If you work in Finance, odds are that you’re hearing about how artificial intelligence (AI) and machine learning (ML) will forever reshape your organization. Despite limited talk about use across Finance today, excitement fills the air as Finance evolves to include AI and ML.

To assess what’s fact and what’s fiction, modern CFOs are evaluating how to optimize the benefits of these technologies. Many are asking the same question: Is the future of Finance new technology or new people, or both? This question was the main topic for a recent webinar with OneStream Software and Ventana Research.

Ventana Research Senior Vice President Robert D. Kugel recently joined us virtually for How Artificial Intelligence Is Transforming FP&A: A Practical AI Strategy for FP&A – a webinar focused on aligning artificial intelligence (AI), machine learning (ML) and Financial Planning & Analysis (FP&A) to maximize results. Rob—along with our very own Scott Stern, Vice President of Product Marketing and Strategy—did a deep dive in this fascinating webinar to highlight ways to leverage AI and ML for FP&A.

To set the tone for the webinar, Mr. Stern shared findings from Accenture’s 2020 CFO Global Research1 showing that speed is becoming a differentiator for top CFOs. Here are a few of the key areas of consideration for top-performing Finance teams:

- Continually accelerating pace of change, revealing new consumer and market dynamics.

- Expanding control and compliance

- Using different strategies to handle the velocity and volume of data.

- Aligning strategies with plans and execution.

- Ensuring alignment between Finance and Operations across the enterprise.

- Evaluating AI/ML to Lead @ Speed.

These types of pressures can push many leaders across the enterprise into “scramble mode,” pushing them to find more data to make faster decisions. Unfortunately, this effort can become overwhelming and offers little value. And in the most extreme cases, the drive for more timely data can run Finance teams right into a brick wall. To avoid overheating, top-performing CFOs are creating agility with curated data to create flexibility in the planning process – but in a governed way that provides control for organizations to handle large, diverse volumes of data.

What if you could finally break free from the routine by combining all the functionality of your existing applications for enterprise planning and reporting in a single, unified platform enriched with artificial intelligence? Would you consider the opportunity?

What’s Stopping FP&A From Adopting AI-/ML-Infused Insights?

Mr. Kugel opened the webinar with some thought leadership about the AI hype – fact vs. fiction.

As Finance leaders, we have all felt the pain of failed technological advancements that had promised to make life easier for the Office of Finance. That “hype cycle” is engrained in our DNA, regardless of whether we want to admit it. Luckily, Mr. Kugel defined five artificial intelligence myths that demystify the “hype cycle” that so many Finance leaders fear:

Myth 1: We need a Data Scientist to make use of AI/ML.

This myth frequently surfaces for a simple reason: market noise and confusion. For complex solutions, a data scientist is clearly needed, but for most Finance uses, a data scientist isn’t a necessity. Why? Because software vendors are building “no code” or “low code” capabilities into solutions to make AI/ML practical and useful for Finance.

Myth 2: AI/ML is a long way off in the future, so why make plans now?

AI/ML has been at work for decades in all other parts of the business beyond Finance to improve performance in functions like determining credit scores, detecting fraud, invoicing and identifying needs for preventative machine maintenance.

Myth 3: AI/ML is just a “black box.”

Partially true – what remains unknown about AI/ML can be viewed as a “black box,” but successful solutions will build in transparency that allows users to certify the insights.

Myth 4: AI/ML is unthinking and robotic.

No, AI/ML is just the opposite. It offers a way to train models.

-

- AI/ML learns from the organizations and individuals that use it, adapting itself continuously to conditions and context.

- Adaptation enables AI/ML to constantly refine automation and recommendations to suit the specific circumstances.

Myth 5: AI/ML takes humans out of the loop.

It’s true that humans may not be needed other than in repetitive situations where the consequences of being wrong are low. AI that uses machine learning can cut the time required for humans to do mechanical work. That saved time in turn allows humans to concentrate on using their experience, expertise and judgment to make better decisions and increase organizational performance.

Pragmatic Use Cases Will Foster Success

AI adoption in Finance is low. Why? Well, a myriad of debatable reasons exists, but Finance should look beyond the why and think about AI/ML as another tool in the FP&A tool kit – think about AI/ML in a pragmatic way to incrementally drive the right dialog without losing credibility. Here’s the real question Finance leaders should be asking: How do I make AI/ML work for my organization?

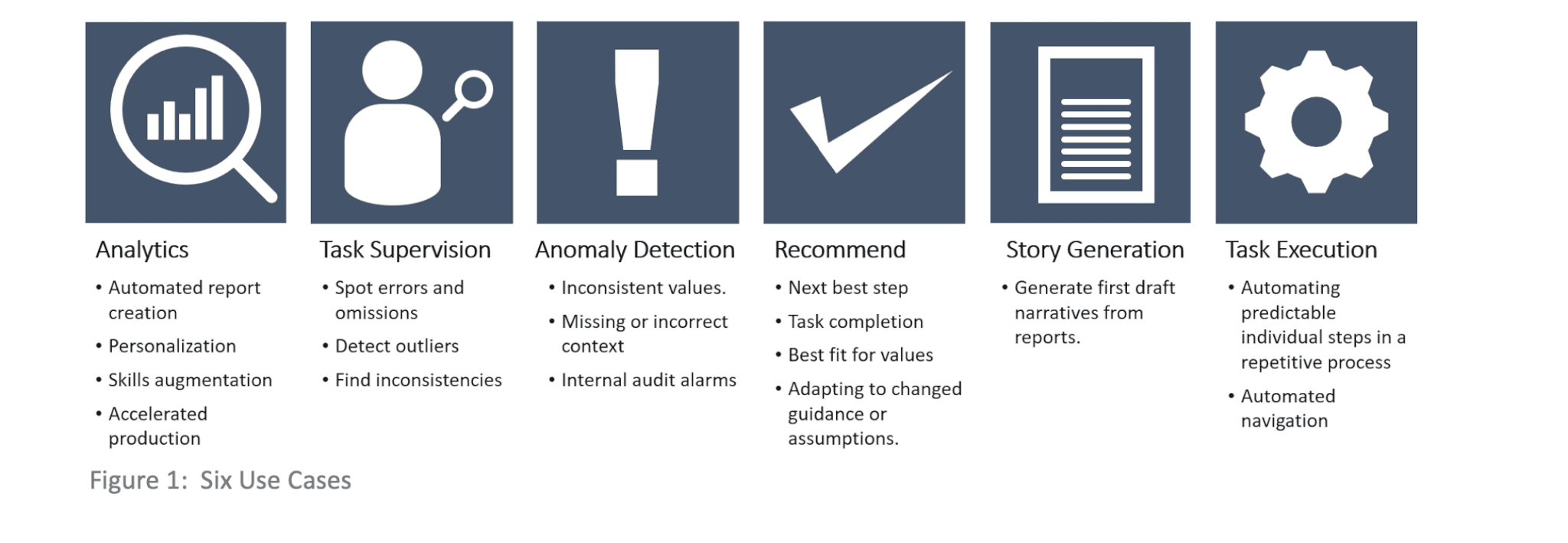

To help answer this question, Mr. Kugel highlights six use cases (see Figure 1).

Laying the FP&A Foundation for AI

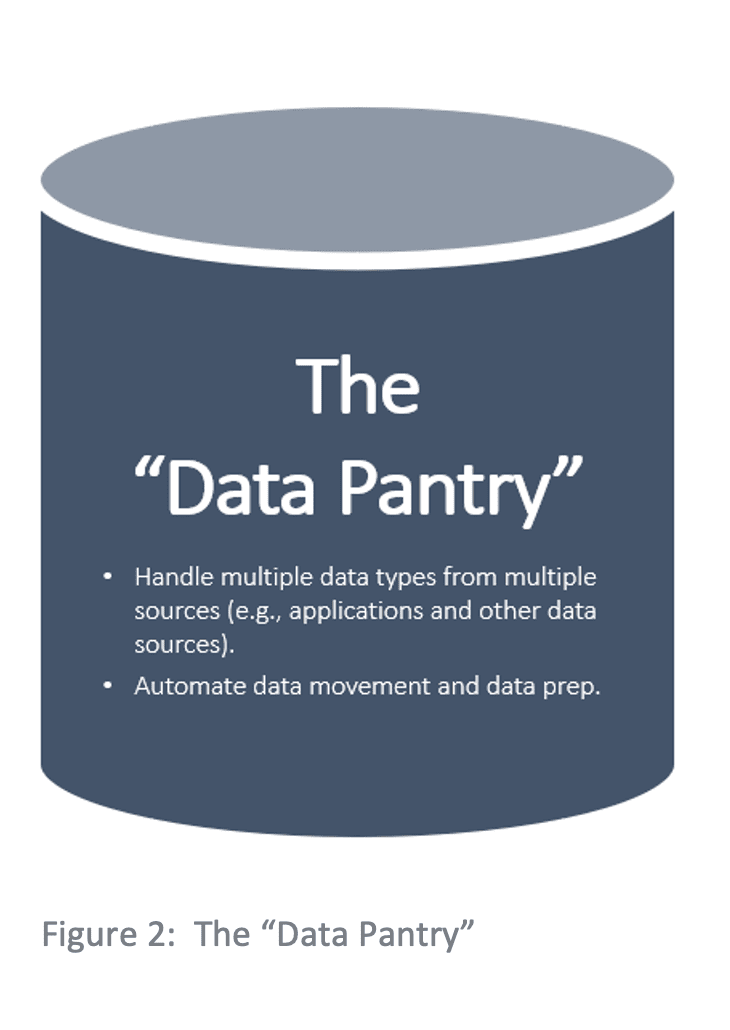

Mr. Kugel then focused on why a dedicated data store, or “data pantry”, for FP&A is essential to the success of AI (see Figure 2). Here’s a list of the reasons:

- Provide consistent, accurate and timely data that’s required for training a system.

- Automate data prep, which saves time and supports accuracy and consistency.

- Support data context with more consistency than in a general data store.

- Use semantics that are well-understood by system users.

- Increase ease of use – optimized for users.

- Provide scalability to support requirements.

As FP&A teams start evaluations to support AI and ML forecasting, Mr. Kugel highlights the following key considerations:

- Form a steering committee with executive sponsorship to develop, define and refine the organization’s AI priorities and roadmap based on understanding what’s feasible and when.

- Identify all operational and financial data sources needed for training AI systems, as well as gaps in data collection.

- Understand and evaluate vendor roadmaps for providing AI capabilities and vendor ability to support data requirements.

- Identify the system or systems that will use the financial and operational data needed to train AI capabilities and establish the data inventory required for such purposes.

Introducing Sensible Machine Learning (Sensible ML)

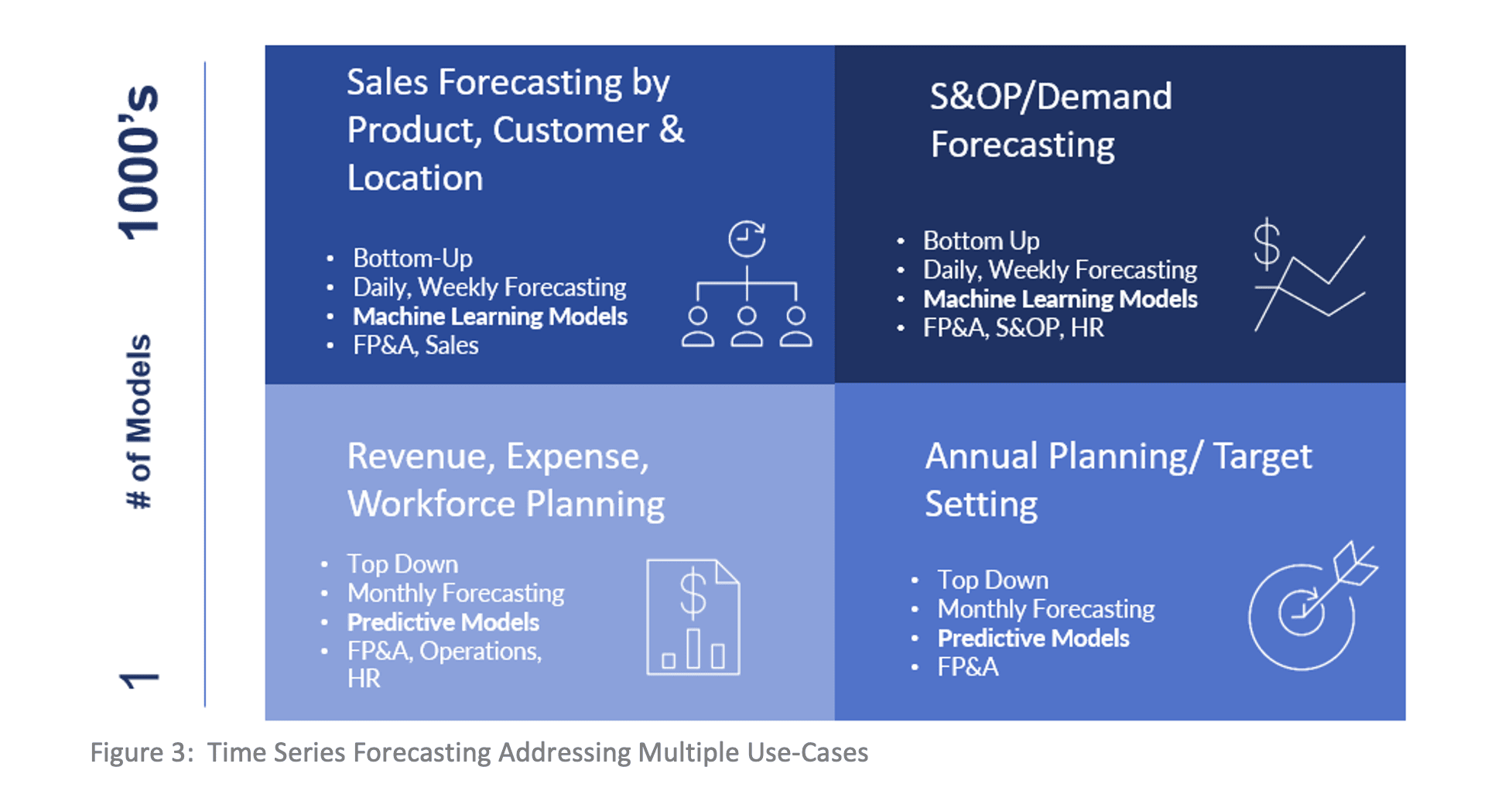

Mr. Stern then closed out the webinar by showcasing OneStream’s Sensible Machine Learning solution. While leveraging OneStream’s planning and data quality, Sensible ML provides time series ML forecasting without the need for a dedicated data scientist or additional software to accelerate time to value for critical planning processes. By leveraging Sensible ML time series forecasting, Finance leaders can now quickly and accurately address multiple use-cases based on available data (see Figure 3).

Conclusion

AI and ML are here to stay, and the Office of the CFO should now be looking to take advantage of these advancements in technology. What do FP&A leaders have to lose by adding another point of view or enriching their insights with the help of AI and ML? You guessed it: nothing.

Here are the key takeaways from this webinar for a practical AI/ML strategy for FP&A:

- AI/ML solutions can dramatically improve predictive power

- AI/ML can drive continuous collaboration and innovation

- AI/ML can instill confidence among financial and operational plans across the enterprise

At OneStream, we call this Intelligent Finance.

Learn More

To learn more about how FP&A teams are leveraging AI/ML for FP&A, please watch the replay of the Ventana webinar.

1 Accenture CFO Global Research – CFO NOW: Breakthrough Speed for Breakthrough Value

Get Started With a Personal Demo