Planning for business is becoming increasingly more complex, requiring new approaches supported by sophisticated planning technologies. Recent research even indicates that business strategy, financial and other planning activities (operational, HR, sales, etc.) are better together. Thus, Connected or Integrated Business Planning (IBP) has become a hot topic for leaders who want to thrive in this challenging business context. But why is IBP so hard to implement?

This blog series looks to answer that question by diving into why companies aren’t successful when adopting Integrated Business Planning. In doing so, the series explores why the CFO is best positioned to lead the change. Part 1 explores why Integrated Business Planning is difficult.

A Broken Mirror

Connecting or integrating business planning activities across the enterprise is not a new idea. In fact, concepts like xP&A aim to respond to this need from a technology perspective, and terms like Integrated Business Planning have been around for decades. However, today’s unique market volatility combined with failed attempts at connected planning shows why the topic needs to be elevated to the C-level.

Organizations encounter various obstacles when implementing an Integrated Business Planning process. And those organizations invest significant resources and time trying to overcome challenges and get the process to work. Amid a long list of challenges, 3 stand out as the most difficult to overcome:

- Leadership skepticism and misalignment around the IBP process. As Oliver Wight rightfully points out, “one set of numbers” is a stepping stone in a well-deployed IBP process. However, getting there isn’t easy. But why? First, the current state of technology and data strategy in many organizations doesn’t support an IBP process. Second, some might be uncomfortable with this better reality: the visibility that comes with one view of the numbers can surface human bias, shortcomings or resource buffers that some leaders want to keep hidden.

- Culture and organizational change can’t do it alone. Companies structured in silos fail to connect strategic goals with planning, model the wrong behaviors (conflicting targets, biased assumptions, etc.) and force a fragmented planning approach. How does all this affect the IBP process implementation? Well, adjusting the culture and behaviors is hard work, as well as setting up a solid management system and implementing horizontal roles to coordinate planning activities across silos. This process requires an enormous effort in culture change, and it doesn’t stick in the long term: organization and culture tend to mold and deform over time in response to leadership changes or strategic direction shifts. Further, today’s volatile business environment requires unparalleled speed in decision-making that can’t be held up by sluggish changes in governance and organizational design.

- Ignoring the technology trap. Having one technology for all planning is a complex endeavor. Finance planning, business unit planning, sales & operations planning, workforce planning (to name a few) are all processes with different goals, data structures, units of measure, mathematical foundations and needs. Even if functional technology is in place to handle these different planning needs, scalability becomes an issue when the solutions are exposed to massive amounts of data.

So…what are the options? Well, many of the solutions out there cannot adapt to current needs due to being made of multiple modules that must be integrated or simply not having the depth and breadth required to support varied planning needs. The alternative, then, is spreadsheet abuse that’s slow, laborious and prone to error. And those organizations that manage to integrate all these modules from different software vendors do it at a high cost and effort, living up with an infrastructure that doesn’t scale and a tremendous technical debt. In other words, the alternative is high RISK and high COST.

Since culture change is never easy and most technology can’t address the needs of truly unified planning, leaders are discouraged from embarking on an IBP journey and stall with sub-optimal processes and technologies.

This sub-optimal status often means a higher impact from risks and uncertainty due to a sluggish decision-making process. Ultimately, that impact translates into the loss of business opportunities and a higher cost of doing business.

A Closer Look at the Technology Trap

Even with strong alignment and commitment around the IBP process, a closer look into the problem shows that organizations struggle to achieve the promised benefits for a specific reason. Primarily, a consensus among planning activities that effectively links strategic & finance goals with financial and extended planning (xP&A) is complicated when technology isn’t fit for the task.

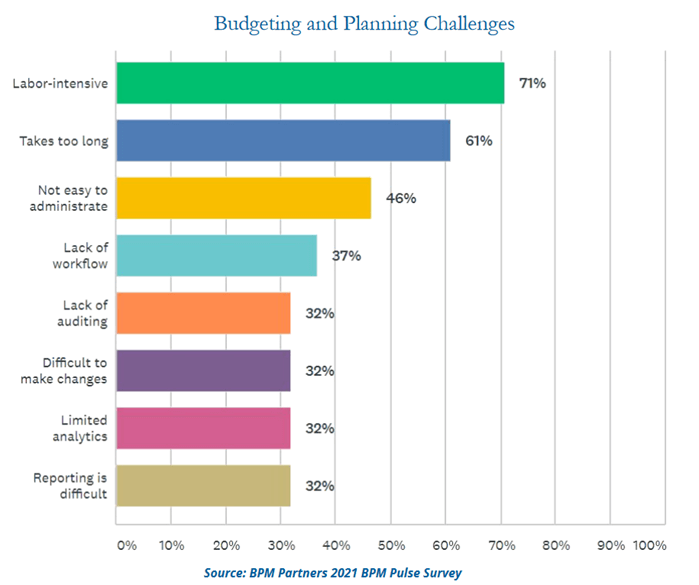

The Pulse Survey launched by BPM Partners in 2021 (Figure 1) displays some of the main challenges an organization can face with budgeting and planning activities:

Collectively, such challenges are strongly correlated to the flawed technology solutions that organizations use to support these processes.

Often, many organizations undertake the implementation of IBP from a process and organizational standpoint, leaving the technology discussion for later.

However, if one set of numbers is a non-negotiable in IBP, why not address the technology trap for starters? Wouldn’t collaboration be easier with a common foundation of data and information? Wouldn’t it be easier for top leadership to execute flawlessly when all planning is based on the same numbers? Why wait for a perfectly fine-tuned process when the right technology can accelerate the adoption of IBP?

There’s Another Way

When business planning isn’t unified, the leadership team can’t really get quality insights fast enough to improve the business performance. Because planning is a cornerstone to budgeting and forecasting processes, both are impacted when the planning processes are carried out in a containerized way supported by inferior technology. The different departments and functions suffer the consequences of a fragmented planning approach.

Despite the many attempts to join and synchronize all planning activities, these planning processes remain disconnected because they rely on different technologies and systems that cannot provide a common data structure.

But a (better) way forward exists, one where the CFO leads the change by implementing a collaborative planning approach with business lines and other functions. Whether that occurs through xP&A, integrated business planning or connected planning, ultimately what CFOs really need to do is unify business planning.

By unifying IBP or connected planning processes, organizations ensure they take a data-first approach to all planning activities. Such planning approach aims to unify business strategy with planning, budgeting and forecasting activity for all business lines and functions – providing one single version of the truth. That single version is verifiable and certified in just one technology platform.

Learn More

Learn how to unify Integrated Business Planning in our next blog:

Get Started With a Personal Demo