In a recent webinar with our partners at KPMG, we explored trends in the financial close and how organisations are increasing the organisational value and guidance their teams provide while driving increased performance. We were joined by KPMG Partner for Finance Transformation Brian Yeager, who examines various causes of disruption and shares the details of two recent KPMG surveys of leading Finance organisations. Cara Peterson, Director, Finance Transformation, KPMG was also on hand to explain how to make the financial close more digital.

To kick off the webinar, I focused on market trends relating to the pace of change and the need for speed within organisations. We highlighted how the expectations of the Finance function are evolving and moving up the innovation curve (see Figure 1). From the ‘foundational’ book-of-record, we’re seeing more forward-looking requirements, operational modeling, and the need for real-time information and data.

Organisations today must, now more than ever, continue to drive the Finance role as a strategic advisor to the business by empowering Finance with new capabilities, including the following:

- Spending more time on the forward-looking analysis

- Combining financial, operational, and transactional data

- Ensuring accuracy and auditability across all financial data

- Creating and sharing dashboards with executives and managers

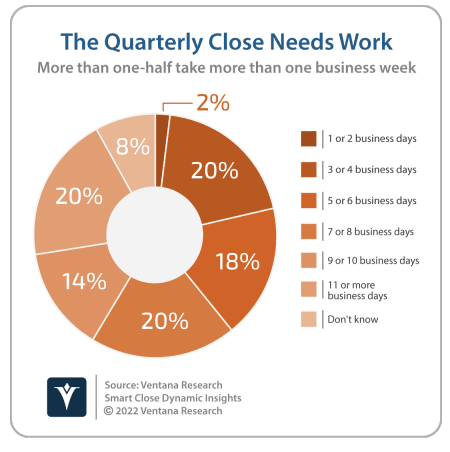

We then shifted gears to explain that the financial close still has plenty of room for improvement – especially for those organisations using spreadsheets or legacy technologies and cited research by Ventana. In fact, the financial close process is one area for continuous improvement for two reasons: constant change is experienced, and the level of complexity only increases. Ventana’s research showed that more than half the organisations surveyed are taking more than a week to complete the quarterly close (see Figure 2). This number has increased compared to the 2019 survey.

Many organisations, even those who have purchased software, have been struggling to simply maintain the status quo given the constant change caused by the fragmented nature of the previous generation and the existing cloud CPM tools.

As a result, high risk, cost, and technical debt are still very much a reality with many of these products.

Finance Survey Results

Mr. Yeager then spoke about how ‘disruption is guaranteed. Setting the scene, he gave a more detailed view of the different types of disruption – many of which have frequently been used as a vehicle for Finance Transformation. Next, Mr. Yeager highlighted two recent KPMG surveys. He specifically focused on how leading Finance organisations are not only handling disruptions but also prioritising investments in digital, data, and people.

The survey results (see Figure 3) showed that leading Finance organisations are leveraging data – both internal and external data – as a competitive advantage. These organisations are elevating their digital fluency and raising their teams’ skill levels. In other words, people are doing less compiling of numbers and more analysing of data for forward-looking decision-making. Digital centres of excellence (COEs), which are staffed with digitally skilled people, are also becoming more common.

As data technology and processes are advancing over time, leading Finance organisations are automating 70% or more of their transactional processes and reporting. These efforts include automating upstream processes and other key areas, such as journal entries and report delivery. Self-service reporting models are becoming more typical as well.

Mr. Yeager also touched on the benefits of automating account reconciliations. Notably, he shared how many leading Finance organisations are integrating non-financial and external data into financial decision-making.

Digitising the Financial Close

Ms. Peterson focused on what types of initiatives organisations can undertake to ensure the close process is not extended given the levels of disruption. For many, the close process is already a long one. Finance teams are thus interested in initiatives to make the process occur more in real-time, ensuring the teams themselves are better prepared to handle any future disruption.

Ms. Peterson discussed two key terms that help make such initiatives possible:

- Digital close – Identifying technology improvements to remove manual steps in the close process.

- Continuous close – Achieving a high level of automation, meaning the Finance team can close at any time and provide information that helps drive key business decisions.

The key message from Ms. Peterson is that ‘it’s never too late to start’. She went on to explain some key areas where organisations can achieve immediate gains. These areas included replacing on-premise applications and Excel, moving towards advanced capabilities in the cloud, concentrating on data quality, and replacing integrations where possible.

Next, Ms. Peterson explained automation in more detail and outlined a few steps organisations can take to achieve a more automated close process. She explained that, as organisations bring technology along, they must also bring the people and shift their skillsets by investing upskilling, right skilling, and building data literacy. These shifts drive efficiencies in the close process. Especially, digital fluency is critical because people must understand the technology, how it all works together and the benefits the organisation achieves as a result.

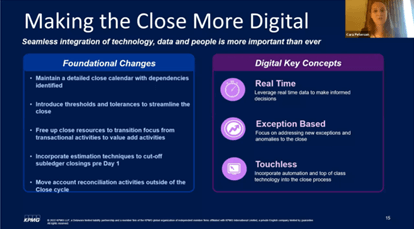

Finally, Ms. Peterson shared a few points on how organisations can tactically advance to a digital close (See Figure 4). A few foundational aspects are still important to implement for any close process, such as using a close calendar, introducing thresholds/tolerances, freeing up resources, and moving account reconciliations activities outside the close cycle. However, some key digital concepts must be considered. These concepts include moving towards using real-time data, getting to an exception-based approach, and examining areas of delay in the process – all of which take time.

Conclusion

The KPMG survey results highlight some interesting trends which leading Finance organisations are following to increase the organisational value and guidance their teams provide while driving much-desired increases in performance. In sum, organisations can take positive steps right now to digitise the close process and reduce the technical complexities of the past.

Learn More

To learn more about how OneStream empowers organisations to lead at speed in Office of Finance Transformations and how KPMG guides organisations on that journey, watch the webinar replay of ‘Trends in Financial Close with KPMG’. And if you’re ready to conquer complexity in your own Office of Finance Transformation, contact OneStream today.

Get Started With a Personal Demo