Machine learning (ML) is poised to drive unprecedented changes in forecasting capabilities – faster iterations, the ability to quickly run multiple scenarios, more meaningful outcomes and improved sensitivity analyses. Traditionally, these exercises required substantial efforts to maintain high-level iterative cycles. But faster, more accurate iterations with ML could mean reducing the budgeting and forecasting cycle from months to days.

In recent years, advances in ML have spurred a shift away from traditional forecasting, fostering a new age of enterprise performance management (EPM). And with the newer methods come more accurate plans that provide greater insights into the future.

Sensible ML for EPM – Four Driving Forces for Change

Amid changing times, decision-makers at all organizational levels need the best and most relevant data and intuitive ways of seeing and interacting with that data. The past few years have undoubtedly shown how unforeseen events can quickly render annual budgets, plans and forecasts obsolete before the new year even starts. As the years unfolded, organizations had to retool business processes. How? One major way was that business functions and teams had to learn to collaborate remotely. Organizations not only had to reconsider marketing, sales and service strategies, but also had to try new ways of engaging with employees, customers and partners. (see figure 1)

These unanticipated changes have only accelerated digital transformation, a major ongoing trend driving organizations to migrate business processes from being heavily manual and offline to being more automated, agile environments that run on software and increasingly involve cloud computing environments. Digital transformation is generating more data – and more opportunities – to use data-driven analytics, visualization, artificial intelligence, machine learning and automation.

And over the past decade, the intersection of Data Science and Finance has evolved dramatically. Yet very few organizations have experienced the full business impact or competitive advantage that comes with advanced analytics, despite significant investments in data science and machine learning. Why? Well, many tools are too complicated to scale ML, and the necessary Finance-focused skill sets are in short supply. However, recent technology advancements are poised to significantly impact how Finance teams operate.

In 2023, four driving forces have the potential to accelerate ML and move organizations from descriptive and diagnostic analytics (explaining what happened and why) toward predictive and prescriptive analytics. The latter forecast what will happen and provide powerful pointers on how to change the future.

Driving Force No. 1: EASY-TO-USE ML TOOLS EMPOWER FINANCE ANALYSTS

Most organizations employ an abundance of financial analysts but only a limited number of data scientists. Even fewer employ Finance-focused data scientists. Since most analysts lack the data science expertise required to build ML models, data scientists have become the bottleneck for developing and broadening the use of ML within FP&A.

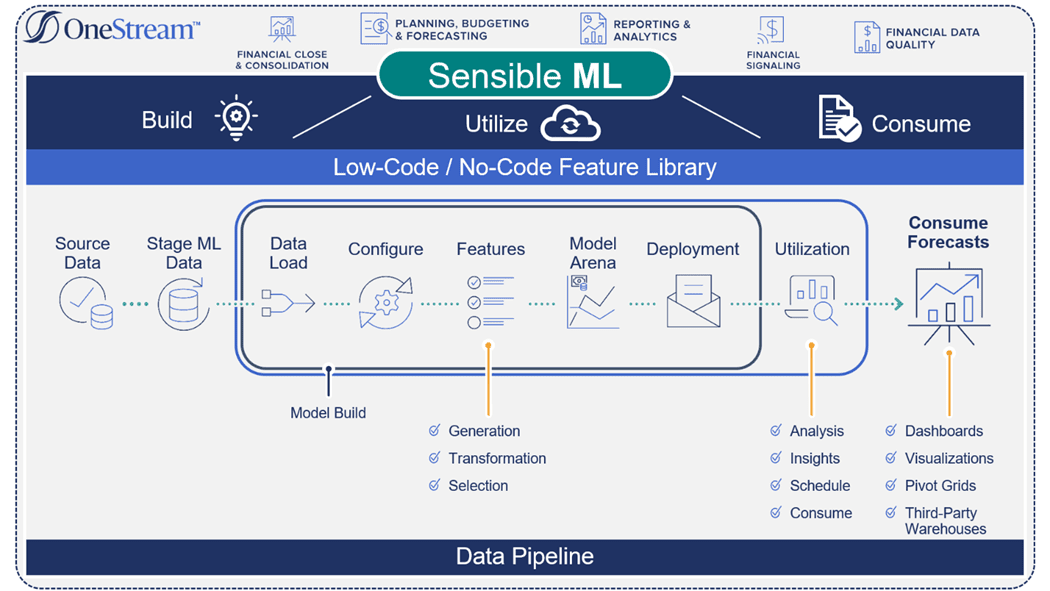

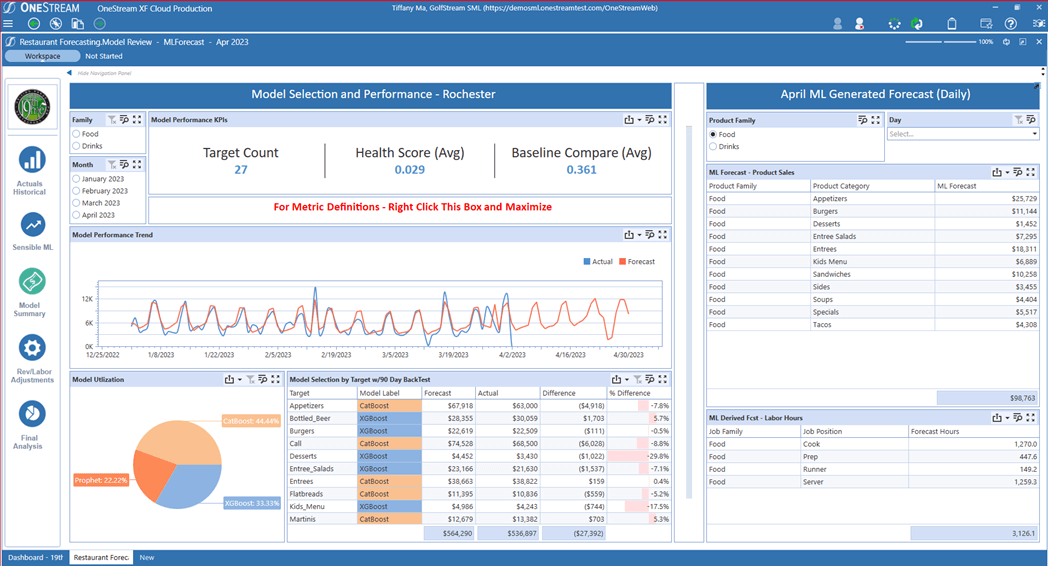

However, new and improved ML tools are opening the floodgates by automating the technical aspects of data science into easy-to-consume models for Finance. Finance teams now have access to powerful models without needing to build them manually, and the solutions not only automate multiple steps in the process but also increase productivity. Specifically, automated machine learning (AutoML) removes the need to manually prepare data and then build and train models. (see figure 2)

Driving Force No. 2: A UNIFIED PLATFORM CLOSES THE GAP BETWEEN ANALYTICS AND ML

Everyone knows data silos exist within and across organizations. Yet many leaders are not putting the same emphasis on measuring and improving collaboration across the enterprise. Why? Well, fragmented solutions cause misaligned technology and forecasting processes, eroding organizational collaboration. And the level of effort to correct the imbalance can simply feel too steep.

However, few realize that these silos also take the form of “analytics silos,” particularly between Data Scientists and Finance. Such silos have formed as a result of the different ways the two roles work and their respective skill sets. But data silos are just one part of the difference. Data Scientists and Finance use different data (raw versus processed), data sources (data lakes versus databases and files), languages (Python and Java versus C#) and tools (ML versus EPM).

The proof? Well, that can be found in all the times Finance teams have had to chase monthly files from Sales, HR, Supply Chain and so on, only to find out the provided files are incomplete or have some anomalies that require follow-up.

Sounds familiar, doesn’t it? Whatever the reason, that process still feels like a waste of valuable time across the organization. This kind of collaboration isn’t the kind for which organizations strive. But unfortunately, this world is the one in which most organizations live.

Driving Force No. 3: MANAGING AND DEPLOYING ML FEATURES AT SCALE

For Finance leaders who have interacted with data scientists’ teams to build new ML models, many leave those meetings feeling like nothing has been solved. Why? Well, the data science process feels like an arduous task of prepping data, creating features and models, and then trying to make sense of the outputs. The real challenge, however, is time. Generally, these projects can take many months – if not years – before a business value is realized.

With advancements in new Low Code/No Code solutions like OneStream’s Sensible ML, Finance and Operation teams can realize value within a few months. These teams can now easily create, consume and maintain data science models without relying solely on the data science team. (see figure 3)

Driving Force No. 4: UNIFIED CLOUD EXPANDS ACCESS TO NEW DATA

According to Statista, an estimated 97 zettabytes of data were created, captured, copied and consumed globally in 2022. That amount of data is only expected to accelerate even more. Over the next few years, global data creation is projected to grow to more than 189 zettabytes by 2025. And as organizations shift to remote work environments, the pace of acceleration is only going to increase. Additionally, by 2025, IDC projections, reported by Analytics Insight, also predict that 80% of the world’s data will be unstructured. That scenario will bring opportunities for organizations to create more meaningful insights, but only if organizations can unify the data.

Here are the top advantages that companies are gaining by leveraging cloud-based systems.

- Always Up-to-Date Solutions: Because the solution is in the cloud, users always have the most up-to-date version – removing the normally steep maintenance costs that many organizations incurred with prior solutions.

- Scalability and Accuracy: Management of siloed tools (e.g., spreadsheets) can quickly get out of hand as business needs increase. For example, many Finance leaders have felt the pressure of trying to explain erroneous data based on manual steps that require individuals to create connected tools. Cloud solutions reduce or, in many cases, eliminate silos and error-prone manual steps.

- Real-Time Reporting: When business managers use siloed tools to gather data, getting a quick, accurate, up-to-date view of how the business is performing is difficult. As a result, leaders may not spot issues early enough to prevent them from developing into bigger problems. Unified cloud systems solve this challenge by providing real-time access to centralized financial and operational data

Conclusion

That traditional forecasting is excessively manual and prone to human biases is no secret. Accordingly, the power of machine learning for EPM – such as Sensible ML for OneStream – is clear. Customers can overcome the high barrier of entry into machine learning with an easy-to-use ML with a single unified Intelligent Finance Platform that can support corporate standards.

Learn More

To learn more about how FP&A teams are moving beyond the AI hype, stay tuned for additional posts from our Sensible ML blog series or download our solution brief here.

Get Started With a Personal Demo