spreadsheets and reports, however, does not enable keeping with the pace of modern business. Visualizations can help users identify trends and signals in a large, complex dataset and ensure the audience can understand the key takeaways more effectively.

- Supports dynamic data sets that can be updated and refreshed quickly to enable swift action. Interactive dashboards can ingest near real-time data and be updated on the fly. This capability can transform a monthly forecasting cycle into a more dynamic process to help organizations understand and react to change instead of wondering why something happened after the fact.

Enable Easier Access to Data Using Visualizations

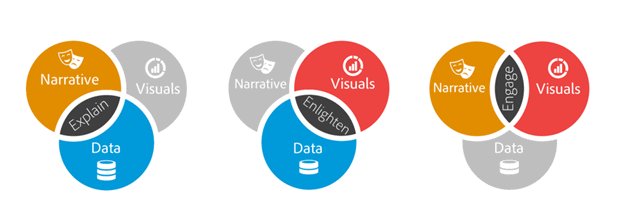

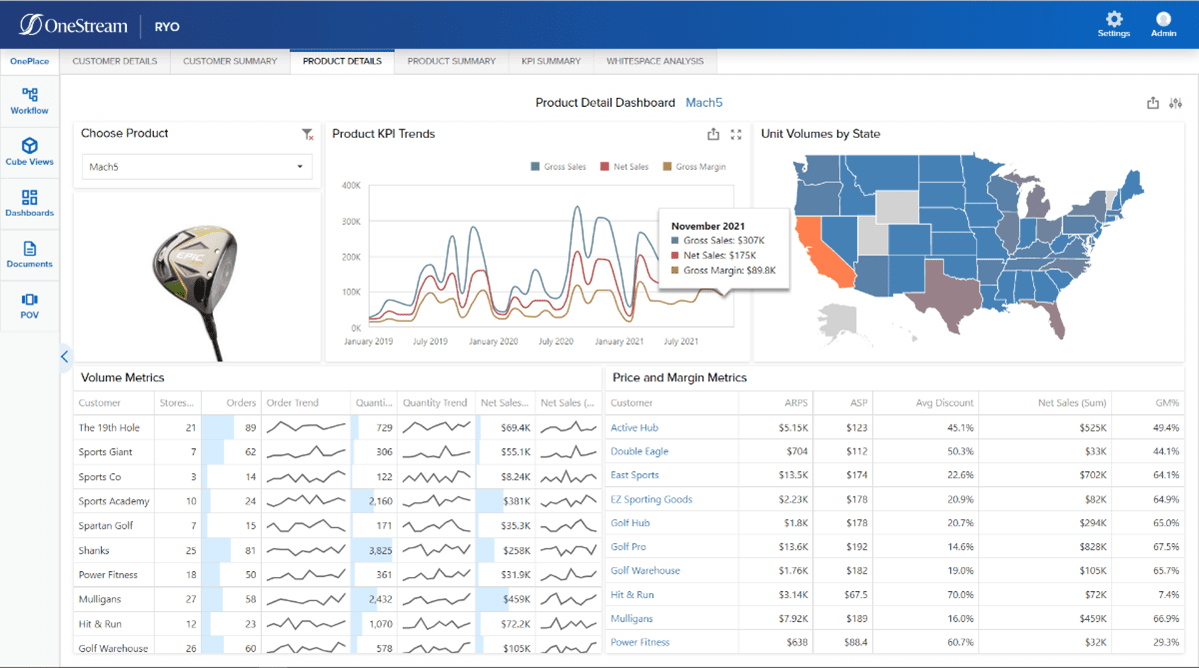

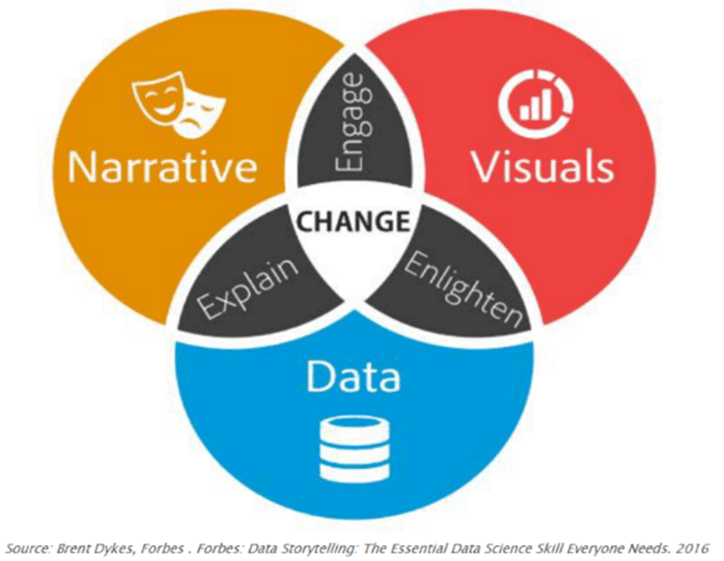

It’s said that a picture is worth a thousand words, and as many financial analysts can attest, painting the proper picture with visualizations (see Figure 1) is critical when telling the story behind a large dataset. When taking FP&A to the next level by shifting to an xP&A process, organization-wide collaboration drives the unification of financial and operational plans across the enterprise. Combining data from various sources into interactive dashboards with precise visualizations (see Figure 2) makes the data accessible to a wider audience and enables the alignment of operational plans with organizational goals.

Why is that so important? Well, utilizing these dashboards and visualizations can enable Finance professionals and leadership to make more informed and rapid business decisions. Those decisions are enabled by everyone staying informed of changes in financial performance with easily refreshed, quickly consumed representations of the data.

Ensure Data is Consumable Using Visualizations

Sharing consumable data with the audience is crucial to storytelling. Why? Because time is valuable and in short supply these days. And if key stakeholders cannot quickly assess risks and opportunities to drive performance without needing hours to sift through reports and spreadsheets, then FP&A has failed.

In the age of disruption and volatility, it’s more important than ever that organizations can consume and react quickly to whatever the data is saying. And they can do it in real-time to predict what’s coming next, which is critical given the uncertainty and instability caused by the pandemic and other global disruptions. Utilizing quickly and easily refreshed data visualizations ultimately helps leaders gain insights critical to keeping organizations running as smoothly as possible.

Ensure Data is Dynamic Using Visualizations

Having dynamic data at your fingertips is crucial to being able to quickly detect and react to change. Yet many Finance leaders have experienced the pain of being reactive instead of proactive to issues that arise with the financial plan. Instead, leveraging reliable and easily refreshed dashboards that offer near-real-time visual insights into the trends and financial signals the data is revealing can enable organizations to respond more quickly and more reliably to anomalies. That’s why dynamic visualizations are so critical.

Here are just a few examples of the key benefits for xP&A:

- Regularly refresh data to provide daily or weekly financial signals that drive operational performance and action prior to month-end.

- Combine and align data from Sales, Operations, Finance, and other KPIs into a single visualization to enable actionable insights and collaboration.

- Proactively react to variances and quickly inform downstream customer, product, purchasing, and staffing forecasts.

Conclusion

For most organizations, dashboards and visualizations are not new, but leveraging them for xP&A is especially important to remain competitive and agile in the face of unprecedented global disruptions. Being able to quickly and reliably refresh and access data and bring it together in a way that can be shared across the organization is crucial – and telling that story through visualizations is a powerful tool in the Finance toolkit.

Learn More

To learn more about using OneStream to create data visualizations for xP&A, download our reporting and analysis e-book here.

Get Started With a Personal Demo