Artificial intelligence (AI) and machine learning (ML) have revolutionized many industries, but the field of financial planning & analysis (FP&A) has been slow to adopt this technology. Despite the numerous benefits AI – and more specifically, ML – can bring to Finance (e.g., increased efficiency, accuracy and strategic insights), many organizations still hesitate to implement either in their FP&A processes. What’s holding FP&A back from reaping the vast benefits of ML?

To answer this question and more, this blog will explore some of the challenges holding FP&A back from fully embracing ML and how those challenges can be overcome.

Market Appetite for ML

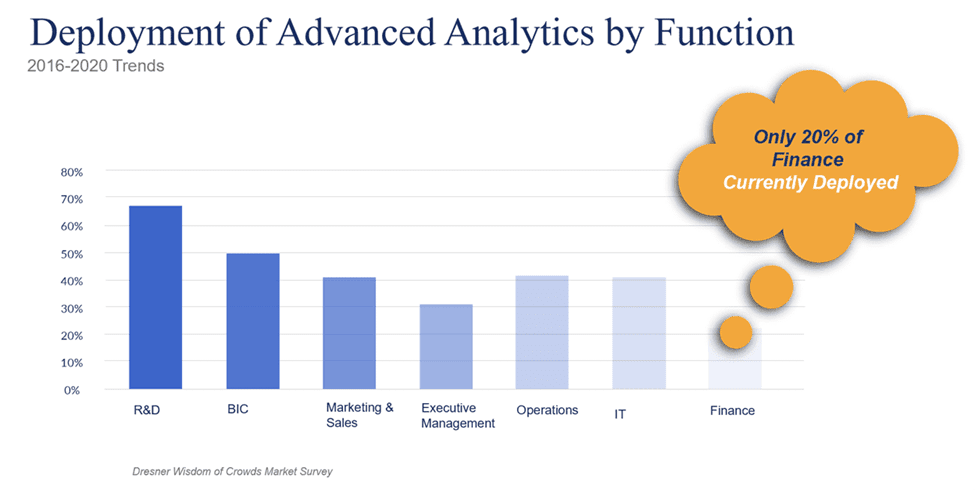

While not yet as widely accepted as the move to the cloud for the financial close and planning processes, ML adoption is already increasing, according to the 2022 Data Science and Machine Learning Market Study by Dresner Advisory Services. In 2016, less than 40% of responding organizations reported using or actively exploring ML. That same metric was about 70% in 2022 (see Figure 1), showing a steady increase over the last seven years. On the surface, that progression underscores the AI hype and excitement for the potential benefits of using AI for FP&A.

But what happens if the data gets broken down by function? A bit of a different reality emerges for the Office of Finance and FP&A.

In fact, the study shows that only 20% (see Figure 2) of Finance organizations are currently using AI and ML, and Finance actuals lag most functions, despite all the buzz and chatter out there.

What’s Holding FP&A Back?

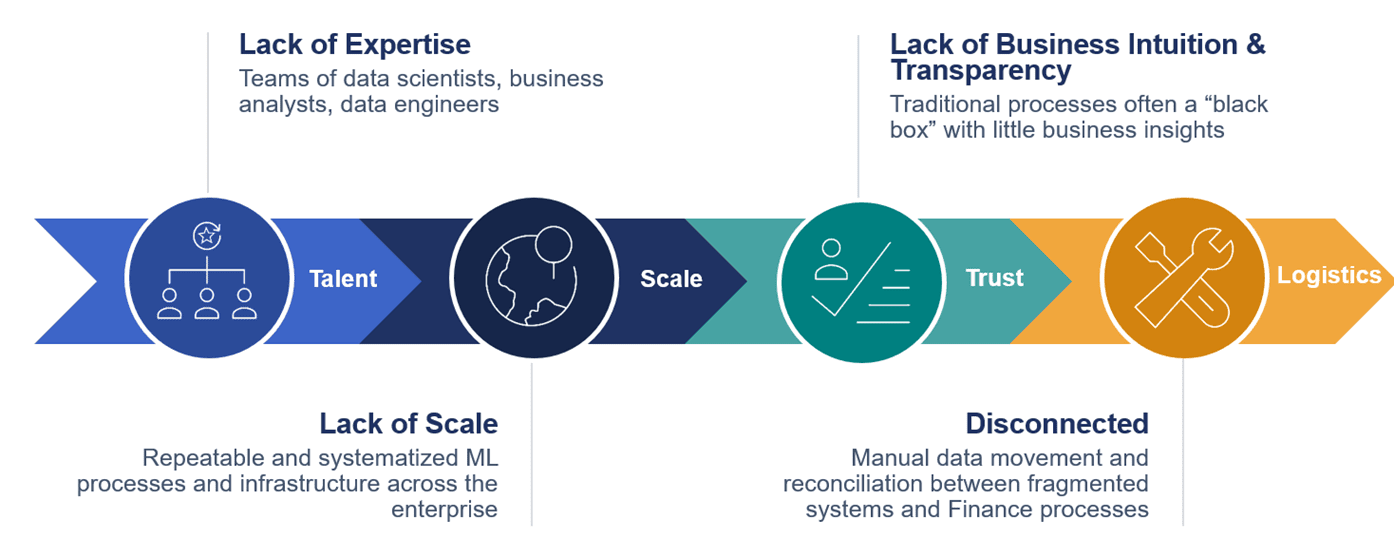

With so much buzz yet low adoption, what key barriers are holding FP&A and Operations teams back from mainstream adoption of ML solutions? Figure 3 depicts the barriers.

Below, the details about these key barriers show why they’re preventing widespread implementation of cutting-edge ML technologies:

Lack of Expertise

- FP&A teams can struggle to deploy ML in enterprise planning processes, such as rolling forecasting or demand planning, due to lacking the required expertise in ML and machine learning modeling techniques. Without dedicated business analysts and data science engineers, teams cannot realize the full potential of ML in planning processes.

- A lack of expertise is especially relevant for organizations with existing ML investments, where the lack of specialized resources hinders the ability of FP&A teams to effectively utilize ML in their work. Without dedicated expertise or resources, FP&A teams are severely limited in their ability to take advantage of AI and ML.

Lack of Scale

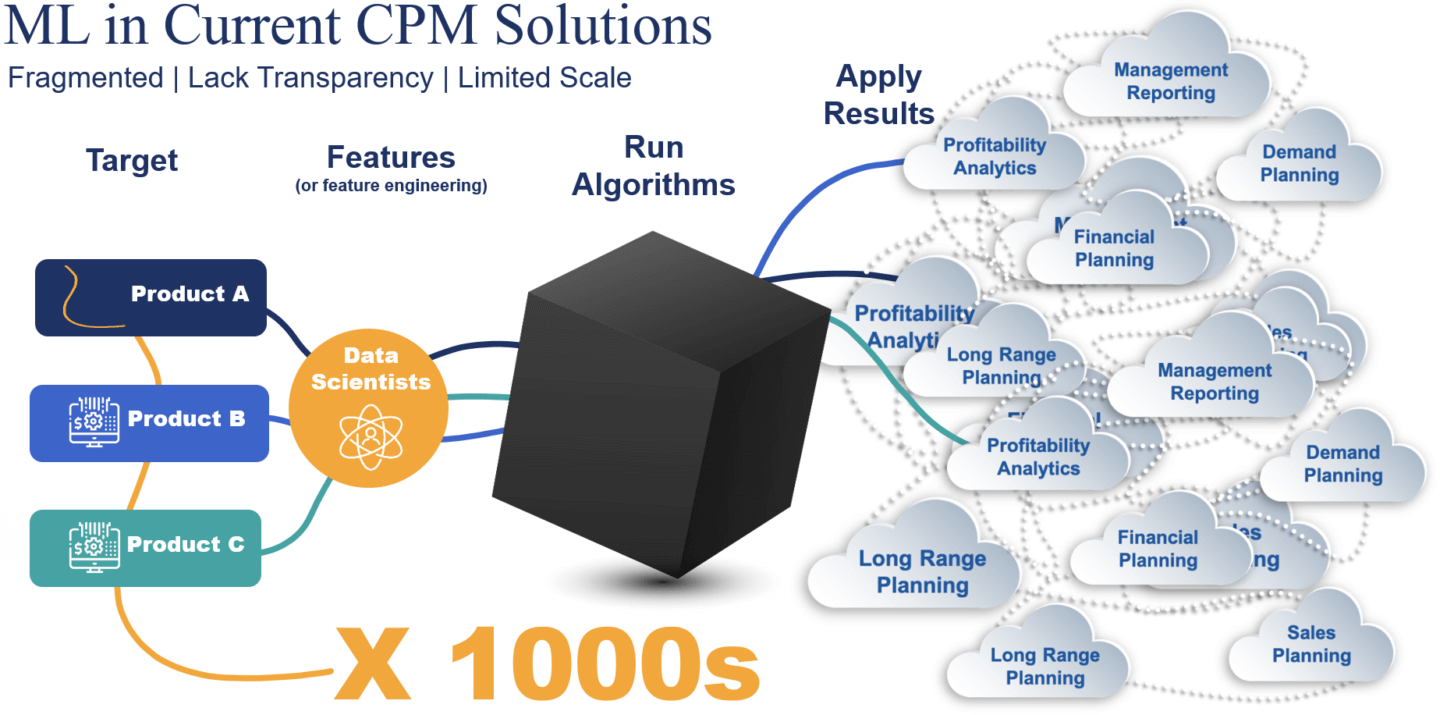

- For organizations with existing data science teams, creating repeatable and systematized ML processes and infrastructure across the enterprise is expensive. Additionally, most ML capabilities within CPM tools today are only capable of producing a single forecast (target) at a time. Why does that matter?

- FP&A’s role is to lead and drive effective planning processes across lines of business and functions (e.g., HR, Sales and Operations). And if unable to empower the organization to forecast at scale, FP&A is not executing as a strategic business partner. AI solutions for FP&A that cannot scale are no different and will never reach mass adoption, causing the solutions to ultimately fail.

Lack of Business Intuition & Transparency

- Traditional ML modeling processes within CPM tools are often a “black box” to FP&A teams (see Figure 4). Why does this matter? Well, ML modes aren’t complete without material business “intuition” and/or offer users only limited visibility or traceability into model inputs and results. Such limitations can result in a lack of trust or confidence in the results.

As a strategic business partner, FP&A must instill confidence in forecasting processes. And while leveraging AI and ML is likely to increase forecast accuracy, P&L owners cannot assess the drivers that comprise forecasts – P&L leaders who can’t will never own their forecasts.

And if P&L owners don’t own their forecasts, forecasting processes break down and fail altogether. That means FP&A has failed too.

Fragmented & Disconnected Processes

- Current AI and ML solutions within CPM typically require data movement and reconciliation between fragmented systems and Finance processes. Those requirements increase the technical debt and limit the ability for advanced analytics to scale across the organization.

- The fragmented software and technical processes needed for connected planning create added technical complexity and administrative burden for FP&A teams. This burden includes constantly moving and reconciling data, monitoring data latency, and managing security between fragmented products or models. Collectively, the burden dilutes the ability of strategic FP&A teams to focus on driving performance and supporting critical decision-making.

Conclusion

Despite these challenges, ML has the potential to significantly improve Finance operations and outcomes. By automating manual processes, ML can help Finance professionals save time and improve accuracy, which can lead to more effective decision-making. Additionally, ML can provide real-time insights into financial performance. Those insights can then help Finance professionals identify trends and make informed decisions.

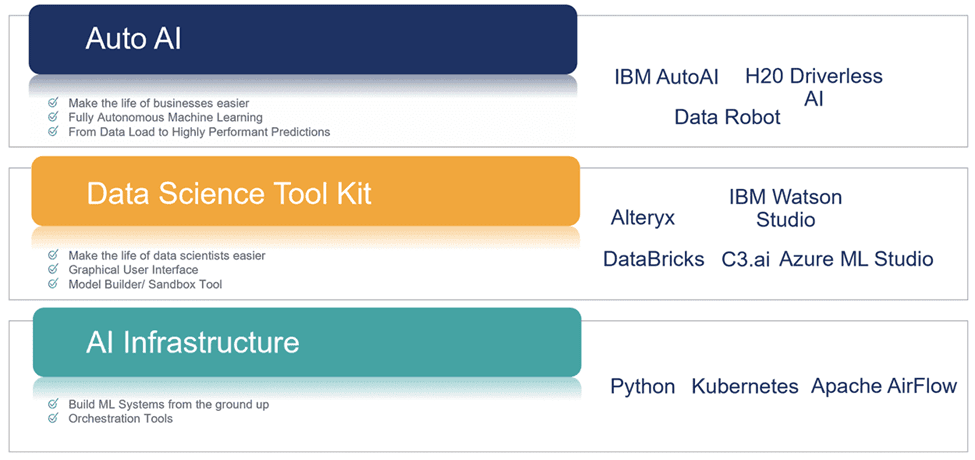

As AI and ML for FP&A enter the mainstream, organizations will undoubtedly have several choices to consider. On one spectrum, solution vendors for AI (see Figure 5) are offering everything from AI infrastructure solutions to data science toolkits and complete AI platforms to create and deploy ML models. While these are powerful tools addressing varying use cases, the tools aren’t designed for FP&A teams.

Corporate performance management vendors are also investing in AI capabilities to support extended planning & analysis (xP&A) processes such as demand planning and sales planning. As Figure 5 illustrates well for AI vendors, CPM vendors will also solve their customers’ AI needs in different ways.

So then, what’s the lesson in all this?

Don’t let AI hype cloud the evaluation process. Start with a clear understanding of “what” business outcomes the FP&A team is trying to achieve with ML. Identify “who” is using the solution and “how” the solution is unified into existing planning processes.

And with answers to these questions in mind, use the evaluation process to “get under the hood” to learn whether the solution will unleash the organization from the key barriers holding FP&A back from moving beyond the hype.

Learn More

Want to learn more about how FP&A teams are moving beyond the AI hype? Stay tuned for additional posts from our blog series, or download our interactive e-book here.

Get Started With a Personal Demo